Regency View:

Update

Kitwave jumps on HY profit

Kitwave (KITW) published a strong set of interim results last week which were well received by the market…

The delivered wholesale business said trading returned to pre-pandemic levels with Half-Year revenue up 51.8% to £223.3m (H1 2021: £147.1m).

Gross margin improved to 19.8% (H1 2021: 17.9%; FY 2021: 18.0%), and there was a “strong recovery in profit after tax” at £4.4m (H1 2021: loss after tax £3.4m).

Cash generation remained strong at £17.1m (H1 2021: £9.8m; FY 2021: £7.9m) leading to pre-tax operational cash conversions of 166% (H1 2021: 174%; FY 2021: 85%).

Kitwave said trading since the period end has been “significantly ahead of expectations”, prompting a revision of its financial expectations upwards for the full year ended 31 October 2022.

CEO, Paul Young commented:

“The outlook for the UK economy is dominated by cost-of-living issues which provide an element of uncertainty in relation to end consumer demand for the Group’s products. While the Board is cognisant that these issues could impact trading in future periods, given the better than expected performance in H1 and the strong start to H2, we expect to be significantly ahead of expectations for the current year.”

The market responded well to the numbers and the shares have retested last year’s highs.

Central Asian Metals gives operations update

Kazakhstan copper miner, Central Asian Metals (CAML) published an operations update this week…

Copper production at its Kounrad recovery plant was 6,617 tonnes for the first half of the year. And zinc production at its Sasa mine was 10,465 tonnes.

CAML maintained a strong balance sheet with cash in the bank on 30 June 2022 of $57.7m versus debt of $12.1m.

In terms of outlook, CAML said it was “on track to achieve 2022 full year guidance” with copper production “towards the top end of the 12,500 to 13,500 tonne guidance range” and “zinc production in the 20,000 to 22,000 tonnes range”, and “lead in concentrate production in the 27,000 to 29,000 tonnes range”.

CAML CEO, Nigel Robinson commented:

“Production was strong for all three of our base metals.”

“There have clearly been global inflationary pressures during the last six months, but we have also seen strong metal prices during the last six months and therefore look forward to releasing our H1 2022 financial results on 14 September 2022, when we will also announce our interim dividend.

“We remain on track to repay our corporate debt facility in full in August 2022.”

Renold posts ‘significant revenue and earnings rebound’

Renold (RNO) released their Final Results for the year ended 31 March 2022 yesterday and they made for pleasant reading…

The industrial chain maker said there had been a “significant revenue and earnings rebound”, a record order book, and continued net debt reduction…

Full-year revenue jumped 18.1% to £195.2m and adjusted operating profit rose 34.2% to £15.3m.

Net debt reduced £4.6m to £13.8m, and order intake surged 31.7% to £223.9m (2021: £170.0m).

Renold CEO, Robert Purcell commented:

“I am pleased with the Group’s robust performance through the pandemic which reflected the benefits of the strategic development completed in recent years.”

“Throughout the reported period the business performance has been on an improving trend and our order books have continued to grow in the early part of the new financial year.”

We are cognisant that there remain considerable Covid-19-related challenges in some parts of the world; supply chain issues are still prevalent and inflation is high. However, we have entered the new financial year with good momentum and a belief in the excellent fundamentals of the Renold business upon which we are building.”

Mpac share tumble on profit warning

Shares in Mpac Group (MPAC) dropped more than 30% this week following the release of a shock profit warning.

The high-speed packaging and automation solutions provider said Full-Year profit was likely to be significantly below current market expectations.

Mpac blamed “increasing macro-economic uncertainty and unprecedented volatility in the global supply chain” for impacting the timing of customers’ order placement. Mpac also said the supply problems were “causing operational challenges, in particular relating to the sourcing of critical, customer specified electronic components”.

And whilst Mpac said it expects to First Half revenue to meet expectations, it warned that Full Year revenue was likely to be “significantly below current market expectations”.

The profit warning caused the shares to gap significantly lower and break below the bottom of the descending retracement channel that has been in place since the turn of the year.

At this point it makes no sense to panic, instead we will monitor the position closely over the next quarter.

Mpac said the supply chain and operational challenges are “likely to continue for the remainder of 2022, before easing in 2023”.

Surface Transforms H1 revenues grew 240% to £2.9m

In a trading statement, released last week, Surface Transforms (SCE) said H1 2022 revenues grew 240% to £2.9m (H1 2021: £1.2m).

The carbon ceramic brake specialist said the jump in revenue reflected deliveries on the Aston Martin Valkyrie project as well as catch up on the OEM arrears reported at the end of 2021.

Gross cash at 30 June 2022 was £6.7m, which includes £3m in the form of an irrevocable letter of credit for furnaces and excludes an R&D tax credit of £0.7m expected in September 2022.

On the production issues reported at the year-end, Surface Transforms said:

“All arrears have been cleared and we can meet the immediate demand requirements of all customers”.

On its full year outlook, Surface Transforms said:

The commencement of OEM 8 full monthly volumes will bring Surface Transforms into profitability for the financial year ending 31 December 2022. The small delay in OEM 8 SOP is offset by higher than forecast development revenues with other customers and the Board is therefore pleased to restate the guidance provided in the Chairman’s report in the 2021 preliminary results; “The Company continues its journey to profitability in 2022 and remains confident that this goal will be achieved, whilst maintaining our commitment to environmental and social goals.”

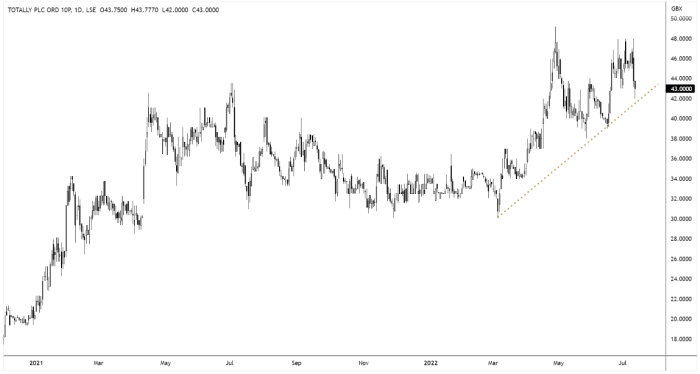

Totally secure urgent care contract extensions and deliver strong prelims

It’s been another strong month of newsflow for NHS insourcing group, Totally (TLY)…

Totally kick-started the month with the announcement of further contract extensions at its urgent care division.

The contract extensions, together valued at £19 million, have been awarded to Totally’s wholly owned subsidiaries, Greenbrook Healthcare and Vocare, which make up its urgent care division and run until 31 January 2023.

Totally followed this up with a strong set of preliminary results, released this week…

The prelims for the period ended 31 March 2022, saw a 12% increase in revenue to £127.4m, and a 24% jump in adjusted earnings (EBITDA) to £6.2m.

On Totally’s outlook, CEO, Wendy Lawrence commented:

“Recent acquisitions and new opportunities within existing business areas present opportunities to grow organically and we remain acquisitive in line with our stated buy and build strategy.”

“We are working in partnership with NHS England at the forefront of plans to deliver a single virtual contact centre framework which presents opportunity for the business to grow flexibly, utilising a centre of excellence structure to deliver the absolute best care to patients.”

Totally’s share price continues to show high levels of strength relative to the wider market, and the shares are currently consolidating near trend highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.