Regency View:

Update

CML gap higher on bullish trading update

Shares in CML Microsystems (CML) surged higher last week following an upbeat trading update…

The chip maker said trading for the first half had been strong and revenues were expected to be well ahead of last year on a constant currency basis with a further boost coming from the cheap pound.

Gross margin has remained robust whilst overheads are in line with expectations. As a result, profitability is expected to be ahead of management’s earlier expectations.

“At the current rate of trading and based on current exchange rates, the Board expects that for the full year ending 31 March 2023 both revenues and profitability will be ahead of market expectations” read the bullish statement.

The market enjoyed what CML had to say and the shares gapped higher – creating a burst of momentum which should see the shares retest their recent highs.

Enwell see higher gas prices offset lower production

Enwell Energy (ENW) delivered a resilient set of half year results last week…

The Ukrainian gas producer saw revenue jump 88% to $77.2m, as significantly higher gas prices offset by lower production volumes.

Net operating profit came in at $32.4m, up 135% on the first half last year.

Enwell’s production has been severely disrupted by Russia’s invasion of Ukraine and while some field activities resumed at the MEX-GOL and SV fields, Enwell’s VAS field has remained closed since the invasion.

Enwell expect to resume production operations at VAS this month, but the scale and duration of the resumption remains unknown.

The shares continue to trade at a small premium to the cash on Enwell’s balance sheet.

TPX drop on profit warning and boardroom changes

It’s been a torrid week for TPX Impact (TPX) who released a shock profit warning on Friday…

The public sector digital transformation consultancy said its first-quarter order book was lower than expected due to internal inefficiencies, and blamed management underestimation about the centralized sales integration impact on its workers.

TXP also expect costs to increase due to further investment in human capital as it seeks to improve its finance, human resources and IT divisions.

The shocking admission of management underestimating issues with integration has lead to a reshuffle of the boardroom…

Co-founders CEO Neal Gandhi and CFO Oliver Rigby have been replaced by Bjorn Conway and Steve Winters, respectively.

TPX share price has fallen to retest their April 2020 post-IPO lows – a level which should provide some support.

We tend not to be too reactive to profit warnings as there is typically a ‘dead cat bounce’ which follows. For this reason we will continue to hold TPX and will keep you updated should this view change.

Learning Tech confident it will beat market consensus

Learning Technologies (LTG) delivered a strong set of half year numbers which saw headline revenue jump 241% as acquisitions gain traction.

Revenues rose to £281.8m for the six months to 30 June, with profit before tax at up four-fold to £18.5m, and adjusted earnings (EBITDA) up 100% to £44.1m.

“We remain confident in LTG’s resilience as we continue to deliver growth despite the wider macro environment,” said CEO Jonathan Satchell.

“LTG is in a strong position as more organisations focus on recruiting, training, motivating, and retaining the best talent.”

Satchell added that performance was supported by resilient growth across the group, benefitting from “well embedded commercial discipline”.

Learning tech upped its dividend by 50% to 0.45p and the shares look to be ‘hammering out a bottom’ on the price chart.

Boohoo warns sales and profits to fall short of forecast

In a downbeat set of interim results, published last week, Boohoo (BOO) warned that annual sales and profits will be lower than previously forecast…

The online fashion house blamed a deteriorating economy and a higher level of returns from customers.

Boohoo said it now expected underlying profit margins in the year to February 2023 to be between 3 and 5%, down from a range of 4 to 7% forecast in May. Analysts had expected forecasts of 4.8 per cent.

Sales are expected to fall by about 10%, similar to the level in the first six months, against expectations for growth of about 2%.

John Lyttle, Group CEO, commented:

“We have a clear plan in place to improve future profitability and financial performance through self-help via the delivery of key projects, which will stand us in good stead as macro-economic headwinds ease. We remain confident in the long-term outlook, as we continue to offer customers unrivalled choice, inclusive ranges and great value pricing, giving them even more reasons to shop with us.”

K3 Capital sees strong growth across three divisions

K3 Capital (K3C) delivered a strong set of final results last week in which revenues increased 50% to £70.7m.

The M&A house said it had seen strong growth across three divisions, with revenue “significantly ahead” of the prior year.

K3’s adjusted earnings (EBITDA) jumped 30% to £20.4m while cash in the bank remained steady at £13.7m.

K3 CEO, John Rigby commented:

“We believe it has been a pivotal year in creating a Group that we now see as extremely robust throughout the economic cycle”…

“At the end of the year we are well positioned to continue this upwards trajectory and early signs looking into the new financial year are encouraging, with revenue across the three business divisions significantly ahead of the same period last year”.

The shares have sprung back to life this week, helped by wider market conditions. And with a strong set of results behind them, the shares look well-positioned to outperform.

Ceres drop on China JV delay

Ceres Power (CWR) released a disappointing set of interim results last month which included a delay in its Chinese joint venture (JV) agreement…

The fuel cell developer said, most of the £30m licence fee revenue associated with the China JVs will be recognised in early 2023, whereas it had previously expected to recognise around half of these fees in 2022.

Ceres added that based on this expected timing of JV signing and regulatory clearances, it is now expected that revenue in the second half of 2022 will be “at similar levels to those in the first half, leading to full-year 2022 revenue lower than 2021 levels”.

However, H1 2023 revenue is expected to be at “significantly higher levels based on the expected recognition of most of the £30 million licence fee revenue on establishment of the JV entities in early 2023”.

The shares have continued to move lower, but our bigger picture outlook for Ceres remains unchanged and we believe they are well positioned to deliver long-term growth.

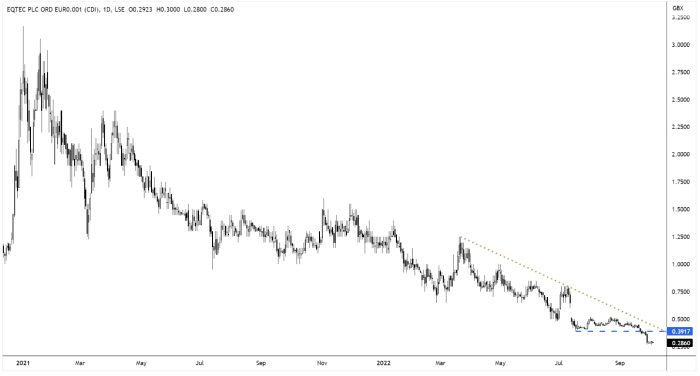

EQTEC to open first tech demonstration plant by the end of the year

Waste-to-energy stock, Eqtec (EQT) said its RDF (refuse derived fuel) projects in the UK are “gaining momentum, benefitting from innovative, multi-technology solutions, sharper financial models and world-class partnerships”…

In an upbeat set of interim results, Eqtec also announced plans to open its first tech demonstration plant (MDC) by the end of the year…

“Our MDCs will demonstrate those responses for the world to see, in live, commercial environments,” said David Palumbo, chief executive.

“The first will be operational this year, in one of the greenest, most beautiful parts of Italy”.

“We are commissioning Italia MDC now and will shortly thereafter move on to MDCs in Croatia and France”.

“Not only will these showcase numerous feedstocks for a range of offtake solutions, but they will demonstrate new business models to power a decarbonised world” he added.

Eqtec’s reenues rose six-fold to €2.98m in the half year to end-June 2022 and pre-tax losses were reduced to €2.3m from €4m.

For the full year, Eqtecis guiding towards total revenues in the range of €10- 2m and underlying losses in the range of €2-3m.

Much like Ceres Power, this is one for the long-term and we’re more than happy to continue to hold the stock.

Xpediator drop on interim profit plunge

Logistics group Xpediator (XPD) reported a rise in interim revenue, but profits dropped due to a hike in administrative costs…

Headline revenue jumped 50% to £189.3m, but pre-tax profit plummeted by 90% to £235,000 from £2.3m, as administration costs increased by 56% to £41m.

Xpediator suspended its interim dividend, compared to 0.50 pence per share a year prior as net debt almost doubled to £8m, compared to £4.8m.

Interim CEO, Mike Stone said:

“The company remains on track to meet full year management expectations due to the ongoing strength in customer demand and the improving performance of those UK businesses which under-performed in the first half.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.