26th Oct 2023. 8.48am

Regency View:

Update

Regency View:

Update

Cake Box deliver strong half year earnings

Cake Box (CBOX) said it has seen a positive trend in sales and reduced cost pressures as it reported a 6% increase in revenue, with profits ahead of the first half of 2023.

Franchisee store sales grew by 6.2% in the first half, a significant improvement over the previous year’s negative 1.6%. The cost of raw materials has remained stable, providing relief to franchisees facing inflationary pressures in utility and fuel prices. Cake Box said it has maintained its pricing, aiming to retain customers and attract new ones.

Despite increased interest rates, franchisees’ demand for stores remains high, with nine new stores opening in the first half. The company’s franchise store estate now stands at 214 stores.

The company maintains a strong balance sheet with £7.1 million in cash and cash equivalents, even after paying a dividend.

Cake Box CEO, Sukh Chamdal commented:

“We enter the second half of the year with good momentum and remain confident in our growth prospects following the investment in our operations and our enlarged and enhanced operational team.”

Cerillion’s impressive trading update boosts shares

Cerillion (CER) reported an impressive trading update for the fiscal year ending September 30, 2023.

The first six months set new revenue and profit records, and this positive trend continued throughout the second half. Notable achievements include signing a £15.1 million contract with an existing customer and completing a significant installation for Telesur.

As a result of this strong performance, Cerillion expects its adjusted pre-tax profit to exceed the market consensus of £14.3 million, and revenue to reach approximately £39.0 million, with significant sales to existing customers. Their net cash position also improved, closing at around £24.7 million. The company’s new customer sales pipeline has grown, with promising opportunities.

The market reacted positively to the update with the shares gapping higher – realigning short-term momentum with the bigger picture uptrend.

Cerillion plans to release its full-year results in late November 2023 and will host a Capital Markets Event for analysts and investors on November 28, 2023, featuring presentations from senior management.

Gattaca profits to be tilted toward second half

Recruitment specialist, Gattaca (GATC) released an in-line set of Final Results which confirmed the company’s turnaround in 2023.

While revenue decreased from £403.9 million in 2022 to £385.2 million, profit before tax showed a significant improvement, going from a loss of £2.4 million in 2022 to a profit of £4.0 million.

Group net cash increased by 76% to £21.6 million as of 31 July 2023, up from £12.3 million in 2022. And the dividend for the year totalled 5.0 pence per share, consisting of a 2.5 pence per share ordinary dividend and a 2.5 pence per share special dividend.

Operational highlights included a focus on strategic priorities, increased marketing investment, improved people engagement, enhanced sales productivity, and cost savings in property management.

Looking ahead, Gattaca acknowledges macro-economic headwinds but anticipates an improvement in profitability weighted toward the second half of the year.

Gattaca CEO, Matthew Wragg said:

“We are well positioned to take advantage of the expected recovery in the market and will look to grow our sales headcount where we see the best opportunities for contract expansion, whilst we continue to focus on our strategic priorities enabling us to further strengthen our platform for growth.”

Oxford Metrics achieves record revenue and profit for FY23

In a concise trading update this week, Oxford Metrics (OMG) said they anticipate reporting record full-year revenues.

The tech specialist expects to achieve £44.0 million in full-year revenue and an Adjusted Profit Before Tax (PBT) of £6.3 million, surpassing initial market expectations for the financial year. To provide context, market consensus as of October 24, 2023, had initially projected lower figures for FY23, with estimated revenues of £39.00 million and an Adjusted PBT of £5.83 million.

This performance was driven by significant contributions from the Engineering and Life Sciences segments, with continued growth in demand for their smart sensing technology, including the recently launched Vicon Valkyrie system.

Oxford Metrics concluded the year in a strong financial position, boasting £64.8 million in cash reserves and no debt. The company will release its Preliminary Results for the fiscal year ending on September 30, 2023, scheduled for December 5, 2023.

The market has reacted positively to the update with the shares gapping higher on Wednesday.

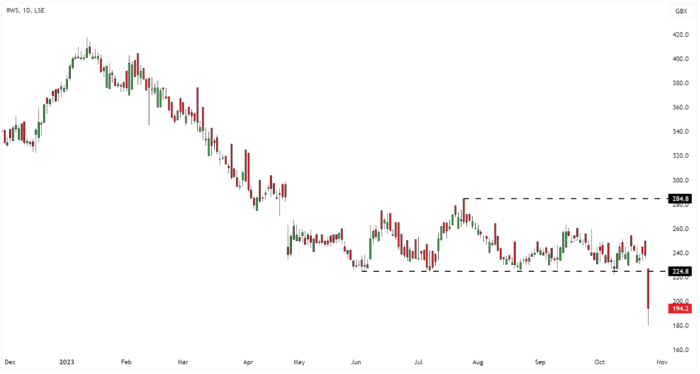

RWS drop on FY revenue miss

RWS Holdings (RWS) share price dropped by 20% after reporting a revenue shortfall for the year ending September 30.

The language tech group said full year revenues were down by 2% to £734 million, missing market expectations of £738 million to £757 million. However, adjusted pre-tax profit is expected to be in line with analysts’ forecasts of £116.5 million to £129 million.

During the period, RWS completed the acquisition of Propylon, a content management technology business, and ST Communications, which gives them access to expertise in African languages. Their cash generation remains strong, with net cash of approximately £23 million.

Ian El-Mokadem, CEO of RWS, commented:

Despite the ongoing challenges in our some of our markets, we are successfully pivoting into higher growth segments, continuing to invest to develop our AI-centred technology solutions, building on our strong acquisition track record and transforming the Group into a scalable platform which will support organic and inorganic growth. With our strong balance sheet and cash generation, global scale and reach and unique combination of market-leading expertise and technology, we remain confident about the Group’s long-term prospects.

Sylvania releases in-line quarterly operations update

Sylvania Platinum (SLP) released production numbers for the first quarter of its financial year.

Sylvania announced that Sylvania Dump Operations (SDO) produced 20,173 4E (25,533 6E) PGM ounces in Q1, in line with guidance. No Lost-Time Injuries (LTIs) were recorded during the Quarter.

SDO recorded $19.7 million in net revenue for the Quarter, with Group EBITDA at $2.8 million. Progress was made in commissioning the Lannex MF2 flotation circuit, and improvements are expected with the fine grinding circuit’s completion.

In terms of the outlook, Sylvania expects the commissioning of the Lannex fine grinding circuit by the end of Q2 FY2024. The company is reviewing an updated Mineral Resource Estimate (MRE) statement and anticipates the release of a Preliminary Economic Assessment (PEA) for the Volspruit project. Sylvania said it maintains strong cash reserves to fund expansion and joint venture initiatives.

CEO Jaco Prinsloo commented:

“The optimisation of value from the exploration assets remains a key component of Sylvania Platinum’s growth strategy and will aid in supporting the Company’s future value proposition for all stakeholders.”

Supreme achieves record growth in H1 2024

Supreme (SUP), the vape manufacturer and supplier of fast-moving consumer products said it is set to report a record performance for H1 2024.

Group Revenues are expected to exceed £100 million, a substantial increase from the £67.6 million reported in H1 2023. Moreover, the Group anticipates an Adjusted EBITDA of at least £15 million for this period, a notable improvement from the £8.1 million reported in H1 2023.

Supreme said its Board is highly satisfied with the Group’s performance during this period as it aligns with the company’s expectations for the fiscal year ending on March 31, 2024. These expectations were significantly revised on September 26, 2023, with projected revenues of approximately £195-£205 million and expected adjusted earnings (EBITDA) of around £28-£30 million.

A significant factor in this growth has been the Elfbar vape distribution contract, which has surpassed initial expectations. This opportunity alone has contributed to roughly half of the reported revenue and gross profit growth during H1 2024. The remaining growth has arisen from the Group’s four other product categories, each of which has shown robust revenue and gross profit growth.

With vaping coming under increasing regulatory scrutiny, Sandy Chadha, CEO of Supreme, emphasized their commitment to preventing underage vaping while recognizing the role of flavoured vapes in helping ex-smokers transition to a healthier alternative. He stated, “We are fully supportive of any legislation and are more than happy to begin to transition our business by removing or changing anything from within our product set that could be deemed compromising.”

TPX reiterates FY 24 targets

TPX Impact (TPX) has reported a strong first half of trading in line with expectations. They expect to achieve first-half revenues of £41-42 million, representing a 20% growth compared to the previous year. Adjusted EBITDA margins are also expected to improve significantly.

The company secured new business worth £105 million during the first half, and their pipeline for future business opportunities remains strong. TPX’s net debt (excluding lease liabilities) decreased to approximately £13 million by the end of September 2023, down from £17.9 million at the end of June 2023, and they have met their banking covenants for the first half.

The Board has reaffirmed its full-year targets for FY24, aiming for a 15-20% like-for-like revenue growth and Adjusted EBITDA margins of 5-6%. This would translate to a revenue range of £80-85 million and Adjusted EBITDA in the range of £4-5 million for FY24. They are also targeting a net debt (excluding lease liabilities) in the range of £11-12 million by the end of March 2024, aiming for a net debt to Adjusted EBITDA ratio of less than 2.5x.

TPX plan to maintain growth in FY25, aiming for like-for-like revenue growth of 10-15% and further margin improvement. Notably, the figures provided exclude the Questers business (sold on 15 September 2023) and TPX Impact Norway (sold on 13 October 2023) from the results and targets for H124 and FY24.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.