25th May 2023. 9.00am

Regency View:

Update

Regency View:

Update

Atalaya deliver in-line quarterly update

Atalaya mining (ATYM) said it was on track to meet full year 2023 outlook due to “steady operational performance and improved electricity prices”.

The owner of the Riotinto open pit mine near Sevilla produced 12.1 kt of copper during the first quarter of its financial year at all-in sustaining cost (AISC) of $3.12/lb Cu.

Adjusted earnings for the quarter were €24.4m and Atalaya’s balance sheet remains strong with net cash of €55.3m.

Atalaya CEO, Alberto Lavandeira commented:

“We are pleased to have begun 2023 with a positive first quarter. Our operational performance was consistent with expectations and significantly reduced electricity prices have helped to deliver lower AISC and solid EBITDA for the period”.

On the price chart, the shares are locked in a choppy sideways range as concerns over global growth weigh on the mining sector.

Boohoo annual results beat market expectations

Shares in Boohoo (BOO) bounced last week after annual revenue and earnings came in ahead of analysts’ expectations…

The online fashion retailer posted full year 2023 revenue of £1.77bn versus market expectations of £1.76bn.

And annual adjusted earnings (EBITDA) came in at £63.3m, comfortably beating analysts’ forecast of £55.7m.

Sales are expected to fall by 10% – 15% in the first half of Boohoo’s current financial year, before returning to growth in the second half.

And Boohoo’s EBITDA for FY24 is expected to rise between £69m-£78m, in line with market expectations.

John Lyttle, Group CEO, commented:

“Our confidence in the medium-term prospects for the group remain unchanged, and as we execute on our key priorities we see a clear path to improved profitability and getting back to double digit revenue growth”.

BOO Daily Candle Chart

Character Group playing game of two halves

Character Group (CCT) said “trading performance would be very much one of two halves” as profits dropped in the first six months of its financial year.

The toy maker reported falls in profit and revenue in the first half of its financial year, saying trading conditions remained “challenging across all the group’s markets”.

Half year revenue fell 36% to £57.9m from £90.9m in the same period last year. And pretax profit dropped to just £0.2m in the half year ended February 28, from £6.5m year-on-year.

Despite the weak headline numbers, Character declared an interim dividend of 8.0 pence per share, up from 7.0 pence per share year-on-year, saying the rise was not supported by earnings cover but reflected its confidence that revenue and profit would recover in the second half year.

Character said the scheduled release of the new Turtles movie in August 2023 bodes well for the launch this summer of the Teenage Mutant Ninja Turtles line of products that they are distributing in the UK and Ireland.

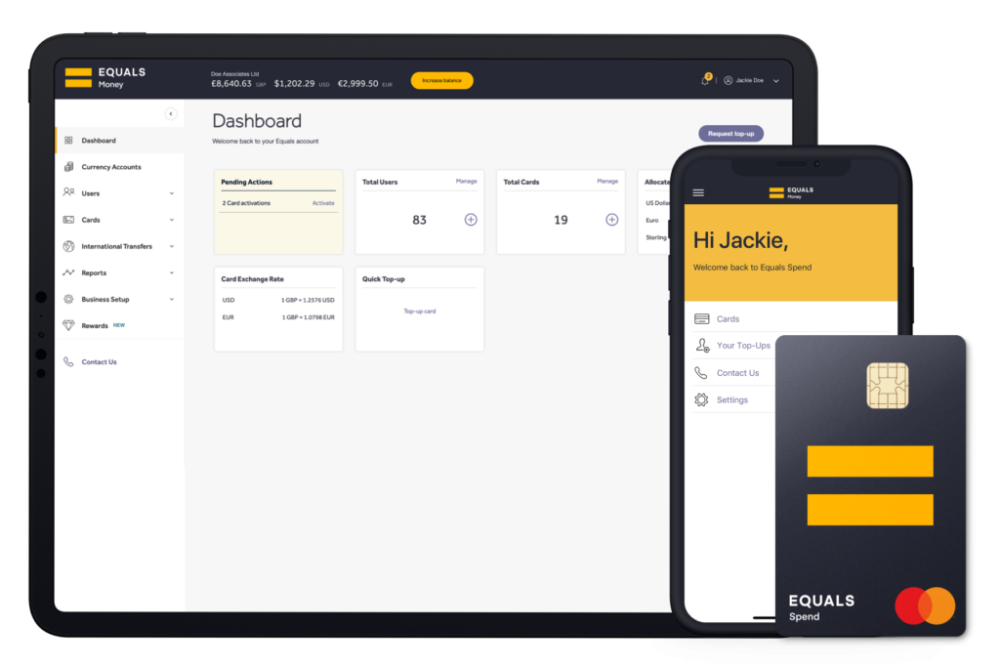

Equals report “significant” revenue growth

Equals (EQLS) released an upbeat AGM statement last week in which it said it has continued to see “significant revenue growth”.

The fintech said total revenue in the 90 working days to 15 May 2023 was £32.7m, an increase of 47% on the same period in 2022.

Equals also said that investment in its platform and solutions product has been “extremely successful” with Solutions revenue doubling to £8.8m over the period. And the board remains confident in achieving expectations for the full year ending 31 December 2023.

The market enjoyed the update and Equals’ share price broke to new trend highs – closing above £1 resistance for the first time in two years.

This technical breakout is a very bullish sign, and we expect the shares to continue to trend higher in the coming months.

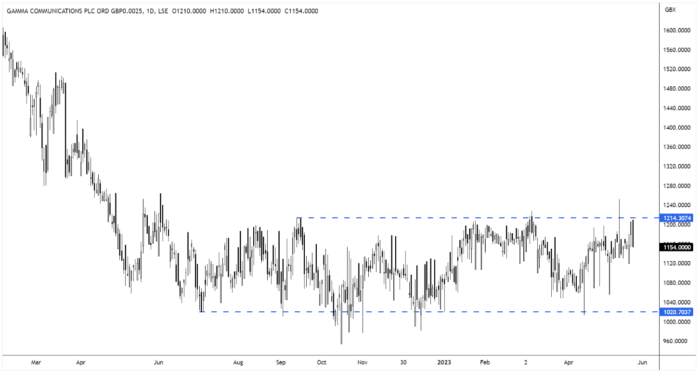

Gamma reiterates full year guidance on strong start to the year

In an AGM statement, released last week, Gamma Communications (GAMA) reported “positive momentum” across all three of its operating segments.

The voice-over internet VOIP specialist said its UK businesses has experienced a positive start to the year. With price rises in line with expectations and spending controls in place to manage inflationary pressures.

Gamma’s European business has continued to recover with a strong second half of 2022 continuing into 2023.

Cash generation remains strong and Gamma has maintained its rock-solid balance sheet, which has £101.3m net cash.

Gamma reiterated its guidance for the rest of the year and proposed a 14% hike in its full year dividend of 15p per share (5p interim, 10p final).

Despite the strong numbers, Gamma’s share price remains locked in a long-term trading range. Should prices finally manage to break out, we believe Gamma will be a candidate for a second tranche buy.

Science Group have scope for further acquisitions

Science Group (SAG) said its strong financial position will allow it to increase scale.

The ‘Science-as-a-Service’ consultancy had gross cash at 30 April 2023 of £33.4m, with net funds of £19.6m. And Science group said its strong balance sheet was further “enhanced” by an undrawn facility of £25m arranged in December 2021.

This financial strength “enables the Board to continue to evaluate corporate opportunities to increase the scale and/or development of the Group” said Science Group in a bullish AGM statement last week.

Science Group’s integration of TP Group is “proceeding satisfactorily” and the business as a whole is trading in line with the management expectations.

The shares are currently in ‘consolidation mode’ and have been for the last year. We do not see this as concerning, given the dominant long-term trend is bullish and Science Group’s underlying financial health is solid.

Totally Secures Multiple Contract Extensions

Totally (TLY) has continued its recent run of contract wins…

The NHS insourcing business has secured extensions across multiple services in the North and Midlands totalling circa £12m.

Totally said the contract extensions vary in length between six and 12 month periods and cover a range of urgent care services including NHS 111, GP out-of-hours and Clinical Assessment Services in Staffordshire, Yorkshire and Northumberland.

Wendy Lawrence, Totally’s CEO said:

“Contract extensions make an important contribution to future revenue by securing the continuation of existing contracts beyond their original term. This demonstrates the strength of our relationships with commissioners and the quality of services we deliver.”

The shares have continued to recover following a poor start to the year, in which the market was spooked by key contract terminations in the South West.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.