8th Feb 2024. 8.55am

Regency View:

Update

Regency View:

Update

Beeks Financial surge on contract wins and upbeat outlook

Beeks Financial (BKS) have surged higher this week following the announcement of two significant contract wins and a positive outlook for the upcoming financial year.

The cloud computing and connectivity provider for financial markets reported that after securing multiple competitive tenders in the first half ending December 31, results for the financial year ending June 2025 are expected to surpass previous board expectations significantly.

Beeks revealed it has entered into another contract with an undisclosed “Tier 1 investment manager.” This follows the initial work won in November 2023 for its Proximity Cloud, a fully configured and pre-installed physical trading environment. The new contract involves additional locations, more than doubling the initial contract’s value to $3.6 million over a four-year period.

Additionally, Beeks signed a conditional contract with one of the world’s largest exchange groups for its Exchange Cloud offering, marking the beginning of a potentially multi-year partnership. This latest contract adds to the three major international exchanges that have already embraced Beeks’ Exchange Cloud offering.

CEO Gordon McArthur emphasised the successful delivery of free cash flow as a key objective for the current year. McArthur stated that they are capitalising on the investments made in expanding their product offering, and the growing contract momentum reflects significant demand across financial markets. The company anticipates that FY25 will surpass previous expectations significantly.

Beeks’ positive contract momentum is exciting, and with the shares 50% below their 2022 highs, there is plenty of headroom to run into.

Nexteq eyes continued success in FY24

Nexteq (NXQ) has reported a positive trading update for the financial year ending December 31, 2023.

The technology solutions achieved improved profitability and cash generation by focusing on higher-value products. The Board expects to report full-year adjusted profit before tax comfortably exceeding market expectations.

Gross margins improved in the second half of the year, particularly in Densitron, driven by higher-margin Broadcast products and efficient supply chain management. Quixant’s gross margins also recovered to pre-Covid levels.

The order book normalised as customers reduced inventory levels, resulting in a 4% decrease in Group Revenues to $114.8m compared to the prior year. The Quixant business posted revenues of $69.4m, down 6%, while Densitron’s revenues were $45.4m, broadly in line with 2022.

The net cash position substantially increased to $27.9m at the end of December 2023. The Board anticipates continued improved margins in FY24, with revenues expected to be broadly in line with FY23, despite persistent macroeconomic conditions.

The Group starts the new financial year with a good order book, providing good visibility for FY24.

Pan African Resources reports strong growth and positive outlook

Pan African Resources (PAF) has reported a substantial increase in headline earnings per share (HEPS) and earnings per share (EPS) for the first half, ranging between 2.14 and 2.3 cents per share, up from 1.52 cents per share in the same period in 2022. This represents a year-on-year increase of 41% to 51%, attributed to a significant 23.9% surge in revenue to $193.9 million, compared to $156.5 million in 2022.

The notable improvements in earnings are primarily linked to an 8.9% rise in gold sales volumes, totalling 98,458 ounces, and a 13.7% increase in the average dollar-denominated gold price received, reaching $1,961 per ounce, up from $1,725 per ounce in the previous year.

Pan African operates with the US dollar as its presentation currency and the South African rand as its functional currency, with reported results impacted by fluctuations in the USD-ZAR exchange rate. During the reporting period, the average USD-ZAR exchange rate was ZAR 18.69 to the dollar, compared to 17.33 in 2022, and the closing exchange rate on December 31 was ZAR 18.30, compared to ZAR 17.01 in the prior year period.

Robinson expects profit growth despite sales dip

Packaging group, Robinson (RBN) issued its year-end trading statement, anticipating a revenue of £49.6 million for the year ended 31 December 2023, a 1.8% decrease from the previous year.

Despite a 6% decline in sales volumes, the operating profit before exceptional items and amortization of intangible assets is expected to be ahead of 2022, aligning with market expectations.

The company faced challenges such as inflation, the cost-of-living crisis, de-listing of products by customers, and a focus on existing business over innovation. A restructuring program implemented in June 2023 resulted in exceptional costs of £0.4 million and annual savings of £0.7 million, benefiting 2023.

Sales volumes rebounded in the second half of 2023, showing a 1% increase compared to the same period in 2022. Successful sales activities are expected to lead to a substantial increase in sales volume in the plastics business in 2024.

Net debt at the end of 2023 is expected to be £6.3 million, down from £9.2 million in 2022. The impact of Storm Babet led to flooding, with an estimated exceptional cost of £0.1 million for 2023. Cleaning activities are mostly complete, but on-site manufacturing continues to be disrupted.

The CEO position is currently being filled by Interim CEO Sara Halton, with the selection process for a permanent CEO underway.

The company sold part of its surplus property in Chesterfield, known as “Mill Lane,” for £0.7 million. Another property transaction is in progress, with the estimated market value of remaining surplus properties held by the Group at approximately £7.4 million. Further sales of surplus property are expected in the next 12 months, with the goal of reducing indebtedness and developing the packaging business.

Restore confirms resilient performance, expects strong FY23 results

Restore (RST) has released a trading update for the year ending December 31, 2023 (FY23).

Despite facing challenges in 2023, the Board is pleased to confirm that Restore expects to report adjusted profit before tax in line with market expectations.

The company attributes its resilience during the challenging year to a foundation of highly contracted and recurring income streams, particularly in storage revenue.

Cash generation remained healthy throughout FY23, with an anticipated year-end net debt of around £98 million, positioning it towards the lower end of market expectations.

The Group plans to publish its FY23 results on Thursday, March 14, 2024. Market expectations for FY23 include adjusted profit before tax of £30.5 million, within a range of £29.4 million to £31.0 million, and net debt of £100.2 million, within a range of £96 million to £103.7 million.

Sylvania Platinum faces production decline

In a quarterly trading statement, released last week, Sylvania Platinum (SLP) reported a challenging second quarter with a decrease in production, recording 18,232 4E PGM ounces, down 10% from the previous quarter.

Despite an all-injury free quarter and safety achievements, net revenue increased by only 6%, reaching $20.9 million. Group EBITDA saw an impressive 57% increase, but net profit was 13% lower due to inter-company dividend withholding taxes.

Cash costs per 4E ounce rose by 13%, impacted by lower production compared to Q1 FY2024. The company paid the FY2023 final dividend of 5 pence per Ordinary Share, further affecting its financial position.

Despite challenges, the Thaba Joint Venture project progresses as planned. The company also faces exploration updates and preliminary economic assessments for the Volspruit project.

Stuart Murray stepped down as Non-Executive Chairman, succeeded by Eileen Carr. Interim financial results are expected on Thursday, February 22, 2024.

Somero reports in-line half year numbers

Cementing screeding company, Somero (SOM) reported a strong performance in H2 driven by a robust North American market, substantial contributions from Europe, and continued growth in Australia.

The Board reported that the company expected 2023 revenue to be US$120.7 million, in line with previous guidance and market expectations. Despite challenges in the US, including concrete supply chain shortages, elevated interest rates, and tightened bank lending, Somero achieved a strong finish to the year. North America revenues were US$88.4 million, down from US$101.8 million in 2022.

The strategic focus on Europe and Australia contributed to improved trading in both territories, with Australia’s sales growing by 18% to US$9.9 million, and European sales reaching US$15.1 million. Parts and service revenue increased by 9% to US$20.5 million, with significant growth in Europe and Australia.

The Rest of World segment faced challenges in Latin America and a planned volume decline in China, resulting in revenues of US$7.3 million, down from US$8.5 million in 2022.

Annual adjusted EBITDA was expected to be US$36.0 million, and the year-end cash position was anticipated to be $33.0 million.

For 2024, the Board anticipated a strong US market, continued growth in Europe and Australia, and multiple new product launches. The outlook included expectations of healthy cash generation, comparable revenues to 2023, and EBITDA reflecting modest incremental investment, including the new Belgium service and training centre.

Inspecs faces below-expectation financial performance:

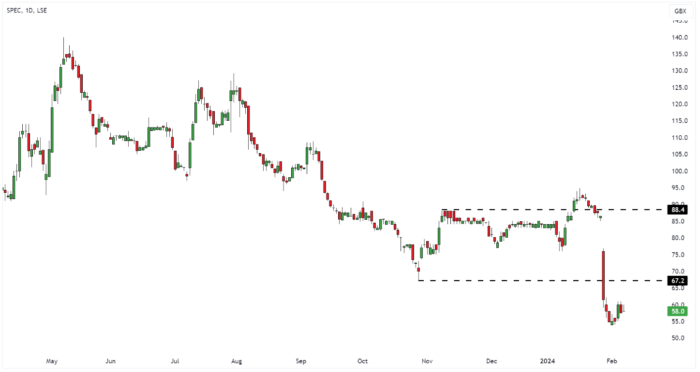

Inspecs (SPEC) reported a below par trading update for the year ended December 31, 2023.

The eyewear designer, manufacturer, and distributor maintained said its financial performance fell below market expectations due to softer trading in December.

There were positives and Inspecs said that operational efficiencies contributed to an increased EBITDA margin on sales for the year, with further progress expected in 2024. The expansion in Vietnam remains on track and within budget, with the expectation of the first production in H1 2024.

Losses from Norville continued to decrease, with new management improving sales and performance. Skunk Works, the innovation division, continued to drive innovation and commercial revenues. The global launch of a licensed eyewear brand is secured for spring 2024.

Integration of US businesses commenced in 2023, aiming to generate synergies within the Americas in 2024. Despite capex expenditure in Vietnam and deferred acquisition consideration, the company experienced a reduction in net debt, ending the year at £24.3 million.

Inspecs said it will continue to focus on operational efficiencies, cost reduction, and debt reduction while developing Group synergies. The new Vietnam facility is expected to enhance the Group’s competitive position in H1 2024. Despite revenue challenges in December, the company is optimistic about driving sales in 2024, building on improved margins and a strengthened balance sheet.

Serica faces leadership transition amidst production challenges

Serica Energy (SQZ) recently announced a change in leadership as CEO, Mitch Flegg departs after six years. Chairman David Latin will assume the role of interim CEO following the publication of the company’s 2023 earnings in mid-April.

The departure comes amid a broader reshaping of Serica’s executive management team. Martin Copeland recently took over as Serica’s Chief Financial Officer, succeeding Andy Bell, who resigned from the board but will continue to assist during the transition and preparation of the 2023 annual report.

Alongside the boardroom changes, Serica published a trading update which revealed that it is facing production challenges. The trading update said pro-forma net production in 2023 averaged 40,121 barrels of oil equivalent per day, with notable contributions from fields like Bruce, Rhum, and Bittern. However, production in the second half experienced declines due to planned shutdowns, safety-related issues, and facility interruptions.

Looking ahead to 2024, Serica set a production guidance range of 41,000 to 48,000 equivalent daily barrels net, representing an increase compared to 2023. The company anticipates a more stable operational year, with ambitious organic investment plans extending into 2025 and 2026.

Serica is aiming to keep unit operating costs below $20 per barrel of oil equivalent in 2024 despite inflationary pressures in the UK North Sea sector. The company reported a year-end cash position of £291 million and borrowings of £210 million.

The market’s reaction has been bearish with the shares breaking below a key level of support. Despite the bearish price momentum, we believe Serica has enough underlying quality to ride through this current period of change.

Supreme surpasses expectations, proposes share buyback amid regulatory changes

Supreme (SUP) has outperformed market expectations for the nine months ending December 31, 2023, projecting a revenue of at least £225 million and an Adjusted EBITDA of at least £38 million for FY 2024.

Addressing recent regulatory developments, Supreme said it welcomes the UK Government’s proposal to ban disposable vape devices as part of initiatives to mitigate underage vaping. The company, having already implemented proactive measures such as flavour narrowing and re-naming, remains committed to eradicating underage vaping while supporting adult smokers with a safer alternative.

In response to operational success and regulatory changes, Supreme’s Board proposes a £1 million share buyback program over the next three months, demonstrating confidence in the company’s future value and commitment to enhancing shareholder returns.

Looking ahead to FY 2025, the Board anticipates a temporary revenue increase as retailers transition to alternative vaping devices, such as pod-system vaping devices and refillable vape kits, following the ban on disposable vapes.

Team Internet achieves record revenue and profit in FY 2023

Team Internet (TIG) said it has delivered a strong performance in the full year 2023, as announced in its January trading update.

The marketing and domain company anticipates reporting record gross revenue of approximately $835 million, net revenue of around $190 million, and adjusted EBITDA of about $96 million for the financial year, marking increases of approximately 15%, 7%, and 12%, respectively, compared to the previous year.

Team Internet’s gross revenue growth is distributed almost equally between the company’s two reporting segments: Online Marketing and Online Presence, each contributing to a 14% and 16% growth, respectively. Year-on-year organic growth, adjusted for acquisitions and FX, stands at approximately 12%.

As of December 31, 2023, Team Internet reports a net debt of approximately $74 million, reflecting a slight increase from $57 million at the end of 2022. The company’s strong financial discipline is evident in its near 100% adjusted operating cash conversion.

CEO Michael Riedl expressed pride in surpassing the ambitious goals set for 2023, emphasising the company’s investment in innovation and the launch of numerous new products. Riedl highlighted Team Internet’s unique positioning in a landscape dominated by social media and user-generated content, coupled with an increasing emphasis on data privacy. The company’s AI-based contextual advertising solutions align with these trends and Team Internet look well positioned to out-perform in 2024.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.