Regency View:

Update

This morning’s news that Vladimir Putin has launched a major military assault on Ukraine has seen global stock markets fall sharply.

We are monitoring this fluid situation very closely with a specific focus on the stocks within our portfolio that have exposure to the region.

Tracsis trading ‘in-line’ with expectations

Tracsis (TRCS) released a strong H1 trading update yesterday in which it said it was trading “in line with the Board’s expectations”.

The traffic software and hardware provider has enjoyed a “strong post-Covid lockdown recovery of activities in the Events and Traffic Data business units”. And Tracsis expect revenue to have increased to approx. £29m in the first half of its financial year (H1 2021: £22.2m).

Earnings (EBITDA) is expected to have increased by around 10% (H1 2021: £5.4m) with cash balances remaining strong at approx. £25m (H1 2021: £20.8m). And Tracsis said this enables them to continue to invest in their technology base and to “pursue a growing pipeline of acquisition opportunities”.

Tracsis also said that the integration of Icon Group, a Dublin-based interdisciplinary geoscience company specialising in Earth Observation that was acquired in November 2021, is “progressing well”.

On the price chart, the shares have fallen back to a key level of swing support at 890p, and we expect this to hold firm.

Ideagen announces acquisition of MailManager

Compliance software group, Ideagen (IDEA) announced the acquisition of MailManager earlier this month for an upfront cash consideration of £26.4m plus earnout.

MailManager is an email management solution that helps businesses manage emails more efficiently and significantly improve control, collaboration and compliance.

The business has annualised recurring revenues of approximately £5.1 million as of 31(st) January 2022. Ideagen expects that MailManager will benefit from the Group’s operational leverage and achieve margins “comparable to the Group’s margins within the first full financial year of ownership”.

Ideagen CEO, Ben Dorks commented:

“We are pleased to announce the acquisition of MailManager, which fits our strategy and acquisition criteria. It complements our existing Regulated Collaboration product suite, it contributes to our ARR base and it has a strong presence in key end markets where the Group expects to be able to drive cross-Group growth.”

Pan African Resources ups Full-Year production guidance

Pan African Resources (PAF) released their unaudited interim results last week in which they said Half-Year earnings per share (EPS) had increased by 13.3% to $0.239 per share…

The South-African gold miner notched up a record half-year production of 108,085oz (2020: 98,386oz), while all-in sustaining costs (AISC) improved 6% to ($1,173/oz).

Net cash generated by operating activities increased by 54.4% to US$43.4 million (2020: US$28.1 million) and net debt reduced by 56.7%.

Pan-African also upped its Full-Year production guidance to approx. 200,000oz.

CEO, Cobus Loots commented:

“Pan African has again delivered an excellent operational performance, achieving record gold production in excess of 108,000oz for the Current Reporting Period, and exceeding our previous guidance…

The Group is on track to produce approximately 200,000oz of gold for the financial year ending 30 June 2022, in line with our increased production guidance.”

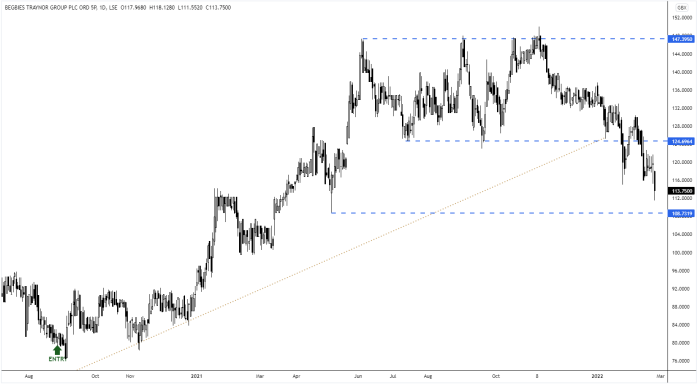

Begbies release bullish Q3 update

Financial insolvency group, Begbies Traynor (BEG) said itQ3 has been “broadly in line” with the first half of the year…

This performance puts them on track to deliver full year numbers “within the range of market expectations” and “significantly ahead of last year”.

Begbies said insolvency numbers have returned to pre-pandemic levels due to increased liquidations, although administrations “remain much lower than pre-pandemic levels”. They now expect a return to “more normal activity levels” to benefit their new financial year rather than the current year.

Ric Traynor, Executive Chairman commented:

“We have performed well in Q3, benefiting from the integration of our recent acquisitions and our broad range of complementary services which provide a strong platform for growth…

Although insolvency numbers are inexorably rising, the market is still awaiting a rise in the larger and more complex instructions that may result from the current economic headwinds and the removal of the final Government financial support measures in March.”

Tremor International Increases TV Data Reach to 44 Million US Households

Tremor International (TRMR) said announced the increased scale of its data-driven TV Intelligence solution…

Through new partnerships signed in recent months, the Tremor’s national footprint now reaches 44 million US households, “with a more holistic and representative dataset sourced from smart TVs and eighteen MVPD (multi-channel video programming distributor) providers” said Jessica La Rosa, VP of Partnerships & Data, Tremor International…

“We will further strengthen our offering in May 2022 when we gain exclusive access to VIDAA’s TV viewership data via ACR technology” she added.

Tremor have also released a Q4 and Full Year trading update this morning in which it said it had achieved record earnings (EBITDA) of $54m for Q4 2021, and $161.2m for FY 2021 – reflecting an organic increase Year-Over-Year of 38% and 166%.

Ofer Druker, Tremor’s CEO commented:

“We continue to drive strong growth and market adoption within our end-to-end platform and delivered record revenue and adjusted EBITDA for both the fourth quarter and full year 2021…

Our strategy to provide the market with a robust data driven end-to-end tech platform offering simplicity for customers with a focus on Video and CTV, resulted in contribution ex-TAC growth of 20% in Q4 2021 compared to Q4 2020, and 64% growth for the full year 2021.”

Tremor also announced a $75m share repurchase program which has been well-received by the market.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.