Regency View:

Update

Shares in Surface Transforms swing wildly after warning is followed by contract win

It’s been a volatile few weeks for Surface Transforms (SCE) with the shares dropping due to an unscheduled profit warning and then bouncing back on major contract win…

The ceramic brake specialist said revenue for the year ending 31 December 2021 will be below £3m, significantly short of market expectations.

The reason for the shortfall centered on one particularly complex furnace, which SCE believe will be ‘fully resolved imminently’. However, SCE said “given December is a short month, the Company is unlikely now to recover the sales gap in this financial year”.

SCE also stated that “these sales have not been lost, the key OEM customers have not seen any impact and the revenue gap, whilst proportionately large in 2021, is small in relation to overall 2022 volumes and is expected to be recovered progressively through Q1 and Q2 2022.”

This negative news was shortly followed by the announcement of a contract win with ‘OEM 6’…

SCE said it has been notified of its selection as a tier one supplier of a carbon ceramic brake disc on the forthcoming launches of three cars of its existing customer, previously described as OEM 6.

The carbon ceramic disc will be fitted as standard to both axles on all three cars. The lifetime value of these contract wins is more than £45m – bringing the overall Company order book to in excess of £115m.

Share price volatility is part and parcel of investing in AIM stocks, and we’re more than happy to continue to hold SCE.

Character Group performing well despite supply crisis

Toy maker Character Group (CCT) released their preliminary unaudited results for year ended 31st August…

Underlying pre-tax profit more than doubled on the year from £5.4m to £11.2m, while revenue jumped 29% to £140m.

The shares had gapped lower earlier in the year due to the global supply crisis, but Jon Diver, Joint Managing Director said the Group remains on track to meet expectations:

“Moving into 2022, our line-up of merchandise not only continues to feature some of the most sought-after toy products but will be further bolstered by the launch of a number of exciting new concepts, additions and brand extensions that the Group will unveil at the London Toy Fair in January 2022 and through to Spring of next year.”

“The Board believes that margins will be under pressure due to high freight rates and increased materials and labour costs, however, it is satisfied that the Group remains on target to meet current market expectations.”

Our decision not to panic is paying off and Character Group’s share price has fought be well over the last two months. We remain happy to hold them.

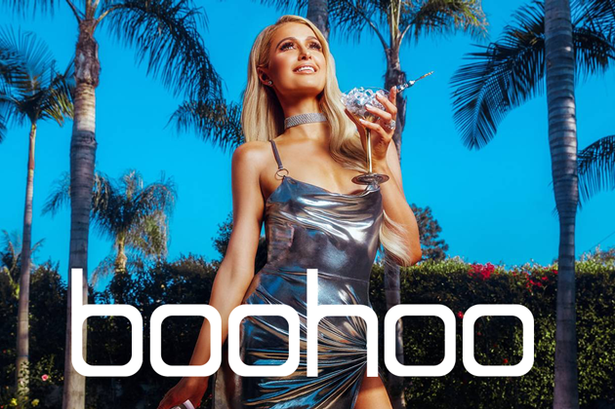

Boohoo slash sales forecast

The storm clouds continue to gather for Boohoo (BOO) with shipping delays and ‘exceptionally high return rates’ creating severe headwinds for the fast fashion house…

Boohoo warned that full-year profits and sales will be lower than expected, almost halving previous guidance.

The company said it was suffering the effects of global shipping delays, rising costs linked to the pandemic, and “exceptionally high” levels of returns linked to an increase in sales of dresses.

However, these headwinds are expected to be transitory and there were some notable highlighted within the numbers, which included a 32% jump in UK sales in the three months to November compared to a year earlier.

And Boohoo still has a very strong net cash position of £148m on a trailing twelve-month basis (TTM).

CEO John Lyttle, commented:

“The group has gained significant market share during the pandemic. The current headwinds are short term and we expect them to soften when pandemic-related disruption begins to ease.”

“Looking ahead, we are encouraged by the strong performance in the UK, which clearly validates the Boohoo model” he added. “Our focus is now on improving the international proposition through continued investment in our global distribution network.”

Somero raises guidance due to strong trading momentum to end H2

Somero’s (SOM) recent trading update made for pleasant reading with the US-focused cement leveller saying it expects to exceed previous guidance for FY 2021.

Revenue guidance has been upped from approx. $120m to approx. $120m, adjusted EBITDA has increased from approx. $42m to $45m and net cash is set to come in at $39m, up from a previously guided $36m.

The strong trading momentum in H2 2021 has been led by “strong trading in North America, healthy contributions to growth from Europe and Australia, with the remaining international markets performing as expected” read the upbeat statement.

Somero’s final 2021 results announcement is scheduled to be released on 9 March 2022.

The shares have performed well for us this year, but we are aware that construction demand is cyclical and hence we may look to crystalise profits into strength at some point early next year.

Cohort’s half-year numbers disappoint

Cohort (CHRT) warned that earnings per share (EPS) would be 60% lower than last year due to weak performances from Chess and EID.

The defence technology firm said it had achieved revenue growth and strong order intake in the six months to 31 October 2021 and further improved its cash position, but COVID-19 restrictions have had some impact on both deliveries and orders.

“We anticipate a much stronger performance in the second half, but do not expect this to fully make up the shortfall. As a result, the Board now believes that Cohort’s performance in 2021/22 will be materially below current market expectations” read Cohort’s summary statement.

The shares dropped back to the bottom of the long-term range following the numbers and buyers have stepped in to support the shares at the bottom of the range.

Whilst we’re not looking to buy a second tranche, given Cohort’s record order book and strong contribution from acquisition ELA, we expect the stock to improve during the second half of its financial year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.