25th Jan 2024. 9.01am

Regency View:

Update

Regency View:

Update

Atalaya Mining thrives with strong 2023 performance, eyes growth in 2024

Atalaya Mining (ATYM) has issued an update on its operations for the fourth quarter of 2023 and outlined its production guidance for 2024.

In Q4 2023, the company mined 3.7 million tonnes of ore, showing an increase from 3.5 million tonnes in Q4 2022. Waste mined also rose to 7.4 million tonnes in Q4 2023 compared to 5.3 million tonnes in the same period last year. Ore milling during Q4 2023 reached 4.1 million tonnes, with a copper grade of 0.36%. Despite lower copper recovery in Q4 2023 (85.39%), copper production totalled 12,775 tonnes.

The average realised copper price in Q4 2023 was $3.78/lb. Settlement adjustments for Q4 2023 were negative €0.2 million. On-site copper concentrate inventories at the end of Q4 2023 were approximately 6,722 tonnes. As of December 31, 2023, the company’s consolidated cash stood at €119.7 million, indicating a robust balance sheet.

Ongoing construction at the 50 MW solar plant at Riotinto is progressing, with the first section expected to be connected in mid-February. The solar plant aims to provide around 22% of Riotinto’s current electricity needs.

For 2024, Atalaya projects copper production in the range of 51,000 to 53,000 tonnes, slightly favouring the second half of the year.

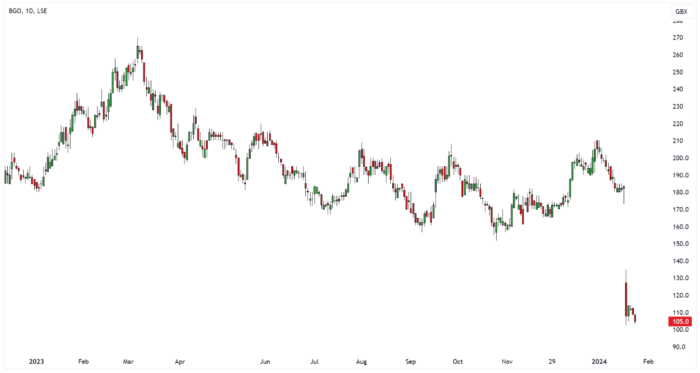

Bango faces investor backlash as earnings dip, despite revenue growth

Shares in mobile payment platform provider, Bango (BGO) dropped sharply after revising down its earnings guidance for the 2023 and 2024 financial years.

Despite a notable 62% increase in revenue to $46.1 million in 2023, the figure fell 6% short of broker forecasts. While the payments business performed as expected, longer customer launch cycles led to lower revenue recognition. Additionally, revenue from Bango’s Audience insights and data analytics services did not meet expectations.

The annual recurring revenue (ARR) from Bango’s Digital Vending Machine (DVM) service, designed to allow customers of telecom operators to manage and pay for all their subscriptions in one place and one bill, fell short of the $10 million target. However, the unit still achieved a 76% increase in ARR, reaching $8.8 million, excluding an extra $2 million from the launch of Bango’s third Tier 1 US telecom customer in H1 2024.

The impact on cash profit was more pronounced, with directors reducing their 2023 guidance to $5 million-$6 million, significantly below previous forecast of $11 million. A $2 million shortfall was attributed to an unexpected non-core direct barrier billing service within Docomo Digital. Despite cost reduction efforts after acquiring the loss-making global payments business of NTT Docomo, a Japanese mobile network operator, Bango expects about half of the $2 million shortfall to recur in 2024.

There was also a $1 million hit to profit due to non-cash market-to-market adjustments of intercompany loans within Docomo Digital. After excluding these two elements, the underlying cash profit was still lower than analysts’ forecasts, ranging from $7 million-$8 million. Despite these challenges, Bango remains committed to its business transformation aimed at improving profitability.

Boohoo CFO exits amidst challenges, Stephen Morana takes the reins

Boohoo (BOO) faces a setback as its Chief Financial Officer (CFO), Shaun McCabe, departs from the company immediately.

Boohoo swiftly named Stephen Morana, former CFO at Betfair and Zoopla, as the replacement for McCabe. Morana, who served as a non-executive director for Boohoo from 2014 to 2017, will assume his new role starting February 19.

Executive chairman Mahmud Kamani stated that Morana is well-acquainted with Boohoo, having supported the company through its IPO process and early years as a PLC. Despite significant growth since then, Kamani expressed confidence in Morana’s expertise with global digital businesses to support Boohoo’s growth ambitions.

Whilst Boohoo shares experienced a small dip when the news broke, shareholders were reassured that the group is trading in line with market expectations for full-year profits – causing the shares to rally.

Character faces challenging market, eyes strong second half amidst profitability boost

Character Group (CCT) released a trading update ahead of its Annual General Meeting.

The toy maker noted challenging trading conditions due to the cost-of-living crisis impacting consumer spend, especially during the recent Christmas season. Despite flat Group turnover in the first four months of the current financial year compared to the same period in FY23, there has been an improvement in profitability.

Character emphasised the importance of its strong product offering for achieving forecasted sales in the second half of the current financial year. The company is optimistic about its portfolio’s strength, confirmed through previews with domestic and international customers. The upcoming Toy Fairs in London and Nurenberg are crucial showcasing events for the market.

With a robust balance sheet, net cash position, and substantial working capital facilities, Character expects profitability for the current financial year ending August 2024 to align with market expectations.

Craneware reports strong H1 FY24: Revenue and EBITDA jump, share buyback extended

Craneware (CRW) has reported positive trading for the six months ending December 31, 2023 (H1 FY24).

The provider of value cycle solutions for the US healthcare market, delivered 8% growth in revenue to approximately $91 million, in line with Board expectations, and an 8% increase in adjusted EBITDA to around $27.5 million.

Annual Recurring Revenue (ARR) has grown approximately 3% to around $171.4 million, maintaining a Net Revenue Retention of 100%. Craneware utilised its cash reserves to reduce debt, resulting in lower interest rate charges. Adjusted EPS returned to growth, increasing by approximately 3%.

The company maintains a strong balance sheet, with total bank debt reduced to $59.2 million and healthy total cash reserves of $63.9 million. The Board has decided to extend the share buyback program for an additional three months until April 17, 2024.

Craneware said its investment in the Trisus platform, coupled with recent launches of optimisation suites and new partnerships, has positioned the company favourably in the market.

The company sees significant opportunities to support customers in delivering better value in the US healthcare sector. With a solid ARR foundation, a broad range of solutions in the Trisus platform, and substantial data flow, Craneware expressed confidence in accelerating growth momentum and anticipates a return to double-digit growth rates in the near term.

GlobalData achieves strong FY2023 growth, unveils new strategy and healthcare business stake sale

GlobalData (DATA) reportedstrong profitable growth in the second half of FY2023, with expected Group revenue of approximately £273 million (12% annual growth, 7% underlying) and adjusted EBITDA growth of around 28% to £111 million. The EBITDA margin is robust at approximately 41%.

GlobalData implemented a new growth plan and Group reorganisation, dividing its operations into three customer-focused divisions – Healthcare, Consumer, and Technology.

Additionally, a minority stake in the Healthcare business, accounting for approximately 36% of revenue, is being sold at a valuation of £1,115 million, generating net cash proceeds of approximately £434 million. The transaction is progressing as expected and is anticipated to be completed in Q2 2024.

CEO Mike Danson, highlighted the company’s strong financial position and its ability to pursue a more ambitious growth strategy in 2024, building on the success of its growth optimization plan.

eEnergy’s energy management division sale fuels growth and net-zero focus

eEnergy (EAAS) has sold its Energy Management Division to Flogas for £29.1 million. This includes an initial cash consideration of £25 million and an additional contingent consideration. The transaction is subject to approval by eEnergy shareholders at a General Meeting scheduled for around February 7th.

The net proceeds from the sale will serve multiple purposes, including the full repayment of the Group’s debt facilities (£8.1 million), reinvestment into the high-growth energy services division (which saw an 87% growth in the 12-month period up to June 2023), and general working capital.

eEnergy said the transaction not only delivers an immediate return on the £23.4 million invested in the Energy Management Division since December 2020 but also unlocks significant value for shareholders.

This strategic move will allow eEnergy to focus on its dedicated energy services business, particularly in the rollout of EV and Solar products, and support investments in other high-growth opportunities.

The strengthened balance sheet resulting from the sale is expected to alleviate cash constraints that have impacted growth in recent periods. The Board anticipates that trading for the period ending December 31, 2023, will be at the lower end of market expectations.

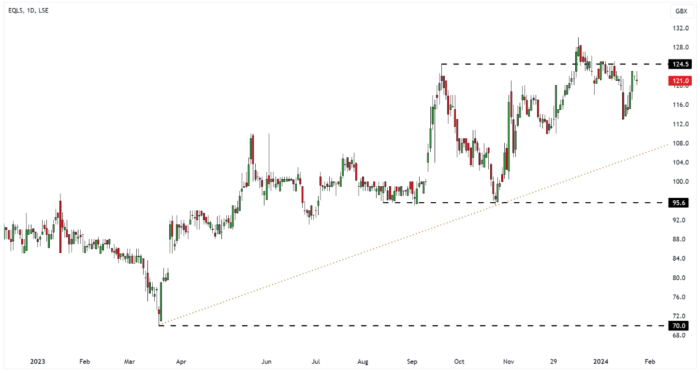

Equals extends deadline amid ongoing talks with Madison Dearborn Partners

Equals (EQLS) has announced updates on its strategic review and extended the PUSU (Put Up or Shut Up) Deadline. The company is conducting a strategic review to explore potential options, and as part of this process, discussions are ongoing with Madison Dearborn Partners LLC, a potential acquirer. The original PUSU Deadline, set for November 29th, was extended to January 24th, and now further extended to February 21st.

Equals Board expressed confidence in the company’s longer-term growth prospects, and current trading is in line with expectations. The strategic review involves evaluating whether an offer for the entire issued share capital of the company could deliver greater value to shareholders compared to a standalone independent strategy. The ongoing discussions will determine whether Madison Dearborn Partners will make a firm offer for Equals.

The company emphasised that there is no certainty regarding the possibility of an offer or the specific terms of any potential offer. The revised PUSU Deadline may be extended further with the consent of the Panel on Takeovers and Mergers, as requested by Equals. Additional announcements will be made as appropriate throughout this process.

Gamma reports strong growth and robust cash generation in 2023

Gamma Communications (GAMA) provided a trading update for the year ended December 31, 2023, indicating healthy year-on-year growth in both adjusted EBITDA and adjusted EPS.

The UK business, comprising the Gamma Business and Gamma Enterprise units, delivered a strong financial performance throughout the year, mitigating inflationary pressures. Gamma Business expanded its UCaaS offering through new partnerships, while Gamma Enterprise secured significant contract wins.

Organisational changes and the combination of the German and Dutch businesses led to a late 2023 restructuring exercise impacting around 5% of the group’s workforce.

The closing net cash balance was £134.8 million, demonstrating continued high cash generation from operations. This represented a substantial £42.3 million net cash increase year-on-year, considering cash outflow for two acquisitions and dividend payments to shareholders. The acquisitions were Satisnet for an initial cash payment of £8.3 million and EnableX Group for an initial cash payment of £18.9 million. The dividend payment to shareholders increased 14.3% to £15.2 million.

Capital expenditure remained within guidance. The Board expects to announce results for the year ended December 31, 2023, including an update on the Company’s approach to capital allocation, on Monday, March 25, 2024.

CEo Andrew Belshaw commented: “Gamma continues to deliver high cash generation, allowing for the self-funding of bolt-on acquisitions while growing net cash by 45% to £135m and is well positioned to continue to grow in 2024 with strong relationships, our evolving in-house and third-party solution set and Gamma’s resilient recurring revenue model.”

H&T expects record profits despite challenging retail conditions

H&T (HAT), the UK’s largest pawnbroker, expects to report record profits for 2023, showing a 40% year-on-year increase.

Despite challenging retail conditions in December, pre-tax profits for the year are anticipated to be around 10% below market forecasts.

Pawnbroking demand remains robust, with lending reaching £260m in 2023, up 19%. The pledge book, as of 31 December 2023, amounted to c.£131m, up 30% from the previous year-end.

Retail faced challenges, but sales by volume increased by 3%, with customers leaning towards lower-priced items. New jewellery items represented 62% of sales by volume, and 33% by value, compared to Q4 2022.

Foreign exchange revenues grew 11%, reaching c.£6.3m for the full year. The on-line ‘click and collect’ service, launched in June 2023, has shown promising progress with an average transaction value significantly higher than over-the-counter transactions.

Gold purchase by value grew by 18% for the full year. Scrap margins remained broadly consistent.

Other services, such as money transfer and cheque cashing, faced subdued demand, impacted by customer caution due to pressure on disposable income.

Cost control measures were taken in H2 2023, moderating cost inflation relative to H1 2023. The company remains vigilant about controlling costs and achieving ongoing efficiencies.

Chris Gillespie, H&T chief executive, expressed gratitude to the company’s staff and looks forward to updating the market further in March.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.