Regency View:

Update

Somero sees growth opportunity in Europe and Australia and from new products

Somero (SOM) released a solid full-year trading update earlier this month…

The cement screeding specialist delivered record full-year revenues driven by a “healthy North American market”, and “significant contributions” from Europe and Australia.

Somero expect to report 2022 revenue of approx. $134.0m, up from $133.3m in 2021.

This 2022 revenue expectation falls below previous guidance of $138.8m, which Somero said reflected “the impact, albeit limited, of supply chain shortages in our North America market on our customers’ pace of work”.

On outlook, Somero highlighted the growth opportunity it was seeing outside of the US:

“The Board is pleased with the strong finish to 2022 and looks forward to 2023 with confidence based on the strength of the US market, direct feedback from our customer base on activity, and the growth opportunity in Europe and Australia and from new products.”

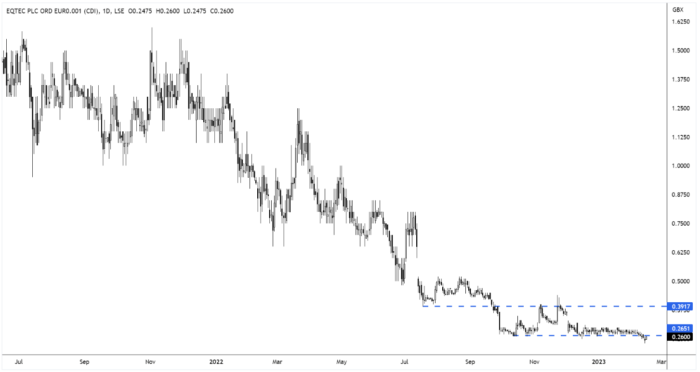

EQTEC expects 2022 revenues to meet guidance

In a recent trading update, EQTEC (EQT) said it expects full-year 2022 revenues to meet guidance.

The waste-to-energy company said its three Market Development Centres are progressing steadily and that it has a “strategic focus” on Deeside and a “delegated approach” to other projects.

EQTEC said the focus on Deeside was in response to changing market conditions – requiring the company to focus its portfolio of active projects on the strategically most important; reduce its project development liabilities; and engage project developers and owner-operators in actively leading development activities.

CEO, David Palumbo said EQTEC were taking on bigger and better projects:

“The market opportunity is vast, our technology is at the core of new energy infrastructure that can produce decarbonised power, heat and fuels and it is ready to be deployed, profitably, now. The challenges of 2022 have strengthened our resolve to deliver EQTEC solutions to the world, and we are engaging bigger, more capable, better financed businesses who are now driving the demand.”

“In many ways, 2022 was a catalyst for us in accelerating our strategy toward working with stronger partners for development of projects and plants that run on EQTEC solutions, and the progress we unlocked in the second half of 2022 suggest that will bear fruit for us in 2023″ he added.

Restore growth boosted by contract wins

Document storage group, Restore (RST) said full year 2022 performance was “in line with expectations”, as it has entered 2023 with “positive momentum”.

Restore’s records management division saw net box growth of 1.5%, up from 1.3% growth last year.

The growth was dues to contract wins which included a £22m 10-year contract with BBC Heritage and a £1m per year contract with the Department for Work and Pensions.

Restore also said its property estate has been reconfigured in order to optimise its space usage, which has resulted in non-recurring property costs in the second half of 2022.

CEO, Charles Bligh said Restore navigated difficult market conditions well:

“Restore delivered another year of revenue and profit growth and I am pleased how the whole team navigated the uncertainties of 2022 to finish in a strong position with major contract wins and excellent operational execution for customers, together with a robust financial position”.

“Whilst the macro-economic outlook is uncertain, our markets remain attractive as our essential services are needed more than ever to help customers reduce their costs while delivering improvements in security and data management” he added.

Kape gets buyout offer from largest shareholder Sagi

Kape Technologies (KAPE) have received a £1.25bn takeover offer from majority owner and Israeli billionaire Teddy Sagi.

Sagi, who plans to de-list the business has offered shareholders 285p per share, valuing the business at £1.25bn – causing Kape to rally 12% on Monday to 290p.

“Having weighed the pros and cons of a public listing under the current macro uncertainties and thin stock market trading as well as new growth avenues, we are firm in our view that Kape’s next chapter in its corporate journey should be within the private arena,” Sagi said in a statement.

Sagi’s offer looks unlikely to gain approval though, as it only values the business at 9.3 times last year’s cash profit to enterprise valuation.

The offer is also 15% below the 337.5p placing and retail offer price when Kape raised $354m to fund the acquisition of ExpressVPN in 2021. And it is only just above last autumn’s 265p placing and retail offer price when the group raised $222.5m.

We will sit and wait for now, with a view to reviewing our stance when the shareholder statement is released.

Ebiquity deliver “significant improvement” in profit

Ebiquity (EBQ) said full year trading was “in line with market expectations”.

The media investment analysis group released a trading update for the financial year ended 31 December 2022 ahead of its full year results announcement planned for late March 2022.

Ebiquity said group revenue jumped 20% with organic growth of 9%. Profitability has “improved significantly” from the prior year with the underlying operating margin expected to be 12%, four percentage points higher than in 2021.

Nick Waters, CEO, commented:

“The Group has performed well in the year as we continue to build momentum in the business and deliver progress against our strategic plan. Pleasingly, we have not only seen strong revenue growth but also a significant improvement in profit from the previous year and an underlying profit margin which is expected to be 12%”.

“These results reflect the benefit of our two transformative acquisitions in the USA and Europe, our unrelenting focus on improving operating efficiencies and our ability to identify, develop and grow higher margin digital solutions” he added.

The shares have had a solid start to the year and this strong trading update is likely to sustain the positive price momentum.

Renold gains on upbeat profit view

Renold (RNO) upped its full year profit outlook last week, causing the shares to rally.

The industrial chain maker said turnover for the 10 months to 31 January 2023 totalled £199m, 25.4% higher than the prior year comparator.

And order intake over the period was £216.5m, representing a year-on-year increase of 19.2% – Renold’s current order book stands at £104.1m which is a new record.

Renold’s forward looking statement said full year profit could be ahead of market expectations:

“Given the continued sales growth, a strong orderbook, benefits of the cost reduction and efficiency programmes, and the successful recovery of cost inflation on raw material and energy, the Board is confident the current trading momentum will deliver revenues and underlying operating profit for the full year in excess of market expectations”.

The shares gapped higher on the back of the trading update, creating a burst of bullish momentum which could see prices retest their 2021 highs.

Pan African expect “much improved performance” in second half

Pan African Resources (PAF) said that work to resolve problems its the Barberton mine is “well underway” and that the market can expect a “much improved production performance” in the second of the company’s financial year.

The South African gold miner released a tepid half-year trading update last week in which it saw pretax profit drop to $38.9m for the six months that ended December 31, down 37% from $61.6m in the prior year.

Revenue fell by 19% to $156.5m from $193.6m on the back of falling production levels.

Gold production decreased by 15% to 92,307 ounces from 108,085 ounces due to troubles at its Barberton mines’ underground operations.

However, Pan African’s statement said:

“We believe that the tangible measures being implemented at these operations, as detailed in this announcement, will result in a significant improvement in production during the second half of the financial year and in the years ahead”.

The shares have performed poorly relative to a strengthening gold price and our position in Pan African is currently under review.

Serica expects annual production to nearly double

North Sea oil & gas producer, Serica Energy (SQZ) released an operations update last week in which it said it said 2023 production would nearly double that of 2022.

Serica’s net production in 2022 averaged 26,182 barrels of oil equivalent per day (boepd), compared to 23,727 boepd in 2021.

However, net production from its recently acquired Tailwind portfolio of assets has averaged 19,600 boepd last month, which gives a combined net production rate of over 43,300 boepd in January.

Therefore Serica expects 2023 average net production to be in the range of 40,000 boepd to 47,000 boepd from the combined Serica and Tailwind portfolios.

“The production performance of both the Serica and Tailwind portfolios has remained strong despite some extremely challenging weather conditions during January” commented Serica’s long-term CEO, Mitch Flegg.

“There is an exciting investment programme of value-adding activities throughout 2023 which has started with the work to tie-in the Gannet GE-04 well. I look forward to updating the market with results of this programme as data becomes available” he added.

Gattaca shares fall as permanent hiring softens

Gattaca (GATC) released a trading update yesterday which warned that permanent hiring had shown signs of weakness since the turn of the year.

The specialist tech recruiter said it expects net fee income for the six months to 31 January 2023 to be £22.7m, up from £21.6m a year ago with double-digit growth in core sectors.

Gattaca expect to report statutory net cash of £21m for end Jan compared to £12m at then end of July 2022.

However, CEO Matthew Wragg warned that permanent hiring was softening:

“As we enter the second half, we are conscious of softening in some external sectors, and perm is likely to be impacted by a level of restraint around hiring, shifting candidate sentiment and, as such, slightly longer hiring cycles.”

“Despite this we continue to see demand for STEM skills in our core sectors and the shortage of candidates plays to our key strength of deep knowledge and understanding of our sectors and niche skills.”

The shares had rallied last week after being tipped in the investment media, but the market’s response to yesterday’s trading update has erased these gains.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.