Regency View:

Update

Alliance Pharma target organic growth as Asian markets recover

Consumer Healthcare group, Alliance Pharma (APH) are targeting a return to “solid organic revenue growth” this year as demand in key Asian markets recover.

In the Preliminary Results, released last week, Alliance said strategic changes last year have given the group a “robust platform from which to grow” its Consumer Healthcare brands.

Last year, Alliance acquired ScarAway and the US rights to Kelo-Cote to create its first global brand. Alliance also launched a Kelo-Cote kids Gel and with Asian markets recovering, they expect total revenue growth for the entire Kelo-Cote franchise to be “above 20% in 2023”.

Alliance expect to see “high single digit revenue growth” from its Nizoral brand in 2023, as it accelerates a new distributor partnership in China and Vietnam.

The markets reaction to Alliance’s prelims has been positive with the shares rallying more than 17% since the numbers were published.

Bango hail “transformative” 2022

Bango (BGO) said it delivered double digit revenue growth together with accelerated progress in annual recurring revenue in 2022.

The e-commerce and mobile payment platform saw full-year 2022 revenue jump 38% to $28.5m and annual recurring revenue (ARR) increase five-fold to $5m driven by multi-year contract wins with T-Mobile, Televisa.

“I talked about Bango approaching an inflection point in its growth trajectory.” said Bango CEO, Paul Larbey.

“In 2022, we passed though that inflection point driven by rapid, organic growth, and then accelerated our strategy by 2 years with the transformational acquisition of DOCOMO Digital” he added.

Bango had previously stated it expected ARR to hit $7m in 2023, but this has been raised to $10m.

Bioventix rally on bullish interim statement

Shares in Bioventix (BVXP) jumped more than 10% on Monday following a 20% hike in their interim dividend.

The monoclonal antibody specialist said total profits before tax for the half-year were up 27% to £4.5m and cash balances at 31 December 2022 stood at £5.2m.

Sales of Bioventix’s heart-attack detection antibody, troponin “grew significantly” and Bioventix said “the continued roll-out of high sensitivity troponin tests provides further encouragement for our future sales in this area”.

Bioventix also revealed that “a considerable amount of our laboratory resource” has been focused on the Tau biomarker, which it said shows exciting potential in neurodegenerative diseases including Alzheimer’s.

“We look forward to reporting further progress in the second half of the year” read the upbeat statement, which has been well-received by the market.

Central Asian Metals maintain sizeable dividend

Central Asian Metals (CAML) kept its full year dividend unchanged after a “solid” financial performance in 2022.

The Kazak copper miner, delivered net revenue of $220.9m last year, down from $223.4m in 2021 and adjusted earnings of $131.6m versus $141.5m the year prior.

CAML has fully repaid its debt facility and has $60.6m net cash on its balance sheet.

“Following this strong performance, we propose a 10 pence per share final dividend, resulting in a full year dividend of 20 pence per share, comparable with 2021. The full year dividend represents 47% of our 2022 FCF and is in line with our stated policy of 30% to 50% of FCF” commented CAML CEO, Nigel Robinson.

CAML kept full-year 2023 production guidance unchanged at:

- Copper, 13,000 to 14,000 tonnes

- Zinc in concentrate, 19,000 to 21,000 tonnes

- Lead in concentrate, 27,000 to 29,000 tonnes

CML says full year results will be in-line with expectations

In a trading update, released on Monday, CML Microsystems (CML) said trading results for FY23 are expected to be “in line with current market expectations”.

The micro-chip maker expects to deliver revenues of circa £20.5m and profit before taxation close to £3.1m for the year ended 31st March 2023.

CML said progress has continued towards the completion of the recently announced acquisition of Microwave Technology and the sale of land assets would give a £2m boost to profits.

“The forward order book remains healthy and serves to underpin the outlook for further growth across the next financial year” read the brief trading statement.

On the price chart, CML have retraced lower in recent weeks, but the shares remain in a powerful long-term uptrend.

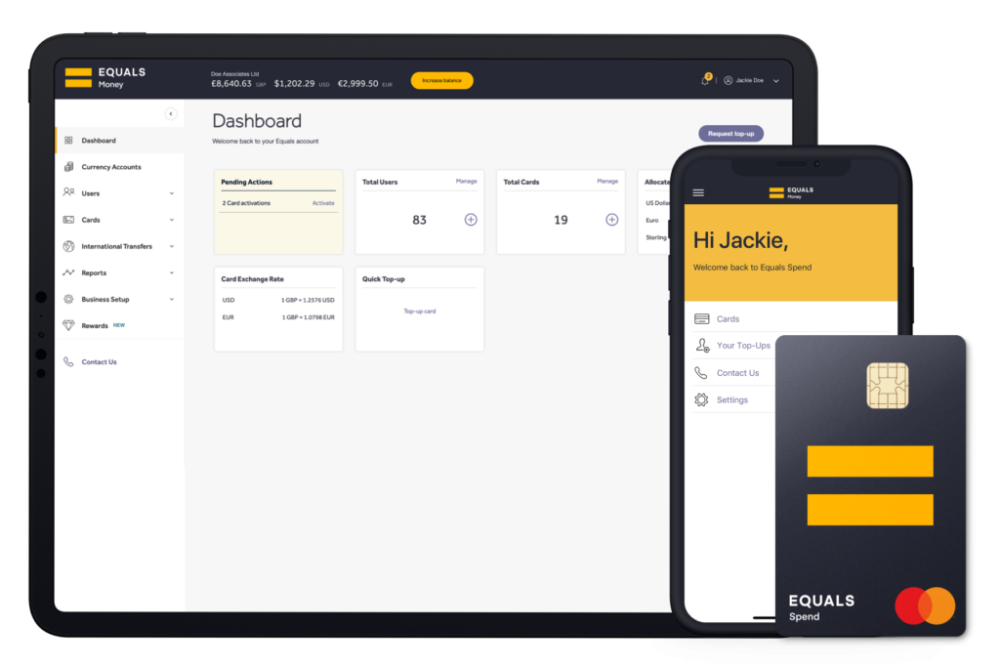

Equals’ “rapid growth” continues into 2023

Equals (EQLS) said the momentum of last year has continued into Q1.

SME payment provider delivered a blockbuster set of full-year 2022 numbers with revenue rising 59% to £69.7m, gross profit climbing 39% to £33.6m and adjusted earnings increasing by 79% to £12.1m.

Importantly, Equals “rapid growth” has continued into 2023 with CEO Ian Strafford-Taylor stating that Q1 2023 trading was “ahead of expectations”.

“We will further invest in the platform and our broader operations to enable us to continue to capture the very clear market opportunity and, as seen with our FY-2022 results, the benefits of scale can be seen in operational leverage and enhanced profitability” he added.

Confirmation of Equals’ strong start to the year has seen the shares bounce back from the Silicon Valley Bank sell-off earlier in the month.

The shares now look well positioned to retest the top of the recent trading range.

Inland miss deadline to file financials

Inland Homes (INL) said it will have to suspend trading on the London Stock Exchange because it will not be able to meet the March 31 deadline to file its financial results.

In a statement, the company said that new auditor PricewaterhouseCoopers LLP needs more time to complete its audit after discovering “certain related party issues of which the Board was not informed at the relevant times.”

The stock will be suspended from trading on Monday April 3rd, but the company intends to request a restoration of trading in its shares on publication of its FY22 audited results.

Inland said that new non-executive director Matthew Robinson and his team are “exploring options” for completing the audit.

It added it had identified a “practical solution” involving suitable internal management procedures along with an independent review led by Robinson.

Separately, the company said it is contemplating a fundraising of up to £5m, to be implemented at 10p per share.

Given the open losses in the stock at this stage, we do not see any benefit from closing our position. However, for clients who require the liquidity, it is understandable that they may wish to look for better opportunities elsewhere.

Warpaint London “enjoying a strong trading performance”

Warpaint London (W7L) said strong trading has continued in Q1 2023.

The mid-range cosmetics provider said sales in the first three months of the year are “expected to be a record first quarter for the Group”.

Sales to 23 March 2023 are already in excess of £16m, up from £13.2m in the same quarter last year with margins “in line with those achieved in 2022”.

Warpaint said given the strong start to the year, the outlook for FY23 is expected to be “ahead of the board’s previous expectations”.

“We are enjoying a strong trading performance across the Group, with sales growth in many territories and online. We also continue to enjoy healthy margins. We look forward to the remainder of 2023 with confidence and will update further at the time of the release of the Group’s results in April” commented Warpaint CEO, Sam Bazini.

The market is really waking up to Warpaint’s potential and the shares have got off to a strong start this year – carving out a solid uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.