Regency View:

Update

Anglo Asian Mining make ‘significant progress’ across development portfolio

Anglo Asian Mining (AAZ) released Interim Results for the six-months to 30 June 2022…

The Azerbaijan-based gold miner produced 28,722 gold equivalent ounces during the period, down slightly versus last year, although this was expected due to lower gold grades at Gedabek.

Anglo Asian’s full year production guidance came in at 54,000 to 58,000 gold equivalent ounces. And they are expecting a modest contribution from development assets at Vejnaly and the Hasan vein at Gosha.

Commenting on Anglo Asian’s development portfolio, CEO Reza Vaziri said:

“We made significant progress in the development of our portfolio with excellent progress made at Zafar, Vejnaly and Hasan, all of which will enter production in the next 3 to 12 months. This will ease our reliance on production from Gedabek as they are set to produce meaningful quantities of ore next year.”

An interim dividend of US 4 cents per share was declared and this will see a modest increase to UK shareholders at current exchange rates.

The shares have continued to struggle on the price chart, but this is largely due to a weak gold price caused by a strong US dollar.

Craneware anticipate accelerated sales

US healthcare fintech, Craneware (CRW) released an upbeat set of Final Results this week…

Headline revenue jumped 119% to $165.5m – reflecting the acquisition of Sentry Data Systems which is bedding in nicely.

Adjusted earnings (EBITDA) increased 91% to $51.8m while statutory profit before tax dropped slightly to $13.1m from $13.2 (FY21) due to amortisation of acquired intangibles and bank interest payments resulting from the Sentry deal.

Importantly, Annual Recurring Revenue (ARR) increased by 164% to $170.3m, and this high level of earnings visibility is why we like the stock.

Craneware CEO, Keith Neilson commented:

“We anticipate accelerated levels of sales moving forward, delivering our next phase of growth. We have a robust balance sheet, high recurring revenues and with our high levels of customer retention, we look to further increase shareholder value.”

The market has responded positively to recent updates and the shares look to have hammered out a bottom.

Bioventix sees FY trading ‘significantly’ ahead of market expectations

In a trading update, released last week, Bioventix (BVXP) said it has seen a clear improvement in the second half of its financial year…

The monoclonal antibodies specialist expects full year performance to end June 2022 to be “significantly ahead of market expectations”.

Bioventix believe the improvement reflects a degree of recovery from the pandemic effects and it hopes that this recovery will prove to be sustained and long-lasting.

The trading statement also said that the strength of the US dollar is a tailwind and that the roll-out of high sensitivity troponin products, supported by Bioventix’s technology, has matched its expectations.

Bioventix’s share price responded positively to the update – posting its largest bullish price gap in over two years.

We expect this burst of bullish price momentum to kick start a new uptrend.

Central Asian Metals’ half year earnings climbs 16% to $74.9m

Central Asian Metals (CAML) released a solid set of Interim Results earlier this month…

The Kazak copper miner delivered revenue of $119.5m for the six months to June 2022, up from $106.3m the year prior.

Copper production at its Kounrad mine increased from 6,214 tonnes (H1 2021) to 6,617 tonnes and full year production guidance was increased from 12,500-13,500 tonnes to 13,500-14,000 tonnes.

CAML announced an interim dividend of 10p per share which represents 40% of free cashflow and underlines the stock’s status as a top income payer.

CEO, Nigel Robinson commented:

“These results reflect increased metal prices to some extent counteracted by inflationary pressures but notwithstanding this, our costs during H1 2022 were well controlled with increases mitigated by weaker operating currencies and a fixed price electricity contract at Sasa”.

“We look forward to the remainder of 2022, expecting strong base metal production and advancing our Sasa Cut and Fill Project with a view to completing construction of the paste backfill plant in H1 2023. We are not immune from global inflationary pressures, in particular energy prices, which are largely outside our control.”

On the price chart, the shares remain locked in a long-term sideways range.

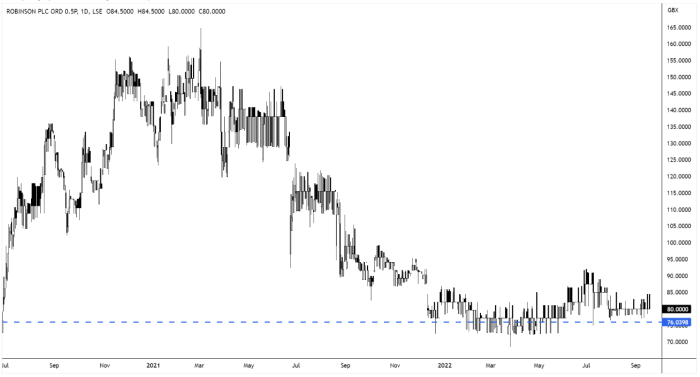

Robinson starting to see an increase in new business

Packaging producer, Robinson (RBN) said it is starting to see more new business activity from existing and potential customers, which “provides opportunities for growth in 2023 and beyond”.

Commenting following the release of the group’s Interim Results this month, Robinson Chairman, Alan Raleigh said he expects full year profits to be “in line with market expectations and comfortably ahead of 2021”.

The maker of plastic and paperboard packaging has been under pressure due to rising resin and energy prices.

And whilst Robinson expect these cost headwinds to remain, the tone of their outlook statement was more upbeat than it has been in previous quarters.

Revenue for the six months to end June 2022 increased 19.8% to £25.4m, gross margin edged higher to 16.7% and operating profit increased to £1.5m, up from £0.1m a year earlier.

The shares have hammered out support at an area of previous resistance and this is a bullish sign.

Keywords release H1 results and announce acquisition of Smoking Gun Interactive

Keywords (KWS) said ‘healthy demand’ had driven double-digit organic revenue growth…

In a strong set of Interim Results, the gaming group delivered organic revenue growth of 21.7% – pushing headline revenue to €321.1m, up 34.5% on the same period last year.

Adjusted profit before tax rose 38% to €54.8m, with margin increasing to 17.1%.

Keywords CEO, Bertrand Bodson commented:

“Going forward, Keywords is increasingly well-positioned to capture a greater share of our large addressable market. We are the clear market leader with unrivalled global scale and a unique service platform across the entire content development life cycle and will continue to cement and build upon our position as the partner of choice for the global video games industry, and beyond.”

Keywords also announced the acquisition of Vancouver-based game developer, Smoking Gun Interactive…

This deal worth an initial payment of CAD$16m – rising to a maximum of CAD$40m is expected to enhance Keywords strategy to be the partner of choice for technical and creative services for the global video games industry.

Marlowe rallies on strong sales outlook

Marlowe (MRL) published a brief trading update last week ahead of their AGM…

The business-critical services and software group said organic revenue growth was in the high single digits during the four-month period from 1 April 2022 to 31 July 2022.

Headline revenue jumped 66% during the period and growth is anticipated to remain strong throughout the rest of Marlowe’s financial year.

Marlowe also said that it has experienced limited cost inflation which was “being successfully managed via contract pricing”.

Group run-rate revenues and adjusted EBITDA are now over £450m and £79m respectively.

“We remain confident of achieving our run-rate targets of £500m of revenues and £100m of adjusted EBITDA materially ahead of the end of FY24, as originally targeted, as we continue to build our positions across the highly attractive and resilient compliance markets that we occupy” read the upbeat statement.

The shares have surged 20% since the turn of the month and we expect this renewed price momentum to continue.

Warpaint deliver record first half sales and ‘significantly improved’ gross margin

Warpaint London (W7L) published a strong set of Interim Results this week…

The mid-market cosmetics group said sales increased by 37% to £25.2m – a record first half performance.

UK revenue increased by 17% to £10.4m and international revenue increased by 55% to £14.8m.

Gross profit margin increased to 39% despite continued supply side price inflation and higher than historic freight costs.

And adjusted earnings (EBITDA) were £4.4m, up from £2.1m a year earlier.

Warpaint CEO, Sam Bazini commented:

“We have been, and continue to be, successful in both adding new retailers to our list of customers and expanding the number of products and outlets served with our existing major customers. I am confident that this can continue, and we are working in partnership with a number of our larger existing retailers, both in the UK and internationally, to grow sales further. We are also in active discussions with additional major retailers”.

The strong numbers were well received by the market and Warpaint’s share price is trading back at the top of its recent range. We are looking for the shares to break above 140p resistance (see chart below).

Sylvania Platinum doubles dividend

Sylvania Platinum (SLP) announced its Final Results for the year ended 30th June 2022 on 8th September…

The platinum group metals (PGMs) producer saw net profit fall from $99.8m to $56.2m, a decline driven by a 23% decrease in the average PGM basket price over the last 12 months.

Sylvania also reported that net revenue decreased to $151.9m this year from $206.1m (FY21).

Lower PGM production, which fell to 67,053 4E PGM ounces compared to 70,043 4E PGM ounces (FY21), was a key contributor as the group struggled to deal with slow production.

Despite the drop in headline numbers, Sylvania declared it would be doubling its annual cash dividend per share from 4p to 8p in the next fiscal year – causing the shares to rally sharply.

Commenting on the results, Sylvania’s CEO Jaco Prinsloo said:

“I am pleased with the solid production performance of the SDO in delivering 67,053 4E PGM ounces for the period”.

“A key contributor to achieving this result was the stellar performance of the Tweefontein plant which achieved monthly, quarterly, six-monthly and annual production records during the period”.

“Looking ahead, I am confident that our operations will continue to deliver a strong production performance and as a consequence have set an annual production target of 68,000 to 70,000 ounces for the year ahead.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.