6th Jul 2023. 9.00am

Regency View:

Update

Regency View:

Update

Alpha Financial Markets Consulting achieves impressive annual growth

Alpha Financial Markets Consulting (AFM) achieved impressive double-digit organic growth in all regions according to its latest annual results.

The wealth management consultancy group said it experienced a substantial revenue increase of 44.8%, reaching £228.7m for the 12-month period ending on March 31, 2023, compared to £158.0m in 2022. Net fee income also grew significantly by 43.9% to £227.2m, with organic net fee income showing a growth rate of 39.6%.

The company’s gross profit amounted to £80.4m, with a margin of 35.4%. Adjusted EBITDA rose by 37.5% to £46.6m, and adjusted profit before tax increased by 38.6% to £44.0m. Additionally, adjusted earnings per share grew 36.4% to 29.27p.

Luc Baqué, Alpha’s newly appointed CEO said:

“I am very pleased by the financial performance of the business over the year; the group has exceeded expectations and achieved excellent organic growth across all regions, in particular North America.”

Looking ahead, Alpha said it remains optimistic of delivering results aligned with market expectations for the current year.

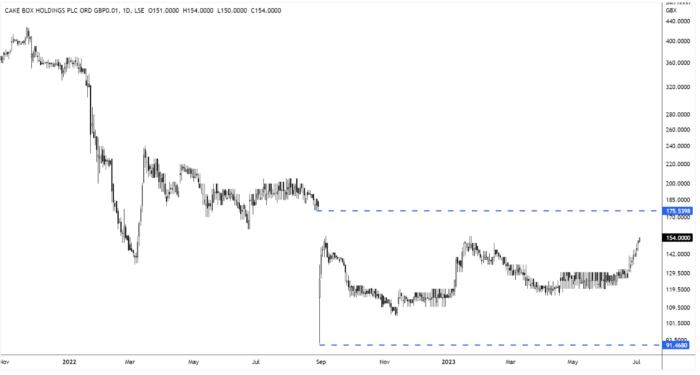

Cake Box rises to the occasion

Cake Box (CBOX) announced its audited full-year results for the twelve months ending March 31, 2023. The specialist retailer of fresh cream cakes made steady progress, invested in growth, and maintained robust current trading, expressing confidence in further progress.

Financially, the highlights included a 5.6% increase in group revenue to £34.8m compared to £33.0m in the previous year. Gross profit rose to £17.2m, representing an 8.5% increase. EBITDA stood at £6.7m, and pre-tax profit at £5.4m. Cash at the bank amounted to £7.4m, showing growth of 11.9%.

Operational achievements involved a 4.1% growth in online sales, opening 20 new franchise stores, reaching a total of 205 franchise stores in operation. The company expanded its supermarket kiosk offering to 18 locations and made significant investments in baking facilities to improve yield.

In terms of franchisee store performance, there was a 1.0% like-for-like sales growth, with franchisee total turnover reaching £72.1m, a 9.6% increase compared to the previous year.

Looking ahead, the company said it remains optimistic about prospects for the year. Current trading continues to be robust, with franchise sales up 5.4% like-for-like in the last 11 weeks. Cake Box acknowledged ongoing economic challenges but noted the softening of inflation in some areas, supporting margin progression.

CML Microsystems reports strong full year results, exceeding expectations

CML Microsystems (CML) reported a strong full-year performance surpassing initial expectations.

The Essex-based semi-conductor company achieved a 22% increase in revenues, reaching £20.64m compared to £16.96m in the previous year. Profit from operations amounted to £4.99m, while diluted earnings per share rose to 29.93p.

CML maintained a cash balance of £22.26m at the end of the period, even after share buybacks, R&D investments, and dividend payments totaling £10.81m. A final dividend of 6.0p per share was recommended, an increase from the previous year.

Operationally, CML Microsystems experienced broad-based revenue growth, driven by resilient end-markets. The company invested 25% of revenues in research and development (R&D) and released seven new products. The expanding product range was well-received by customers, contributing to the company’s growth.

Chris Gurry, Group Managing Director commented:

“The positive momentum built over previous years alongside our clear strategy, robust business model and investment in our product roadmap have allowed us to take advantage of the expanding market opportunity and position the Company for continued growth over the coming period.”

Duke Royalty expands investment portfolio

Alternative capital specialist Duke Royalty (DUKE) announced a strong set of final results which were broadly in-line with market expectations.

In FY23, Duke experienced significant growth in recurring cash revenue, with a 46% year-on-year increase to £21.8m, compared to £14.9m in FY22. Total cash revenue also saw a 19% year-on-year increase to £21.9m, up from £18.4m in FY22. The company achieved free cash flow of £13.1m, representing a 9% increase from £12.1m in FY22.

However, the free cash flow per share decreased from 3.53p in FY22 to 3.30p in FY23, primarily due to the lack of investment buyouts. On the positive side, recurring free cash flow per share increased by 30% from 2.52p per share to 3.27p per share. The dividend per share also grew by 24% to 2.80p, compared to 2.25p in FY22.

During FY23, Duke deployed over £26m of capital, adding two new royalty partners to its portfolio and completing four significant follow-on investments into existing royalty partners. The company also raised £20m of equity capital through an oversubscribed placing and refinanced its £100m credit facility to facilitate more investment opportunities.

In the post-period, Duke achieved £6.0 million of recurring cash revenue in Q1 FY24, marking an 18% year-on-year increase from £5.1m in Q1 FY23. Additionally, the company successfully exited royalty partner Instor, receiving net cash of US$11.2m and generating a total gain of US$2.4m over the initial investment amount, resulting in a triple-digit internal rate of return.

Equals reports record-breaking revenue growth in H1-2023

Equals (EQLS) delivered a positive trading update for the six months ended 30 June 2023.

The fintech, which focuses on SMEs, achieved record-breaking results, with revenues soaring by 43% to £45.0m, marking a significant increase compared to H1-2022 and representing 102% of FY-2021 revenue.

The breakdown of revenues across different sectors shows growth in Bureau, Other SME Solutions, and White Label segments. Notably, revenue per day for H1-2023 reached £363k, reflecting a strong 42% increase compared to the same period in 2022. Furthermore, gross profit margins have exceeded 50% – boosting Equals’ profitability.

Equals reaffirmed that trading remains in line with expectations for FY-2023 and anticipates adjusted EBITDA margins of approx. 20% for the entire year, even after factoring in the acquisition of Oonex.

Ian Strafford-Taylor, CEO of Equals, expressed satisfaction with the half-year revenues surpassing those of the entire year in 2021:

“It is very pleasing to be able to report half-year revenues for 2023 that exceed those posted for the whole year in 2021. To have come so far in such a short period of time is testament to the incredible efforts of everyone who works for the Equals Group. Our trading performance clearly shows the success of our focus on the B2B customer segment and the continued growth of our Solutions business. With expanding distribution channels opening up increased addressable markets, we look forward with confidence.”

Mulberry’s annual sales rise 4% as dressing up makes a comeback

Handbag seller Mulberry (MUL) is benefiting from the resurgence of consumers wanting to dress up after a period dominated by casualwear during the pandemic.

The fashion house reported a 4% increase in annual sales, driven by a return to parties and the office, which boosted sales of high-end accessories. CEO Thierry Andretta noted that people are going out for dinner and attending parties, signalling a return to previous fashion trends.

Luxury shoppers, including those at brands like Hermes, Mulberry, and LVMH, have been undeterred by cost-of-living concerns, leading to sales growth in the sector. Mulberry exceeded expectations of 2% sales growth, with its “micro bags,” including smaller versions of popular products, particularly appealing to Asian consumers and retailing for hundreds of pounds.

However, Mulberry’s profits for the year to April 1 experienced a significant decline of nearly 40%. The drop was attributed to investments made in Sweden and Australia, as well as £14.8m in costs associated with the closure of its Bond Street store in London.

Despite the profit slump, Mullberry defended the decision to close the store, emphasising that it doesn’t make sense to remain on Bond Street until a VAT-free shopping scheme is reinstated.

Robinson announces CEO departure and restructuring program amid sales challenges

In an AGM statement released last month, packaging group, Robinson (RBN) said CEO, Dr Helene Roberts has decided to step down, and the search for a new CEO will begin.

The effective date of her departure will be determined soon, and in the meantime, Sara Halton, the Senior Independent Director, will serve as the Interim CEO to ensure a smooth transition.

Alongside the boardroom shakeup, Robinson released a trading statement which said the company remains optimistic about its financial performance despite ongoing economic uncertainty and lower sales volumes.

Robinson said sales in the first five months of the year were 11% below the same period in 2022 due to a major UK customer facing supply chain issues and reduced demand.

The company has not been able to fully offset the impact of inflation and this has negatively impacted profitability.

To address the margin squeeze Robinson has initiated a restructuring program which aims to generate annual savings of approximately £0.7m, with £0.4m of these savings expected to benefit the company in 2023.

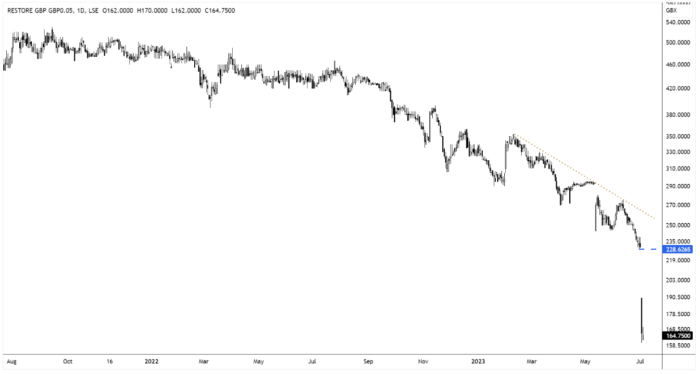

Restore faces profit woes and CEO departure

Document storage company Restore (RST) has faced a challenging week, with news that profits are expected to fall below previous expectations. Additionally, CEO Charles Bligh has announced his decision to step down from his role.

The announcement of lower-than-expected profits comes as a blow to Restore. The company had been striving to meet its financial targets, but a combination of factors has led to a downward revision. Weakness in the Technology business, a decline in demand for certain services, and a significant drop in the price of recycled shredded paper have all contributed to the lower profit forecast.

The departure of CEO Charles Bligh adds to the company’s challenges. Bligh’s decision to step down by “mutual consent” raises questions about the company’s leadership and direction moving forward. Senior independent director Jamie Hopkins will temporarily take on the role of CEO while an executive search process is initiated to find a permanent replacement.

These recent developments have caused Restore’s share price to plummet. The market’s response to the news reflects the concerns and uncertainties surrounding the company’s future.

We have placed Restore under review and it remains to be seen how it will address the underlying issues affecting its profitability. The company will need to devise strategies to overcome the challenges in its Technology business and find a capable and experienced CEO.

Surface Transforms reports sales and manufacturing progress in operations update

Ceramic break disc manufacturer, Surface Transforms (SCE) provided an operations update highlighting its progress in manufacturing and sales.

CEO Kevin Johnson delivered a presentation in which he said manufacturing output continues to improve, although it has not yet reached the desired levels.

Sales for the six-month period ending on June 30, 2023, are expected to be around £3.3m, indicating a 14% increase compared to the same period in 2022. Notably, the volume of manufactured discs during this period surged by over 80%, reflecting the advancements made in production throughout 2023.

While the production difficulties mentioned in the previous quarter’s trading update did not recur, the company experienced minor disruptions that hindered the ramp-up in output.

The installation of extra capacity is currently underway, and Surface Transforms anticipates having surplus capacity beyond current demand by the fourth quarter of 2023. Moreover, the company plans to further expand its capacity to meet future demand, particularly when OEM 10 commences production towards the end of 2024.

During the presentation, Johnson emphasised that he remains optimistic about the benefits resulting from increased capacity and the ongoing resolution of production disruptions. As a result, Surface Transforms reaffirmed its previous guidance for 2023 and 2024.

Solid State hits near 4-month high on upbeat outlook

Solid State (SOLI) announced its final results for the 12 months ending March 31, 2023. The specialist tech component manufacturer reported a strong financial performance with significant growth in revenue, operating profit, and profit before taxation compared to the previous year.

Full year revenue jumped 48% to reach £126.5m, and adjusted operating profit margin stood at 9.2%, representing a 50 basis points improvement. Adjusted profit before tax reached £10.8m, a 50% rise.

In post-period events, Solid State said it had secured a follow-on order worth $10.7m for radio frequency components from existing customer CyanConnode through its Components division. The company’s current trading has been strong, supported by the recent NATO contract, and it maintains a robust order book for the coming year.

CEO Gary Marsh expects to hit the ambitious targets he has set for 2030:

“By targeting structurally growing end markets and having a specialist technology-led workforce, the Board is optimistic for the continued success of the business. The Group remains ambitious to meet the new 2030 targets for the benefit of all stakeholders.”

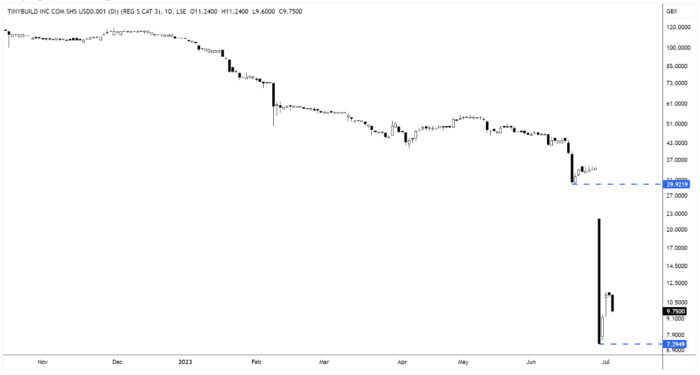

tinyBuild’s challenges continue as shares tumble

tinyBuild (TBLD) have continued to tumble as analyst downgrade revenue and earnings per share (EPS) forecasts.

Consensus analyst estimates now predict a 20% decline in revenue to $51m for 2023, accompanied by a 93% drop in EPS to $0.004. Prior to this revision, analysts had projected revenues of $70m and EPS of $0.081 for the same period.

The decline in tinyBuild’s share price can also be attributed to the underperformance of recent acquisitions of indie game developers.

This raises doubts about the company’s growth strategy and further undermines investor confidence. And the shrinking cash flow from digital platform deals, including partnerships with platforms like Xbox Game Pass, adds to concerns regarding the sustainability of revenue sources.

Meanwhile, tinyBuild’s board room shake up has continued with CFO, Tony Assenza stepping down for personal reasons and being replaced by experienced tech analyst, Giasone Salati.

As the dust settles, tinyBuild will need to demonstrate its resilience and adaptability in the face of adversity. tinyBuild’s share price is now trading close to cash – meaning if the game developer can support its cash position, the current low share price may present an opportunity for bargain hunters.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.