30th May 2024. 8.57am

Regency View:

Update

Regency View:

Update

Atalaya mines solid Q1 results

Atalaya Mining (ATYM) reported copper production of 10.7 kt at a cash cost of $2.99/lb and an all-in sustaining cost (AISC) of $3.17/lb – in line with expectations.

Despite lower production, cost control remained strong. The company achieved an earnings (EBITDA) of €10.3 million at a realised copper price of $3.89/lb. Operating costs were lower, partly offsetting the reduction in copper revenues. Atalaya maintained a strong balance sheet with €36.1 million in net cash, although negative working capital movements impacted operating cash flows.

In terms of operations, the company mined 3.7 million tonnes of ore and processed the same amount, consistent with the previous year. However, the copper grade fell to 0.34% from 0.38%, mainly due to pit sequencing and rainfall affecting access to higher-grade areas. Copper recovery also decreased to 84.74% from 86.88%, leading to lower production of 10,666 tonnes, down from 12,139 tonnes in Q1 2023. The company noted that lower grades and recoveries were the main reasons for reduced production.

Cash flows from operating activities were negative €1.7 million, compared to positive €12.4 million in Q1 2023. Investments in key projects led to higher cash outflows in investing activities, totalling €17.9 million compared to €8.8 million the previous year. Financing activities also saw higher outflows due to repayments under the company’s credit facilities, resulting in a negative €16.8 million, up from €9.4 million in Q1 2023.

For the full year 2024, Atalaya maintains its copper production guidance at 51,000 to 53,000 tonnes, anticipating improved copper grades in subsequent quarters. The company’s cost guidance remains at $2.80 to 3.00/lb for cash costs and $3.00 to 3.20/lb for AISC.

Bango jumps after “Going for Gold” report highlights SportsVOD growth potential

Bango’s (BGO) share price rallied last week following the publication of its “Going for Gold” report, which highlighted significant opportunities in the SportsVOD market.

The report revealed that 29% of American subscribers plan to sign up for a new streaming service to watch the Olympic Games this July, with this figure rising to 66% among those who already pay for at least one SportsVOD platform. This surge in potential new subscriptions underscored the growing demand for sports streaming services, positioning Bango and its bundling solutions as key players in the market.

Investors reacted positively to the report, seeing Bango’s Super Bundling services as a solution to the challenges identified in the research, such as the fragmentation of sports streaming services and the associated high costs for consumers. The report’s findings that SportsVOD subscribers are willing to pay significantly more for their subscriptions than the average subscriber ($120 per month versus $77) further highlighted the lucrative nature of this market segment.

CEO Paul Larbey’s comments on the market potential and the role of Super Bundling in simplifying subscription management resonated with investors, who saw the potential for Bango to drive significant growth in the SportsVOD market.

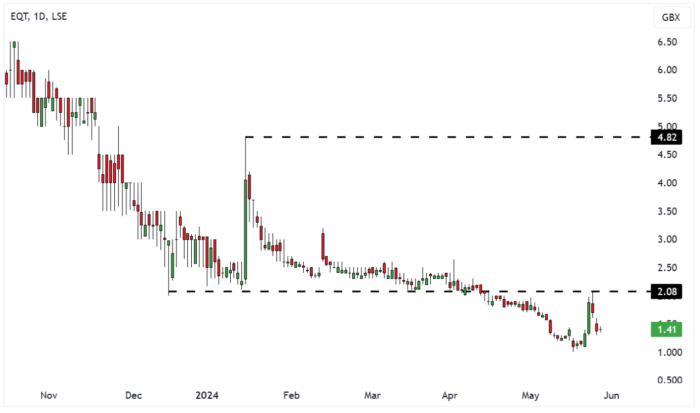

EQTEC charges ahead with refinancing

EQTEC’s (EQT) share price jumped last week after the company confirmed that it had successfully refinanced its existing secured lending facility.

This positive development was seen as a crucial step in stabilising the company’s financial footing and enhancing investor confidence.

The refinancing agreement involves a £5.5 million term loan with a fixed interest rate of 9.5%, payable at the end of a 24-month term. Importantly, the new loan removes the previous repayment schedule and conversion rights, except in the event of a default. This means that the outstanding debt will be repaid in proportion to future capital inflows, thereby aligning the company’s repayment obligations with its cash flow and revenue generation capabilities.

CEO David Palumbo expressed optimism about the new financing arrangement, noting that it demonstrates the increased confidence from secured lenders in EQTEC’s business model and strategic direction. He emphasised that the refinancing, coupled with anticipated cash inflows from the Logik settlement and other operational revenues, will create a strong foundation for the company to enter a growth phase.

FRP Advisory beats forecasts with strong FY 2024 performance

FRP Advisory (FRP)released its full-year trading update for the period ending 30 April 2024, showcasing exceptional performance exceeding market expectations.

FRP delivered robust revenue and profit growth, surpassing forecasts, with revenues reaching £128 million, a 23% increase from the previous year, and adjusted underlying EBITDA soaring to £37 million, up 37% from the previous year. All five service pillars contributed positively to this growth, underscoring FRP’s collaborative approach in delivering optimal client outcomes.

Despite economic challenges, particularly in sectors like Construction and Retail, FRP’s Restructuring team remained active nationwide, handling high-profile appointments such as the Body Shop and WiggleCRC. The Group maintained its position as the UK’s most active administration appointment taker, securing a 16% market share.

FRP expanded its capabilities through strategic acquisitions, including Wilson Field Group, GWC, and Hilton-Baird Group, bolstering its restructuring, advisory, and risk management services.

FRP said its expansion to 27 UK locations and two international offices enhanced its ability to provide tailored solutions to clients across diverse sectors. And with a strong balance sheet boasting an unaudited net cash balance of £29.7 million, FRP remained well-positioned for future growth.

Knights Group holdings delivers strong growth in full-year update

Legal services company, Knights Group (KGH) reported a solid performance in its full-year trading update.

Revenue is expected to reach approximately £150m, marking a 6% increase from the prior year, while underlying profit before tax is projected to rise to at least £25m, a 16% increase within market expectations.

Knights maintained strong working capital discipline, with debtor days decreasing to 28 days. Despite increased net debt of around £35.2m due to acquisitions, Knights retains significant headroom within its revolving credit facility.

Recruitment momentum remained strong, with senior fee earners joining the business, reflecting the attractiveness of Knights’ platform and corporate model.

CEO David Beech expressed confidence in the company’s growth strategy and operational performance, looking ahead to further growth in FY25.

Knights will provide a detailed update on trading with its full-year results announcement in July 2024.

EQT in talks to acquire Keywords Studios for £2.2bn

Keywords Studios (KWS) share price surged more than 60% last week following news of advanced discussions with European private equity group EQT regarding a potential acquisition. This significant increase in share price reflects investor optimism and confidence in the potential deal.

The surge in share price indicates the market’s positive reaction to the proposed cash offer of £25.5 per share from EQT, which represents a substantial premium compared to the stock’s recent value.

If the deal goes through, it would be the latest in a series of UK-listed companies attracting takeover interest due to depressed share prices, reflecting a broader trend in the market.

EQT has until June 15 to formalise its offer or withdraw from negotiations. Given our average entry price across the two tranches, we will sit tight and wait to see is the deal goes through. If EQT walk away, the shares will undoubtedly drop sharply, but underlines the value of Keywords offering which we believe is well positioned to shine through over the long-term.

Marlowe unveils strategic moves and positive trading update

Marlowe (MRL) announced several significant developments, including updates on divestment, capital return, board changes, and trading performance.

In terms of divestment and capital return, the £430 million divestment of certain Governance, Risk & Compliance (“GRC”) software and services assets was expected to be completed by May 31, 2024, after receiving all necessary regulatory approvals.

Marlowe planned to return up to an increased £225 million of divestment proceeds to shareholders through a special dividend and a share buy-back program. The special dividend amounted to £150 million (£1.55 per share), with an additional share buy-back of up to £75 million to be launched following the dividend payment.

Looking at the trading update for FY24, Marlowe made good financial and strategic progress, with trading performance in line with market expectations. Revenue from continuing operations was anticipated to be £292 million for Testing, Inspection and Certification (TIC) and £111 million for Occupational Health (OH). Adjusted EBITDA was expected to be approximately £49 million. Net debt at March 31, 2024, was projected to be around £177 million, reflecting strong cash generation and working capital improvements.

Regarding future strategy, Marlowe said its primary focus remained on driving margin enhancement and organic growth within its compliance service markets, with a strong emphasis on cash flow optimisation.

Finally, Marlowe announced the launch of a share buyback program. The company intended to return up to £75 million to shareholders through on-market purchases of ordinary shares under this program. The buyback program would commence upon payment of the special dividend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.