Regency View:

Update

Surface Transforms surge higher on contract win worth £100m

Share in carbon ceramic brake manufacturer Surface Transforms (SCE) surged higher in early trading this morning following a big new contract win with an existing customer…

The new contract titled ‘OEM 8’ has a contract value of approx £100m and replaces the previously announced contract from September 2020 which was valued at approximately £27.5m.

“This increased contract value of over £70m is driven by both significantly increased demand for this particular model of OEM 8 and the contract being extended to 2027” read this morning’s statement.

The contract increases the Company’s sales forecast by £4m in 2023, £11m in both 2024 and 2025 and by £20m in both 2026 and 2027, taking the Company’s overall lifetime order book to over £180m – not bad for a company with a market cap of £82m!

This bullish news comes ahead of the company’s Capital Market’s Day and may provide the catalyst required for the shares to break out of their descending channel.

Restore reports stella FY results

Document storage group Restore (RST) reported a market-beating set of Full-Year Results last week…

A combination of “strategic M&A and organic growth” saw profit before tax jump four-fold to £23.2m.

Headline revenue increased 28% to £234.3m while adjusted earnings (EBITDA) came in 29% higher at £74.2m.

Charles Bligh, CEO, commenting on the results and outlook, said:

“Our strong organic growth and eight successful strategic acquisitions have delivered an outstanding performance with record results for 2021. The new businesses we have acquired are improving margins and there is no doubt the quality of Restore’s services is reflected in our sector leading positions in all of our markets.

With excellent sales momentum, activity levels further increasing across all our markets and a well progressed pipeline of acquisitions, I am confident our success will build further in 2022 and beyond.”

The market has responded positively to the numbers, and Restore’s share price has rallied 14% from its March lows.

Pan African secures sizeable gold exploration block in Sudan

One of Pan African Resources (PAF) recent objectives has been to “investigate potential exploration and mining opportunities outside South Africa”.

And earlier this month, we got a glimpse of what Pan African has in mind…

They have secured five prospecting concessions in north-eastern Sudan – located on the same suture zone as the Hassai gold mine, which is the largest gold producer in Sudan, with historic production of some 100,000 ounces per year.

“Our management team has been visiting Sudan for the last two years to identify prospective gold mining sites,” said Cobus Loots.

“We believe that the Block 12 concessions are highly prospective, and we look forward to reporting exploration results from these properties in due course. Our exploration programme will be phased, with expenditure of approximately US$7m expected to be incurred during the first three years, to ensure we limit the group’s financial risk” he added.

Pan African’s exploration activities in Sudan are expected to commence in the second calendar quarter of 2022 to verify the results for the initial identified targets and endeavour to identify additional targets.

TPX jump 25% after two strategic acquisitions

TPX Impact (TPX) have announced two strategic acquisitions “significantly improving the Group’s data offering”…

The digital transformation consultancy said it has acquired Peak Indicators and Swirrl IT. The Acquisitions are strategically important to TPX, significantly expanding the Group’s capabilities in artificial intelligence (AI), data science and analytics.

TPX also published a bullish Trading Update which said existing revenue growth would be at the “top end of market expectations”. And that it was on track to hit its FY23 £100m run rate revenue target “around a year ahead of plan” with FY22 revenue growth anticipated to be “in-line with market expectations”.

TPX CEO Neal Gandhi said:

“These acquisitions represent another key strategic step forward for TPX in our mission to take on the multitude of complex challenges facing the public and commercial sectors and deliver sustainable digital change. More than ever, we are now confident in our ability to bid for and win larger, more lucrative contracts with our enhanced service offering…

We’re also delighted to announce that having reached run rate revenues of approximately £100m through both these acquisitions and existing growth, we are on track to achieve our original commercial vision a whole year ahead of plan.

We’re excited to now focus on our FY25 commercial vision of achieving £200m revenues on a run rate basis by March 2025.”

Craneware’s H1 adjusted earnings rise 78%

Craneware (CRW) delivered a solid set of interim results last week in which it said H1 adjusted earnings (EBITDA) had increased by 78% to $23.7m…

Top line revenue more than doubled during the half year to $80.2m while Profit before tax decreased to $6.2m (H1 2021: $9.9m) after $8.9m of amortisation of acquired intangible assets (H1 and exceptional costs of $1.9m.

Annual recurring revenue (ARR) from its cloud business increased to 67% up from 16% in 2021.

CEO, Keith Neilson commented:

“The combined scale and expertise of the enlarged Craneware Group provides the potential for acceleration in ARR growth over the medium term, as we unlock the considerable cross and upsell opportunities within our enlarged customer base…

With a strong balance sheet, high levels of recurring revenues, high customer retention rates and an ARR of $165m as at 31 December 2021, we have a strong financial foundation from which to accelerate growth and investment to fulfil our potential, thereby increasing shareholder value.”

The shares have under-performed in recent months, but this trading update underlines Craneware’s quality.

Ceres says strong top-line growth set to continue into 2022

Fuel cell innovator Ceres Power (CWR) released an upbeat set of Final Results for the year ended 31 December 2021…

Ceres see the demand for hydrogen power to double each decade between 2030 and 2050 to create a market worth $2.5trn (forecasts according to consultant McKinsey).

With such strong forecasted growth in hydrogen power, Ceres intend to increase its spending on R&D and capital investment significantly.

Ceres also said that Group grew revenues by 44% to £31.7m, driven largely by licence fee income, which more than doubled.

Strong revenue growth is expected to continue into 2022, though the phasing will be materially influenced by the timing of its new China joint venture that we outlined in our February portfolio update.

Ceres CEO, Phil Caldwell commented:

“We need a different energy landscape and Ceres’ purpose to deliver technology that enables a clean and efficient energy future is absolutely aligned with that goal. We have made significant progress on our growth ambitions this year, to establish Ceres as a leading player in the sector.”

Spectra Systems upbeat as central bank revenue increases

Banknote and gaming tech firm Spectra Systems (SPSY) said buoyant demand for banknotes, anti-fraud sensor systems and optical equipment from its main central bank customer helped FY21 revenues increase by 13%.

Total revenues rose to $16.6m – helped by a 71% jump in service income to $5.52m, while profits rose by 10% to $5.94m.

Spectra said its long-established relationship with a major world central bank “continues to drive the introduction of more advanced products and an increasingly steady stream of hardware sales to authenticate our covert materials which reached record sales this year.”

Spectra CEO, Dr. Nabil Lawandy commented:

“Spectra Systems has delivered an excellent performance for the 2021 financial year, continuing its track record of year-on-year profit growth…

The Board therefore believes that the Company, by achieving key business milestones, will continue to perform well and has excellent prospects for maintaining strong earnings in 2022 and beyond.”

Spectra upped its dividend payout and the shares are now trading on an eye catching forward yield of 5.36%.

Americas region continues to perform well for MPAC

MPAC Group (MPAC) reported a significant rise in pretax profit for 2021 last week…

The AI packaging company posted a pretax profit of £8.2m compared with £2.9m for 2020, and said that its Americas region continues to perform well and that its outlook in the Europe, Middle East and Africa has improved.

FY21 revenue rose 13% to £94.3m from £83.7m for the year before and operating margins increased with underlying operating return on sales 9.3% (2020: 7.8%).

CEO Tony Steels commented:

“I am pleased to report Mpac made strong progress in the year, delivering significant growth in order intake, order book and a financial performance for 2021 exceeding market expectations…

In the year the Group surpassed the milestone of generating more than £100m of order intake and grew operating margins significantly over the prior year…

The positive first half 2021 performance continued, and the Group ended 2021 with both a strong closing order book and a healthy prospect pipeline, providing an encouraging outlook for 2022.”

The market enjoyed the numbers and MPAC’s share price has put in a sharp V-shaped recovery in recent weeks.

Marlowe trading ‘in-line’ with current market expectations

Marlowe (MRL) published a brief Trading Update to accompany its Capital Markets Day…

The compliance software said:

“The Group continues to make strong financial and strategic progress, and trading for the year ending 31 March 2022 is expected to be in line with current market expectations…

The integration programmes of all recent completed acquisitions are proceeding as planned with synergies being delivered in line with expectations. In addition, the Group’s pipeline of earnings-enhancing acquisitions remains attractive and the Group is in a strong financial position to capitalise on these opportunities as they arise.”

Marlowe also announced the acquisition of Griffin and General Fire Services Ltd, a provider of fire safety services, for an enterprise value of £0.7m.

For the year ended 31 December 2020, Griffin Fire generated profit before tax of £0.2m on revenue of £1.4m. Net assets at 31 December 2021 were £0.4m. The acquisition will be funded from Marlowe’s existing cash resources.

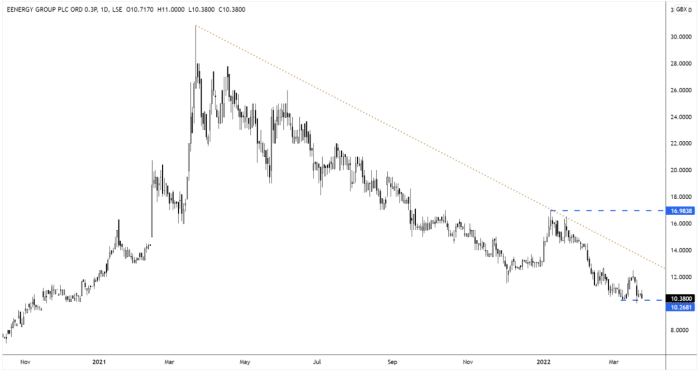

eEnergy believe energy crisis is a ‘key inflection point’ for the business

In a robust set of Half-Year 2022 results, eEnergy (EAAS) said it was well positioned to win business due to a number of tailwinds…

“The ongoing energy crisis and the resulting increase in energy prices has provided an inflection point for our business”, commented cofounder and CEO Harvey Sinclair…

“Our customers recognise the commercial significance of reducing energy wastage now more than ever. We are one of the only businesses that enable customers to reduce their energy consumption as well as generate their own energy without the need for capital investment,” he added.

“Additionally, the broader macro conditions and clear regulatory drivers continue to be a tailwind for the business”.

Half-Year 22 revenue jumped 42% to £9.6m while Group gross margin increased in the period to 57.6% (H1 FY21: 38.2%) due to the change in sales mix towards Energy Management.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.