Regency View:

Update

Relaxation on Zero-COVID policy in China to boost consumer healthcare demand

Alliance Pharma (APH) released an in line full-year trading statement this week..

The consumer healthcare group delivered revenues of £172m in 2022, up from £169.6m in 2021 and in line with its November trading update.

In a change in tone to previous updates Alliance CFO, Andrew Franklin, said the outlook for 2023 was more positive due to China lifting COVID restrictions:

“2023 has started well for Alliance and we were pleased to announce last week the appointment of Jeyan Heper as Chief Operating Officer, starting on 1 February. Whilst there was a sudden rise in COVID cases in China in December, following the relaxation of the Zero-COVID policy, the level of infection in major cities is reducing and normal life is beginning to resume.”

“Whilst end-market demand for consumer healthcare products in China has been constrained, available evidence indicates that the recovery has already commenced and the Board remains confident in our full year expectations.”

On the price chart, we have seen some positive signs in recent weeks…

Having gapped lower on the November profit warning, the shares have rallied from a long-term support zone. And this rally has been strong enough to snap the descending trendline which has been in place for several months (gold dotted line on chart below).

CML to buy US semiconductor company

CML Microsystems (CML) announced it has agreed to buy Silicon Valley semiconductor company Microwave Technology Inc.

The deal is worth up to $18m and will be funded from a combination of existing cash resources and the issue of new CML shares to the sellers in an approximate 60-40 ratio respectively.

CML expect the deal, which is subject to regulatory approval, to be completed in the first half of 2023.

Microwave Technology’s products are complementary to CML’s existing offering and the acquisition gives CML the opportunity to increase its current market share.

“Microwave Technology’s dedicated and very experienced team will accelerate our multi-year growth strategy,” said CML’s Managing Director Chris Gurry.

“Their technical knowhow, product range and trading relationships enhance the group’s existing competencies and a shared strong emphasis on cultural synergy and strategic future direction bodes well for the combined businesses over the medium term” he added.

Equals to beat market forecasts

SME payment group, Equals (EQLS) released a strong trading update this week…

Full-year 2022 revenue jumped 59% to £69.7m and gross profit climbed 39% to £33.6m. And adjusted earnings (EBITDA) increased 79% to ‘marginally above’ £12m – beating market expectations.

Equals said the increase in second half revenues shows the effects of Solutions revenues coming on stream and points to continued strong growth of the business.

Commenting on the strong numbers, CEO Ian Strafford-Taylor said:

“We have delivered a particularly strong financial performance in 2022 as the Group reaped significant benefits from operational gearing and economies of scale”.

“This has been made possible as a result of prudent and sustained investments into the proposition, specifically technology and connectivity, since 2018. That investment continued throughout 2022, supporting and enabling rapid growth, and will continue through 2023 as we target investment into an exciting roadmap of product development and growth initiatives that will expand our capabilities. We look forward to this year and beyond with confidence in our proposition, our teams, our technology and, ultimately, our sustained growth prospects.”

Gamma’s UK business performing strongly

Gamma Communication (GAMA) kept full-year expectations unchanged as it published a solid trading update last week.

The cloud communication services provider said its UK business has continued to perform strongly throughout 2022 – noting healthy demand for its broadening UCaaS (unified communications as a service) portfolio and products enabling Microsoft Teams.

Gamma’s cash pile stands at £92.2m as at December 31, compared to £49.5million a year ago. And Chief Executive Andrew Belshaw said the business is coping well with inflationary headwinds:

“The strength of our financial performance more than offset the UK inflationary pressures, and the minor industry-wide hardware supply delays in the Direct channel were actively managed and resolved within the year.”

“The positive, UK driven, momentum in the first half continued throughout the year, more than offsetting the cost headwinds created by the increased inflationary environment”, he added.

Looking ahead, Gamma expect adjusted earnings (EBITDA) to be in line with expectations, in the range of £102.7m to £107m.

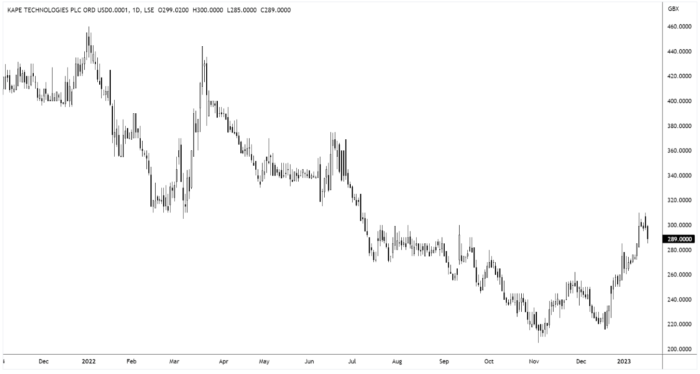

Kape to beat earnings expectations after strongest year ever

Our decision to buy back into Kape Technologies (KAPE) has started to pay off with the digital security group releasing a blockbuster trading update on Tuesday.

Kape said 2022 was its “strongest” year to date, with pro forma adjusted earnings (EBITDA) now expected to exceed guidance.

Revenues for the year to end December are expected to be at the upper end of guidance at $623m, while pro forma adjusted EBITDA more than doubled to $173m versus $78m the year prior.

Kape said the integration of ExpressVPN had exceeded expectations, creating “one unified team” across management, product, research and development, marketing and customer support.

The group realised $9m of synergies in the year, and expect this to climb to $30m in 2023.

Ido Erlichman, Chief Executive Officer of Kape, commented:

“2022 was Kape’s most successful year to-date. We not only delivered substantial profitable growth and executed on our largest integration exercise to date; we have also been able to further strengthen our balance sheet.”

Midwich gains on upbeat profit outlook

Audio-Visual retailer, Midwich (MIDW) rallied sharply this week as its full-year trading update beat expectations.

Midwich said it finished the year strongly and now expects to report record revenue for 2022 of £1.2 billion, representing growth of approx. 40% over the prior year, with organic growth of over 20%.

“As a result of this strong performance, the Board now anticipates reporting adjusted profit before tax for the 2022 period comfortably ahead of market consensus” read the bullish trading statement.

Stephen Fenby, the Group Managing Director, commented:

“Despite continued general economic uncertainty and rising interest rates, the strength of the business and expected growth of the AV market lead the Board to look forward to 2023 and beyond with confidence.”

The strong numbers saw the shares gap higher during Wednesday’s trading and we expect this burst of bullish momentum to continue.

Mpac look to move on from supply problems with ‘encouraging outlook’

In a full-year trading statement released on Monday, Mpac Group (MPAC) said an improved second half will see revenue and profit meet the market’s revised expectations.

Mpac had announced in July that unprecedented global supply chain disruption and increasing macro-economic uncertainty had impacted both operational efficiencies and the timing of customer order intake.

This week’s more positive statement should help the packaging automation group to move on from a year to forget.

“Order intake in H2 22 was significantly above H1 22, reflecting the resilience of the healthcare, and food and beverage end markets” read the statement.

“Our closing order book, along with an increasing prospect pipeline, leaves the Group well placed and with an encouraging outlook as we enter FY 23” it continued.

Whilst the market responded positively to the update, the shares continue to languish near recent lows.

Surface Transforms 4Q revenue hit by production issues

Surface Transforms (SCE) said production issues dented its Q4 2022 revenue, but that it isn’t changing its 2023 guidance.

The carbon ceramic brake manufacturer said it suffered “some highly specific, but cumulatively significant, production issues” in late November and December which led it to miss its already lowered revenue guidance.

It said revenue for the year to end December was £5.1m, up from £2.4m in the comparable period, but short of the guided £6.5m.

Surface Transforms said its guidance for 2023 and will be profitable, without specifying metrics or figures, and flagged that the group will be “capacity constrained, not demand constrained” in the first half of 2023.

CEO Kevin Johnson said:

“It is most frustrating to again be reporting a production problem impacting our previous guidance. The core issue is not the technical problems themselves, but the lack of capacity to provide headroom when they occur. Technical problems are part of the learning curve arising from a tenfold increase in production rates, the key is to ensure that we have spare capacity to recover the lost production after the problem has been solved. The installation of Phase 2 capacity by Q2 will enable the Company to get ahead of the continuingly strong customer demand and then, with completion of Phases 3.1 and 3.2 capacity increases in the following two years, to stay there.”

Warpaint London beats its own expectations as sales leap

Warpaint London (W7L) saw ongoing buoyant trading in Q4 and said its full-year 2022 results will be ahead of expectations, with the firm calling out its US performance as particularly strong.

The mid-market make up company said that sales for the full year have exceeded previous expectations and are expected to be around £64m.

Warpaint expect to report adjusted EBITDA of £11.8m versus £7.6m the year prior. And adjusted pre-tax profit of approx. £10m. Both of these new forecasts are ahead of market expectations and ahead of previous guidance.

CEO Sam Bazini said:

“I am delighted with the performance of the group in 2022. We enjoyed a strong trading performance in Q4 across the group, with sales growth in the US and online being particular highlights. We were also able to improve our margins year-on-year. We expect to see a continuing strong performance in 2023.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.