21st Mar 2024. 9.00am

Regency View:

Update:

Regency View:

Update:

Atalaya Mining powers forward: Strong financials and strategic growth initiatives

Atalaya Mining (ATYM) shared its 2023 annual financial results, reporting positive outcomes in various aspects.

They achieved a copper production of 51.7 kt with favourable cash costs and All-In Sustaining Costs (AISC).

Financially, the company saw improvements, with adjusted earnings (EBITDA) reaching €73.1 million, up from €55.3 million in the previous year. Cash flows from operating activities also jumped to €64.7 million compared to €38.5 million in the prior year.

Despite significant investments in projects like E-LIX and a 50 MW solar plant, Atalaya maintained a strong balance sheet with €54.3 million in net cash. Shareholders can anticipate a proposed final dividend of $0.04/share, summing up to $0.09/share for the full year.

Looking ahead, Atalaya plans to focus its capital expenditure for 2024 primarily on early works at the San Dionisio project, alongside further investments in E-LIX and the solar plant. The company forecasts a copper production range of 51 – 53 kt for 2024, with AISC in the range of $3.00 – 3.20/lb, consistent with the previous fiscal year.

Beeks extends contract with JSE, accelerates growth

Beeks Financial Cloud (BKS) announced a significant contract extension with the Johannesburg Stock Exchange (JSE) for its Exchange Cloud services. This extension followed the successful launch of JSE Colo 2.0 in September 2023.

“Following the successful launch of JSE Colo 2.0 in September 2023, the exchange has signed a significant contract extension to meet stronger than anticipated customer demand for the solution and a significant pipeline,” said Gordon McArthur, CEO at Beeks.

Due to stronger-than-expected customer demand, revenue expectations had increased, supporting upward revisions for FY25. JSE had also explored additional services from Beeks, including a second site for backup and disaster recovery, and potential use of Proximity Cloud.

This positive newsflow adds to the increasing momentum around the company. The shares have established a strong uptrend in recent weeks, and we expect the stock to retest the April 2022 highs at 208p.

Duke scores double success with profitable investment exits

Duke Capital (DUKE) has announced two successful exits, demonstrating its commitment to facilitating growth for its partners while delivering profitable returns for investors.

The first exit involved Fairmed Healthcare AG, a Switzerland-based provider of generic prescription medicines and healthcare products. Duke received a headline cash consideration of €11.4 million, marking its seventh exit and sixth profitable one. The financing solution provided by Duke enabled Fairmed’s management team to expand its product portfolio while retaining minority equity stakes. The exit was facilitated by Strides Pharma Global Pte Ltd, paving the way for Strides to advance its European strategy.

In the second exit, Duke successfully exited its investment in Fabrikat, a UK manufacturer of street lighting columns and guard rails. This exit delivered an impressive IRR of 36% for Duke, with further potential gains from future performance-related deferred consideration.

Duke’s total investment in Fabrikat amounted to £6.2 million. Neil Johnson reiterated Duke’s commitment to achieving above-average returns on exits, emphasising the success story of Fabrikat as a testament to Duke’s capital being a perfect fit for management buyout endeavours.

Ebiquity’s profitable growth: Trading update

Ebiquity (EBQ) issued a bullish trading update for the fiscal year ending December 31, 2023.

The media analysis group said revenue is expected to have grown by 7% to £80.2 million, with adjusted earnings increasing by 31% to £12.0 million, reflecting enhanced cost management and a slightly higher margin business mix.

Ebiquity also said that its profit margin improved to 15% from 12.2% in 2022, driven by operational efficiencies from the transformation program and growth in the Digital Media Solutions business.

Despite ongoing media market challenges, Ebiquity said it has started 2024 satisfactorily, with clients seeking services to maximize returns from their investments.

While client spend may remain subdued until consumer confidence returns, Ebiquity anticipates further profitable progress in 2024, supported by the transformation program, cost management, and the growing Digital Media Solutions business.

Equals reports strong Q1 growth and extends PUSU deadline

Equals (EQLS) recently released a strong trading update which indicated a robust performance in the first quarter of FY-2024.

Revenues for the period reached £22.2 million, marking a significant 28% increase from the same period in FY-2023. This growth trend is consistent with recent patterns, with particularly strong growth observed in its Solutions division.

In addition to the trading update, Equals is conducting a Strategic Review to explore potential options to enhance shareholder value. As part of this process, the company has engaged in discussions with Madison Dearborn Partners.

The initial deadline for Madison Dearborn Partners to announce a firm intention to make an offer for Equals has been extended multiple times. The latest extension sets the deadline to April 17, 2024, to allow for more time to continue discussions.

H&T report record profits and robust growth despite challenging conditions

H&T Group (HAT) the UK’s largest pawnbroker recently released its preliminary results for the twelve months ending December 31, 2023. Despite market challenges, the company achieved significant progress, boasting record profits and robust growth.

Profit before tax jumped to £26.4 million, marking a 39% increase from the previous year, while profit after tax reached £21.1 million, up 42% year-on-year. The pledge book grew by 28% to £129 million, with net revenue generated from the pledge book increasing by 36% to £69.5 million.

Retail jewellery and watch sales totalled £48.6 million, representing an 8% year-on-year increase. Diluted earnings per share rose to 48.5p, a significant 31% increase from the previous year. The balance sheet remained robust, with net asset value reaching £177 million, up 8% year-on-year.

The company proposed a full-year dividend of 17p, reflecting a 13% increase from the previous year. Chris Gillespie, H&T chief executive, expressed satisfaction with the company’s performance, highlighting record demand for pawnbroking services and continued growth in retail sales despite challenging trading conditions.

Looking ahead, Gillespie remains optimistic about the company’s growth prospects, citing strong demand for pre-owned products and ongoing investment in scale and capabilities.

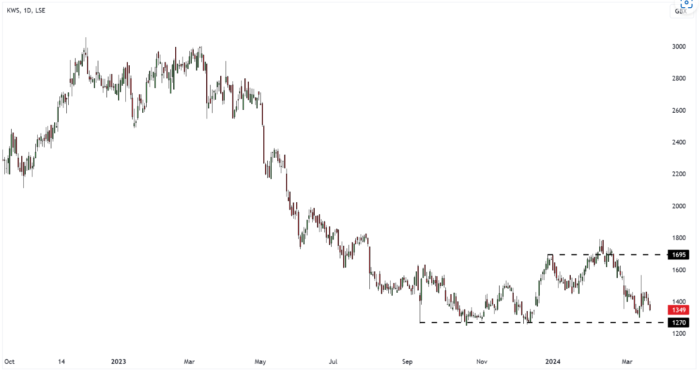

Keywords Studios reports strong full-year results

Keywords Studios (KWS) delivered a resilient performance in the face of a contraction in the video games industry.

Financially, the Group reported a 13% increase in revenue to €780.4 million, with organic revenue growth at approximately 9%. Adjusted operating profit rose by 6% to €122 million, surpassing guidance, and a recommended final dividend of 1.76p per share was declared, marking a 10% increase from the previous year.

Strategically, Keywords Studios continues to outperform the market, driven by its diversified global platform and strong strategic execution. The company achieved record M&A activity, completing five high-quality acquisitions, and extended its Revolving Credit Facility (RCF) to $400 million, ensuring long-term liquidity and flexibility.

Looking ahead, Keywords Studios expects strong revenue and profit growth in 2024, driven by improving organic growth and recent M&A activities. The company remains confident in its ability to add significant value through its acquisition strategy and aims to become a +€1 billion revenue business in the coming years.

Midwich makes market share gains in FY23

Audio visual (AV) distributor Midwich (MIDW) reported record financial performance and market share gains for full year 2023 (FY23)

In terms of financial highlights, revenue increased by 7% to £1,289.1 million compared to £1,204.1 million in the previous year. Gross profit rose by 18% to £216.5 million from £183.7 million, and operating profit grew by 19% to £41.6 million, up from £35.1 million. Basic earnings per share (EPS) stood at 27.98 pence, showing a 62% increase from 17.32 pence in the previous year. The company declared a dividend of 16.5 pence per share, marking a 10% increase from the previous year.

Operationally, Midwich experienced strong technical product growth, particularly in the audio market. The company entered the Canadian pro audio market through the acquisition of S.F. Marketing Inc. Six acquisitions were completed during the period, including prodyTel, with integration progressing well.

Looking ahead, despite challenging economic conditions, Midwich Group remains confident in achieving another year of growth exceeding the overall market in 2024.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.