1st Aug 2019. 9.01am

Regency View:

Update

Regency View:

Update

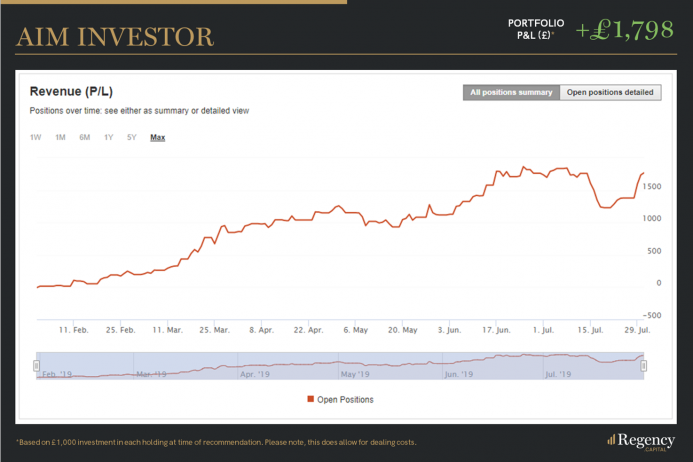

Our AIM Investor portfolio is showing good levels of resilience in the face of Boris Johnson’s hardening stance on Brexit.

Strong recent performances form Trans-Siberian Gold, Gamma Communications and Ramsden’s indicate that our conscious effort to insulate the portfolio from Brexit risk is paying off.

Travel stock Dart Group is our largest headache, but the shares are now trading back at a key zone of support (741p-726p) and this is likely to attract fresh buyers.

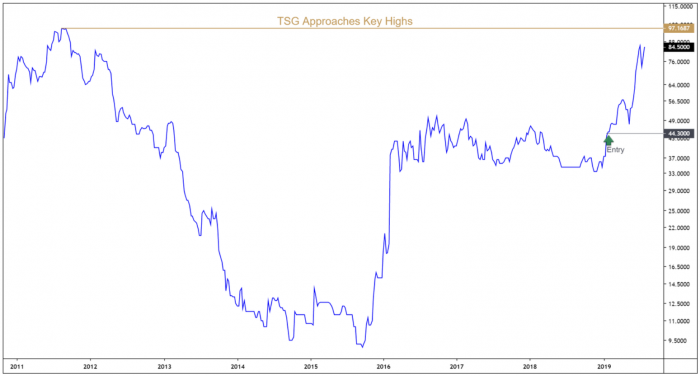

Trans-Siberian Gold Heads for Aug 2011 Highs

After a brief pullback during mid-July, Trans-Siberian Gold have continued their stellar start to the year – fuelled by a resurgent gold price.

The shares are now just 15p away from hitting the psychologically significant £1 marker which represented a major inflection point back in Aug 2011.

Should prices retest these highs, which we fully expect them to do, we may look to take partial profits on our position.

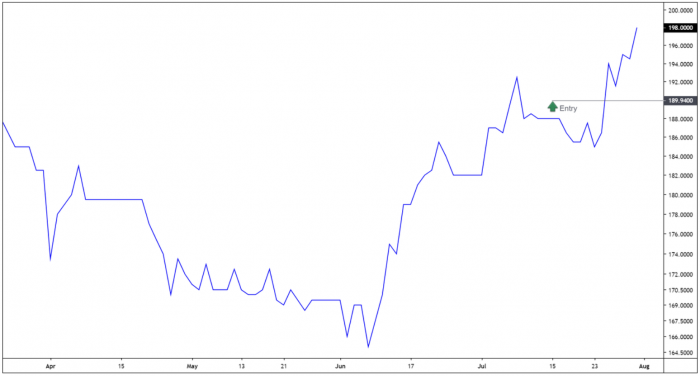

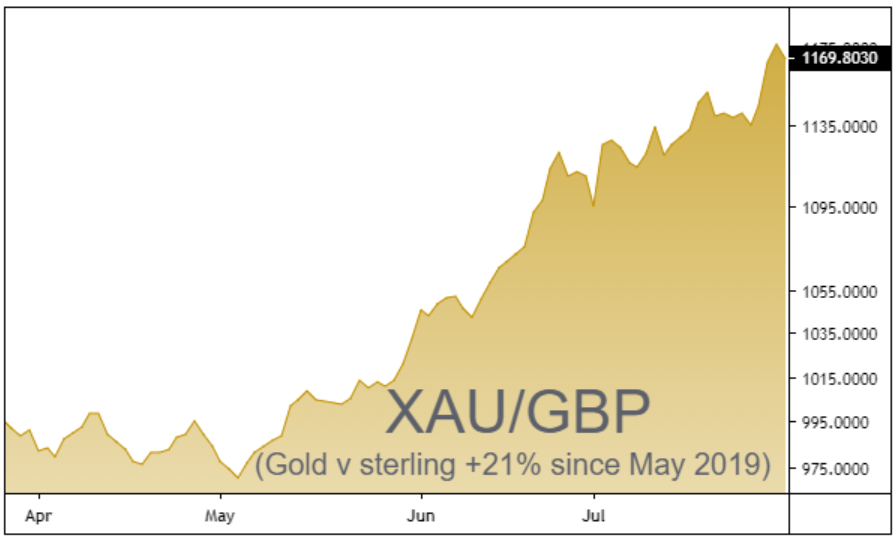

Ramsdens Enjoying the Drop in Sterling

As mentioned in our original recommendation, Ramsden’s precious metals buying and selling service benefits directly from an increase in the sterling value of gold. Boris Johnson’s hard-line stance on Brexit has seen sterling take a tumble during the last two weeks, falling over 3% against the euro and the US dollar – causing the sterling value of gold to surge higher.

Whilst it’s very early days, the initial signs are very positive for our Ramsden’s position and we’re up 4.2% since entry.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.