Regency View:

Update

Alliance share hit by drug pricing scandal

Alliance Pharma (AFM) CEO, Peter Butterfield, is facing a competition disqualification order (CDO) from the Competition and Markets Authority (CMA).

Alliance and three other healthcare groups were fined £35m by the CMA amid accusations of conspiring to restrict the supply of prochlorperazine, a medicine designed to treat nausea, dizziness and migraines.

The agreement is alleged to have caused the price of the drug paid by the NHS to surge seven-fold from £6.49 for a pack of 50 tablets to £51.68 between 2013 and 2017.

Alliance said it “fundamentally disagrees with the CMA’s actions, both in relation to the findings against the Company and in applying for a CDO against Mr. Butterfield”.

The shares broke below support following last Friday’s announcement from the CMA. However, we do not see this altering our long-term view on the stock.

Cohort wins new contract with UK MOD

Defence tech firm, Cohort (CHRT) announced yesterday that its subsidiary SEA (Systems Engineering and Assessment) has been awarded a new contract with the UK MOD.

The deal, worth around £34m, is to provide systems and equipment upgrade of the Anti-Submarine Warfare and countermeasures systems on some of the platforms crucial to the Royal Navy.

Under the contract SEA will also provide in-service support for these systems across the naval fleet for a period of five years with the option to further extend for two years.

Andy Thomis, Cohort CEO said:

“This order is a clear demonstration of the strong relationship between SEA and the UK MOD, and further cements SEA’s position as a leading supplier of maritime defence systems to navies across the globe. Together with other recent contract wins across the Group, this order further strengthens our order book and enhances the visibility of future revenues.”

CentralNic’s half year revenue jumps 93%

CentralNic (CNIC) released half year results last week in which revenue jumped by 93% to $334.6m, up from $173.8m in H1 2021.

Organic growth further accelerated during the period, driven by the ongoing market share gains of its proprietary privacy-safe online marketing solutions which CentralNic say have a ‘$100bn+ opportunity’.

Adjusted earnings (EBITDA) almost doubled during the period to $38.6m and non-core operating expenses reduced by 51% to $2.5m.

CentralNic said it was “comfortably trading towards the high end of the recently upgraded forecasts”.

With CEO, Ben Crawford commenting:

“CentralNic has enjoyed a strong first half of the year with year-on-year organic growth now reaching a record 62%, with our high cash conversion driving our net debt down to below our consensus EBITDA for 2022”.

These were a very strong set of numbers, and the market’s tepid reaction suggests that the stock is being suppressed by wider sentiment towards the advertising sector.

Equals generate record first half revenue

Equals (EQLS) published its interim results for the first six months of 2022 this week…

The payment solutions provider ended the period with an after tax-profit of £0.8m, recovering from a loss of £1.2m in a similar period of the previous year. And headline revenue hit a new record of £31.4m – an increase of 86%.

Adjusted earnings (EBITDA) jumped two-fold to reach £4.9m – giving Equals a basic earnings per share (EPS) of £0.38p.

“This is an outstanding set of results with record revenue and EBITDA cementing our extremely successful transition into cash generation and, ultimately, a return to the first statutory profit since 2018,” said Equals CEO, Ian Strafford-Taylor.

“Based on these strong results and our current trading performance, we look to the future with increased confidence and remain in line with expectations for the full year” he added.

The shares are locked in a powerful long-term uptrend, and we are more than happy to continue to hold Equals after such an impressive set of numbers.

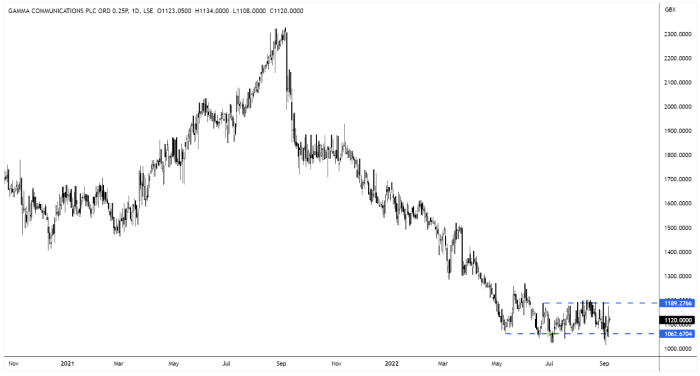

Gamma posts interim profit rise and expects further growth

Gamma Communications (GAMA) on Tuesday raised its interim payout and retained its confident outlook for the full year, following a robust performance in the first half of 2022.

For the six months ended June 30, Gamma posted pretax profit of £38.4m, up 19% from £32.4m on the same period a year before. And adjusted earnings (EBITDA) rose 13% to £51.9m from £46m.

This was on revenue which grew 8% year-on-year to £234.7m from £217.4m. Gamma attributed the strong revenue growth to a solid performance in the UK, with the Indirect business benefiting from data product growth and UCaaS sales, while the Direct business prospered from MS Teams user contract wins.

Gamma declared an interim dividend of 5.0 pence per share, up 14% from 4.4p a year prior.

Despite the strong numbers, the shares continue to languish near recent lows as the market attempts to price-in the impact of a severe recession throughout Europe.

Inland Homes founder steps down after profit warning

Inland Homes (INL) shares plunged more than -25% on Tuesday following a shock profit warning…

The South-East developer said it expects to sink to a £37m pre-tax loss for the year after having been hit by contract and planning delays and cost inflation and said it had appointed advisors Lazard & Co. to conduct a ‘strategic review’ of the business.

Inland will suspend its share buy-back programme until the strategic review has concluded.

CEO and founder Stephen Wicks has fallen on his sword following the news and will step down from the firm on September 30, to be replace on an interim basis by chief finance officer Nish Malde, while a new CEO is recruited.

The shares are now trading at a Price to Tangible Book Value of just 0.23, and we will wait for the dust to settle before reviewing our house view on the stock.

Ixico expects profits to exceed previous guidance

Ixico (IXI) released an upbeat trading update last week in which it said trading for the second half of its financial year had been strong…

The neuroimaging company now expects that EBITDA profits for the year ended 30 September 2022 will “comfortably exceed” previous guidance of £1.2m stated in the trading update of 24 May 2022.

Revenues for the period were “broadly in line with market expectations” with circa £0.2m revenues expected to move from 2022 into 2023 due to the timing of client trials.

Ixico said that since its half year at 31 March 2022, the company has signed contracts worth circa £7.5m as it continues to build up and further diversify its order book, which it expects to be in excess of £15m at the year end.

Ixico CEO, Giulio Cerroni commented:

“We continue to diversify our client base and prioritise commercial and investment strategies that position the Company for future growth. 2023 will see us further strengthen our orderbook to capture the growth opportunity for our specialist neuroimaging technology services for 2024 and beyond.”

Somero sees interim profit slip despite record revenue

Somero (SOM) reported a dip in interim profit despite a rise in revenue as the cement leveller cited increased staffing-related expenses.

Pretax profit slipped 4.7% to $22.4, but revenue rose 6.4% to $68.5m during the six months ended June 30, 2022.

Somero’s US revenue amounted to $55.6m during the period, up 9.2% from $50.9, reflecting a “strong, active non-residential construction market and the positive impact of 2022 price increases.”

However, total operating expenses, increased by $17.3m “reflective of increased staffing that includes investment in sales and support staff in the US and abroad, as well as higher compensation, employee related expenses and increased travel”.

Somero CEO, Jack Cooney commented:

“Outside of a very strong US market, we are pleased with the contribution to revenues from our international regions, and in particular with the activity levels and interest in our equipment, new and existing, that we continue to see in Europe and Australia.”

Somero declared an interim dividend of 0.1 US cents per share, up 11% from 0.09 US cents a year prior.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.