2nd May 2024. 9.01am

Regency View:

Update

Regency View:

Update

Alpha FMC surge amid takeover approaches

Financial services consultancy, Alpha FMC (AFM) surged higher this week after confirming rumours of two takeover approaches.

One of the parties involved is investment firm Bridgepoint Advisers, which presented a non-binding indicative proposal concerning a potential cash offer for the entire issued and to be issued ordinary share capital of Alpha FMC. Additionally, private-equity firm Cinven is also reportedly considering making an offer. However, as of the announcement, Alpha FMC has not received a formal proposal from Cinven.

In its response to the recent press speculation, Alpha FMC emphasised that there is no assurance that any firm offer will materialize, nor are there certainties about the terms of such an offer. The company stated that both Bridgepoint Advisers and Cinven have until May 29th to announce whether they intend to proceed with formal offers.

Despite the surge in share price and the interest from potential acquirers, Alpha FMC underscored the uncertainty surrounding the situation. We will continue to monitor the situation closely as it develops.

Cerillion’s record-breaking growth and strong outlook

Cerillion (CER) recently reported record-breaking growth in its half-year trading update for the first six months of its financial year.

The CRM software company expects to achieve revenue of approximately £22.5 million, up 10% from the previous year, while adjusted EBITDA is anticipated to reach around £10.9 million, also a 10% increase year-on-year.

This impressive performance is supported by ongoing strong demand from customers, particularly in the telecommunications sector, which is undergoing digital transformation. The shift towards Software-as-a-Service solutions and investment in enterprise software are driving revenue and efficiency gains in the market, contributing to Cerillion’s positive outlook.

The company’s balance sheet is bolstered by a rise in net cash to approximately £26.6 million, providing a solid foundation for future growth.

Cerillion’s sales pipeline remains strong, featuring several significant potential contracts at various negotiation stages. With a favourable trading backdrop and a well-positioned portfolio of solutions, Cerillion’s board is confident in the company’s ability to meet market expectations for the current financial year and beyond.

eEnergy sparks growth with spire healthcare contract

eEnergy (EAAS) has secured a significant contract with Spire Healthcare Group plc worth approximately £5.2 million.

The contract involves the installation of a PV (photovoltaic) system across 38 sites operated by Spire. Revenue from this contract is expected to be recognised in FY24, aligning with the Group’s existing forecasts for the period. The contract underscores eEnergy’s commitment to delivering innovative energy efficiency solutions, showcasing its capabilities across multiple projects and sites.

In its financial results for the 18-month period ending 31 December 2023, eEnergy reported revenue of £26.3 million, with an increase in Energy Services revenue by 68% on a like-for-like basis. Adjusted earnings (EBITDA) stood at £0.2 million.

Profit generation for FY24 is expected to be concentrated in the second half of the year, supported by solar contracts secured in prior periods and reductions in the Group’s cost base. The company anticipates market recovery, with a strong forward order book and growing pipeline indicating confidence in revenue and earnings growth for H2 24. Expansion plans include targeting new sectors such as healthcare and reducing the Group’s cost base to enhance efficiency.

Eleco powers forward: Record growth and strategic advances in 2023

Construction software specialist, Eleco (ELCO) reported a strong set of full year numbers last week.

Financially, highlighted included a 24% increase in Annualised Recurring Revenues (ARR) to £22.6 million and a 22% rise in Total Recurring Revenues (TRR) to £20.7 million. Gross margins improved to 89.81%, and EBITDA increased by 12% to £5.8 million. Profitability metrics such as Profit before taxation (PBT) and Profit after taxation (PAT) also saw significant growth. The company remains debt-free with cash of £10.9 million post M&A activity.

Operationally, Eleco said it has pursued strategic initiatives such as acquisitions to widen capabilities and customer base, with acquisitions of BestOutcome Limited and Vertical Digital. The company also focused on margin improvement, leading to discontinued lower-margin product lines and the divestment of non-core business Eleco Software GmbH.

In terms of growth, Eleco achieved record recurring revenue growth and implemented a direct sales channel in the USA. Jonathan Hunter, Eleco CEO highlighted the record levels of recurring revenue growth and future revenue security through increased subscription licenses. He emphasised Eleco’s commitment to growth through acquisitions and innovation, expressing confidence in the company’s potential to further enhance its performance and continue its growth in 2024.

Jet2’s profit projections take off amidst sunny outlook

Jet2 (JET2) released a buoyant trading update covering the year ended 31 March 2024 (FY24) and insights into the upcoming year ending 31 March 2025 (FY25).

The travel group expects to report a profit before foreign exchange revaluation and taxation of between £515m and £520m, showcasing a notable increase of approximately 33% compared to the prior year. The Balance Sheet remains robust with total cash at £3.2bn and an ‘Own Cash’ balance of £1.3bn.

Looking ahead to FY25, the company reported positive trends in seat capacity, forward bookings, and package holiday mix, with encouraging performance across leisure travel products.

Operational preparations for the upcoming summer season are well underway, including fleet expansion and successful flight operations from new bases.

However, the company remains cautious about macroeconomic and geopolitical factors impacting consumer spending.

CEO Steve Heapy expressed confidence in the Group’s resilience and customer-centric approach, anticipating continued success in the upcoming year.

The Group will provide a fuller outlook for FY25 during its Preliminary Results announcement on 11 July 2024.

LBG Media sees a clear path to £200m revenue

LBG Media (LBG) reported final results for the year ended 31 December 2023 (FY23). The company highlighted significant strategic progress and expressed confidence in its growth strategy, with a clear path towards achieving £200m in revenue.

Financial highlights for FY23 included total group revenue of £67.5m, up 7.5% from FY22, and adjusted EBITDA of £17.4m, demonstrating strong year-on-year growth.

Strategic and operational highlights included significant progress in the US market with the acquisition of Betches Media, improvements in the operating model in Australia & New Zealand (ANZ), and notable growth in the global audience and video views.

The Betches acquisition, completed in October 2023, marks a significant addition to the US growth platform. Betches achieved proforma revenue of $17.2m in FY23, contributing £2.3m to LBG Media’s FY23 revenue, with expectations of greater contribution going forward.

CEO Solly Solomou emphasised the Group’s unique position and resilience, highlighting the growth in global audience and strengthened presence in the US market. The company’s commitment to socially responsible initiatives and deepening relationships with blue-chip advertisers were also highlighted.

Looking ahead, the Group is optimistic about revenue momentum and growth opportunities, with a clear path towards achieving £200m in revenue. Revenue is expected to be affected by seasonality in advertising spend, with adjusted EBITDA weighted towards the second half of the year. Nonetheless, the Group remains on track to deliver market expectations for the full year.

Mulberry’s revenue decline reflects luxury retail’s struggles amid economic turmoil

Mulberry (MUL) released its year-end trading update for the financial year ended 30 March 2024 (FY24).

Despite facing challenging macro-economic conditions and a decline in luxury consumer spending, group revenue declined by -4% (-2.7% on constant exchange rates) compared to the prior year. Retail sales remained largely flat, with growth in Europe and the United States offsetting declines in the UK and Asia Pacific regions.

The positive growth in Europe and the United States was driven by increased brand awareness and direct-to-customer strategies. However, challenges persisted in the UK and Asia Pacific regions due to economic conditions and reduced footfall. Franchise and wholesale sales also declined, consistent with the first half of FY24.

Thierry Andretta, CEO of Mulberry, acknowledged the impact of the broader downturn in luxury spending but highlighted positive trading in the US. Looking ahead, he noted that the trading environment in the UK and China remains challenging, and the company is focusing on executing its strategy to become a global sustainable luxury brand.

Mulberry remains prudent in managing its business amidst ongoing challenges, with a strategic vision for future growth.

RWS anticipates a stronger performance in the second half

Language services group, RWS Holdings (RWS) released a solid trading update for the first half of the fiscal year 2024 (FY24).

Despite encountering a 2% decline in organic revenue, RWS maintained robust levels of cash generation. It anticipates a stronger performance in the second half, supported by a range of new business wins across its operations and an expected recovery in higher-margin segments.

RWS’s revenue for the period is projected to be £350 million, reflecting a 4% decrease compared to the prior year. Notably, this decline follows an improving trend compared to the previous fiscal year’s performance, with the first half of FY23 seeing a 7% decline and the second half a 5% decline.

While certain market segments continue to exhibit soft activity levels, the Group remains encouraged by the return to growth in two of its services divisions and the increasing traction of its AI-based solutions. These factors have contributed to several new business wins during the first half.

Adjusted profit before tax (PBT) for the first half is expected to be approximately £45 million, down from £54 million in H1 FY23. This decline is attributed to weaker performance in some higher-margin businesses, an unfavourable mix of work in parts of Language Services, ongoing investments, and year-on-year foreign exchange differences.

While Language Services and IP Services have returned to growth, challenges persist in Regulated Industries and certain segments of content management software. Nevertheless, RWS said it remains optimistic about its ability to successfully leverage its growth initiatives and AI offerings to navigate these challenges and deliver on the Board’s full-year expectations.

Serica maintains dividend despite challenges

Serica Energy’s (SQZ) recent results highlighted the company’sresilience amidst industry challenges, maintaining its dividend despite a drop in profitability.

Serica reported headwinds including lower sales prices and a hefty 75% marginal tax rate, but remained steadfast in delivering value to its shareholders. The final dividend remains at 14p per share, reflecting a total dividend increase for 2023 to 23p per share. Additionally, a £15 million share buyback initiative signals the board’s confidence in the company’s future prospects and asset value.

The acquisition of Tailwind Energy Investment Ltd in March 2023 marked a significant milestone, bolstering Serica’s portfolio and expanding its operational footprint. Proforma production averaged 40,121 boe per day in 2023, with 2P reserves soaring to 140.3 million boe. Despite challenging market conditions, Serica reported robust revenue of £632.6 million and an EBITDAX of £381.4 million.

Looking ahead, Serica remains focused on driving value and operational excellence. Anticipated capital expenditure of around £170 million in 2024, coupled with targeted operating costs of US$20 per boe, reflects the company’s commitment to prudent financial management amidst inflationary pressures. Furthermore, the addition of new commodity price hedges underscores Serica’s proactive approach to mitigating risks and safeguarding projected production volumes.

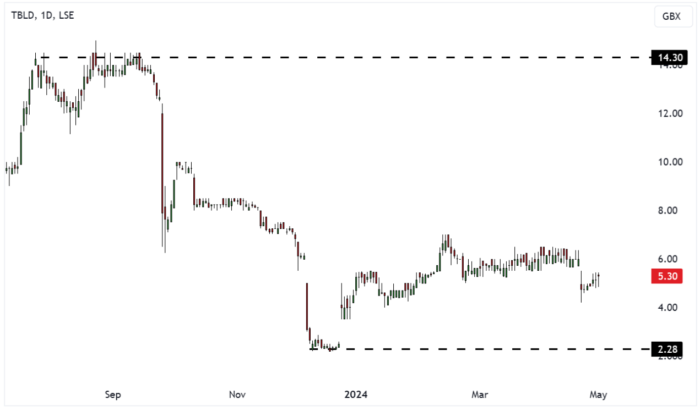

tinyBuild’s robust performance in 2023 despite revenue dip

Video games publisher tinyBuild (TBLD) faced a 29% revenue decline to $44.7 million, primarily due to decreased revenues from large contracts.

Operating profit swung to a loss of $63.8 million, contrasting with the previous year’s profit of $15.9 million, mainly due to impairment charges and lower revenues. Adjusted EBITDA also turned negative at $7.1 million. Despite these challenges, tinyBuild swiftly implemented a cost action plan, resulting in substantial annualised savings for 2024.

Operational highlights included robust back catalogue sales, although contribution from own-IP titles decreased slightly. The company released several new titles and DLCs, showcasing its commitment to product development.

Post-period, tinyBuild raised funds and announced upcoming game releases. However, it also saw studio closures and a key executive resignation.

Looking ahead, tinyBuild remains optimistic about its pipeline, albeit cautious due to geopolitical uncertainties. CEO Alex Nichiporchik emphasised the importance of diversification and long-term franchise sustainability in navigating industry challenges. He expressed gratitude to the board and staff for their dedication during tough times.

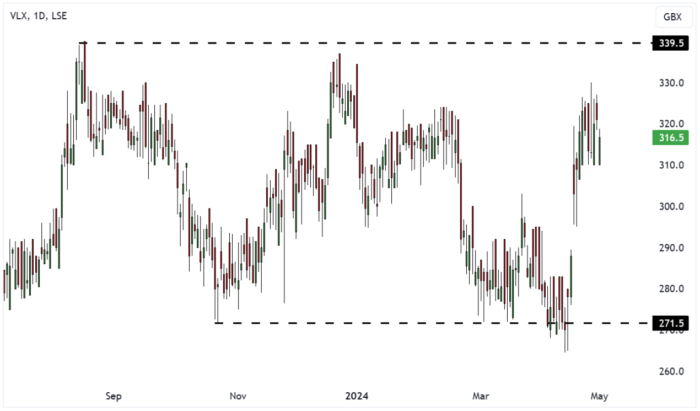

Volex surges on strong full-year performance outlook

Volex (VLX) have surged higher this week after announcing full-year performance is expected to surpass market expectations due to strong organic growth.

The manufacturer of critical power and data transmission products said revenue is projected to be at least $900.0 million, representing a minimum 25% increase over the previous year, including contributions from the acquisition of Murat Ticaret.

Underlying operating profit is anticipated to exceed analyst predictions and operating profit margins improved in the latter half of the year, partly due to product mix and contributions from Off-Highway sales.

Despite accelerating investments in future strategic growth initiatives to support long-term customer demand, Volex remains confident and optimistic about entering the new financial year.

Chairman Nat Rothschild attributed the company’s strong growth in challenging markets to the quality of its team, strategy, and responsiveness to customer needs. He expressed confidence in the momentum generated during the current financial year, improving market conditions in electric vehicles and consumer electricals sectors, and opportunities in the new off-highway sector.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.