31st Aug 2023. 9.14am

Regency View:

Update

Regency View:

Update

Cake Box Reports Strong Sales Growth

Cake Box (CBOX), a company known for its fresh cream cakes, reported a positive trading update ahead of its annual meeting.

In the 17 weeks leading up to July 30, 2023, their franchisee store sales increased by 6.8% compared to the same period last year. This growth is better than the 5.4% reported earlier for the first 11 weeks of the financial year. The company effectively managed costs, reduced inflation impacts, and passed on some savings to franchisees to help their profits.

Cake Box’s balance sheet remains strong with a cash balance of £7.9m, and a dividend payout of 5.5 pence per share will result in a cash outflow of £2.2m on August 29, 2023. Cake Box has also strengthened its marketing efforts and launched a new website in June 2023, yielding positive early results.

Geographically, they expanded by opening seven new franchise stores this financial year, reaching a total of 212 by July 30, 2023. In a board update, Chairman Nilesh Sachdev will step down in November 2023 after over five years, with the company initiating the search for a successor.

Cohort’s SEA lands £17.5m defence contract

Shares in defence tech company, Cohort (CHRT) jumped higher this week after one of its subsidiary’s, Systems Engineering & Assessment Limited (SEA), landed a big contract from a UK customer worth £17.5m.

SEA will provide an External Communications System (ECS) for a “major defence programme” in the UK. This system will help with sharing important data in real-time, passing along critical information, and making sure everything works smoothly.

Cohort CEO, Andy Thomis said:

“This contract is another significant win for SEA and will deliver essential communications capability to our customer’s programme. It builds upon SEA’s long-standing reputation and record of successful performance in this technology area. Together with other recent wins across the Group, this contract further underpins our order book and enhances the visibility of future revenues.”

Whilst the shares continue to chop sideways in a long-term range, the outlook for the defence sector looks bullish and we remain happy to hold Cohort in our list of open positions.

hVIVO plans state-of-the-art testing facility for growing demand

Human challenge trial specialist, hVIVO (HVO) announced plans to build a new and advanced testing facility in London.

The expansion is a response to increasing demand and a growing order book. The facility will house quarantine bedrooms, cutting-edge laboratories, outpatient units, and offices.

Initially, it will have 50 quarantine beds with the potential to expand to 70 in the future. The project is being primarily funded by hVIVO’s clients.

The new facility is set to enhance operational efficiency, increase testing capacity, and broaden services in virology and immunology. Completion is expected in Q2 2024, with a positive impact on financials and overall operations.

hVIVO CEO, Yamin ‘Mo’ Khan said:

“The new facility will also allow us to conduct a greater number of trials concurrently across various challenge models enabling the Company to maintain a higher level of capacity throughout the year.”

“Furthermore, we will expand our laboratory capability, facilitating the broadening of our service offerings. Consolidating our operations into a single location will lead to improved operational efficiencies, ultimately enhancing our profit margins.”

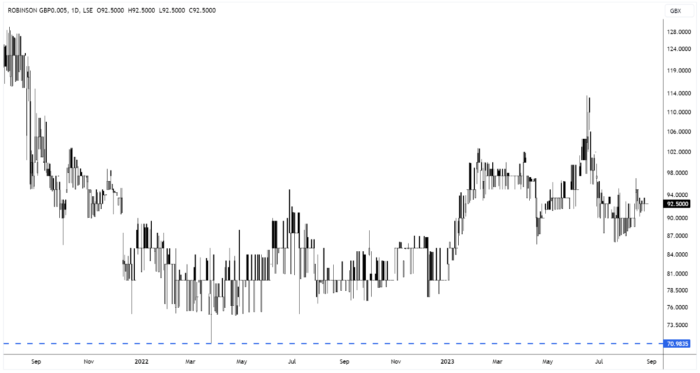

Robinson plc’s H1 2023: Challenges and optimism amidst transition

Robinson’s (RBN) interim results for the first half of 2023 revealed a 4.3% drop in revenue to £24.3m.

The packaging company’s gross margin had remained stable at 18% and operating profit, decreased to £0.5m from the previous £1.5m.

Robinson said the dip in profit was influenced by exceptional costs of £0.5m, which impacted the overall financial performance. This contrasts with the situation in the same period last year, where there was a profit of £2.0 million due to gains from property sales.

In terms of operations, there have been several noteworthy developments. The company has made progress in transitioning to a new Interim CEO, which is an important leadership change. Additionally, a restructuring program was put into effect in June. This restructuring has resulted in costs of around £0.4m, but it’s expected to yield annual savings of approximately £0.7m.

Looking ahead, Robinson expects better results in the second half of the year. This anticipation is grounded in recent business successes, seasonal factors, and the positive effects of the restructuring program. The company’s broader goal is to reduce its financial obligations through property sales and pension scheme actions. These actions aim to streamline the company’s structure, making it more competitive in an unpredictable market.

Despite the tepid results, Robinson kept its interim dividend unchanged at 2.5p per share.

Tracsis sees 19% jump in group revenue

Transport tech company, Tracsis (TRCS) released an in-line trading update for the fiscal year ending July 31, 2023.

Tracsis said its performance is consistent with expectations, with a projected approx. 19% rise in group revenue to over £81.5m compared to £68.7m in the previous year. Adjusted earnings (EBITDA) is anticipated to be around £16m, up from £14.2m in 2022.

Cash balances at the end of July amount to about £15.3m, down from £17.2m the prior year, mainly due to cash outflows of approx. £9.5m associated with contingent and deferred consideration.

The Rail Tech and Services Division has achieved substantial growth in the UK, driven by multi-year SaaS contracts for Train Operators and Network Rail. This growth extends to North America, thanks to increased technology investment from the US Government’s infrastructure spending bill.

The Data, Analytics, Consultancy, and Events Division has also exceeded revenue expectations due to new contract wins, strong consultancy demand, and post-Covid recovery in the Events and Traffic Data sectors.

Tracsis said it is focused on integrating activities, technologies, and its operating model for sustained scalable growth. Increased tech investments are planned to further fuel future expansion, particularly in the second half of the upcoming financial year as the company continues to expand its pipeline and fulfil its order book.

Tough times for Tremor as advertiser cuts outlook

Tremor International (TRMR) dropped sharply after the advertising platform provider reduced its profit and sales expectations for 2023.

The company now anticipates adjusted EBITDA for the year to range from $85m to $90m, down from the previous guidance of $140m to $145m. It also revised down its revenue (excluding traffic acquisition costs) outlook to $320m to $330m, compared to the earlier projection of $400m.

Tremor’s management cited challenging macroeconomic conditions as the cause for reduced budgets and advertising spending. They also mentioned that a longer and more complex sales cycle, combined with changes in the revenue mix, will contribute to weaker full-year results than previously anticipated.

The downward adjustment to the guidance accompanies disappointing second-quarter results. Although revenue was $84.2m, surpassing the previous year’s $75.8m, it fell short of the expected $97.9m. Similarly, adjusted earnings per share dropped to $0.06 from $0.16 in the same quarter last year and were lower than the estimated $0.22.

Whilst the performance of the shares has been very disappointing, the long-term outlook for the connected TV market is bullish and we expect Tremor to emerge from the contraction in US advertising spend a stronger and more streamlined business.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.