23rd Nov 2023. 9.04am

Regency View:

Update

Regency View:

Update

Atalaya Mining eyes LSE main market move

Atalaya Mining (ATYM) recently shared its unaudited financial results for Q3 and the year-to-date 2023, displaying positive progress in various areas:

- Copper production stood at 12.5 kt in Q3 and 38.9 kt YTD, with operating costs and all-in sustaining costs (AISC) tracking within their predicted ranges.

- The company expects to meet the lower end of its copper production guidance for FY2023 and maintain AISC within the previously stated range.

- Noteworthy financial indicators include adjusted earnings (EBITDA) of €19.1 million in Q3 and €59.2 million YTD, backed by a robust net cash position of €66.8 million after recent investments and dividend payments.

- Plans were announced to seek admission to the premium listing segment of the London Stock Exchange’s Main Market and relocate from Cyprus to Spain, potentially enhancing the company’s visibility to new investors and enabling future inclusion in FTSE UK Index Series upon Main Market listing.

CEO Alberto Lavandeira emphasised the company’s consistent operational and financial success in Q3. He highlighted their commitment to efficient operations, responsible investments in solar energy and exploration, and the strategic move to broaden the company’s appeal to new investors amidst growing interest in copper and energy transition initiatives.

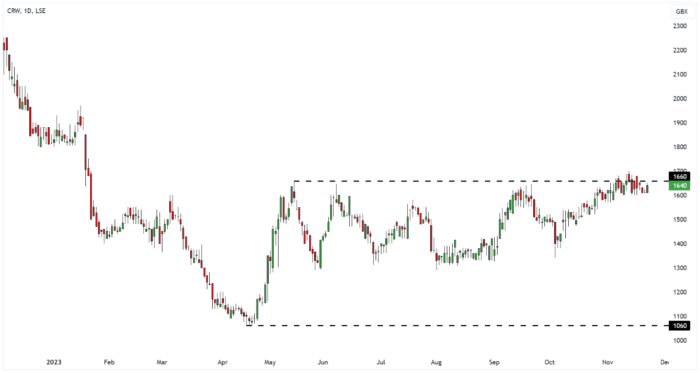

Craneware’s strong performance fuels healthcare digital revolution

In a recent AGM statement, Craneware (CRW) said it has been experiencing ongoing positive financial and operational performance as they move into the new financial year.

The US healthcare-focused fintech said opportunities initiated at the end of the previous financial year are gaining momentum, contributing to a growing sales pipeline that’s translating into revenue. Their financial results are on track as expected by the management.

US hospitals are now refocusing on delivering Value-Based Care and bolstering their operational models by gaining deeper insights into their finances and operations. Craneware aims to play a central role in this by leveraging Trisus, their cloud-based data analytics and intelligence platform.

Confidence is high within Craneware regarding their resilient business model, a substantial customer base, and strong levels of Annual Recurring Revenue (ARR). The AGM statement said management are strategically set on growth, primarily centred around expanding the Trisus platform.

Duke Royalty Interim Results: Strong growth and steady dividends

Duke Royalty (DUKE), known for providing alternative capital solutions to established businesses, has reported strong interim results for the six months ending September 2023.

Financially, the company saw impressive growth:

- Total cash revenue surged by 35% to £14.1 million.

- Recurring cash revenue reached £12.2 million, marking a 17% increase from the previous interim period.

- Free cash flow rose by 23% to £7.9 million, reflecting solid financial performance.

- Adjusted earnings also climbed by 23% to 1.95 pence per share.

- Cash dividends of 1.40 pence per share were paid to shareholders, consistent with the previous period.

Operationally, Duke Royalty made significant moves:

- Invested over £18 million into new and existing Royalty Partners.

- Expanded its portfolio to 15 royalty partners with one new addition.

- Achieved a triple-digit IRR through an investment buyback with Instor.

- Boasts over £40 million in available liquidity for future deployments.

Duke Chairman, Nigel Birrell highlighted the company’s impressive performance, marking twelve consecutive quarters of rising recurring cash revenue. Looking ahead, Duke remains poised for growth, emphasising an appealing offering through its private credit and equity hybrid product, focusing on long-term partnership-based solutions that resonate with SME business owners.

FRP Advisory sees strong growth and strategic resilience in H1 2024 trading update

FRP Advisory (FRP) released a solid trading update for the half-year ending October 2023.

Financially, they’ve shown robust growth:

- Revenue for H1 2024 reached £58.7m, a significant 19% increase from H1 2023’s £49.4m.

- Underlying adjusted EBITDA soared to £15.5m, marking a 34% rise from H1 2023’s £11.6m.

In the restructuring sector, FRP remains highly active, especially within industries facing challenges due to increased debt service costs and elevated inflation. The company continues to offer commercial solutions for clients in stress and distress situations.

Corporate Finance encountered a decrease in deal volumes due to economic challenges, but the team closed 25 transactions in H1 2024, valued at £537 million and raising £209 million in debt. A solid pipeline for H2 2024 is anticipated.

Forensic Services witnessed increased activity in investigations and disputes, largely driven by fraud-related matters.

FRP maintains a robust balance sheet with an unaudited net cash balance of £11.7m as of October 31, 2023, and an undrawn credit facility of £10m.

Investors have reacted positively to the update with prices starting to trend higher in recent weeks.

Pan African Resources on track with MTR plant construction

Pan African Resources (PAF) provided an interim production update and progress report on constructing the Mogale Tailings Retreatment (MTR) Plant. The company expects robust gold production for the half-year ending December 2023, with production figures estimated between 94,000oz to 98,000oz, showcasing a potential 2% to 6% increase from the previous year.

Highlights of gold production expectations for various operations include:

- Barberton Mines underground: An anticipated increase due to continuous operations.

- Evander Mines underground: Improved production due to higher grade ore and better conveyor belt availability.

- Elikhulu tailings retreatment: Expected increase in gold production.

- Evander surface sources and Barberton tailings retreatment: Expected production figures.

- The company increased its full-year 2024 production guidance to a range of 180,000oz to 190,000oz.

Regarding the MTR Plant construction:

- Progress is on track, aiming for commissioning in late 2024.

- Construction is on schedule and within budget.

- Environmental rehabilitation efforts have begun.

CEO Cobus Loots expressed confidence in the expected performance, positioning the company for an excellent full-year result. The progress in constructing the MTR Plant signifies their ability to develop world-class tailings retreatment projects, projecting an estimated 25% increase in annual output upon its commencement in 2024.

Renold achieves record earnings growth

Industrial chain maker, Renold (RNO), reported record earnings growth in its interim results for the half-year ending September 2023.

Financial highlights included:

- Revenue increased by 7.7% (£125.3m) due to improved Torque Transmission activity and Chain growth.

- Adjusted operating profit surged by 56.3% (£15.0m) driven by strong performance.

- Return on sales rose by 370bps to 12.0%, showcasing improved profitability.

- Net debt stood at £28.3m, demonstrating strong management despite acquisitions.

- Adjusted earnings per share grew by 40.7% to 3.8p.

Renolds order book reduced to £83.6m due to supply chain normalisation. Strategically, Renold said the acquisition of Davidson in Australia for AU$6.0m strengthened the Group’s market access.

CEO Robert Purcell highlighted the company’s momentum, achieving record results in sales, margins, profits, and cash generation. He acknowledged global uncertainties but expressed confidence in Renold’s resilience and ability to surpass market expectations for the current year.

Restore optimistic about meeting full-year expectations

Doc storage group, Restore (RST) shared an update on their 10-month trading period ending October 2023.

The report highlighted steady revenues, mainly driven by core storage and contracted income streams, especially in Records Management, contributing significantly to the Group’s profitability.

In the Digital sector, despite a decrease in non-recurring contracts, cost management remained robust. Noteworthy contract wins with HM Revenue & Customs and HM Land Registry showcased the segment’s momentum.

The Technology division navigated challenges due to subdued volumes of IT assets, focusing on higher-margin activities in response to market conditions.

Datashred, amid expected trading conditions, tackled challenges posed by reduced recycled paper pricing, while Harrow Green maintained performance in line with expectations.

Though additional cash was expended on restructuring and change processes, overall cash generation remained healthy. Expectations of the net debt position aligning with the previous year’s figures at year-end were expressed.

Restore said it remains optimistic about meeting full-year performance expectations. Additionally, Restore Digital secured a significant three-year contract worth £4.5m from HM Land Registry for comprehensive virtual mailroom, document scanning, and data extraction services starting September 2023.

Science Group cautious outlook for 2024

Science Group (SAG) shares took a tumble this week after it published a cautious outlook for 2024.

The science-as-a-service consultancy anticipates its Adjusted Operating Profit for the year ending December 2023 to meet expectations, positioning the company for another record year. However, global economic and geopolitical conditions have impacted revenue, especially in client investments in consumer and industrial sectors.

Science Group said the acquisition of TP Group facilitated an entry into the defence market, with the integration of TPG Services and CMS2 progressing well. They added that investments have bolstered operational management and business development functions.

Looking ahead to 2024, Science Group sited geopolitical instability and economic factors, including high interest rates and weak consumer environments, as challenges. While reduced inflation in key geographies provides some optimism, uncertainty in end-user markets persists.

Science Group said it will continue with its share buy-back program. As of mid-November 2023, the company has repurchased approximately 1.8% of issued shares at a total cost of £3.3 million.

With a strong balance sheet, boasting significant cash reserves and a substantial undrawn bank facility, Science Group said it is well-positioned to explore corporate opportunities aligned with its strategic objectives.

Tracsis drives record growth in transport tech

Tracsis (TRCS), released its audited final results for the year ended 31 July 2023, showing impressive financial and operational achievements.

Financial highlights included:

- Revenue growth: A robust 19% revenue hike to £82.0 million, with both Rail Technology & Services and data, Analytics, Consultancy & Events Divisions contributing.

- Profit surge: Operating profit soared 123%, while adjusted earnings per share surged 19%, demonstrating exceptional growth.

- Dividends: Increased final dividend per share by 9%, maintaining the Group’s progressive dividend policy.

Strategically, Tracsis Witnessed growth in software license usage and annual recurring revenue, clinching large SaaS contracts and experiencing high demand for Remote Condition Monitoring solutions. Tracsis’s Rail Technology in North America flourished, driving substantial opportunities in the pipeline. And Tracsis Streamlined organizational structure to facilitate smoother operations and efficiency.

Looking ahead, Tracisis forecasts FY24 performance to align with market expectations, with an emphasis on robust organic growth in Rail Technology & Services and sustained performance in Data, Analytics, Consultancy & Events.

CEO Chris Barnes expressed satisfaction with the year’s accomplishments, highlighting growth, successful contracts, and efforts towards integration.

Tremor’s Q3 2023: Steady growth despite market challenges

Tremor International (TRMR) reported robust financial results for Q3 2023, showing an 18% year-over-year increase in Contribution ex-TAC.

The growth was primarily fuelled by a 23% jump in programmatic revenue, driven by strategic enhancements and increased enterprise partnerships. However, CTV revenue faced a temporary setback due to market conditions, leading to a shift in spending towards lower-cost alternatives.

Tremor said it aims to prioritise internal growth initiatives and potential share repurchase programs using its healthy cash resources.

Despite ongoing market uncertainties impacting ad demand and budgets, Tremor foresees stable growth and aims to capitalise on its diverse business model.

CEO Ofer Druker commented:

“We continue to have unwavering confidence in our long-term competitive positioning and strategy, and believe that as macroeconomic conditions improve, and as CTV advertising demand expands, we are very well-placed to generate Contribution ex-TAC growth, significantly improve profitability, achieve outsized market share gains, and further our Ad Tech leadership position.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.