7th Dec 2023. 9.07am

Regency View:

Update

Regency View:

Update

CML Microsystems expect to meet full-year expectations

CML Microsystems (CML) recently released a strong set of half-year results which saw revenues increase 5% to £10.58 million alongside a 9% rise in profit from operations, hitting £1.90 million after excluding external costs.

The company maintained a strong cash balance of £20.95 million at the period end, after spending £1.75 million on share buybacks and £0.9 million on dividend payments.

CML’s operational highlights included the successful acquisition of MwT which expanded the company’s product portfolio and R&D capabilities.

CEO Chris Gurry expressed satisfaction with the results, citing sustained revenue growth amid industry challenges. He emphasized the significance of the MwT acquisition in positioning CML favourably to seize opportunities in emerging markets. Gurry also conveyed confidence in meeting full-year expectations, underscoring the company’s resilience and readiness to navigate evolving market dynamics.

CML recommended a half-year dividend of 5p per share was declared, consistent with the previous year’s first-half dividend.

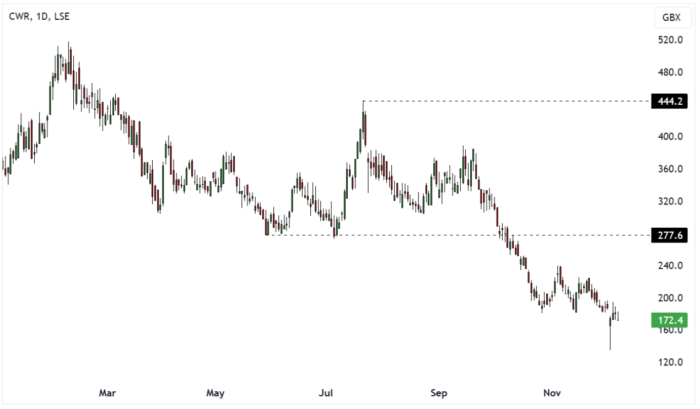

Ceres Power drop on license deal delay, lower revenue outlook

Clean energy company, Ceres Power (CWR) lowered full-year revenue forecasts due to license deal delays.

Ceres said that despite ongoing discussions with potential partners, the anticipated agreement with the closest new licensee is progressing well but may not be finalised in time to record associated revenue for 2023. Consequently, the company expects its total revenue for the year to range between £20-21 million, slightly lower than the previous fiscal year’s £22 million.

Phil Caldwell, Ceres’ CEO, noted the positive commercial progress and heightened interest in their SOEC technology. However, the company hasn’t managed to secure a new license partnership in this financial year. Caldwell remains confident about securing one in the upcoming months and assured stakeholders of an update on the year’s trading status in January.

The shares dropped sharply following the trading statement but have since regained some ground. Ceres is part of our long-term ESG theme, and we believe stocks of this nature should be combined with stocks that have higher earnings visibility as part of a balanced portfolio.

Jet2’s operating profit takes off

Jet2 (JET2) reported strong interim results with significant growth in operating profit by 19% and profit before taxation by 47%. Despite challenges like disruptions and natural events impacting profitability, the company ended the period with a strong cash balance.

The outlook for Winter 2023/24 and Summer 2024 remains positive, with increased seat capacities and promising early booking trends. Jet2 aims to deliver a Group profit of £480-520 million for the financial year ending March 2024, contingent on no major external events.

Additionally, Jet2’s move to control in-flight retail operations through its Retail Operations Centre in Middlewich signifies a strategic step to enhance customer experience and revenue potential, creating up to 300 new jobs.

“Jet2’s customer-focused approach and resilience in challenging times continue to drive our success,” commented CEO Steve Heapy.

“Despite disruptions, our commitment to exceptional service and innovative products reinforces our confidence in delivering outstanding travel experiences,” Heapy added.

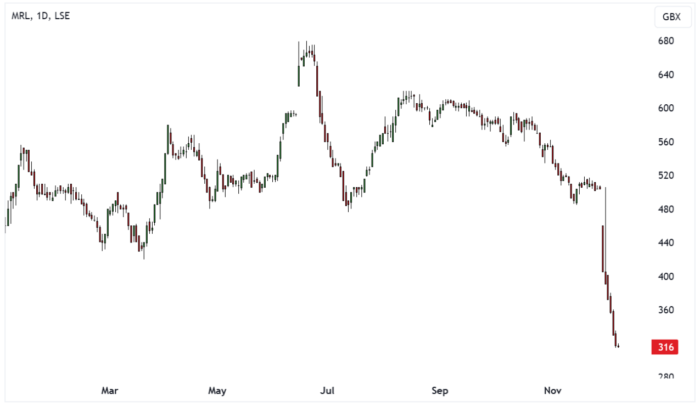

Marlowe’s first-half results reveal £9m loss despite jump in revenue

Marlowe (MRL) faced a setback as it reported a substantial £8.9 million loss in the first half, primarily attributed to non-cash amortisation, acquisition-related factors, and significant investments in integration activities. However, the adjusted operating profit showed a 9% improvement at £33 million, and revenues rose by 13% to £251.3 million, driven by a 6% organic growth.

The company’s net debt increased to £192.7 million from £160.8 million due to M&A activities, but it aims to reduce leverage to below 2x by year-end using cash generated in the second half.

Amidst this, Marlowe initiated a strategic review focused on optimising its organisational and capital structure. This might involve a managed separation of certain group businesses, with outcomes pending disclosure.

CEO Alex Dacre acknowledged the challenging economic landscape but highlighted the company’s resilience, citing a 6% organic growth as evidence. He expressed optimism for the second half, anticipating mid single-digit organic growth, supported by acquisitions and continued double-digit growth in adjusted EBITDA.

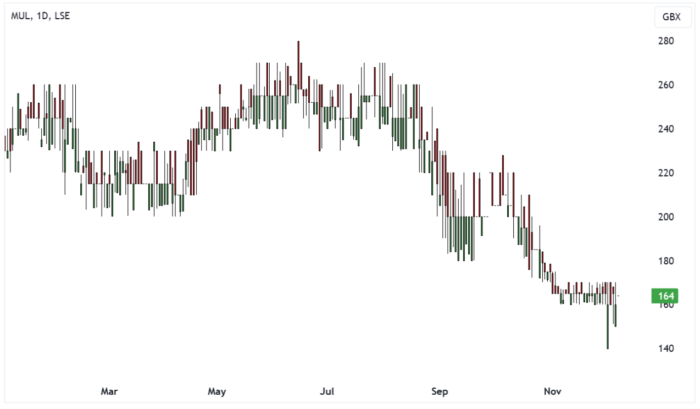

Mulberry posts revenue rise despite challenges

Mulberry (MUL) reported a 7% rise in Group revenue to £69.7 million, driven by growth in the UK, international retail sales, and increased brand awareness in the US.

However, macroeconomic challenges led to a gross margin dip to 69%, contributing to an underlying loss before tax of £12.3 million, largely due to investments for future growth, operational costs of new stores, and SaaS expenses.

CEO Thierry Andretta highlighted investments in the direct-to-consumer model and digital systems, emphasizing product innovation, such as the successful launches of new bag families. Amidst the uncertain economic and geopolitical landscape, Mulberry remains confident in its strategy, emphasizing the value proposition in the luxury market and urging policy changes, like VAT-free shopping in the UK, to support business growth.

The company’s sustainability efforts continued, including initiatives like Mulberry Pre-Loved and sourcing 100% of leather from environmentally accredited tanneries. Mulberry remains prepared for the second half, leveraging its Somerset factories and customer-focused growth plan, emphasising a clear strategy amidst ongoing uncertainty.

Next 15 initiate £30m share buyback

Next 15 (NFG) released a trading update before its Capital Markets Event, indicating solid performance across its businesses.

The three-month period ended October 31 delivered a 2.5% organic growth in net revenue, contributing to a 2.6% rise for the first nine months compared to the previous year. However, NFG said client spend delays affected the Customer Engagement segment.

Despite these challenges, the company anticipates its full-year net revenue, profits, and earnings per share to meet management expectations. Operating margins are expected to improve, driven by integrated business performance following acquisitions and stringent cost controls amid inflationary pressures.

Next 15 said it maintains a robust balance sheet and projects a modest net debt position by year-end. The company initiated a share buyback program of up to £30 million, with £10 million earmarked for repurchasing shares by January 31, 2024. As of November 24, 2023, approximately £1.9 million was invested in buying back and cancelling 274,980 shares.

Oxford Metrics see full-year revenue more than 50%

Smart sensing and software company, Oxford Metrics (OMG) recently delivered a strong set of preliminary results for the fiscal year ending September 30.

Here’s a summary of the key takeaways:

Financial performance: Achieved record revenue of £44.2m, marking a 53.5% increase from the previous year. Adjusted profit before tax surged by 151.9% to £6.5m.

Dividends and cash position: Proposed an increased final dividend of 2.75p per share. Maintained a robust net cash position of £64.8m, facilitating potential M&A activities.

Operational highlights: Notable revenue growth across market segments like Entertainment (up 82%), Engineering (up 56%), and Life Sciences (up 40%). Demonstrated markerless technology at Siggraph 2023, anticipating its commercialisation in FY24.

Strategic moves: Acquired Industrial Vision Systems Ltd (IVS) post-period, enhancing the company’s smart manufacturing capabilities and bolstering its smart sensing portfolio.

Imogen Moorhouse, CEO of Oxford Metrics, highlighted the company’s robust revenue and adjusted profit performance, emphasising the successful execution of their five-year strategy. Moorhouse also highlighted the company’s innovation in markerless technology and the pursuit of M&A opportunities, projecting a positive outlook with a strong sales pipeline and anticipated growth in existing markets.

Serica maintains production guidance after summer shutdowns

In an operations update, released on Wednesday, Serica Energy (SQZ) reported recent production averaging over 52,000 barrels of oil equivalent per day, maintaining its annual guidance between 40,000 and 45,000 daily barrels due to a slower ramp-up post-summer shutdown.

Production resumed at the Bruce Hub in September after maintenance and strong production from the Bruce and Rhum fields was achieved, with resolved constraints. Serica said the Light Well Intervention Vessel campaign enhanced production. And the Triton Area also concluded its summer shutdown, addressing production issues through interventions in Guillemot fields.

On the licensing front, Serica is progressing in acquiring a 30% interest in the Greater Buchan Area. Licence extensions were sought for Mansell discovery, and documentation for the Kyle discovery is nearing completion. However, Serica relinquished Licence P2506 due to the absence of viable targets.

Regarding organisational changes, the integration of Tailwind is ongoing, with key members transitioning out by March. Martin Copeland is set to become CFO, and Mike Killeen will take on the role of COO. CEO Mitch Flegg expressed satisfaction with the successful shutdowns and highlighted the achievements in production and investment projects from the Tailwind acquisition.

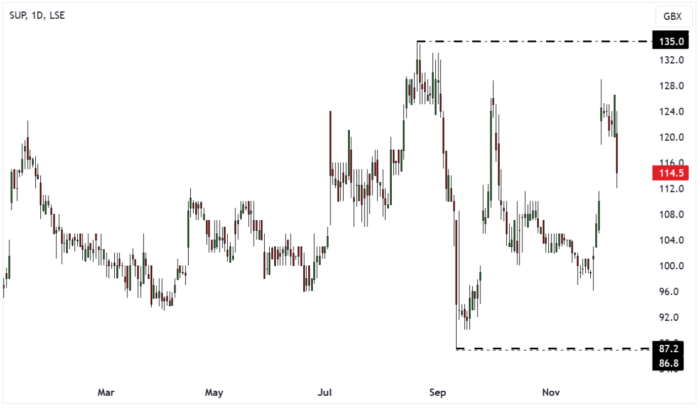

Supreme: Record profits and revenue propel expectations skyward

Supreme (SUP) achieved record-breaking results in the first six months of the fiscal year ending on September 30, 2023. The consumer products manufacturer experienced a significant 63% surge in revenue, reaching £105.1 million, alongside an impressive 179% jump in pre-tax profit, hitting £12.3 million.

The standout factor driving this growth was the ElfBar distribution opportunity, contributing £26.4 million in revenue during this period. Moreover, strong organic growth, which added £8.7 million, and the value from acquisitions made in the prior year also significantly contributed to this remarkable performance.

Operational achievements included a 25% expansion in vaping production capacity at the Manchester manufacturing site. This expansion aimed to accommodate the operations of three acquired vaping businesses from the previous fiscal year, while also positioning the company for further organic growth.

Additionally, the successful and timely completion of the ‘Ark’ warehouse project marked a significant milestone for the company. This achievement was completed within budget and without causing significant disruption to broader business operations.

The momentum continued into the second half of the financial year, with ongoing growth observed across all business divisions. This robust performance led the Supreme board to revise their full-year adjusted EBITDA expectations upward by £4.5 million.

tinyBuild’s revenue and cash fall short of expectations

Game developer, tinyBuild (TBLD) reported disappointing revenue and cash figures, prompting discussions around potential fresh investments.

In their latest update, the company revealed that their current trading fell below expectations, particularly citing weak performance in October, impacting their estimated full-year revenues. Now projected between $40-50 million, these figures are notably lower than their initial forecasts.

A major contributor to this downturn is the underperformance of Versus Evil, a subsidiary of tinyBuild. Delays in releasing three out of four scheduled games have pushed these launches into 2024, further exacerbating their revenue projections. This setback has also impacted tinyBuild’s cash position, which, as of November’s end, stood at US$5.7 million. However, this figure is anticipated to fall short of their previously forecasted US$10-20 million by December 2023.

To bolster their financial position, CEO and founder Alex Nichiporchik expressed willingness to underwrite a future equity fundraise of up to $10 million. This move is contingent on obtaining shareholder approval and aims to strengthen the company’s balance sheet in response to these challenges.

tinyBuild’s share price dropped back to its recent trend lows in response to this lastest update. The shares are now trading at a market cap near to its net cash position and with this in mind, we will continue to hold the stock.

TPX Impact hits milestone growth in interim results

TPX Impact (TPX) delivered a robust set of interim results for the six months ending on September 30th.

The company, focusing on people-powered digital transformation, reported ‘in-line’ financial and operational achievements. Highlights from their financial performance include a 22% increase in revenue (like-for-like) to £41.6 million and a noteworthy acceleration in revenue growth, hitting 7% in Q1 and rising to 38% in Q2.

TPX secured record new business wins totalling £105 million in the first half, which encompassed significant contracts with notable entities like the Department for Education and His Majesty’s Land Registry. The company also reported improved adjusted earnings (EBITDA) of £2.0 million and delivered operational advancements, such as enhanced staff retention rates.

Strategically, TPX is on track with its full year targets, projecting revenue in the £80-85 million range and an Adjusted EBITDA of £4-5 million for the full year.

Bjorn Conway, TPXimpact’s CEO, expressed his satisfaction with the team’s response to the company’s new vision and strategy, which led to the impressive first-half performance. The major business wins underscored TPXimpact’s capability and potential to make a positive impact through digital transformation. Conway also emphasised the progress made in simplifying the business, investing in core platforms, and ensuring future growth.

Volex navigates EV demand dip with solid growth in diverse sectors

Cable manufacturer Volex (VLX) experienced a setback in electric vehicle (EV) component demand, resulting in a 16% decline in organic EV sales for the six months ending October. Similarly, the consumer electrical division faced a 9% drop in organic sales due to decreased post-COVID demand and reduced material costs that led to price reductions.

Despite these declines, Volex delivered overall organic growth of 4.2%, propelled by strong performances in its medical and industrial technology sectors. This growth contributed to a 16% increase in adjusted profit before tax, reaching $33.6 million (£26.7 million), attributed to broader margins and recent acquisitions.

Uncertainty lingers regarding the recovery of consumer electricals and EV cables, especially in the US and Asia, where destocking processes began later than in Europe. The visibility of demand for simple power cords used in EVs remains low due to short lead times, making prediction challenging.

However, Volex’s diversification strategy has proven effective, sustaining sales, margins, and profit growth despite market challenges. The company remains on track to meet full-year forecasts. Notably, the industrial technology division, supplying cables for data centres, shows promise.

Water Intelligence reports robust growth and operational resilience

Water Intelligence (WATR) has released a robust trading update for the ten months ended October 31st.

The leak detection company said it experienced increased market demand for precision water infrastructure solutions globally. It renewed municipal contracts in Australia, secured new contracts in the EU, and aims to enhance operating efficiencies by implementing Salesforce in Q1 2024. Despite inflation and higher interest rates, both adjusted earnings and profit before tax (PBT) margins have improved.

Financially, the company reported a 6% rise in revenue to $64.4 million, driven by growth in various segments, including franchise-related activities, US and international corporate sales, and insurance business channels. Statutory PBT increased by 11%, reaching $6.8 million, while adjusted PBT grew by 14% to $8.7 million. The company’s balance sheet remains robust, with cash and equivalents at $17.2 million and low leverage, enabling significant financial capacity for acquisitions.

Executive Chairman Dr. Patrick DeSouza expressed satisfaction with the company’s operational resilience amidst inflationary challenges and higher interest rates. DeSouza said the company’s investments aim to accelerate sales growth in 2024, reinforced by Salesforce implementation and a new training centre in Connecticut.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.