16th May 2024. 8.53am

Regency View:

Update

Regency View:

Update

Argentex: Driving strategic growth with new CEO and expansion plans

Argentex (AGFX) recently released its final results for the year ending December 31, 2023.

Despite a slight decline in revenue and operating profit compared to the previous year, the company remains debt-free and cash generative, with a focus on strategic growth.

The company’s strategic review has led to plans for operational and financial efficiencies, product diversification, and geographic expansion over the next five years. Additionally, the company plans to raise additional capital to accelerate its progression into Alternative Banking solutions.

Interim CEO Jim Ormonde has been appointed as permanent CEO, tasked with implementing the new strategy for continued growth. Despite challenging market conditions, the company sees multiple opportunities for future growth, with near-term revenue expected in the mid £40s million range.

Long-term growth potential is contingent on additional investments, with revenue growth projected in the 15% – 20% range by FY26, accompanied by improved EBITDA margins.

There’s no escaping the fact that Argentex’s share price has performed woefully during the last year. However, given the underlying quality of the company’s financials, and the stocks lowly valuation, we expect the shares to bounce back over the long-term.

Alliance Pharma faces CEO exit and delayed results

Alliance Pharmaceuticals (APH) is facing challenges as it replaces its CEO and experiences delays in publishing its 2023 results for the third time this year. The delays, attributed to auditing issues, have led to a sustained decline in the shares.

The departure of long-serving CEO Peter Butterfield, although unrelated to the delays, adds to the uncertainty surrounding the company. Despite efforts to address leadership concerns by appointing Nick Sedgwick as CEO, the company’s performance remains under scrutiny.

Alliance has faced a series of setbacks, including a fine from the UK’s Competition and Markets Authority and suspension of its dividend. The company’s heavy investment in acquisitions has increased its debt, but there are indications that debt levels may have decreased by 2023.

However, challenges persist in turning around the company’s performance, with scar treatment Kelo-Cote, a key revenue generator, facing pressure to sustain growth.

This week’s price action has seen the shares ‘drop and pop’ indicating that a short-term bottom may be in place. We will continue to monitor our position closely.

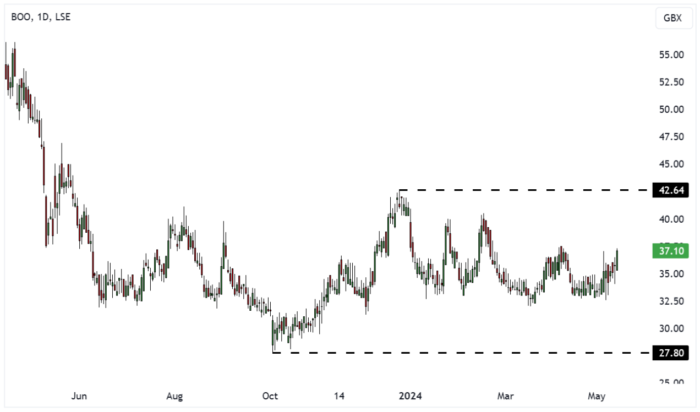

Boohoo faces widening losses amid tough market, but sees hope in core brands

Boohoo (BOO) faced challenges as its adjusted pre-tax losses widened by 30% to £31 million in the year ending February 2024.

There was also a 7% drop in adjusted EBITDA to £58.6 million. Despite these setbacks, positive trends are emerging in core brands like Boohoo, PrettyLittleThing, and Debenhams. Margins are also improving due to a focus on more profitable sales and cost-saving programs.

Group revenue fell 17% to £1.5 billion, attributed to intense competition and the normalization of online shopping post-pandemic. UK revenue declined 16% to £921.5 million, while US revenues were down 18%. However, management remains optimistic, noting improved sales momentum between the first and second halves.

Investments in infrastructure, such as opening a new US distribution center and completing an automation project in Sheffield, position Boohoo for sustainable growth. With greater cost savings and lower capital expenditure, management is confident of achieving its medium-term EBITDA margin target of 6%-8%.

CEO John Lyttle expressed confidence in the company’s strategy, emphasising the positive performance of core brands amid challenging market conditions. He highlighted a trend of improved performance in core brands, with gross merchandise value down 9% in the first half of the year and down just 4% in the second half.

Eckoh reports record contracted business

Eckoh (ECK) released a trading update for the year ended March 31, reporting profit and cash in line with market expectations. The company achieved record new contracted business in North America, with total contracted business reaching £52.6 million, driven by high renewals and strong new business growth in the second half of the year.

Despite slightly lower revenues of approximately £37.2 million compared to the previous year, adjusted operating profit increased to approximately £8.3 million, marginally ahead of market expectations. This improvement was attributed to a higher proportion of cloud-based revenues and ongoing cost efficiency.

In North America, the company saw significant growth in both renewals and new contracted business, driven by successful deal closures delayed from the first half of the year. The transition to cloud-based solutions continued at pace, leading to increased recurring revenue and enhanced revenue visibility.

CEO Nik Philpot highlighted the company’s strong pipeline of new business opportunities and the impact of the new version of the PCI standard on driving formal tender processes. Despite lower total renewal value expected this year due to timing factors, Philpot expressed confidence in significant growth from existing client base and further improvement in operating margin leveraging cloud platform and new product set.

Pan African updates production outlook and explores expansion

Pan African (PAF) provided an update on its production and cost guidance, narrowing production estimates for the current financial year to between 186,000oz to 190,000oz. The company ceased processing marginal surface sources at Evander Gold Mines due to economic reasons. Group all-in sustaining costs (AISC) guidance remains between $1,325/oz to $1,350/oz.

For the 2025 financial year, production guidance is set at 215,000oz to 225,000oz. The MTR Project is progressing as planned, with commissioning and steady state production expected in December 2024. The project’s capital cost remains on budget, and financial projections have been updated to reflect changes in exchange rates and gold prices.

An internal pre-feasibility study for the Soweto cluster was completed, indicating the potential for expanding the MTR operation’s capacity and increasing production. This expansion could extend the life-of-mine to 21 years and require additional capital investment. The combined NPV for Mogale and the Soweto Cluster is estimated at US$283 million.

Pan African CEO Cobus Loots expressed satisfaction with the company’s production results and the progress of the MTR project. He highlighted the positive impact of record Rand gold prices on the company’s financial performance and emphasized the economic attractiveness of the project with the addition of the Soweto Cluster resources.

Robinson reports strong trading momentum and pursues CEO appointment

Robinson (RBN) announced at its Annual General Meeting that it’s in advanced discussions for a new CEO appointment.

The packaging company reported continued positive momentum in trading, with sales volumes up by 12% compared to the same period last year, resulting in an 8% increase in total revenue. This growth is attributed to partnerships with major FMCG brands, investment in technology, and a focus on packaging made from post-consumer recycled material.

Profits have improved due to higher sales volumes, improved gross margins, and lower operating costs. Robinson also said it is pursuing the sale of surplus properties in Chesterfield, with an estimated market value of approximately £7.4m, with the intention of using the proceeds to reduce debt and develop its packaging business. Net debt has increased to £7m, including capital expenditure.

The company anticipates revenue for the 2024 financial year to surpass 2023, with full-year operating profit expected to be around £3m, ahead of market expectations. Robinson said it remains committed to achieving above-market profitable growth and aims for a 6-8% adjusted operating margin in the medium term.

Team Internet Group sees Q1 profits jump 44%

Team Internet Group (TIG) announced unaudited financial results for Q1, highlighting substantial growth in operating profit, which increased by 44%.

Key financial metrics included organic revenue growth of approximately 8%, with gross revenue increasing by 1% to USD 195.9 million and net revenue increasing by 4% to USD 47.6 million. Adjusted EBITDA increased by 4% to USD 22.2 million, and operating profit increased by 44% to USD 11.1 million.

Q1 highlights included increased visitor sessions in the Online Marketing segment and organic revenue growth in the Online Presence segment.

Post-period end highlights included the announcement of a final dividend for FY2023, the commencement of trading on the OTCQX Best Market, and the acquisition of Shinez and its subsidiaries.

The company remained confident in its strategic investments and expected to meet market expectations for the full year, emphasising its focus on earnings growth and operational excellence.

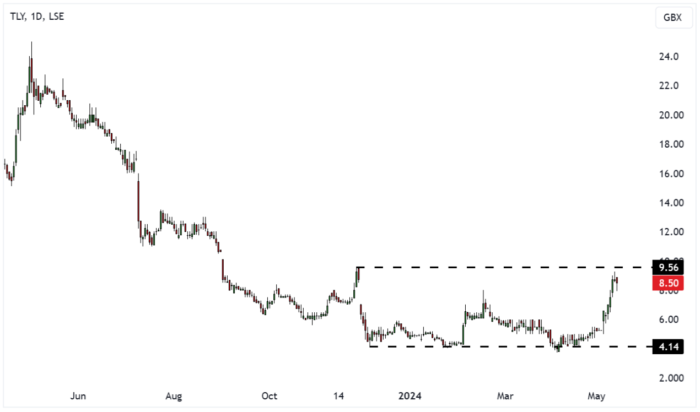

Totally reports improved performance amidst healthcare challenges

Totally (TLY) reported improved performance despite operational challenges, with revenue anticipated to be £106 million, down from £135.7 million in FY23.

Earnings (EBITDA) for the full year is expected to be approximately £2.3 million, compared to £1.1 million in H1 24. The company maintained gross cash of £2.3 million, with headroom on all bank covenants.

During FY24, Totally said it executed internal restructuring to optimise its organisation, resulting in a reduction in overhead costs by £2.2 million for the year and annualised savings of approximately £3.5 million. Exceptional costs for these restructuring efforts are forecasted to be £0.8 million.

In response to increasing demand for healthcare services, Totally increased insourcing activities for NHS Trusts and renewed its contract with NHS England as its sole resilience partner for NHS 111.

Looking ahead, Totally said it sees opportunities in supporting commissioners to manage demand and reduce waiting lists for treatment. The company is mobilising new services to address these challenges, leveraging internal improvements in efficiency, performance, agility, and innovation.

Wendy Lawrence, CEO of Totally, emphasised the company’s commitment to delivering quality care amidst market difficulties. She highlighted the successful cost-saving measures undertaken, which supported performance in FY24 and are expected to contribute to future profitability and growth.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.