Regency View:

Update

Totally announce multiple contract extensions

It’s been another great week for Totally (TLY) who have announced a number of contract extensions across the group…

The insourcing healthcare group said its Urgent Care division had signed a trio of 12-month contract extensions for the continuation of GP out of hours (GP OOH) services across the North-East England for a total value of c. £4.2m.

Totally also announced the award of a five-year contract extension to Energy Fitness Professionals (EFP), the corporate fitness provider acquired by Totally in December 2021, for the delivery of on-site gyms for the Royal Mail, valued at a total of £2.5 million. The contract will run until 16 May 2027.

EFP has managed the Royal Mail’s on-site gyms for 18 years. The contract covers the management of 34 sites across the UK, the introduction of an enhanced digital offering, Health Hub, and the trial of a new wellbeing consultation protocol for gym members called Health Fair.

Solid State enjoy ‘exceptionally strong’ finish to FY22

In a trading statement released last month, Solid State (SOLI) said it expects to announce a record set of Full-Year 2022 results.

The component supplier and design-in manufacturer has enjoyed an “exceptionally strong finish to the Period” (31 March 2022).

Solid State expects to announce Full-Year revenues of approximately £85m (2021: £66.3m) up 28% over the prior year, and adjusted profit before tax of approximately £7.2m (2021: £5.4m) up 33%; both “ahead of recently upgraded consensus expectations”.

The like for like open orderbook at 31 March 2022 is up 106% over the prior year at a record £85.5m (31 March 2021: £41.5m).

Like for like organic revenue growth is in excess of 8%, which Solid State said was “pleasing given the well-publicised supply chain and macro-economic challenges faced in the year and the more recent conflict in Ukraine which, to date, has had negligible impact”.

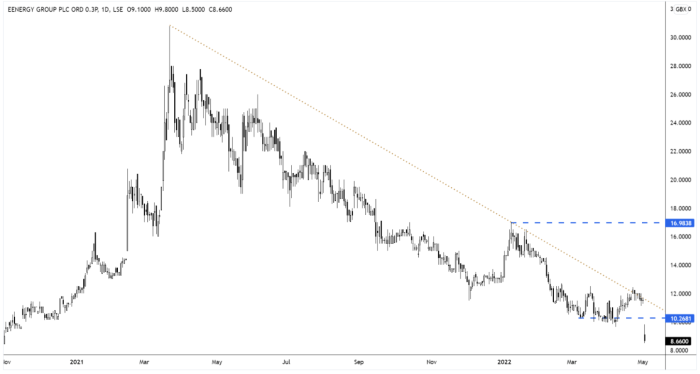

eEnergy earnings to be ‘behind market expectations’

eEnergy (EAAS) gapped lower yesterday following a surprise profit warning…

The green energy services is forecasting £23m of revenue and around £3m of adjusted earnings for Full-Year 2022 – “behind market expectations”…

eEnergy blamed a slower than expected recovery in Ireland due to longer COVID-19 lockdowns, as well as customers entering into larger multi-service contracts resulting in longer conversion times from signing to installation.

However, it wasn’t all bad news and eEnergy saw record contract signings in Q3 with customers responding to higher energy prices.

CEO Harvey Sinclair commented:

“We are pleased to see this momentum continuing with a strong start to Q4 and a robust sales pipeline to take us into FY23.”

“Despite these gains, the impact of covid lockdowns in H1 has continued in Ireland which has seen a slower than expected recovery. Adding to this, we are seeing longer lead times between signing and project completion for the larger, multi service contracts we are now winning. Whilst this is inherently a positive, the longer lead times means certain contracted revenues will now fall after the financial year end.”

“The Board is pleased with the new business pipeline momentum which is not only seeing cross selling of services to existing clients but also to new customers seeking multiservice Net Zero strategies across our energy efficiency and energy management divisions. We continue to invest in new products and services and are excited by the launch of eCharge and our onsite solar power generation offering which has met with strong demand.”

The market’s reaction has been somewhat brutal, and we tend not to overreact to short-term market shocks. For now, we remain happy to hold eEnergy in our AIM Investor portfolio.

Kitwave deliver ‘strong first half’ performance

In a trading update released yesterday, Kitwave (KITW) said it experienced a strong first half financial performance with “all divisions of the business now trading at pre-pandemic levels or higher”.

The wholesale business now anticipates the Group’s results for the full financial year to be “slightly ahead of market expectations”.

CEO Paul Young commented:

“Following an encouraging first half performance, and with the second half of the year typically driving increased trading, we expect full year results to be slightly ahead of market expectations…

“During the period, we were delighted to announce Kitwave’s first acquisition since its admission to AIM in May 2021. The acquisition of M.J. Baker enables a significant expansion of the Group’s activities into south-west England and complements the Group’s existing Foodservice division. The integration of the business into the Group is going as hoped and the business is operating in line with internal expectations.”

It’s very early days for our position in Kitwave, but it’s a case of, ‘so far so good’ with the shares continuing to maintain their upward trajectory.

Boohoo sees tough year ahead as profit falls 28%

Boohoo’s (BOO) Final Results for the year ended Feb 2022 did not make for pretty reading this week…

The online fashion house reported a 28% fall in annual core earnings that reflected significant freight and logistics cost inflation and warned that pandemic-related external factors will continue to impact it this year.

Boohoo made adjusted earnings (EBITDA) of £125m which was – in line with guidance and down from £173.6m in 2020-21, while revenue rose 14% to £1.98bn.

Boohoo is now forecasting revenue growth to be broadly flat in the first half of 2022-23 as relatively higher product returns rates lead to net sales being down year on year in the first quarter, with a return to growth in the second quarter.

John Lyttle, Group CEO, indicated that Boohoo would focus on maintaining the market share it had gained through the pandemic:

“Over the past two years, we have significantly increased market share in our core geographies of the UK and the US, and we have grown active customer numbers by 43% across the group to 20 million. Our focus over the past two years has been on investing to build a strong platform, with the right infrastructure, supported by increased capacity to better serve our customers…

In the year ahead we are focussed on optimising our operations through increasing flexibility within our supply chain, landing key efficiency projects and progressing strategic initiatives such as wholesale and our US distribution centre. This will ensure that the group is well-positioned to rebound strongly as pandemic-related headwinds ease.”

Learning Tech raises margin guidance

Learning Technologies (LTG) posted a strong set of Final Results this week in which it said its GP Strategies acquisition was “progressing ahead of plan”.

The e-learning group saw sustained momentum and organic growth across the business, with high quality earnings from SaaS and long-term contracts.

Full-Year operating profit came in at £11.7m versus 14.9m the year prior, but headline revenue rose 95% to £258.2m (organic revenue growth was 8%) due to its ‘transformational’ acquisition of GP Strategies which is bedding in quicker than anticipated and prompted an increase in margin guidance.

Learning Tech CEO, Jonathan Satchell commented:

“Our transformational GP Strategies’ acquisition is progressing ahead of plan and enables us to upgrade our margin expectation for FY 2022. The enlarged Group provides a platform to capture a greater proportion of the circa $100 billion and growing addressable market in digital learning and talent management. Following the acquisition we have a deeper offering to serve a global customer base facing greater complexity and change, creating further margin enhancement and cross-sell opportunities for LTG….

Current trading in Q1 2022 is strong, in line with management expectations. While mindful of the current macro environment, strong business momentum has continued into the new financial year and we have a robust balance sheet that will support further software company acquisitions in due course, underpinning the Board’s confidence of significant progress in FY 2022.”

Mpac sees 2022 ‘in line’ on strong pipeline prospects and orderbook

Mpac Group (MPAC) said this week that performance has been in line with the board’s expectations and that its orderbook is significantly above the previous year’s level.

The packaging-tech firm expects 2022 performance to be “in line” with expectations as the robust pipeline prospects and order book provide extensive coverage over its forecast revenue.

The company added that supply-chain pressures are expected to continue throughout the year, and that these have been mitigated with a new business model application.

In an AGM statement, CEO Tony Steels commented:

“I am pleased to report that we have started 2022 trading in line with expectations. Our management team has responded well to the supply chain disruption and has been able to largely mitigate the impact on Mpac and our customers…

While we anticipate that the current supply chain challenges are likely to continue throughout 2022, the Group has momentum from a strong orderbook and the sound operational foundations, established by implementing the One Mpac business model, and I continue to be confident that results for the full year will be in line with expectations.”

IXICO says first half represents period of consolidation

AI neuroimaging company Ixico (IXI) said it performed in line with expectations for the six months to end-March, delivering positive underlying earnings and remaining operating cash-generative despite challenges in the period.

Ahead of the release of interim results in late May, IXICO expect revenues to be £3.9m compared to £4.9m the year before, with a net cash balance of £5.8m at the half-year stage.

The contracted order book stood at £12.6m at the end of March, compared to £19mln a year earlier.

Chief executive Giulio Cerroni said:

“I am satisfied with IXICO’s performance over the past six months, delivering positive EBITDA and positive operating cash, given the challenges we have faced with the halting of several important client trials representing significant multi-year revenue opportunities.

“The results delivered do not reflect the growth opportunity we see in front of us, rather a necessary period of consolidation as we continue to diversify our contracted order book.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.