22nd Jun 2023. 8.56am

Regency View:

Update

Regency View:

Update

Globe Invest Makes Takeover Offer to BOTB

Best of the Best (BOTB) has received a takeover offer from Globe Invest Ltd, an investment holding company owned by Teddy Sagi. Globe Invest currently holds a 30% stake in BOTB and intends to acquire the remaining shares, valuing the company at around £45.3m.

Teddy Sagi, a prominent figure in the business world, founded Playtech, a renowned gambling software developer. His company, Unikmind Holdings Ltd, recently completed the acquisition of Kape Technologies, a digital privacy and security company which we had also held in our AIM Investor portfolio.

The offer presented by Globe Invest carries significant weight. They propose to pay 535p per share, representing a 34% premium compared to their initial stake acquisition in September. Additionally, it offers an 8.9% premium compared to the average closing price of BOTB over the past year. However, the offer is 3.6% lower than BOTB’s closing price on Monday, which stood at 555 pence.

In separate news, BOTB announced its annual results, reporting a rise in pretax profit but a decline in revenue. BOTB achieved a pretax profit of £5.4m for the year ended April 30, up from £5.1m the previous year. The increase in profit was attributed to cost savings and disciplined investment in customer acquisition and marketing. However, revenue from continuing operations dropped to £26.2 million from £34.7 million, which BOTB attributed to the advantageous trading conditions it experienced during the pandemic.

Despite the challenges faced, William Hindmarch, the CEO of BOTB, expressed satisfaction with the financial results, as they aligned with the expectations set during the interim financial results in January 2023. He also mentioned that trading in the new financial year has begun as anticipated.

Eckoh’s FY23: Impressive Growth and Security Solutions Success

Eckoh (ECK) released a market-beating set of results for the full year ended 31 March 2023.

The Customer Engagement Data Security Solutions provider achieved significant double-digit revenue and profit growth, exceeding expectations and demonstrating the success of their strategy.

Eckoh’s financial performance was impressive, with revenue increasing by 22% to £38.8m and adjusted operating profit growing by 48% to £7.7m. The company also reported increased revenue visibility and a promising new business pipeline, instilling confidence for the fiscal year 2024.

Nik Philpot, CEO of Eckoh, emphasised the growing demand for data security in the customer engagement space:

“Tightening data regulations and the shift to home working has created new security and performance challenges for enterprise contact centres, which significantly expands the opportunity for us”.

Looking ahead, Eckoh said it was is focused on making customer data more secure and capitalising on the expanding opportunities in enterprise contact centres. With their go-to-market strategy, global team alignment, scalable cloud platforms, and an expanded software portfolio, Eckoh said it is well-positioned to convert new business opportunities and leverage their sizable addressable market.

Inland Homes Audit Completion Timeline Extended

Inland Homes (INL) has once again delayed the publication of its annual accounts. This marks the third time the company has postponed the release, citing a longer-than-expected audit process.

The initial delays were caused by the discovery of “related party issues,” which led to the resignation of it Chairman and two board members. Inland has hired FRP Advisory Trading Limited to independently review these issues. Once the review is complete, the company expects its auditor, PwC, to finalize the audit of the accounts.

In April, Inland stated that it anticipated completing the process and publishing the accounts in June. However, in a recent statement, the company admitted that the audit process will take longer than initially estimated.

Inland has already warned of a significant pre-tax loss of over £90m. As a result of the delays in publishing its results, trading in the company’s shares has been suspended since April. The company aims to resume trading as soon as its accounts are published.

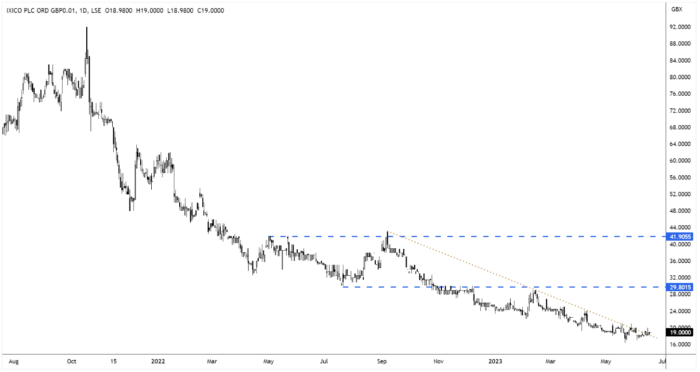

IXICO Wins £2m Contract for Huntington’s Disease Imaging Services

Medical imaging analytics company IXICO (IXI) has secured a contract worth approximately £2m.

The contract involves providing imaging services for the extension study of a client’s Huntington’s disease (HD) Phase 2b trial. This new study protocol will result in a work order spanning four years.

Huntington’s disease is a rare inherited condition that causes the progressive breakdown of nerve cells in the brain. It affects a person’s movement, mood, and cognitive abilities.

By securing this contract, IXICO is further establishing itself as a trusted provider of imaging services in the field of HD research.

Giulio Cerroni, the CEO of IXICO said:

“This contract strengthens our order book, securing further visibility to future anticipated revenues. We have been working with this client for several years and I am delighted to be further deepening our long-term partnership as they pursue a treatment for this terrible neurological disease.”

LTG Reports Promising Growth and Expansion at AGM

Learning Technologies (LTG) released a brief statement to accompany their recent AGM.

Chairman, Andrew Brode emphasised that the recent integration of GP Strategies has “significantly expanded LTG’s business scale”. This expansion positions the company to capture a larger share of the growing digital learning and talent management market, which is estimated to be around $100bn.

Brode added that, despite a challenging macro environment, LTG has experienced “moderate business momentum” in the first half of 2023. He said this positive trend is supported by a strong sales pipeline and that “the company’s solid financial position enables it to pursue strategic acquisitions that align with its long-term goals”.

LTG will provide more detailed information on its trading performance in a Trading Update scheduled for 27 July 2023.

Marlowe’s Testing Division Sale Sparks Share Price Surge

Marlowe’s (MRL) share price has experienced a significant rally in the past week following the announcement of its intention to sell its testing, inspection, and certification (TIC) division.

The TIC segment represents Marlowe’s largest revenue stream, and if the unit is sold, it could potentially fetch a valuation of up to 16 times its annual profit, equivalent to around £650m.

A potential sale of the TIC business would allow Marlowe to shift its focus towards higher-margin operations, particularly in the field of compliance software.

M&A activity is gaining momentum within the Professional & Commercial Services sector in Europe. There are reports of multiple buyout firms showing interest in Applus, a Spanish-headquartered company operating in a similar industry.

Isquared Capital, an infrastructure investor that holds joint ownership of Aggreko, is said to be preparing a bid for Applus in the coming week. Such an offer is expected to value Applus at approximately €2.2bn, which may generate speculation surrounding Marlowe’s future moves in response.

RWS Holdings Reports Half-Year Results: Driving Growth with AI-Powered Solutions

RWS Holdings (RWS) has reported an in-line set of half-year results for the period ending on March 31, 2023.

The company, which offers language, content, and intellectual property services, achieved a 2.5% increase in revenue, totalling £366.3m. However, adjusted profit before tax experienced a decline of 10% to £54.4m.

RWS maintained a gross margin of 45.7% which it said was achieved through a combination of price recovery, efficiency benefits in language production, and strategic prioritisation of securing longer-term revenue.

During the first half of the year, RWS successfully launched its AI Data Services proposition, TrainAI, and said it achieved promising wins in the early part of the second half.

RWS said it anticipates an acceleration of organic growth in the second half, driven by the Unitary Patent’s impact, the commencement of postponed projects, and incremental revenues from key growth initiatives and product launches.

RWS also said it plans to launch a share repurchase program of up to £50m, and it is “actively exploring attractive opportunities” to deploy its cash and is already in advanced stages with several bolt-on prospects.

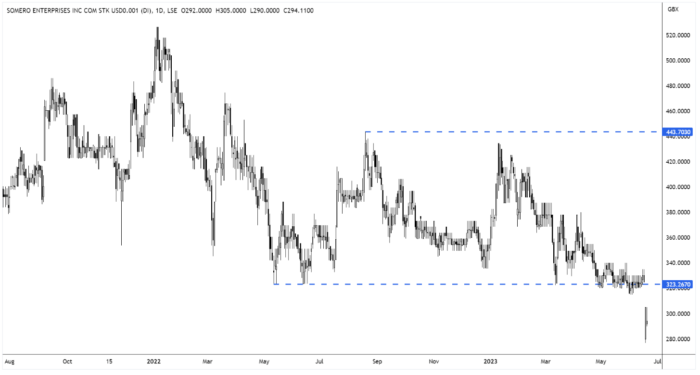

Somero Revises Full-Year Guidance Due to US Construction Challenges

Concrete screeding specialist, Somero (SOM) has lowered its full-year guidance, citing new factors affecting construction projects in the US.

While the non-residential construction markets in the US, Europe, and Australia are showing positive activity, certain challenges have emerged in the US market. Factors such as rising interest rates, tightened bank lending standards, and construction permit delays have led to delayed starts for non-residential projects, impacting equipment purchase decisions.

Additionally, limited availability of a relaunched product has further delayed sales. As a result, Somero expects a decline in first-half revenue and projects total revenue for 2023 to be approximately 10% lower than the previous year.

However, Somero remains optimistic about revenue contributions from Europe and Australia. It said that measures, including workforce reduction and cost controls, have been implemented to offset the impact on profitability.

The market’s reaction has been very negative with the shares dropping sharply lower this week. We have placed the stock under internal review and we will need to decide whether Somero’s strong balance sheet and market-beating dividend is enough to offset slower earnings growth.

Warpaint Expects Stellar Performance in 2023

Warpaint London (W7L) released a short and sweet trading update last week in which it said that positive momentum has continued into Q2 2023.

The mid-market cosmetics maker delivered a 45% increase in sales for the five-month period ending on May 31, 2023 amounting to £29.7m.

This is a considerable improvement from the £20.5m achieved in the corresponding period of 2022. Furthermore, Warpaint said it has managed to maintain robust margins, surpassing those achieved last year.

Warpaint’s debt-free balance sheet has become even stronger, with net cash as of end May at £7.5m, up from £2.7m in May 2022 and £5.8m at the end of December 2022.

Given the continued strong start to the year, the company’s Board now expects the full-year performance for 2023 to be substantially better than previously anticipated.

The shares gapped higher on the trading update – propelling the shares to fresh all-time highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.