Regency View:

Update

Cohort expect increased focus on defence spend

Defence tech group Cohort (CHRT) released a trading update last week in which indicated that FY revenue would be “slightly weaker than expected”…

Cohort’s performance was broadly in line with thier revised expectations for the year, as set out in our interim statement in December 2021…

Strong performances from MCL, SEA, ELAC and MASS were offset by weaker performances from Chess and EID.

Cohort said, “all of the Group businesses are returning to normal working after the pandemic but continue to experience some impact from global supply chain issues”.

Order intake remains strong with the Group benefiting from an order for over €49m for the Italian Navy (announced July 2021), continued orders from the UK MOD for MCL’s hearing protection and communication ancillaries (announced April 2022), significant export orders for SEA’s Torpedo Launcher System (announced February 2022), and a strong first half contribution from MASS.

Cohort says that it expects defence spend to remain elevated in Europe due to the impact of the Ukraine war.

Oxford Metrics announces sale of Yotta

Smart sensing tech group, Oxford Metrics (OMG) announced the sale of its infrastructure asset management division, Yotta, to Causeway Technologies for a cash consideration of £52.0 million.

Oxford Metrics said proceeds from the sale will increase the Group’s near-term financial firepower to accelerate M&A and planned organic investments…

“These actions will aim to both broaden Vicon’s product bench and extend the Group’s sensing and analysis capabilities…

The Group will continue to be disciplined in its approach to M&A, in line with the criteria set out at the time of the 2020/21 results. This will enable the Group to increase its addressable markets and scale as it progresses towards its five-year financial and strategic goals.”

Commenting on the sale, Nick Bolton, CEO of Oxford Metrics said:

“Today’s sale of Yotta is an enabler of growth on multiple fronts. First, it combines our excellent Yotta team and technology with a platform that can unlock additional growth across Yotta’s existing market – and in other adjacencies.”

Begbies Traynor sees FY results ahead of market views

Begbies Traynor (BEG) released a bullish trading update in which it said that FY results were “expected to be comfortably ahead of market expectations”…

The business recovery specialist expects FY revenue to increase by approx. 30% to £109.5m (2021: £83.8m), and adjusted profit before tax to increase by approx. 55% to £17.8m (2021: £11.5m).

Ric Traynor, Executive Chairman of Begbies Traynor Group plc, commented:

“We performed strongly in the financial year with results comfortably ahead of market expectations and significantly ahead of the prior year. This reflected the material increase in scale and scope of the group since 2021 following our acquisitions and investment in both divisions…

Our strong financial position has further improved and we retain substantial resources to make further acquisitions to build our scale and range of complementary services. We have started the new financial year confident in our outlook and anticipating a year of further progress.”

The shares have had a nice lift since the trading update and are now back within touching distance of their all-time highs.

Strong trading momentum continues for Restore

Restore (RST) delivered a bullish trading update prior to their May AGM…

The secure document storage group said the strong momentum seen in H2 2021 continued throughout the period the first quarter of the year.

Revenue was 37% ahead of the comparative period – driven by organic growth (+14%), acquisition effects (+18%) and COVID-19 repair (+5%).

While run rate revenue expanded from £255 million reported in January 2022 to more than £265 million at end of the period.

Charles Bligh, CEO, commented:

“After a record year in 2021, Restore has continued its strong momentum in 2022. Revenue continues to expand and we are hiring staff to support increasing activity levels for the essential services we provide to customers as they also rebound, transform their business and seek to reduce their costs…

We continue to progress our strategic pipeline of acquisition opportunities and are seeing an increasing number of businesses coming to market and anticipate substantial opportunities to invest whilst maintaining our disciplined approach to valuation and integration.

This combination of strong organic expansion and acquisition driven growth are the foundations of our strategy and we believe will provide strong returns to shareholders over the medium to long term.”

Robinson says group sales 22% up on same period last year

In a brief trading statement, released last week, Robinson (RBN) said group sales in the first four months of the year were 22% ahead of the same period in 2021…

The update comes after a difficult period for the packaging company, which has had to struggle with rising input costs caused by a shortage of resin.

Robinson said that despite the ongoing uncertainty, profits in the 2022 financial year (excluding the uplift from the profits on disposal of properties) are expected to be “in line with expectations” and “comfortably ahead of 2021”.

The shares have flatlined in recent months, finding support at broken resistance and indicating that prices are ready to push higher.

Ixico anticipate stronger second half

Ixico (IXI) released a half year trading statement last week in which it said that trading was “in-line with expectations” and that they “anticipate stronger second half trading”…

The neuroscience precision analytics group delivered adjusted earnings (EBITDA) of £0.5m (H1 2021: £0.9m) on revenues of £3.9m for the six months to 31 March 2022 (H1 2021: £4.9m).

Ixico said its order book, which incorporates the negative impact of client trial cessations announced over the past twelve months, stood at £12.6m as at 31 March 2022 (H1 2021: £19m).

Giulio Cerroni, CEO of IXICO, commented:

“Whilst our clients’ recent trial cessations create an interruption to our record of consistent growth, and will continue to do so across FY23, we are positioned to support our clients in the design and analysis of their trials to maximise their likelihood of success…

The neuroscience field is poised to leverage data to refine disease categories such as Alzheimer’s disease and Huntington’s disease and identify the biological drivers in different subpopulations…

IXICO’s data driven AI analytical techniques will enable the design of more precise therapeutic indications in targeted populations to support further scientific advances in precision medicine in neuroscience.”

Gamma says full year profit outlook in the top half of analyst expectations

Gamma Communications (GAMA) announced a solid start to 2022, supporting a full year profit outlook in the top half of current analyst expectations…

In its May trading update, the communications kit designer said that it has seen growth in its three operating segments and it “expects this positive momentum to continue through the rest of the year”.

Gamma saw strong momentum in its Cloud PBX offering across European, with Germany in particular performing well. It also said that it does not expect inflationary pressures to have any material impact on performance in 2022.

Despite the bullish update, the shares are struggling to gain much traction – forming a strong downtrend since the turn of the year.

With valuations continuing to look attractive, we expect bargain hunters to step in soon, and we do not rule out snapping up a second tranche over the coming weeks.

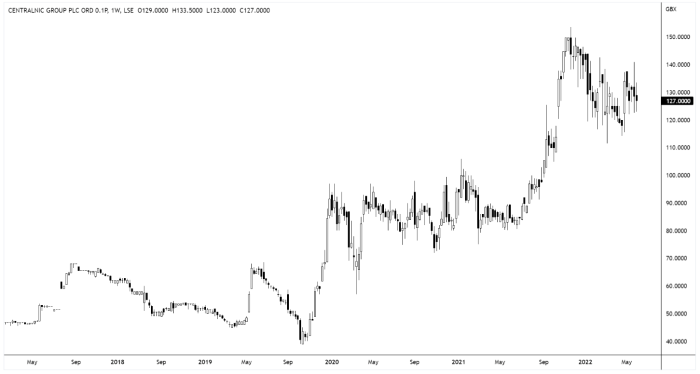

CentralNic quarterly revenue surges 86% as acquisitions gain traction

CentralNic (CNIC) has had a stellar start to the year with top line revenue of 86% for the three months ended 31 March 2022.

The online presence and online marketing services provider said growth was being driven by a combination of acquisitions and underlying organic growth…

Organic growth for the trailing twelve months ending 31 March 2022 was 53% and adjusted earnings (EBITDA) increased by 83% to $18.5m.

Ben Crawford, CEO of CentralNic, commented:

“CentralNic has enjoyed a strong start to the year with year-on-year organic growth now reaching north of 50%, gaining market share in a growing market…

At the same time, we have continued to add scale and capability through the completion of three strategic acquisitions in the period, including VGL, our largest acquisition to date, funded by an oversubscribed equity placing and tap bond issue…

With notably reduced leverage and a healthy cash cushion, CentralNic remains well positioned for the future .”

It’s early days for our CentralNic position, but so far, so good and we look forward to seeing the shares progress higher during the second half of the year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.