18th Jul 2019. 10.18am

Regency View:

Update

Regency View:

Update

Dart Group profit rises as Britons book more holidays

Dart Group announced a 36% jump in pre-tax profit (FY March 2019) following the release of their full-year results on 11th July.

During the year, Jet2.com flew a total of 12.82m flight-only and package holiday passengers (2018: 10.38m). Demand for their Real Package Holidays continued to grow, as Jet2holidays took 3.17m customers on package holidays, an increase of 27%. Executive Chairman Philip Meeson said he remains “optimistic” about meeting profit expectations for the 2020 year despite tough competition, cost pressures and weaker consumer confidence.

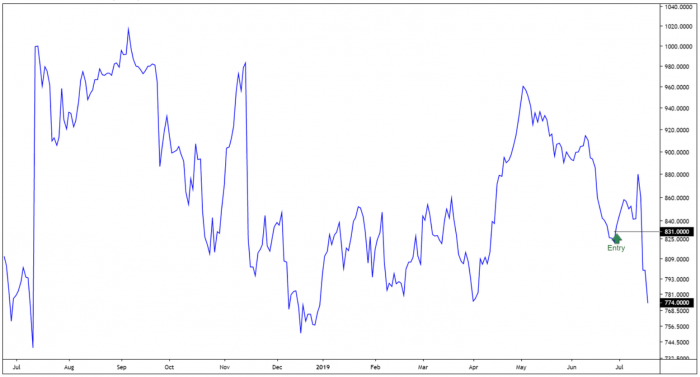

The shares rallied more than 4% on the day of their trading update but have since given back their gains. Whilst we’re currently in the red on this position, the integrity of Dart Groups long-term uptrend remains intact and the quality of their recent trading update reaffirms our buy conviction.

Clinigen sees higher full-year revenues

Clinigen released a bullish trading statement on Tuesday with full year revenue growth expected to come in at 19%.

Management expect gross profit to rise by at least 30% for the year and for earnings per share (EPS) to have increased by at least 15%. Cash generation remains solid with net debt expected to have fallen below £255m for the year to 30th June.

The strong growth has been driven primarily by acquisitions with the two largest acquisitions, CSM and the rights to Proleukin in the US exceeding expectations. The impressive performance from Clinigen’s acquisitions plus good underlying growth overall has offset pressure on the Group’s largest product, Foscavir, an alternative therapy, and from the UK Specials business within Unlicensed Medicines.

After hitting highs of 1,066p in May, the shares have been in ‘retracement mode’ for the last month. Clinigen will release their final results for the year ended 30th June on Thursday 19th September and we will send another update following this full year statement.

Gamma’s cloud-based sales gain momentum

Gamma Communications’ July 10th trading statement underlined their strong start to the year with full-year earnings expected to be ‘slightly above’ the range of market expectations.

Cloud PBX sales have performed well in the period with good sales momentum going into the second half of the year.

Andrew Taylor, Chief Executive, commented “I am delighted to announce that in the first half of 2019 we have continued to deliver strong revenue and gross profit growth across all business areas, representing a positive performance.”

Whilst the shares are currently undergoing a retracement from their June highs, we remain bullish on this stock and are more than happy to hold them within our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.