3rd Oct 2024. 9.00am

Regency View:

Update

Regency View:

Update

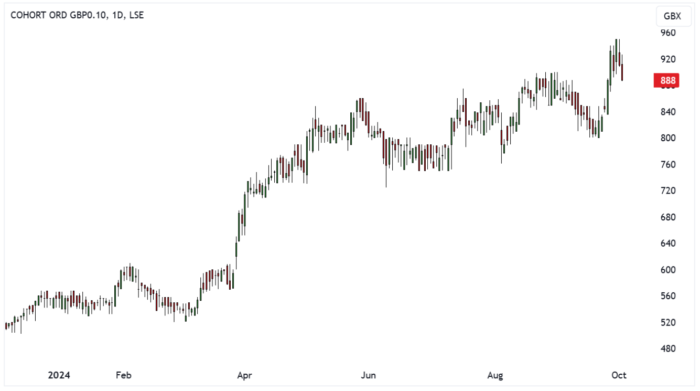

Cohort hits new highs following strong AGM update

Cohort’s (CHRT) share price has surged to new highs after a robust update at their Annual General Meeting. The technology group reported record financial results for FY2024, with standout performances in revenue, adjusted operating profit, and a growing order book. The order book reached a record £518.7 million, extending out to 2037, providing strong revenue cover for the current financial year.

As of September 2024, Cohort secured over £575 million in new contracts, giving them around 90% revenue cover for FY2025. First-half trading is expected to be significantly ahead of last year, driven by strong demand in their Sensors and Effectors division, with an improved net margin anticipated.

The company remains optimistic about further contract wins, fueled by rising global demand for defence products and services. Geopolitical tensions are pushing increased defence investment, creating opportunities for organic growth. Coupled with their targeted acquisition strategy, Cohort is well-positioned for future expansion.

While the group expects a slight reduction in net funds by the end of FY2025 due to planned capital expenditures, their overall outlook remains positive. Cohort now expects both revenue and profit performance for FY2025 to be slightly ahead of previous forecasts.

Ceres Power pushes higher on strategic partnerships and financial success

Ceres Power’s (CWR) share price surged higher on Friday following a flurry of positive developments that underscored the company’s growing momentum in the green hydrogen sector.

The rise in shares can be attributed to several key factors, starting with the announcement of a significant global long-term manufacturing collaboration and licensing agreement with Delta Electronics. This landmark deal, which is the first of its kind for Ceres, is set to generate substantial revenue through technology transfer and engineering services, signalling a robust demand for its innovative solid oxide technology.

Additionally, the recent partnership with Shell to design a SOEC demonstrator module for large-scale industrial applications further fuelled investor enthusiasm. This collaboration aims to develop a scalable 10MW pressurized module for green hydrogen production, a move that positions Ceres at the forefront of the burgeoning hydrogen market, particularly as industries seek sustainable fuel alternatives.

The positive sentiment was also bolstered by the company’s impressive financial performance in the first half of 2024. Ceres reported a significant increase in revenue, rising to £28.5 million from £11.71 million in the previous year, primarily driven by high-margin licensing agreements. This growth in revenue reflects the company’s asset-light, licensing business model and showcases its potential for sustained profitability as it continues to expand its market presence.

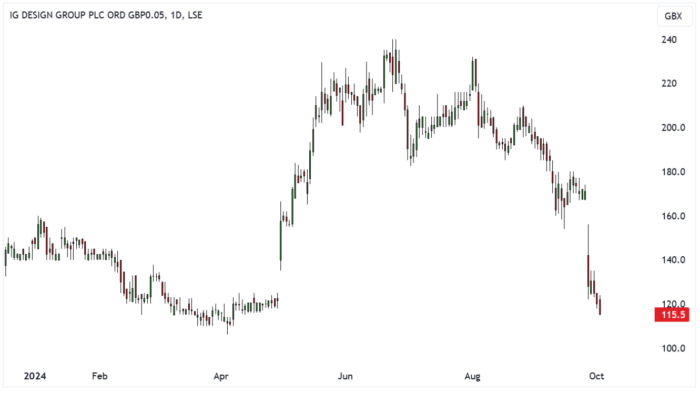

IG Design takes a hit following challenging AGM update

IG Design (IGR) saw its share price drop sharply following a disappointing AGM trading update that highlighted continued challenges in the DG Americas division.

For the five months ending August 31 the Group reported a 13% decline in overall revenue compared to the previous year, largely due to a persistent downturn in consumer demand and cautious ordering from major retail clients as they prepare for the upcoming holiday season.

The DG Americas division experienced a significant revenue decrease of around 14% during this period, building on a previous 16% decline reported in the prior fiscal year. This decline is attributed to reduced demand across various product categories and the need to manage credit risk exposure carefully.

Despite these setbacks in the Americas, the Group remains committed to its turnaround strategy, focusing on simplifying operations and leveraging scale to improve margins. The Board is optimistic that margins can return to above pre-pandemic levels of at least 4.5% in the fiscal year ending March 31, 2025. Adjusted profit is projected to grow by over 20% year-on-year, although this growth is now anticipated to fall within 10% of previous market expectations, believed to be around $36.0 million.

The outlook for the full year suggests that Group revenue may decline by approximately 5%, primarily due to the ongoing challenges in the DG Americas division. However, the Group expects operating profit to improve year-on-year, supported by strategic initiatives and a more favourable product mix in the second half of the financial year.

Learning Technologies soars 28% amid General Atlantic’s £800m takeover bid

Learning Technologies Group’s (LTG) share price surged by 28% on Friday after news broke that US private equity firm General Atlantic was nearing a deal to acquire the company for over £800 million. The offer, priced at £1 per share, prompted a sharp rally, boosting LTG’s market value to £760 million.

The potential buyout is the latest in a wave of private equity interest in UK-listed companies, and LTG, a leader in workplace digital training, has drawn attention due to its established client base in government and corporate sectors. Despite recent challenges, including a 12% drop in revenue for the first half of 2024, the company remains an attractive target, as General Atlantic looks to capitalize on its technology and strong market presence. The proposed deal, which includes an option for shareholders to reinvest, signals confidence in LTG’s future growth prospects, even amid its current market struggles.

With LTG’s board reportedly leaning toward recommending the offer, this development highlights the increasing momentum of private equity takeovers in the UK market, particularly in the tech sector.

Marlowe shares slide amid strategic transition

Marlowe’s (MRL) share price took another hit, gapping lower after the release of its latest trading update. Despite the company reporting mid-single-digit organic revenue growth and staying in line with the Board’s expectations, the market seemed to focus elsewhere.

The update highlighted the success of Marlowe’s share buyback program, with over £40 million returned to shareholders. While this should have been a positive signal, it wasn’t enough to prevent the share price from sliding further.

Marlowe has been in a period of strategic divestment over the past two years, streamlining its operations and optimising its business portfolio. This deliberate process has led to the stock moving sideways, as the market adjusted to the company’s transitional phase. The recent restructuring costs only added to the negative sentiment, which likely contributed to the downward movement in the stock.

Looking ahead, profitability is expected to improve significantly. Analysts forecast a dramatic turnaround in earnings over the next two years, driven by Marlowe’s leaner, more focused business strategy.

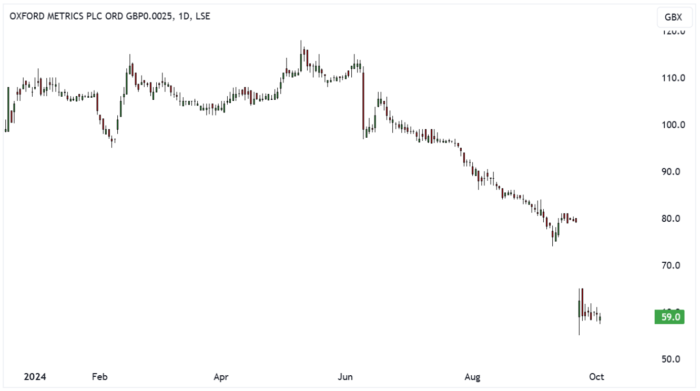

Oxford Metrics faces slower performance amid revenue revisions

Oxford Metrics’ (OMG) share price struggled following a trading update that pointed to slower-than-expected performance across key segments. While the company continues to maintain a healthy pipeline, prolonged buying cycles have been a major challenge in the second half of the financial year. This has led to a shift in several key opportunities into the next financial year, with Engineering, Life Sciences, and the Entertainment sectors all experiencing declines compared to the previous year.

In particular, the Entertainment sector has been hit by the ongoing global games industry slowdown, affecting content creation, which is a significant driver of demand. Despite these short-term setbacks, Oxford Metrics is focused on its future growth, with its much-anticipated markerless technology on track for commercial delivery in FY25. The technology has garnered interest from a growing number of blue-chip partners, now totalling ten, which highlights its potential as a game-changer in the market.

However, the immediate outlook has dimmed as the company revised its revenue expectations to the range of £40-42 million, resulting in adjusted profits before tax falling significantly below market expectations. Yet, Oxford Metrics remains in a solid financial position, boasting a strong net cash position of approximately £50 million. This financial strength is allowing the company to actively pursue M&A opportunities, particularly in the smart manufacturing space, where they aim to build upon their recent acquisition of Industrial Vision Systems (IVS).

With strong gross margins and a clear focus on the future, Oxford Metrics appears well-positioned to navigate these temporary headwinds. More detailed financials will be shared during the upcoming Preliminary Results in December, shedding further light on the company’s long-term strategy.

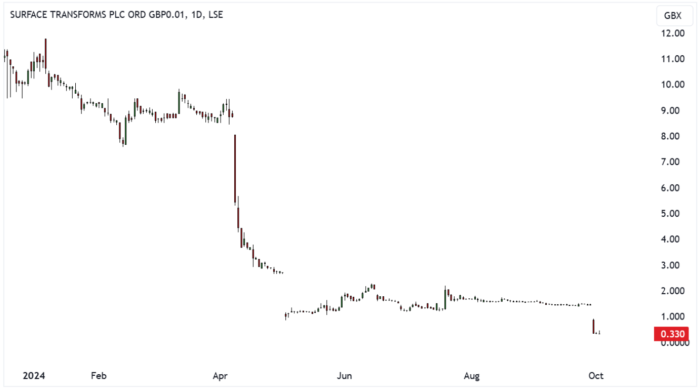

Surface Transforms faces challenges with overpromising and underdelivering

Surface Transforms (SCE) has continued their recent trend of overpromising and underdelivering, which is becoming increasingly concerning. Despite significant revenue growth of 58% in their interim results, reaching £4.7 million, the company has struggled to meet expectations across various performance metrics.

The operating loss widened to £7.4 million, compared to £5.6 million in the same period last year, highlighting ongoing challenges in controlling costs while trying to scale operations. This loss is exacerbated by increased research and development expenditures, which rose sharply as the company attempts to enhance its manufacturing processes. While investing in R&D is critical for long-term success, the lack of immediate returns raises questions about the company’s current operational efficiency.

Additionally, the forecast for Q3 revenues of £2.7 million was significantly below initial projections. The outlook for Q4 also paints a bleak picture, with revenues expected to be around £3.5 million—40% down on planned targets. This means that the total annual revenue is anticipated to be approximately £11 million, falling well short of the market guidance of £17.5 million.

Customers have expressed some support, recognising improvements in capacity and output. However, delays in upgrading manufacturing capacity and improving yield have hindered progress. These delays not only affect production but also impact the company’s cash flow, which has become constrained as operational costs mount.

Solid State initiates bonus issue and Gateway acquisition

The recent sharp drop in Solid State’s (SOLI) share price from 1175p on Tuesday to 263p on Wednesday is primarily the result of the company’s Bonus Issue.

This event, designed to improve liquidity and accessibility, issued four new shares for every existing one, multiplying the total share count and reducing the share price accordingly. While the price per share is now lower, the overall value of a shareholder’s holding remains unchanged because it is spread across more shares.

In addition to this Bonus Issue, Solid State announced the acquisition of Gateway Electronic Components Ltd on Wednesday. Gateway, a specialist in ferrite and magnetic components, will join Solid State’s Components division, Solsta.

This acquisition is expected to enhance the company’s earnings and boost the gross margin of the Components division in the first full year. Gateway brings valuable expertise, a complementary product line, and a strong client base that aligns well with Solid State’s existing business model.

By integrating Gateway’s products with Solid State’s broader portfolio and leveraging an enlarged sales force, the company aims to tap into new market opportunities, including cross-selling potential.

Wynnstay faces shortfall ahead of FY24 results

Wynnstay (WYN), the agricultural supplies company, has issued a trading update that indicates a challenging end to the financial year ending 31 October 2024 (FY24). The Board has signalled that results will fall significantly short of market expectations and below the prior year’s performance.

The company’s Feed division has struggled, with a noticeable decline in volumes amid a marginally growing market. This is primarily due to reduced poultry feed production at Twyford, which is expected to continue for the foreseeable future. Compounding this issue, the fertiliser blending operations at Glasson Grain have been hit hard by falling market prices and reduced sales volumes as farmers adopt a cautious purchasing stance ahead of harvest outcomes.

Despite these challenges, Wynnstay’s arable activities have largely met management expectations, and the Specialist Merchanting Division has outperformed last year, albeit modestly. While joint venture contributions have decreased compared to record levels in FY23, they remain in line with the company’s forecasts.

Looking ahead, Wynnstay maintains a solid market position, bolstered by a strong balance sheet and healthy cash flows. The Board is optimistic about the outlook for the livestock and dairy sectors and anticipates improved financial performance in FY25. The company plans to focus on operational efficiencies and future investments to navigate the current challenges.

Wynnstay is set to announce its full trading results for FY24 in late January 2025, with further updates on current trading expected at that time.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer: