4th Apr 2024. 9.01am

Regency View:

Update

Regency View:

Update

Billington breaks records with £90m contract wins

Structural steel and safety company, Billington (BILN) has recently been awarded six new contracts totalling approximately £90 million.

These contracts represent a significant achievement for the company and contribute to its growing order book. Among these contracts is the largest single contract in Billington’s trading history, marking a notable milestone for the company.

The contracts cover a diverse range of sectors, including power generation, manufacturing, and retail logistics. They are slated for delivery over the next 24 months, indicating a steady stream of work for the company. Mark Smith, Billington CEO, expressed his satisfaction with these contract wins, emphasising their importance in a challenging trading environment.

Smith sees these contracts as a validation of Billington’s reputation as a preferred steelwork contractor. The company’s record order book, bolstered by these new contracts, instils confidence in its performance for 2024 and beyond.

The shares gapped higher on this positive newsflow and we expect this burst of bullish price momentum to propel the shares above resistance.

Cohort secures £135m Royal Navy countermeasures contract

Cohort (CHRT) recently announced that its subsidiary, Systems Engineering and Assessment Ltd (SEA), has won a contract from the UK Ministry of Defence.

The contract involves providing Electronic Warfare Countermeasures Increment 1a (EWCM 1a) to the Royal Navy, with a total value of at least £135 million. The work includes supplying and supporting SEA’s Trainable Decoy Launcher System, named Ancilia, which incorporates technology from Cohort’s Chess Dynamics Ltd. The contract, expected to last more than ten years, may see its value increase with additional options. Cohort anticipates significant earnings growth due to recent order wins, including this contract.

Ancilia offers rapid protection against modern anti-ship threats and will be installed on various Royal Navy surface ships. The design draws upon SEA’s extensive experience with existing Royal Navy systems.

Andy Thomis, Cohort’s CEO, considers this contract a major achievement for SEA and the Group. He emphasised the improved protection Ancilia will provide against evolving threats and sees potential for exporting the UK-designed and built solution.

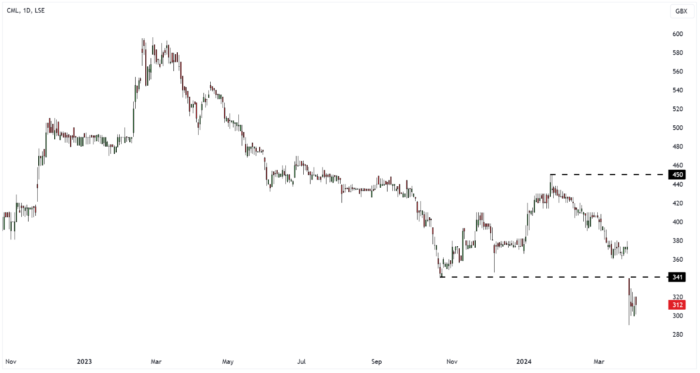

CML drop on weak performance in China

Shares in chip-maker, CML Microsystems (CML) dropped last week following the release of a trading update for the year ended 31 March 2024 (“FY24”).

The company performed well in the first half of the year, showing solid growth despite a general decline in the semiconductor market. However, caution was advised for the second half due to elevated inventory levels, weak performance in the China market, and the integration of Microwave Technology, Inc. (MwT).

The second half confirmed the need for caution as some customers continued to reduce inventory levels, affecting core business shipments. On a positive note, revenue from MwT exceeded expectations, showing progress under CML’s ownership.

Total revenue for the year is expected to be around £23 million, in line with expectations but with a change in revenue mix impacting profitability. Pre-tax profit is forecasted to be just under £3 million, with EBITDA around £6.4 million, slightly below expectations.

The market’s reaction has been bearish and CML gapped below key support. Given the underlying quality of the company and its position in key markets we will look to sit tight and ride out the storm.

Good Energy results: transformational twelve months

Good Energy’s (GOOD) preliminary results for the twelve months ended 31 December 2023, marked a significant period of transformation for the company.

Operationally, Good Energy completed three strategic acquisitions throughout the year, expanding its offerings to include heat, EV charging, and solar installation services. The company cemented its position as a microgeneration specialist, offering premium, end-to-end solutions in solar and heat pump installations alongside top-ranked renewable electricity supply offerings.

In financial terms, the company reported a 2.4% increase in revenue, reaching £254.7 million, driven by high commodity costs. Gross profit rose substantially to £44.2 million, reflecting a strong performance in the first half of 2023. The company’s reported profit before tax improved to £5.7 million, signalling recovery from previous wholesale price spikes.

Looking ahead, with rapidly growing heat and solar markets, Good Energy said it is well-positioned to capitalise on its expanded service portfolio. The company anticipates lower costs in 2024 due to decreased wholesale prices and expects its energy services segment to become a significant driver of profitability by 2025.

CEO Nigel Pocklington emphasised the company’s transformation into a fully-fledged clean energy services business, supported by strategic acquisitions.

Science Group reports strong growth and increased dividend

Science Group (SAG) surged higher as it saw a notable increase in group revenue to £113.3 million, driven in part by contributions from the TP Group acquisition completed in January 2023.

Adjusted operating profit rose to £20.5 million, and adjusted basic earnings per share increased to 33.3 pence. Reflecting the company’s growth, the proposed dividend is set to increase by 60% to 8.0 pence per share.

The company ended the year with cash and cash equivalents of £30.9 million and net funds of £18.0 million. Science Group’s Executive Chair, Martyn Ratcliffe, highlighted the company’s resilience in a challenging macro-environment and its strong operating track record.

The consultancy services division, which includes the recent addition of TP Group’s defence and aerospace services, generated revenue of £81.3 million and an adjusted operating profit of £20.4 million. The systems businesses reported revenue of £31.2 million and an adjusted operating profit of £2.2 million, with notable performance from Submarine Atmosphere Management Systems (CMS2) and Audio Chips and Modules (Frontier).

Looking forward, Science Group anticipates continued geopolitical and economic instability in the first half of 2024. However, the company remains confident in the trajectory of the TP Group acquisition and its ability to deliver value to shareholders through its proven operating model and strategic initiatives.

Solid State reports record-breaking year FY24

In a recent trading update, Solid State (SOLI) reported a record-breaking year for FY24, surpassing consensus expectations with revenues and adjusted profit before tax expected to exceed projections.

This is attributed to accelerated revenue recognition from specific contracts in FY24, previously anticipated for FY25, particularly in the Systems division, driven by heightened demand from security and defence sectors.

The Systems division experienced exceptional growth, with revenues up approximately 80% compared to the prior year, largely due to increased demand from security and defence customers. However, the Components division faces challenges as component lead times reduce, resulting in a slowdown in the industrial sector. Despite this, Solid State said the open order book for FY25 remains robust.

Looking ahead, Solid State anticipate a strong order book for FY25, with strategic investments planned to expand production capabilities and drive mid-term growth. These investments include developing sales channels for proprietary products and establishing a new Integrated Systems production facility.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.