Regency View:

Update

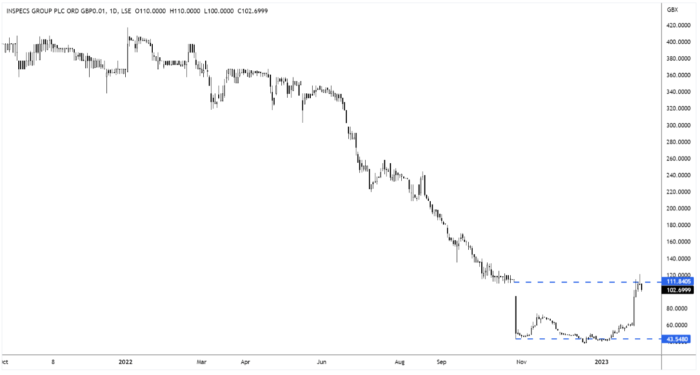

Inspecs bounce on full-year trading update

Inspecs (SPEC) share price rallied sharply last week following the release of a confident full year trading statement.

The eyewear manufacturer and retailer said full year trading was in line with previously lowered expectations.

Inspecs have been hit hard by COVID-19 restrictions in Asia and falling consumer spend in Europe, but this positive update indicated that the worst may be behind them.

On a constant exchange rate basis, group revenue increased by 9.5% $270 despite reduced order flow towards the end of the year.

Richard Peck, Chief Executive Officer commented:

“The Group experienced significant financial and trading headwinds in 2022 and the Board has implemented both cost reduction and operational efficiency programmes to ensure a better performance is delivered in 2023. Having taken over as CEO on 1 December 2022, I am confident that these programmes will ensure the Group is fit for the future and best placed to take advantage of the exciting growth opportunities that I see in the market.”

The shares have rallied back to close the large negative gap that formed on last year’s profit warning – we will be watching closely to see if this provides some resistance.

eEnergy half year revenue up 58%

eEnergy (EAAS) said it was pleased with the progress made during the six months to end December.

The energy-as-a-service provider saw half year revenue jump 58% to £15.1m and adjusted earnings (EBITDA) jump 87% to £1.5m.

Cash as at 31 December 2022 dipped slightly to £1.1m, excluding £0.4m of restricted cash balances.

eEnergy’s Forward Order Book stood at £26.4m over 4 years, up 45% from H1 2021 with £8.8m expected to be recognised as revenue in H2 FY23 and £6.8 million recognised in FY24.

“Given the strength of the pipeline and historic H2 weighting, whilst recognising the importance of the next two key trading months ahead, the Board is cautiously optimistic for the trading outlook for FY2023” read the statement.

Ceres Power expecting strong margins, confident after electrolyser test results

Fuel cell innovator, Ceres Power (CWR) posted better-than-expected full-year gross margins and announced encouraging test data for its first electrolyser modules.

Ceres said revenue and other operating income for the year ended 31st December 2022 was in line with previous guidance at approx. £21m – slightly ahead of market expectations.

Gross margins were also ahead of expectations at approx. 60%, and cash and short-term investments for the year was £182m.

Ceres first 100kW electrolyser module is on test and initial results were said to be “positive and give confidence that this technology can deliver green hydrogen at <40kWh/kg, around 25% more efficiently than incumbent lower temperature technologies”.

Ceres CEO, Phil Caldwell commented:

“These are just some highlights of another year of significant investment for growth at Ceres, despite a challenging macroeconomic backdrop. We remain focused on building a world-leading team and capability in solid oxide fuel cells and electrolysis, and partnering to deliver global deployment of our technologies at scale and pace.”

Character Group issues profit warning as revenues drop 42%

Character Group (CCT) issued its second profit warning in less than four months after sales dropped sharply.

The toy manufacturer said its revenue dropped 42% in the four months to 31 December 2022 as a result of challenging markets.

As a result, it added, sales and pre-tax profits (before highlighted items) are expected to be below market expectations.

However, Character remains optimistic that the company will rebound strongly in the second half due to its “strong product portfolio of both in-house developed and distributed products”.

The shares gapped lower earlier this month, but firmed last week as several Character products received a good reception at the London Toy Fair.

Our position in Character remains under review.

CentralNic’s full year trading ahead of upgraded market consensus

CentralNic (CNIC) released an impressive full year trading update this week with record revenue and earnings.

The domain name and marketing platform said it expects to report record gross revenue of $728m, a 77% increase on the year prior.

Net revenue is expected to climb 33% to $177m and adjusted earnings (EBITDA) is expected to surge 84% to $85m.

These numbers are ahead of recently upgraded guidance and CentralNic said the outperformance was largely driven by the growth of its Online Marketing segment – reflecting increased demand for its privacy-safe online customer acquisition services.

Cash increased to $95m from $56m the year prior, whilst Net Debt decreased to $57m from $81m. And CentralNic’s adjusted operating cash conversion continued to be in excess of 100%.

CEO, Michael Riedl, stated:

“CentralNic ended the year 2022 on a high note, with record revenue and profit in a challenging economic environment.”

“We will continue to exhibit discipline and efficiency as we accelerate product rollouts, launch strategic partnerships, and enhance scalability in the year ahead. As a result, we anticipate another year of robust growth and shareholder returns. I look forward to updating on our continued progress throughout 2023.”

Learning tech delivers strong performance ahead of expectations

Learning Technologies (LTG) released a bullish trading statement last week in which it said full year revenue and earnings would be ahead of market expectations.

The digital learning and talent management group said it expects to deliver group revenues of not less than £595m (2021: £258.2m). Revenue growth is expected to be c.5% on a pro forma basis and c.3% on an underlying organic basis. And adjusted earnings (EBITDA) is expected to be not less than £100m (2021: £54.8m).

Learning Tech said this strong performance was delivered as a result of achieving targeted margin improvements at GP Strategies driven by a commercial transformation programme, in addition to solid organic growth.

CEO Jonathan Satchell said:

“We are making good progress with our strategy to capture the structural growth opportunities in the digital learning and talent management market and remain laser-focused on delivering profitable growth across our businesses.”

“This momentum, supported by the majority of our revenues being long-term and contracted, supports our confidence of achieving our goal of delivering run-rate revenues of £850 million and run-rate adjusted EBIT of £175 million by the end of 2025. We look forward to helping organisations meet their need to develop, motivate and retain talent in the year ahead.”

Totally’s Greenbrook Healthcare terminates four urgent care contracts

Totally’s (TLY) share price has dropped last week following some confusing newsflow around four urgent care contracts held by its subsidiary Greenbrook Healthcare Limited.

On Tuesday 24th, news broke that the Health Service Journal had reported that North West London Integrated Care Systems had terminated its four contracts with Greenbrook due to performance concerns, prompting Totally’s shares to fall 8.4% to 30.5 pence.

Totally have since released a statement which said it had terminated the contracts early due to “legal reasons”.

The contracts were due to expire on January 31st and Greenbrook added that:

“The services were inspected by the Care Quality Commission in August 2022 and rated as good overall. Greenbrook has previously submitted a tender to deliver services at the four UTCs from Jan. 31 onwards and continues to await the result of that procurement process”.

The uncertainty around the Greenbrook urgent care contracts in North West London is unsettling, but our long-term outlook on Totally remains unchanged.

Totally has robust financials with a strong, debt-free balance sheet and an impressive levels of projected revenue growth. We remain happy to hold the stock.

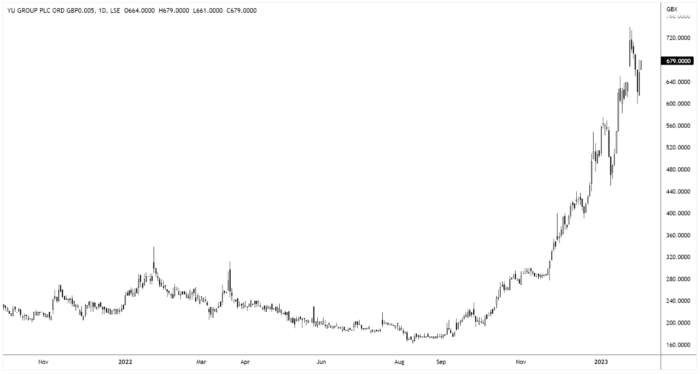

Record-breaking Yu in the ‘fast lane of growth’

Yu Group (YU.) delivered record breaking organic revenues, profitability and forward contracted revenues have all exceeded management expectations.

The energy and utility solutions company released a block buster full year trading update last week.

Yu said record breaking annualised contracts have delivered average monthly bookings of £24.5m (FY21: £13.8m), an increase of 78% in the year, with a particularly strong performance in Q4 2022 which had average monthly bookings of £48.6m.

Yu’s charismatic founder and CEO, Bobby Kalar said:

“I’m thrilled to report a fantastic, record-breaking performance for FY22.”

“We may have underestimated the accelerated contribution our strengthened business would have on the Group’s FY financial metrics.”

“We are now in the fast lane of growth and expect to exceed current guidance that had already been upgraded in March, July, September and November 2022”.

Inland warns of more losses

Inland Homes (INL) has issued another profit warning and is set to breach banking covenants.

The developer announced a trading update which cautioned that the group’s financial performance for the second half of its financial year was dependent on the completion of planned land sales and on the timing of planning approvals to support those planned land sales.

Expected loss before tax for the year ending 30th September 2022 is now £91m.

Four months ago, Inland said the it was expected a pre-tax loss of £37.1m for the year but since then the economic outlook for the UK housebuilding industry had deteriorated, it said.

The losses include provisions of £28.8m on five ongoing construction projects, increased from £15.4m following a further review, and a £39m provision on asset management schemes, including the planned £600m Cavalry Barracks development in Hounslow.

The board said that it had already secured a waiver from one of its lenders in respect of its revolving credit facility on the interest cover ratio covenant for the three quarters ending 30 June 2023.

Our position in Inland remains under review.

TPX Impact drop on bleak annual outlook

TPX Impact (TPX) dropped sharply lower this week following another poor trading update.

The digital transformation consultancy cut its full-year revenue guidance to around £80m, down from £90m before, with an underlying earnings margin in a range of 2-3%.

Based on its updated forecasts, the group is “unlikely to pass its debt covenants” at the 31 March year end, and so is “actively engaged” with bankers on “appropriate actions to address this event (including a waiver)”.

TPX CEO, Bjorn Conway commented:

“I am pleased by the strong momentum in our new business win rate which exceeded £41m in the last quarter and has continued into January with £9m won in the month. However, trading performance in Q3 23 was below our expectations: an encouraging performance in November was followed by a disappointing December, reflecting external factors largely outside the Group’s control.”

“Having conducted a thorough review of our latest reforecast with all our businesses, we have revised our full-year estimates to reflect current expectations of performance in Q4 23.

Our position in TPX remains under review.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.