Regency View:

Update

Anglo Asian expect ‘no material impact’ of Russian invasion on operations

Our Azerbaijan-focused precious metals producer, Anglo Asian Mining (AAZ) released a statement on the Russian invasion of Ukraine…

AAZ said its operations in Azerbaijan are “unaffected by the recent international sanctions levied against the Russian state”. The Company expects “no material impact on its supply chain or operations due to the conflict in Ukraine”.

AAZ also said it had produced 64,610 gold equivalent ounces (“GEOs”) for the year ended 31 December 2021 – in-line with expectations.

However, despite the calming statement, the shares have continued to underperform a surging gold price.

The shares are near support, and whilst their performance has been underwhelming relative to other gold miners, AAZ are showing strength relative to the wider market.

Bango set to see continued strong growth

Bango (BGO) released a strong set of Final Results this week, with Full-Year revenue growing 31.5% – ahead of expectations…

The mobile payment platform said annual recurring revenue (ARR) from subscription services grew as a proportion of overall revenues. And Bango Audience sales accelerated due to rising demand for ‘purchase behaviour targeting’ by app developers.

End User Spend (EUS) increased to $4.1bn, up 73.6% (2020: $2.4bn), the seventh year of continued strong growth. While adjusted (EBITDA) grew to $6.2m (2020: $6m) and net profit from the core Bango business, was up 48.6% at $2.5m (2020: $1.7m).

Paul Larbey, Chief Executive Officer of Bango, commented:

“Once again, Bango delivered revenue growth ahead of expectations. The transactional payments business continues to grow, as we added new telco routes and mobile wallets and our merchant customers delivered new products and services…

Just as exciting is the accelerating adoption of the Bango platform licensing solution by tier 1 telcos and utility providers for all of their 3(rd) party bundling.”

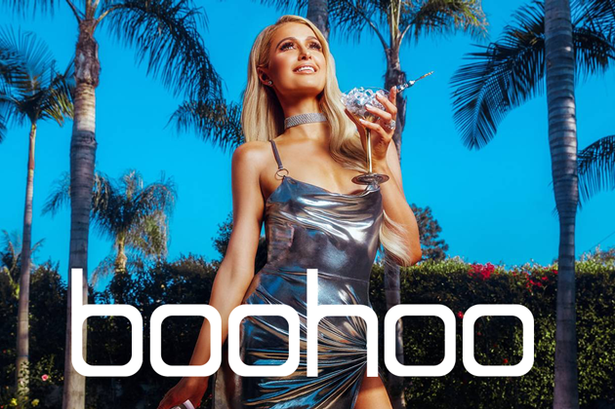

Boohoo to meet earnings guidance as sales growth slows

Boohoo (BOO) released a trading update this morning for the three and twelve months ended 28th Feb 2022…

The fast fashion group said it has delivered net sales growth in the fourth quarter of 7% (down from 10% the previous quarter), and Full Year sales of 14% which is “in line” with guidance.

As previously warned in Decemeber, Boohoo said net sales growth in the quarter was impacted by higher returns rates year on year and said it expected this to continue in the first half of FY23.

Boohoo expect to report Full-Year adjusted earnings EBITDA of approx. £125m – in line with prior guidance issued in December and market expectations.

John Lyttle, Group CEO, commented:

“The Group has delivered strong growth over the last two years, which has translated into significant market share gains. We are confident that pandemic-related headwinds are short-term in their nature, and our focus is to ensure the business is well positioned for growth as these headwinds ease.”

Enwell shuts Ukraine field operations

Enwell Energy (ENW) announced last week that ithas shut down field operations at several of its gas and condensate fields, due to Russia military activity in north-eastern and eastern Ukraine.

The oil-and-gas producer said that it has “shut-in and made safe” production and drilling operations at its Mekhediviska-Golotvshinska, Svyrydivske and Vasyschevskoye fields and its Svystunivsko-Chervonolutskyi exploration license.

The company said it was taking all measures available to protect and safeguard its personnel and business, and has implemented its emergency response measures following Russia’s military action.

Our decision to remain in Enwell during the last month has been one of the toughest investment decisions we’ve had to make. And those of you who follow our research closely will know that we don’t like to be make knee-jerk reactions following market shocks…

Enwell’s share price is currently trading below net cash value and for this reason we have decided to hold for now.

We will continue to monitor the situation very closely, and will keep you up to date with any developments.

Midwich Group posts record revenue

Specialist audio-visual distributor Midwich (MIDW) reported record revenue and adjusted profit before tax in its full-year results on Tuesday…

Midwich delivered top line revenue growth of 22.9% to £856m, including organic growth of 18.9%.

Gross margins had recovered “strongly” to 15.3% for the 12 months ended 31 December, from 14.3% in 2020. And adjusted profit before tax surged 130.3% to £31.9m, ahead of pre-Covid levels.

The board proposed a final dividend of 7.8p, bringing the full-year distribution to 14.1p including special and interim payments.

Group Managing Director, Stephen Fenby commented:

“The Group has had a very strong year, achieving record revenues and adjusted net profits…

We have continued to focus not only on delivering strong short-term performance, but also building the business for the long term. We have grown and strengthened our team during the year, including particularly in North America, and also in our group-wide IT capabilities…

As markets start to open up once more, I believe our business is well placed to enjoy further growth and success.”

Somero says healthy North American market drives strong finish to 2021

Somero (SOM) released a strong set of Final Results this week in which saw sales grow “a remarkable 51%”…

The US-focused cement leveller said sales hit a new record to $133.3m (2020: $88.6m) and that sales growth had “translated efficiently” to profit and cash flow.

Adjusted earnings (EBITDA) grew 83% from 2020 to $47.8m, while operating cash flow grew jumped 21% to $36.9m.

Jack Cooney, CEO of Somero, said:

“We closed the period with the strongest cash position and balance sheet in company history. This liquidity positions us well to make investments, including adding key resources, that will drive growth in the years to come from new and existing products across our key markets and to provide a healthy return of cash to shareholders through dividends.”

However, Cooney did note that growth would be “modest next year” adding…

Following what has been an exceptional year, we expect to deliver modest growth in revenue and consequently profitability in FY 2022, on top of what has been an exceptional year.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.