11th Jan 2024. 8.58am

Regency View:

Update:

Regency View:

Update:

Duke Royalty’s Q3 FY24 update sparks optimism

Duke Royalty (DUKE) provided a trading update for the third financial quarter ending December 31, 2023. They anticipate achieving £6.3 million in recurring cash revenue for Q3 FY24, representing a 12% increase from the same period last year and surpassing the previous quarter’s record of £6.2 million. Their revenue has shown consistent growth over recent quarters.

One significant development is Duke’s additional investment of CA$8.6 million into Creō-Tech, bringing their total exposure to CA$27.1 million (£16.0 million). This investment aims to facilitate the refinancing of Creō-Tech’s existing senior lender.

During the quarter, Duke expanded its investment team by hiring two new associates, aiming to capitalize on prevailing market opportunities. Additionally, the company initiated a review of its branding and positioning, which is ongoing. The board anticipates unveiling these changes in the next quarter.

Neil Johnson, CEO of Duke Royalty, expressed satisfaction with the revenue growth despite economic uncertainties. He highlighted the company’s stable dividend, currently representing an approximate 9% yield at the current share price. Johnson also emphasised the importance of Duke’s rebranding efforts and expanded investment team in leveraging the growing opportunities in the Private Credit market, particularly within SME lending.

Surface Transforms fails to inspire despite growth accelerating

Surface Transform (SCE) shared a pre-close trading and operational update for the year ending December 31, 2023 (“FY23”).

Revenue surged by 63% to £8.3 million in FY23 compared to £5.1 million in 2022. They closed the year with £6.1 million in gross cash, bolstered by an equity fundraising in December 2023. A £13.2 million loan agreement solely for capital expenditure was also secured, yet none was utilized by year-end. Planned capital expenditure for 2023 stood at around £9 million.

Q4 sales hit £3.0 million, a notable increase from previous quarters. No fresh technical issues arose recently, allowing the company to focus on enhancing operations, installing capacity, fortifying manufacturing processes, and improving management and supervision.

They aim to install £50 million p.a. sales capacity by mid-2024 and £75 million p.a. by end-2025, supporting existing contracts, projected growth, and bolstering manufacturing resilience. The recent equity fundraising and new capital expenditure facility enable faster acquisition of new equipment, with ongoing discussions with equipment suppliers.

Surface Transforms maintains its revenue guidance for 2024 at £23 million. The outlook until 2027 looks promising due to existing contracts, recent business announcements, and ongoing capacity expansions. However, the market remains unimpressed following a series of production delays which have eroded confidence in Surface’s ability to fulfil demand.

Supreme expands wellness division with key acquisition of protein manufacturing assets

Supreme (SUP) has completed the acquisition of the trade and assets of FoodIQ UK Holdings Limited (“Food IQ”), a protein manufacturer.

The acquisition cost stands at £175,000. This move provides Supreme access to a cutting-edge, accredited manufacturing facility that was established just 18 months ago at a cost of nearly £1.2 million.

Situated near London, this purpose-built facility will be retained by Supreme and is expected to significantly enhance the company’s wellness manufacturing capacity by approximately 40%.

Sandy Chadha, the Chief Executive Officer of Supreme, expressed enthusiasm for the acquisition, citing its pivotal role in meeting the escalating demands within their Sports Nutrition & Wellness division. Chadha also highlighted their prior positive experiences utilising Food IQ to manage capacity requirements in this division.

Totally extends vital NHS 111 support with £13m contract

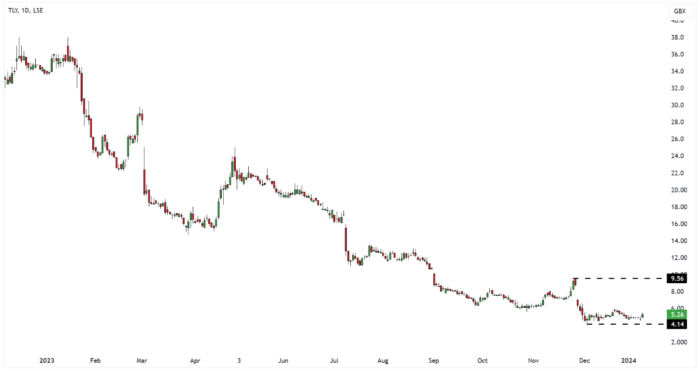

Totally (TLY) has secured a contract extension from NHS England for their subsidiary, Vocare Limited, operating under Totally Urgent Care.

This extension involves providing national contingency services for NHS 111 for an additional year, starting from February 16, 2024. The contract is valued at around £13 million per annum, a step up from the initial 12-month contract worth approximately £10 million annually.

Wendy Lawrence, CEO of Totally, emphasised the company’s extensive experience in delivering high-quality and responsive NHS 111 services. She highlighted their significant contributions to the National Resilience programme, handling nearly half a million calls that would have otherwise been unanswered, ensuring individuals seeking care receive necessary support. With this contract extension, Totally reaffirms its position as a key partner in delivering NHS 111 services until February 2025.

Additionally, Simon Stilwell, previously appointed as a Non-Executive Director and Chairman Designate, officially assumed the role of Non-Executive Chairman of the Company from January 1, 2024, following the announcement made on November 28, 2023.

Tremor International is now Nexxen International

Tremor International (TRMR) has officially rebranded as Nexxen International, effective immediately. The company’s ordinary shares and ADRs will be traded under the new ticker symbol “NEXN.”

This change follows shareholder approval at the latest Annual General Meeting on December 27, 2023. However, there will be no modifications to the share structure or codes, and existing shareholders need not take any action.

CEO Ofer Druker expressed excitement about this rebranding, emphasising its role in unifying brands and highlighting the company’s unified data-driven advertising platform, particularly in the realms of video, data, and Connected TV (CTV) advertising ecosystems.

Nexxen International enables global advertisers, agencies, publishers, and broadcasters in leveraging video and Connected TV. Their technology stack is designed to provide a flexible and comprehensive suite of tools for discovery, planning, activation, measurement, and optimisation.

The name change serves to refresh the company’s image and has the PR benefit of removing two years of dreadful share price performance from the chart. This of course is no comfort to long-term shareholders who will be hoping that the company can finally regain some momentum.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.