18th Apr 2024. 8.58am

Regency View:

Update

Regency View:

Update

Alpha FMC reports solid FY24 performance despite market challenges

Alpha Financial Markets Consulting (AFM), recently reported a solid trading update for the year ending March 31, 2024 (FY24).

Despite facing a more competitive global consulting market with longer sales cycles, Alpha FMC experienced improved trading in the fourth quarter. This improvement led to overall consultant utilisation nearing target levels by March.

The Board anticipated net fee income growth of approximately 3% from the prior year and adjusted earnings (EBITDA) of £42m – £43m, with a slightly improved margin compared to the first half. Alpha FMC said it had maintained robust client demand and achieved higher sales wins recently. It also held a strong pipeline of new business opportunities.

CEO Luc Baqué highlighted the challenging market conditions but expressed optimism due to recent improvements. With confidence in its long-term growth drivers and a goal to double its business by 2028, Alpha FMC remained well-positioned for continued growth.

CAML achieves solid production growth in Q1 2024

Central Asia Metals (CAML) provided a Q1 2024 operations update for its Kounrad copper recovery plant in Kazakhstan and the Sasa zinc-lead mine in North Macedonia.

At Kounrad, copper production reached 3,120 tonnes, while at Sasa, zinc in concentrate production was 4,741 tonnes, and lead in concentrate production was 6,529 tonnes.

For the full year 2024, CAML provided production guidance: copper production is expected to be between 13,000 to 14,000 tonnes, zinc in concentrate between 19,000 to 21,000 tonnes, and lead in concentrate between 27,000 to 29,000 tonnes.

Nigel Robinson, CEO, noted a solid first quarter of production despite challenging weather conditions and ongoing construction at the Sasa site. The company is on track to complete infrastructure required for the transition to paste fill mining by H2 2024.

Additionally, CAML announced its intention to invest up to £5 million in Scottish copper and nickel explorer, Aberdeen Minerals.

Cake Box delivers full year profits ahead of expectations

Cake Box (CBOX) announced a full-year trading update for the period ending March 31, 2024, indicating strong growth across the business and profits slightly ahead of market expectations.

In the second half of the year, Cake Box experienced increasing momentum, marked by new store openings, positive sales growth from enhanced marketing campaigns, higher online sales, including a popular “click and collect” feature, and the launch of new innovative products. Revenues for the year are expected to increase by approximately 9% year-on-year.

The company balanced cost control with investment in growth areas, benefiting from stabilised raw material costs and efficiency gains from previous investments. This, combined with increased revenues, is anticipated to result in adjusted profits slightly above market expectations.

Cake Box’s brand awareness, customer experience, and loyalty have strengthened, driven by an enhanced marketing strategy, including a new CRM system, e-commerce website, and brand identity refresh. Marketing effectiveness has improved, aided by a co-funded national advertising fund with franchisees, resulting in an enhanced customer experience and higher retention.

Franchisee stores are performing well, with like-for-like sales expected to increase by approximately 4.4% year-on-year. The demand for new stores remains strong, with plans to reach a long-term target of 400 stores. During the year, 20 new stores were added, bringing the total to 225.

The company’s balance sheet strengthened, with a significant increase in net cash position to £7.3m at the period end.

Gattaca focuses on core strengths amidst challenging conditions

Specialist staffing business, Gattaca (GATC) reported a mixed set of interim results for the six months ending January 31, 2024.

Financially, the group reported a decrease in revenue and net fee income (NFI) compared to the previous year, with an underlying profit before tax of £0.8 million. The total sales headcount decreased by 1%, and net cash increased to £22.3 million.

Despite macro-economic headwinds affecting demand and candidate sentiment, Gattaca expect full-year underlying profit before tax to be in the range of £2.4m to £2.7m.

Strategically, Gattaca’s results emphasised four priorities: external focus, culture, operational performance, and cost rebalancing. Efforts included investing in the Business Development team, enhancing client and candidate service, launching customer-focused automations, and optimising costs.

CEO Matthew Wragg highlighted positive impacts from business development investments, client extensions, and managed service provider wins. He acknowledged challenges in permanent fee income due to reduced volumes and program exits but expressed confidence in the Group’s resilience and focus on building market share amidst economic recovery.

hVIVO announce record margins and cash generation

hVIVO (HVO) announced record financial and operational results for the year ending December 31, 2023.

Financially, the company reported a 16% increase in revenue to £56 million and a 44% increase in EBITDA to £13 million, with EBITDA margins reaching 23.3%. Cash and cash equivalents stood at £37 million, and the company initiated an annual dividend policy with a dividend of c.£1.4 million.

Operationally, hVIVO signed multiple human challenge trial contracts, including its first contract with an Asia-Pacific client in over a decade. The company also commenced development of challenge agents and completed manufacturing of the Flu B challenge agent. Operational efficiencies led to record margins and cash generation.

Post-period end highlights include the signing of a Master Services Agreement with a mid-sized pharma client and the ahead-of-schedule fit-out of a new facility at Canary Wharf, which will increase quarantine capacity to 50 beds, establishing it as the world’s largest commercial human challenge trial unit.

Looking ahead, the company expects revenue guidance of £62 million for 2024, with 90% of revenue guidance already contracted. The company remains confident in achieving its medium-term target of growing revenue to £100 million by 2028, supported by its strong cash position and strategic initiatives.

Dr. Yamin ‘Mo’ Khan, CEO of hVIVO, expressed confidence in the company’s ability to meet increasing demand and achieve its growth targets, attributing the success to the dedication of the team.

Inspecs sets sights on strong performance for 2024

Eyewear designer, Inspecs (SPEC) released its final results for 2023, showcasing a strong financial performance and operational highlights.

Financially, the company reported a group revenue of £203.3 million, with gross profit increasing by 4.7% to £103.5 million. Adjusted Underlying EBITDA saw a significant rise of 16.1% to £18.0 million. Notably, the company achieved a profit before tax of £0.2 million, compared to a loss before tax in the previous year.

Operationally, key highlights include the completion of a new 8,000sqm manufacturing facility and successful launches of leading brands into major global retailers. The company secured new distribution deals for its brands and made significant operational improvements, particularly with the Norville team. Additionally, new product launches and acquisitions contributed to the company’s growth strategy.

Despite a slower end to 2023 and a slow start to 2024, recent trends have been more encouraging, supporting the delivery of market expectations for 2024. CEO Richard Peck expressed confidence in the company’s future, highlighting its resilience in a growing market and its commitment to sustained and profitable growth.

Learning Tech plan acquisition return in 2024

Learning Technologies (LTG) has released its full-year results for 2023, showcasing resilient financial performance in line with consensus expectations.

In terms of strategic execution, LTG focused on doubling profits at GP Strategies, renewing major client contracts, and actively managing its portfolio, including the sale of Lorien Engineering Solutions.

Financially, LTG reported revenue of £562.3 million and adjusted earnings of £98.5 million, with resilient revenue driven by durable SaaS and long-term contracts. The company achieved record net cash flow from operations of £79.5 million, driving swift deleveraging to 0.7x prior to incorporating proceeds from disposals. The Board proposed a final dividend increase of 5% to 1.21 pence per share, subject to shareholder approval.

Looking ahead, while maintaining a cautious stance for 2024 due to macroeconomic uncertainty, LTG remains confident in its effective Go-to-Market strategy, ongoing product innovation, and portfolio management to drive growth in adjusted EBIT and restore underlying revenue growth as the macroeconomic environment improves.

The Board also revised its 2025 targets for run-rate revenues and adjusted EBIT due to the subdued macroeconomic environment. However, LTG’s strong cash generation and balance sheet strength support a return to acquisitions in 2024 and beyond, alongside an expectation of organic growth as the economy improves.

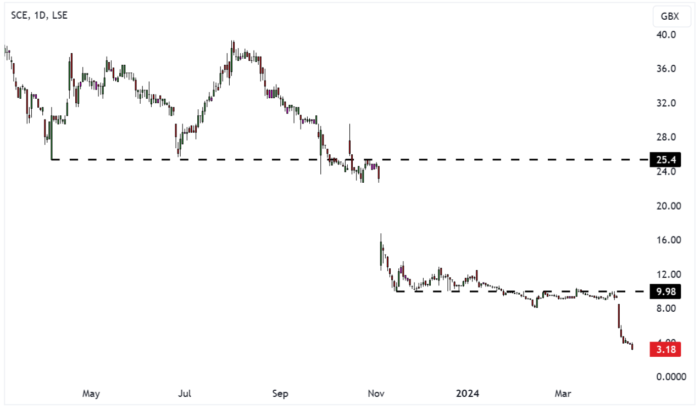

Surface Transforms slide as sales miss targets

Surface Transforms (SCE) share price has continued to decline this month following a weak trading update that revealed sales had fell short of internal targets.

The ceramic brake disc manufacturer reported sales of £3 million, consistent with the previous quarter’s performance but below management expectations.

Surface Transforms said operational improvements have addressed capacity constraints and improved plant availability, though challenges with scrap from processes not yet fully capable persist.

Revised 2024 delivery schedules have been agreed with customers, and progress on installing new capacity is on track, with all but one furnace expected to be on site by mid-year. The company has secured financing for its capital expenditure programs.

Despite challenges, sales guidance for 2024 remains unchanged at £23 million. Board changes are underway, with the Chairman intending to retire in 2024.

CEO Kevin Johnson emphasised the company’s commitment to addressing challenges and building production capacity to drive revenue growth in 2024 and beyond.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.