Regency View:

Update

Argentex rally on upbeat outlook

Argentex (AGFX) share price surged to an 18-month high on Monday’s bullish trading update.

The foreign exchange services provider said strong trading momentum has continued in the last quarter of this calendar year and sees revenue and earnings for nine months ending Dec. 31 ahead of current market expectations.

The growth has been driven by robust trading across all products and geographies, with the company’s core foreign exchange (FX) offering benefiting from market tailwinds.

The new Amsterdam office has also outperformed and there has been growth in client numbers on the online platform, it added.

Argentex CEO, Harry Adams said:

“The momentum behind Argentex is the result of our unrelenting focus on investment into our technology platform, international presence and our people, in order to capitalise on significant near and long-term market opportunities. I am pleased that our vision for the future of our business and the strategy we have outlined, centring around these three pillars, is already demonstrating its strength and potential for future growth.”

Cohort swing to first half profit on higher UK defence sales

Cohort (CHRT) rallied on Wednesday after the company said it swung to a first-half pretax profit and revenue rose on higher UK Defence Ministry sales.

The defence tech group posted a pretax profit of £1.1m for the six months ended Oct. 31, swinging from a pretax loss of £1.7m a year prior.

Revenue rose to £77.5m from £60.0m, while adjusted operating profit rose to £5.0m from £1.7m.

The company had a record closing order book of £304.2m, up from £291.0m at the end of fiscal 2022, with more than £80m of revenue deliverable in the second half.

Cohort also hiked its dividend with the board declaring an interim payout of 4.25 pence a share, up from 3.85 pence a year prior.

Chairman Nick Prest said:

“Demand for our solutions and services continues to be driven by the UK’s increased spending on defence and security and by international tensions in the Asia-Pacific region and Europe”.

Equals see FY results ahead of market expectations

Equals (EQLS) delivered an upbeat trading statement last week…

The payments group said full-year results will be ahead of current market views, helped by robust growth in all its segments in the 11 months ended Nov. 30.

Revenues for the Period were £63.5m, an increase of 61% over revenues of £39.5m achieved in the same period in 2021. Revenue per day increased to £0.27m per day from 230 working days compared to £0.17m per day in 2021.

Equals said revenue growth remained robust despite “unfavourable global macro-economic conditions”.

Ian Strafford-Taylor, CEO commented:

“We are extremely pleased to see a 61% increase in our revenues in the 11 months ended 30 November with all segments performing strongly. Our revenue growth has continued in the face of difficult macro environments and this augurs well for 2023 and beyond. We continue to invest in people, products and technology to drive our growth strategy and look forward to updating the market in early January with our full year trading statement.”

K3 Capital rises on strong HY revenue outlook

K3 Capital (K3C) released an in-line trading statement this week, helping the shares to continue their recent recovery.

The M&A group said it is expecting to report revenues in the region of £42m (H1 FY22: £31.2m) delivering profits which are “comfortably in line with the Board’s expectations”.

John Rigby, K3’s CEO, commented:

“The first six months of the year have been positive for K3C especially when taking into account the wide variety of challenges created by global events and the UK macro-economic environment. Our Q1 momentum has been maintained as we continue to deliver our growth strategy. The results are underpinned by diversified revenue streams and illustrate the benefits of our strategy of building a broader SME services group with greater visibility of future revenues”.

“I am particularly pleased with the performance of the Business Sales Division. Despite the market headwinds, it has continued to grow and deliver strong results which includes some sizeable completions in H1 within our Corporate Finance function”.

“The Board continues to look for complementary acquisitions within the professional services space. While cognisant of the negative outlook for the UK economy, we remain confident in the prospects of the Group for the remainder of FY23.”

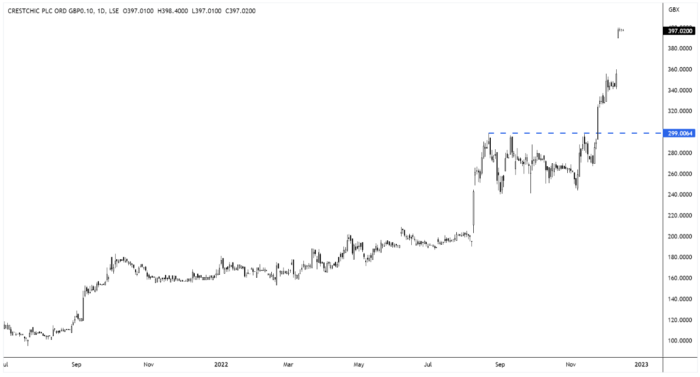

Crestchic agrees to Aggreko bid

Power equipment supplier Crestchic (LOAD) surged higher this week as it agreed to a £122m takeover bid from Aggreko.

This is Aggreko’s first major acquisition since returning to private hands.

Under offer terms, Crestchic stockholders will be entitled to get 401p in cash for each share, which is a premium of 13% on last Thursday closing price of 356p.

The deal comes just two months after we first highlighted the stock to our AIM Investor clients, putting our position nicely into a profit north of +40%.

We are reviewing our position in the stock and will announce an update in due course.

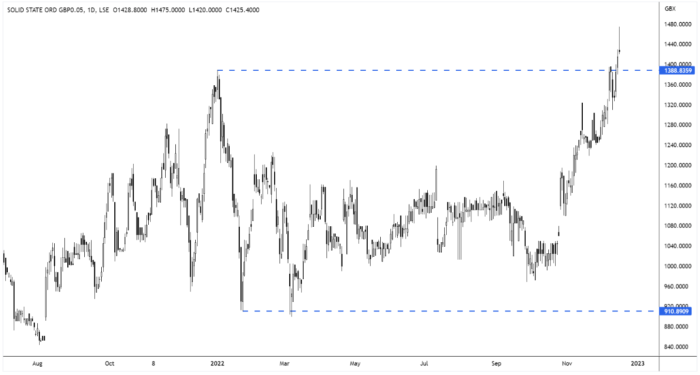

Solid State ‘building strong momentum’

Solid State (SOLI) reported a 50% jump in half year revenue to £59.4m and said it was building strong momentum despite a more challenging climate.

Adjusted profit surged 60% to £5.23m for the six months to end September and adjusted diluted earnings per share increased 38.5% to 43.5p per share.

Commenting on the results and prospects, Nigel Rogers, Chairman of Solid State, said:

“The Group has delivered excellent first half results and is building strong momentum despite a more challenging macro-economic climate.

“The successful acquisition of Custom Power has added resilience to the Group and accelerated the expansion of our Power business in the key North American market. We continue to see acquisitions as a key pillar of our growth strategy alongside internal investment to fuel organic growth.

“Group-wide we have worked closely with customers and suppliers to mitigate the impact of global component shortages and macro-economic challenges. This is evident in the order flow and the strong open order book, which gives the Board confidence in the outturn for the full year.”

Yellow Cake turns to loss as costs rise and takes hit to fair value

Uranium storage vehicle, Yellow Cake (YCA) reported a swing to a half-year loss as it noted constrains due to supply issues and cost inflation.

Yellow Cake’s fair value movement of investment in uranium turned to a loss of $142m from a gain of $175.9m.

Uranium holding fees and storage incentive fees more than doubled to $1.6 million from $777,000.

Yellow Cake CEO, Andre Liebenberg commented:

“We continue to deliver on our stated strategy. During the period we took delivery of a further three million pounds of uranium, bringing our total holdings to 18.8 million pounds. The case for buying and holding uranium, despite a much weaker economic outlook, is compelling. The underlying fundamentals for nuclear energy, particularly with recent events highlighting the need for greater energy security, continue to strengthen.”

We are seeing an acceleration of new nuclear build intentions, particularly from China and a broader based appreciation of the value of the existing nuclear fleet infrastructure, with life extensions in the US and Europe and further restarts in Japan. Meanwhile, supply is still heavily constrained driven by supply side pressures and cost inflation and will not keep up with rising demand. We remain very excited about the outlook for uranium and confident in our strategy and investment case.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.