Regency View:

Update

Kitwave continue to go from strength to strength

Kitwave (KITW) released an impressive set of Final Results this week which saw revenue growth accelerate and profitability increase.

The food wholesaler delivered revenues of £503.1m, up from £380.7m the year prior and gross profit margin increased to 20%.

Adjusted operating profit surged three-fold to £21.5m (FY21: £7.1m) and the business generated £26.5m net cash from operations.

“The strong performance during the first half of the year continued into the second half” commented CEO Paul Young.

“The Board recognises the significant market opportunity within the fragmented UK wholesale market and Kitwave’s strategy is focused on capitalising on this” he added.

Kitwave has been one of our star performers this year and the shares have carved out a poweful long-term uptrend which shows no sign of slowing down.

Bango partners with Dropbox to expand to new users

Bango’s (BGO) list of blue-chip partners grew further last week as it announced a tie-up with global tech giant Dropbox.

The data-driven commerce platform said it is partnering with Dropbox to expand its global user base.

Through this partnership, Dropbox will be able to expand its subscription offering through telecom operators that have adopted the Bango Platform to deliver third-party offers.

“Market leaders look to Bango to scale their partnerships with key operators which helps them to reach new, paying customers everywhere. Dropbox has incredibly high user engagement and retention, making it a natural choice for telecom operators as the need for cloud storage and collaboration services increases” said Anil Malhotra, CMO at Bango.

The shares have finally started to gain some traction this year and Bango’s long-term uptrend is back in full swing.

Beeks has ‘considerable runway of visible revenue’

Beeks Financial Cloud (BKS) delivered a strong set of Interim Results on Monday.

Beeks, which provides computing and connectivity services to financial markets, saw revenues jump 35% to £10.40m for the six months ended 31 December 2022.

Underlying adjusted earnings (EBITDA) increased by 48% to £3.59m and Annualised Committed Monthly Recurring Revenue (ACMRR) leapt 35% to £21.30m.

Cash flow from operations was up 46% to £3.68m causing the balance sheet to flip to a net cash position of £3.35m versus a net debt position of £3.73m in H1 2021.

Beeks CEO, Gordon McArthur commented:

“Our principal focus for the second half will be to convert our substantial pipeline of opportunities across the newly launched Exchange Cloud offering”.

“Our pipeline of business with both existing and potential new customers provides us with a considerable runway of visible revenue and our balance sheet strength has enabled us to continue to make substantial investment into product, people and stock capacity to capitalise on this pipeline and considerable market opportunity.”

It’s early days for our position in Beeks, but so far so good and these strong numbers provide a solid platform for the remainder of the year.

Sylvania Platinum doubles dividend as interim profit grows

In an upbeat set of half year numbers, Sylvania Platinum (SLP) reported higher interim profit as revenue growth outpaced a slight increase in cost of sales.

The South Africa-focused platinum miner said production of platinum, palladium, rhodium and gold jumped 19% to 38,471 ounces in the half-year to 31 December 2022.

Revenue grew 16% to $79.9m and cost of sales increased by just 3.7% to $30.3m – causing pre-tax profit to jump 30% to $45m.

On the back of the strong numbers, Sylvania declared an interim dividend of 3 pence per share, versus none a year before.

Looking ahead, Sylvania guided for financial year 2023 production of 70,000 to 72,000 ounces of platinum, palladium, rhodium and gold, at least 4.4% higher than 67,053 produced in financial 2022.

Sylvania’s CEO Jaco Prinsloo said:

“In the second half of this year focus remains on further improving the confidence in and expanding resources and quantifying the potential benefit from these assets. An updated scoping study is underway at Volspruit which will now include value from the south body and rhodium, which were initially excluded from the north body scoping study, as well as studies aimed at improving the resources estimate for the Aurora project and towards declaring a maiden mineral resource estimate for the Hacra project.”

Tracsis reports strong first half of trading

Tracsis (TRCS) reported strong trading in a first-half update on Thursday, in line with expectations.

The rail, traffic data and transport technology specialist’s revenue for the six months ended 31 January 2023 was expected to have increased to over £39m, up from £29.2m year-on-year, with strong underlying growth in both of its divisions.

Adjusted earnings (EBITDA) was expected to have increased by more than 20%, from £6.2m in the first half of the 2022 financial year.

Cash balances remained strong at £17m, down from £25.1m a year earlier and £17.2m at the end of the 2022 financial year.

Tracsis said its Rail Technology & Services Division “delivered further growth in rail technology software licence usage and annual recurring revenue” and its Data, Analytics, Consultancy and Events Division saw “high activity levels across all business areas”.

Tracsis also added that its Events and Traffic Data businesses have now “completed a full post Covid lockdown recovery”.

The shares remain locks in a choppy long-term consolidation phase, but the overall trend structure is bullish and our position is in a healthy profit.

Boohoo recalibrate exec share incentives after price drop

Boohoo (BOO) announced a new “growth share plan” last month as it plans to re-incentivise its exec team.

Under the new plan, CEO John Lyttle could receive a maximum of £50m in Boohoo shares out of a total £175m payout to executives, if the company’s share price reaches 395p, more than eight times higher than current levels – and remains there within a 90-day average window within the next five years.

Iain McDonald, the chair of Boohoo’s remuneration committee, said the incentives were needed to retain executives “particularly in an era where the recruitment of such quality is more competitive than ever before”.

While investors may feel that Boohoo’s executive team should be punished after a period of horrendous performance, the only way out is through recruiting the right people and incentivising them accordingly.

The markets reaction to the news has been broadly positive with prices moving back towards six-month highs.

CentralNic bucks advertising downturn to deliver impressive growth

CentralNic’s (CNIC) preliminary full-year results showed the business was in rude health despite a wider downturn in the advertising sector.

The domain name and advertising broker saw headline revenue jump 77% to $728.2m on organic growth of 60%.

Adjusted earnings (EBITDA) surged 86% to $86m and operating profit more than doubled to $33.6m from $12.4m the year prior.

“I am absolutely delighted with CentralNic’s performance in 2022, achieving record revenue and profit, despite the challenging macro-economic environment” commented new CEO Michael Riedl who took the reins after Ben Crawford retired at the end of last year.

“Whilst early into the new financial year, we anticipate 2023 will see yet another year of robust growth and shareholder returns. We remain committed to delivering outstanding value to our shareholders, and we are confident of another successful year” he added.

On the back of the strong numbers, CentralNic announced the intention to pay a maiden dividend of 1.0p for the year 2022.

Given the impressive headline numbers, the performance of CentralNic’s share price has been somewhat underwhelming. However, within the context of a downturn in US advertising, we believe the shares are showing decent levels of relative strength and we’re more than happy to continue to hold them.

Chairman resigns as Inland delays publication of FY results

The newsflow around Inland Homes (INL) continues to go from bad to worse.

On Tuesday, the housebuilder announced the appointment of PWC as its new auditors and that its results for the financial year ended 30 September 2022 will now be released later this month.

Inland said: “the Board expects to report full year results and IFRS net asset value in line with the trading update provided on 25 January 2023”.

This news was followed by the resignation of Chairman Simon Bennett and a number of non-exec directors.

Inland said: “The Company has become aware of certain related party issues (which may or may not fall to be treated as related party transactions under the AIM Rules) of which the Board was not informed at the relevant times. The Company is collating relevant details, following which a further announcement will be made.”

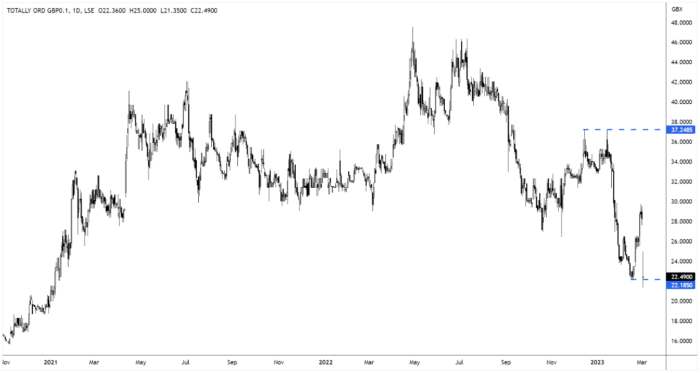

Totally tumble on earnings miss

Totally (TLY) gapped lower this morning on release of a trading update for the twelve months ending 31 March 2023.

The NHS insourcing group said it expects fiscal 2023 earnings to miss market expectations due to the “combined impact of high inflation, national strikes, which increase pressure on services and scheduling, and clinical workforce shortages which increase reliance on agency staff for the delivery of urgent care services”.

Totally expect full-year adjusted earnings to be around £6.3m which it said also reflects delays in the conclusion of tender processes and continuing legal discussions with one commissioner on certain contracts.

The shares gapped lower on the news and it remains to be seen if the shares can find some support at the February swing lows.

Totally said it is taking multiple actions to manage and control costs, and it expects some effect on forecasts for the first quarter of fiscal 2024. Cash at the end of fiscal 2023 is expected to be £5.5m and it intends to maintain its dividend in-line with previous expectations.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.