Regency View:

Update

Somero sees FY adjusted earnings of $47.7m

Somero (SOM) released an upbeat H1 2022 trading statement earlier this month…

The cement screeding specialist said Group trading in the first half of the year “ended higher than the comparable H1 2021 period”.

Somero highlighted positive momentum from a “highly active US non-residential construction market” and “elevated activity levels in the European and Australian markets”.

Whilst warning of the “uncertain macro economic environment”, Somero said it “continues to anticipate healthy trading to continue in H2 2022, a view underpinned by direct feedback from customers in the US, Europe & Australian indicating high workloads and extended project backlogs”.

“As such, the Board is pleased to confirm 2022 results are anticipated to fall in line with market expectations for revenues of approximately US$ 138.8m, EBITDA of approximately US$ 47.7m, and year-end cash of approximately US$ 39.9m”.

Craneware’s FY revenue rises 119%

In a FY Trading Update, released on Tuesday (26th July), Craneware (CRW) said key metrics were “in-line” with management’s expectations…

The US healthcare fin tech delivered headline revenue for the year ended 30 June 2022 of approx.. $165.5m, up 119% on the prior year.

Adjusted earnings (EBITDA) jumped 85% to over $50m and cash reserves remained “strong” at $47.2m.

Software revenue performance and customer retention was robust and underlying Annual Recurring Revenue (“ARR”) increased to $170m from $165m the year prior.

Keith Neilson, CEO of Craneware, commented:

“It is now just over a year since we acquired Sentry and we are delighted with how the teams have come together behind our shared vision to transform the business of U.S. healthcare. With $170m in ARR this year, approximately 40% of all U.S hospitals as customers and a considerably increased scale and offering, we look to the future with confidence.”

Midwich’s record first half revenue

Audio visual distributor, Midwich (MIDW) said trading was “strong” during the first half of the year…

Midwich expect revenue to be in excess of £560m, an increase of over 45% versus H1 2021, and a record first half for the Group.

Organic revenue growth was approximately 27% versus H1 2021, with strong contributions from the Nimans and DVS businesses, which were both acquired early in H1 2022.

Gross margins remained flat at 15%, but Midwich said if live events and in-person activities continue to come back across a number of markets, then margins should pick up in the second half.

On its outlook, Midwich said:

“With order books remaining very strong, unless general economic conditions deteriorate significantly, the Board expects the momentum seen in H1 2022 to continue throughout the remainder of the year. As a result, the Board now expects trading performance for the full year will be slightly ahead of its previous expectations”.

Learning Tech’s integration of GP Strategies is ‘progressing well’

Learning Technologies’ (LTG) Half year Trading Statement made for pleasant reading this week…

The online learning specialist expects to deliver half year revenues of not less than £280m – up considerably on last year due to the huge contribution from GP Strategies (H1 2021: £82.6m). While organic revenue growth on a constant currency basis is expect to be approx. 5%.

Learning tech said the integration of GP Strategies is “progressing well” with margin improvements and strong organic revenue growth ahead of expectations.

“This momentum supports our confidence that GP Strategies will achieve our previously stated guidance of 12% EBIT margin in FY 2022” read the upbeat statement.

Learning Tech CEO, Jonathan Satchell commented:

“I am delighted the momentum in our business has continued since the start of the year. Our transformational acquisition of GP Strategies is delivering strong returns and offers new opportunities for the Group as an enlarged business.”

“The resilient organic growth across our divisions alongside the continuing outstanding margin improvement in GP Strategies, provides the Board with confidence for the full year. While we are mindful of the wider macro environment, LTG is better placed than ever to support an increasing number of organisations to recruit, train, motivate and retain talent.”

Tremor’s new acquisition significantly increases its global market share

On Monday (25th July) Tremor International (TRMR) announced that it had reached an agreement to acquire Amobee for a total consideration of $239m, subject to adjustments.

Like Tremor, Amobee is a ‘Connected TV’ (CTV) advertising platform and fits well with Tremor’s global growth strategy.

Amobee serves over 500 customers globally and operates across three core business segments: Omnichannel Demand Side Platform (“DSP”), Amobee Advanced TV Platform, and Email Marketing Platform.

“The acquisition of Amobee is expected to build upon Tremor International’s growth strategy and proven track record of successfully integrating companies that enhance and expand the capabilities and scale of its data-driven end-to-end technology and business platform, focused on CTV and video,” said Temor’s CEO, Ofer Druker.

“Amobee would add several capabilities including campaign execution across linear and digital channels within a single platform. Additionally, the Transaction would fulfill our strategy to add significant global scale and self-service growth to our demand side platform, increase our US and international customer reach and data footprint, and drive more advertiser spend to our SSP, Unruly” he added.

Science Group’s H1 results ‘slightly ahead’ of expectations

Science Group (SAG) released Interim Results this week in which saw double digit revenue and profit growth for the period…

The ‘Science-as-a-Service’ consulting group first half revenue jumped 10% to £44.8m (H1 2021: £40.7m), and adjusted operating profit increased by 22% to £8.8m (H1 2021: £7.3m) – “slightly ahead of the Board’s expectations”.

Science Group said its balance sheet remains “very strong” with Group cash of £38.6m and net funds of £23.9m (H1 2021: £29.0m and £13.0m), and it is on track for another record year.

On outlook, Science Group’s statement struck a cautious tone:

“The macroeconomic environment is unpredictable with global inflationary pressures and destabilising geo-political events, now combined with an uncertain UK political direction and economic policy. Economic performance in some of the Group’s markets is anticipated to deteriorate in the months ahead as consumer spending slows”…

“While the Group is not immune to macroeconomic factors, the revenue streams are well diversified with little reliance on individual customers or sectors and therefore is well positioned with solid foundations. As a result, the Board remains cautiously optimistic for the remainder of the year.”

TPX Impact delivers organic like-for-like revenue growth of 16%

TPX Impact (TPX) released a strong set of Preliminary Results last week…

The digital transformation consultancy saw revenue for the year ended 31 March 2022 increase 58% to £79.7m (FY2021(1): £50.3m) with organic like-for-like revenue growth of 16%.

Adjusted earnings jumped 72% to £12.2m and basic earnings per share from total operations was 2.1p versus a loss of 3.5p per share last year.

72% of revenue came from public services with Local Government representing 17%, Central Government 35%, Healthcare 9%, Education 4%, and the remaining 7% coming from other public services.

TPX CEO, Neal Gandhi commented:

“We have achieved a great deal this year. In financial terms, we’ve delivered revenue up 58%, adjusted EBITDA up 72%, 110% cash conversion and our first statutory profit after tax. We’ve also made great progress against our ESG goals, with countless projects underway in this area.”

“Notwithstanding the broader macro environment, digital transformation remains a high growth market and we are excited to see what we can achieve as we continue to work towards our 2025 commercial vision.”

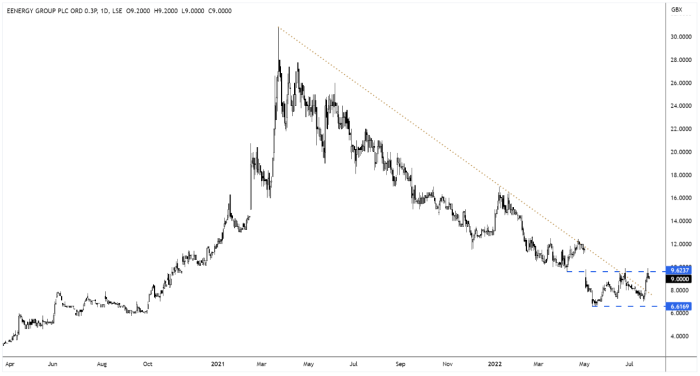

eEnergy says energy crisis continues to generate strong demand

eEnergy (EAAS) released a Full Year Trading Statement last week…

The net zero energy services provider said it generated revenue of £22m and adjusted earnings (EBITDA) of £3m for the financial year ended 30 June 2022.

eEnergy delivered a “record performance” in Q4 FY22 with revenues of £8.3m and EBITDA of £2m. It also said that “due to strong demand seen across our services, the Group enters FY23 benefiting from a strong pipeline and encouraging momentum”.

The Group’s forward order book is £25.3m, up from £18.3m at 31 December 2021, with 88% Q1 revenues contracted as at 30 June 2022 and 39% FY23 revenues contracted as at 30 June 2022.

CEO, Harvey Sinclair commented:

“We are pleased to announce a record Q4 which follows the record contract signings achieved in Q3. The continued energy crisis continues to generate strong demand for our integrated Net Zero offering with the new business pipeline developing strongly as we enter the new financial year”.

Alliance Pharma tumbles on lower H1 margin forecast

Healthcare group Alliance Pharma (APH) expects first-half gross margin to be lower than last year owing to sales mix and cost inflation in warehousing and distribution.

In a Half Year Trading Update, published last week, Alliance said that whilst H1 margins were squeezed, these pressures were likely to ease in H2:

“We anticipate gross margin to improve in H2 22 through favourable product mix and lower freight costs as supply chains normalise”.

Alliance also said that it expects Group performance will be more heavily weighted to H2 than in previous years due to the lockdown in Shanghai and associated temporary disruption to its supply chain, coupled with anticipated revenue trajectory for both Nizoral and Amberen.

Group ‘see-through’ revenue of £81.6m was up 1% on the prior period (H1 21: £80.9m) and down 2% at constant exchange rates (CER).

Alliance CEO, Peter Butterfield commented:

“I am pleased with the performance of the Group in the first half of 2022 against the backdrop of difficult global trading conditions. Our portfolio continues to provide a robust platform from which to grow our consumer healthcare brands; I was also delighted to have closed a highly strategic US acquisition in the Period and the integration of ScarAway has gone very smoothly”…

“June was a record trading month for Alliance and we expect this positive momentum to continue, delivering strong sales growth versus prior year across our key brands in H2 as we execute the revenue trajectory expected by us and our distribution partners, in addition to booking the Nizoral orders delayed from H1.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.