20th Jul 2023. 8.59am

Regency View:

Update

Regency View:

Update

Alliance Pharma reports strong growth in key product franchises

Alliance Pharma (APH) recently released its half year trading update for the period ending June 2023.

The international healthcare group reported half year revenues of £82.4m, showing a 1.1% increase compared to the previous year. Despite some challenges, the company’s performance remained in line with expectations, thanks to strong growth in certain product franchises.

One of the key drivers of growth was Kelo-Cote, a scar-treatment product. The demand for Kelo-Cote in the China cross-border market saw a recovery in line with expectations, with in-market revenues increasing by 23%.

In the domestic market, Kelo-Cote’s in-market revenues grew by 31%, demonstrating significant success. The company’s revenues from the total Kelo-Cote franchise grew by 6.2% at constant exchange rates, amounting to £25.6m in the period. Despite some challenges, the company expects revenue growth for Kelo-Cote to surpass 20% for the full year.

Nizoral, another product in Alliance Pharma’s portfolio, also showed robust performance during the period. Revenues for Nizoral increased by 40.4% at constant exchange rates, reaching £11.1m. This growth was attributed to gains in market share, distribution, and timing of orders. With strong opportunities in the Chinese market and promising marketing initiatives, Alliance Pharma reiterated its guidance of high single-digit revenue growth for Nizoral in FY 2023.

Free cash flow during the period was £10.8m, which was higher than the previous year. This contributed to a decrease in net debt to £94.5m. The company’s Board remains optimistic about the second half of the year, expecting strong gross margin improvement, substantial earnings expansion, and a decrease in net debt and leverage by the end of the year.

Argentex reports impressive half-year results amidst boardroom shakeup

Despite announcing impressive half-year results, Argentex’s (AGFX) share price took a hit this week following the announcement of a boardroom reshuffle.

The currency management and payment services provider experienced a significant 28% year-on-year increase in revenues, reaching £25m. Both Argentex’s core Currency Management offering and the new Alternative Transaction Banking product surpassed expectations, with the online platform playing a crucial role in the positive performance.

The decline in share price was triggered by the announcement of a boardroom shakeup, with Lord Digby Jones stepping down as Chair to make room for Nigel Railton, the former CEO of Camelot, who will assume the role starting September 1, 2023.

However, Lord Jones will remain on the board as a Non-Executive Director. As part of their restructuring plans, the company intends to appoint two new Non-Executive Directors, one of whom will take over as Chair of the Audit Committee, succeeding Nigel Railton.

Despite the sell-off, Argentex share price remains in a very healthy position. Prices are consolidating sideways within the context of a powerful long-term uptrend.

CAML on track to meet full-year guidance

Central Asia Metals (CAML) has provided an update on its operations for the first half of 2023.

The Kazakhstan copper miner produced 6,716 tonnes of the metal from its Kounrad mine. It also produced 9,764 tonnes of zinc concentrate, and 13,734 tonnes of lead concentrate from its Sasa mine.

CAML maintained its healthy balance sheet and the company has $50.6m cash in the bank as of June 30, 2023, with no debt.

Looking ahead, CAML is on track to meet its 2023 full-year guidance, with projected metal production targets as follows: 13,000 to 14,000 tonnes of copper, 19,000 to 21,000 tonnes of zinc in concentrate, and 27,000 to 29,000 tonnes of lead in concentrate.

During H1 2023, Sasa sold 167,919 ounces of payable silver to Osisko Gold Royalties as part of its streaming agreement.

CAML said its strong production, low costs, and healthy financial position will allow the company to consider various business development opportunities while paying dividends to shareholders.

Cohort rally on record breaking prelims

Cohort (CHRT) rallied on Wednesday following the release of a record-breaking set of preliminary results.

The defence tech company said full year revenue increased by 33% to £182.7m, and adjusted operating profit rose by 23% to £19.1m. Adjusted earnings per share also saw a significant increase of 17%, reaching 36.48p.

Cohort’s net funds rose to £15.6m, a 42% increase from the previous year. Order intake increased by 19% to £220.9m, and the closing order book reached a record £329.1m, a 13% increase.

In line with its positive financial performance, Cohort increased its dividend by 10%, continuing its tradition of increasing dividends every year since its IPO in 2006.

Looking forward, Cohort said its strong order intake and closing order book provide revenue cover for the upcoming financial year. As of now, approx. 80% of current market revenue expectations for 2023/24 are already secured, and the company is optimistic about further progress in the medium to longer term.

The market enjoyed Cohort’s results and the shares jumped more than 10% on Wednesday – setting the stage for a retest of recent highs.

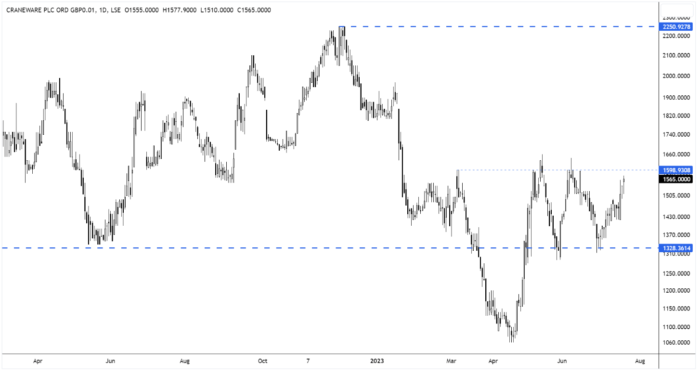

Craneware’s optimistic outlook: recurring revenue grows

Craneware (CRW) released an upbeat full year trading statement on Monday…

The US healthcare-focused fintech said full year revenue is expected to be approx. $174m, a 5% increase compared to the previous year. Adjusted earnings (EBITDA) also increased by approx. 5% to over $54m, maintaining an EBITDA margin of 31%.

During the second half of the year, Craneware said it saw growth in Annual Recurring Revenue (ARR), reaching around $169m.

In response to their strong financial position, Craneware has decided to extend its share buyback program for an additional three months. Looking ahead, Craneware said it is optimistic about its prospects for FY24 and beyond, with the recent sales performance and increasing customer confidence.

The CEO of Craneware, Keith Neilson said:

“It is particularly encouraging to see the improving prospects across the US healthcare landscape in recent months. We are seeing an increasing number of opportunities enter our sales pipeline, which has been reflected in a positive start to the current financial year.”

Craneware will announce its results for FY23 on 5 September 2023.

Midwich sees adjusted earnings jump by 25%

Midwich (MIDW) has recently released a positive pre-close trading statement for the first half of 2023.

The audio visual (AV) distributor achieved strong overall trading with record first half revenues and adjusted profit before tax.

Revenue exceeded £610m, showing a 7.5% increase compared to H1 2022 and organic revenue growth was 2.2%. While the live events market showed recovery, the corporate and education markets in the UK & Ireland experienced slower growth.

The company’s gross margin significantly improved to 16.3% in H1 2023, driven by higher-margin sales in the live events market. Adjusted earnings increased by over 25% to approx. £26m compared to H1 2022 on margin of around 4.3%. Adjusted profit before tax for the first half is expected to be over £21.5m, a 14.0% increase from the previous year.

Midwich said it experienced strong trading in the EMEA region, with revenue up by approx. 14% compared to H1 2022. The UK & Ireland region’s revenue was slightly below H1 2022, but efficient cost management resulted in increased operating profits.

In terms of outlook, Midwich said it was optimistic for the remainder of the year with healthy order books and expected continued momentum. Unless there is a significant deterioration in general economic conditions, Midwich expects trading performance for the full year to be in line with previous expectations, excluding the positive contribution from the recent acquisitions.

The market enjoyed the trading statement and the shares have started to rally from key support. Midwich will release its half-year results for the six months ended 30 June 2023 on 5th September.

Renold delivers record full year results

Renold (RNO) achieved a record full year trading performance and saw a significant increase in its order book, with notable growth in revenue and earnings.

The chain maker’s revenue rose by 26.6% to £247.1m (18.8% at constant exchange rates) compared to the previous year’s £195.2m. Adjusted operating profit increased by 58.2% to £24.2m, with a return on sales of 9.8%, up by 200 basis points. The reported operating profit also showed growth, reaching £22.9m, a 41.4% increase. Adjusted earnings per share (EPS) surged by 51.2% to 6.5p, while basic EPS came in at 5.7p.

Renold said it faced challenging market conditions, including inflation and global supply chain issues. Despite these difficulties, Renold’s order intake reached £257.5m, a 15% increase from the previous year. The closing order book stood at £99.5m, up by 18.3% compared to 31 March 2022.

Robert Purcell, Renold’s CEO, commented:

“Throughout the reported period, the business performance has been on an improving trend and our order books continue to be healthy though order patterns have been inconsistent in the early part of the new financial year.”

“We recognise that there are still considerable economic challenges in many parts of the world; supply chain issues, although reducing in number and severity, are still prevalent and inflation and prices remain high, for both energy and materials. However, we have entered the new financial year with good momentum and confidence in the excellent fundamentals of the Renold business, although macroeconomic trends add a note of caution.”

Totally issues profit warning amid challenging healthcare landscape

Totally’s (TLY) share price broke to new trend lows last week after the NHS insourcing company warned revenue and profits for the upcoming financial year would be lower than the previous twelve months.

The warning comes amidst “increasingly challenging operating conditions” in the healthcare industry, which could significantly impact sales and potentially lead to a marginal decline in earnings for the current year.

Reporting its preliminary results for the 12 months ending on March 31, 2023, Totally showed resilience in certain areas, with revenues experiencing a healthy 6.5% increase year-on-year, reaching almost £136m. Underlying profits also rose by 11% to £6.9m during the same period.

However, urgent care revenue experienced a notable decline of over 10% to £98.8 million, primarily due to the expiration of four contracts in northwest London. This decline, along with the uncertainties in the healthcare landscape, has contributed to Totally’s cautionary stance for the upcoming financial year.

Totally CEO, Wendy Lawrence said: “We expect the coming year to be challenging as the NHS continues to operate in crisis and faces ever-increasing demand across all services.”

TPX Impact targets strong growth ahead

TPX Impact (TPX) released its unaudited preliminary results for the year ended 31st March 2023, which were in line with the trading update from 30th January 2023.

Financially, TPX saw positive momentum with strong new order growth, winning £115m in the fiscal year, including £36m in Q4. Total revenue increased by 5% to reach £83.7m compared to £79.7m in 2022.

TPX’s like-for-like revenue trends improved in Q4 (-1.6%), and TPX said this trend continued into the current fiscal year (FY24) with a 5% growth in the first two months. However, FY23 like-for-like revenues declined by 7.2%.

Looking forward, the post-period trading and outlook seem promising, with the first two months of FY24 showing revenue growth of over 5%. They won over £90m in new orders in Q124, including significant contracts with His Majesty’s Land Registry and the Department for Education. TPX’s FY24 outlook remains unchanged, with expected like-for-like revenue growth of 15-20% and adjusted EBITDA margins of 5-6%. Their three-year plan aims for an adjusted EBITDA margin of 10-12% in FY26.

TPX CEO, Bjorn Conway said:

“I am pleased to report that the business met the revised forecast, with a robust order backlog exceeding £80m into FY24.”

“This achievement, driven by the exceptional performance of our business unit management teams, provides a solid foundation for improved business performance in FY24 and beyond.”

Yellow Cake confident in outlook for uranium market

Yellow Cake (YCA) recently released its Annual Results for the year ended 31 March 2023…

The uranium holding company said that despite a 12.5% decrease in the spot price of uranium, the outlook for uranium continued to improve.

Yellow Cake’s holding of uranium increased by 4% during the financial year to $952.5m, primarily due to a net increase in volume offsetting the price depreciation.

The financial results showed a loss after tax of $102.9m for the year, compared to a profit of $417.3m in the previous year. This loss was mainly attributed to the reduction in the spot price of uranium, resulting in a decrease in the fair value of the company’s uranium holdings.

The CEO of Yellow Cake, Andre Liebenberg, expressed confidence in the company’s strategy and the outlook for the uranium market. He highlighted the strengthening uranium market fundamentals, constrained supply, and increasing demand for nuclear power as factors supporting the uranium price. Liebenberg also emphasised the need for reliable, low-carbon power sources amid global energy challenges.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.