Regency View:

Update

Ebiquity trading in line with expectations

Ebiquity (EBQ) recently released Final Results for 2022 which included an upbeat outlook statement.

As previously guided, the media investment analysis house delivered a strong set of Full Year numbers, which included a 9% increase in organic revenue and a 98% jump in operating profit to £9.3m.

Of more note was Ebiquity’s outlook statement for the current year, which said:

“As we look to 2023, we see continued growth opportunities. The global media market is highly complex, creating significant challenges for our clients, brand marketers” commented CEO, Nick Waters.

“Ebiquity’s expanding product and service offering, breadth of geographic presence, and depth of expertise makes us well placed to fulfil advertisers’ needs. Trading in the current year has started in line with expectations” he added.

The market responded positively to the statement and the shares continue to bounce from the bottom of a long-term consolidation range.

Gattaca gains on share buyback plan

Gattaca’s (GATC) share price has had a strong week as it pressed ahead with a £0.5m share buyback plan.

The specialist recruiter said it was confident that the business has sufficient surplus cash available to proceed with the buyback.

Gattaca also said that its board has agreed to distribute 50% of post-tax profits over the cycle and will be reviewing its dividend at year end.

Whilst general newsflow surrounding the stock has been negative, with recent numbers indicting that permanent hiring is starting to soften, the buyback and board statement has helped to restore some confidence.

Our position in Gattaca remains under close review. We may use this buyback bounce to exit and will, of course, alert AIM Investor members if this is the case.

Unikmind updates acceptance levels in bid for Kape Technologies

Unikmind updated the market on acceptances of its cash offer to acquire Kape Technologies (KAPE) on Tuesday, reporting that as of 6 April, it had received acceptances over 160,678 Kape shares, or 0.03% of its issued ordinary share capital.

As of the close of business on 6 April, Unikmind declared it held 232,288,281 Kape shares, representing about 54.21% of the existing issued share capital, while Pierre Lallia held 15,000 shares, and HSBC Bank held zero shares.

Unikmind said it expected the offer would become or be declared unconditional during the second quarter.

The offer remains subject to the acceptance condition, with Unikmind stating the offer would initially remain open for acceptance until 1300 BST on 5 May, unless the unconditional date was brought forward by an acceleration statement.

Keywords buy Digital Media Management

Keywords Studios (KWS) has acquired Digital Media Management (DMM), a leading US-based social media agency.

The gaming services provider said the deal “adds significant US expertise and scale to its digital and social media marketing”.

DMM recently completed construction on an 11,000 square-foot production studio that will allow it to create original social media content and experiential activations that support their clients’ marketing efforts.

It also comes with its proprietary software ‘Creator Lab’ that allows it to partner influencers with brands that have expressed an affinity for a particular game or entertainment property.

DMM delivered revenues of approx. $34m and adjusted earnings of approx. $8.5m.

The terms of the deal allow for initial consideration of $67.5m, comprising $57.4m in cash and $10.1m in shares on completion.

There is also a maximum deferred contingent consideration of $32.5m payable in a mix of cash and new ordinary shares, dependant on the future performance of the Company over the two years from completion.

The cash component of the initial consideration will be funded by drawing down on part of Keywords’ existing €150m revolving credit facility.

Robinson expect to increase profitability despite uncertainty

Robinson (RBN) expect 2023 operating profit to be ahead of 2022 and “in line with current expectations” despite “ongoing macroeconomic uncertainty”.

The packaging firm said that as a result of the further cost inflation experienced in 2022, it was “seeking substantial price increases from all customers for 2023”.

“We remain committed in the medium-term to delivering above-market profitable growth and our target of 6-8% adjusted operating margin” read Robinson’s statement which accompanied its full year 2022 results.

Robinson also said that it has recently been awarded a “significant” new contract in Denmark which will require substantial capital expenditure in 2023. The expenditure will be funded from existing facilities and Robinson said it will begin to benefit sales and profit from 2024.

On the price chart, Robinson have started to rally from a key area of support, and this indicates that last year’s bad news may now be baked in.

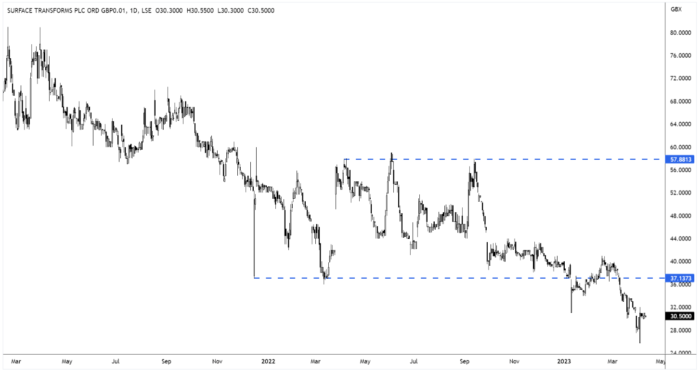

Surface Transforms says production issues have been resolved

Surface Transforms (SCE) released a trading update last week which stated that production issues have been resolved, but profitability this year will suffer.

The ceramic brake disc maker said:

“There are more than twenty complex production steps in the overall production process and all sub-processes are now achieving their individual Q1 2023 daily production targets”.

However, the statement also said that as a result of January and February production volumes being lower than planned, and scrap costs being higher than planned, Q1 2023 sales were just £1.4m, and the quarter was loss making.

The trading update went on to state that overall profitability during FY 2023 is predicted to be below market expectations.

From here, we’ll now be watching SCE closely to see if it can deliver on its promise to start ramping up production output once again.

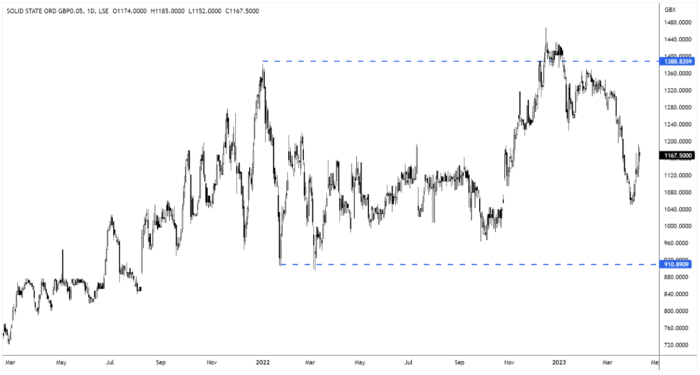

Solid State bounce on bullish trading update

Solid State (SOLI) has rallied more than 10% this month on the back of a bullish full year trading update which boasted record revenues, profits and a strong orderbook…

The specialist component supplier said strong trading had continued in the second half of its financial year, resulting in a performance that is “at least in line with consensus expectations”.

Solid State expects to announce record revenues for FY23 of approx. £125m, up 47% on the prior year.

Furthermore, organic revenue growth is expected to come in close to 20% and adjusted profit before tax is expected to jump more than 40% to £10.5m.

Solid State’s order book as of 31 March 2023 stood at £120.1m (31 March 2022: £85.5m) which they said reflected “extended order schedules as clients manage supply chain risks”.

The shares have had a poor start to the year and this upbeat trading statement has been welcomed – sparking a nice recovery rally. We would, of course, like to see price momentum continue to increase during the coming weeks.

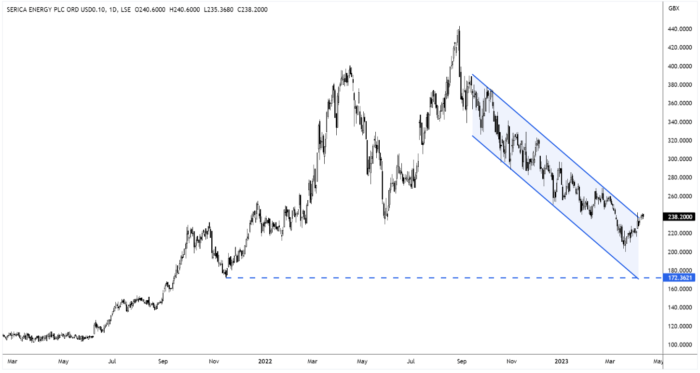

Serica Energy confirms production guidance

In a full year production update, released last week, Serica Energy (SQZ) said it expects net production this year to range between 40,000 and 47,000 of barrels of oil per day (boe/d).

The production levels are almost double the output for 2022, which averaged 26,182 boe/d, due to the acquisition of Tailwind.

Serica said early production in 2023 was slightly lower than average, due to maintenance work on a gas compressor, but it has now been returned to service.

Mitch Flegg, Chief Exec of Serica commented:

“These independent estimates are a testament to the activities undertaken by both Serica and Tailwind in recent years to enhance the recovery of hydrocarbons from their respective fields, to extend the productive lives of the Bruce and Triton production hubs and to meet the objectives of the North Sea Transition Deal”.

The strong production update follows last week’s surprise OPEC+ supply cut, which sparked a sharp rally in oil prices.

Tracsis reports solid growth in first half

Tracsis (TRCS) released a solid set of Interim Results on Monday…

The traffic and rail tech specialist reported a 34% increase in revenue to £39.2m, with organic revenue growth coming in at 13%.

Tracsis’ rail technology and services division accounted for 69% of revenue growth in the six months ended 31 January, including recurring software licence revenue and a strong performance in North America.

Meanwhile, its data, analytics, consultancy and events division saw an 11% increase in revenue growth.

Adjusted earnings jumped 21% to £7.5m, compared to £6.2m in the first half of the 2022 financial year.

Looking ahead, Tracsis said it has made a “positive start to Q3 trading with high activity levels across the Group” and has kept full year expectations unchanged.

Tracsis CEO, Chris Barnes said:

“We are confident that there are strong growth prospects for all parts of our Group and therefore we remain committed to implementing our overall strategic growth and investment plans. We will continue to pursue organic and acquisitive growth, including greater investment in self-funded R&D supported by a strong balance sheet.”

Xpediator agrees £62m takeover by former CEO

Xpediator (XPD) has reached an agreement on the terms of a cash offer from Bidco, a consortium spearheaded by former CEO Stephen Blyth, to acquire the logistics company.

A statement from Cogels Investments, which owns roughly 26% of Xpediator, said a deal has been agreed upon at 44p per share, valuing Xpediator at roughly £62m.

The offer price, which comprises 42p in cash and a 2p special dividend, represents a 45.5% premium to the closing share price on 19 December 2022, which was the last business day before the commencement of the offer period.

We will look to close our position once the takeover and dividend have been officially confirmed.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.