Regency View:

Update

Tracsis delivers strong set of Final Results

Tracsis (TRCS) released their audited Final Results for the year ended 31 July 2021…

The transport tech firm delivered a strong financial performance with a return to growth in revenue and increased profit despite continued Covid-19 challenges.

Revenue increased to £50.2m (2020: £48.0m) with growth in the higher margin Rail Technology & Services Division and in Data Analytics/GIS only partially offset by lower sales in our Events and Traffic Data businesses as expected due to ongoing Covid-19 restrictions on their end markets.

Adjusted earnings (EBITDA) came in at £13.0m versus £10.5m (FY20) – reflecting growth in software revenue and the impact of cost reduction actions taken in response to the pandemic.

Commenting on the numbers, CEO Chris Barnes said:

“We are confident that there are strong growth prospects for all parts of the Group and therefore remain committed to implementing our overall strategic growth and investment plans. We will continue to pursue organic and acquisitive growth supported by a strong balance sheet”.

The market enjoyed the numbers, and the shares have rallied with strong momentum during the last week – taking the shares back within touching distance of their summer highs.

Eckoh wins ‘significant’ cloud contract

Secure payments provider Eckoh (ECK) announced its largest ever global Secure Payments Cloud contract win last week…

The three-year contract is worth a minimum of $1.5m in total and “comes with the expectation that this will be exceeded”, and that over time “Eckoh has the opportunity to significantly upscale the value of the relationship” read the statement.

The solution will be first deployed in the US before being rolled out to as many as 28 further countries over the contract term.

Nik Philpot, Chief Executive Officer at Eckoh, commented:

“We’re delighted to have been chosen to provide a critical security solution to such a well-known brand, securing our largest ever global Cloud Secure Payments win. Our success reflects three key factors. First, our expertise in delivering successful enterprise-level deployments across multiple geographies in the Cloud. Second, the reassurance we offer clients as a growing and profitable listed company, with a strong balance sheet. And thirdly, that Eckoh offers proven patented solutions”.

“We expect our ongoing investment in Cloud platforms, and continued innovation in our security offering, will maintain Eckoh’s position as market leader in the fast-growing data and payments security market for the customer engagement industry.”

Ideagen first half revenue expected to jump 33%

Ideagen (IDEA) released a half-year trading update along with news of an acquisition…

The compliance software provider said the first half of the year was in line with the Board’s expectations with revenue up 33% at approximately £38.8m (H1 2020: £29.2m).

Recurring revenue grew by 41% to £34.2 million, representing 88% of total revenues (H1 2020: 83%). While adjusted earnings (EBITDA) increased by 32% to £13.2m.

Ben Dorks, Chief Executive Officer of Ideagen, said:

“Ideagen enters the second half of the year in a great position, confident of delivering on its expectations for the year and the considerable opportunity continuing our current M&A plus organic growth strategy that lies ahead.”

Ideagen also announced the acquisition of CompliancePath Holdings Limited (“CompliancePath”), a leader in software validation and assurance, focused predominantly on the healthcare and life science sectors…

This acquisition was funded from the Group’s existing resources with an initial consideration of US$6 million is payable in cash.

CompliancePath recorded pro-forma revenues of approximately $2.1 million and profit before tax of $0.9 million in the 12 months to 30 September 2021 with net assets of US$1.5 million at that date.

Tremor’s programmatic revenue increased 56% in Q3

Tremor International (TRMR) updated the market last week with a Q3 & 9-Month trading update…

Programmatic revenue increased 56% in Q3 2021 – driven by 115% growth in CTV with strong organic growth.

“I’m pleased to report another record quarter, the strongest in Tremor’s history,” said Ofer Druker, Tremor’s Chief Executive Officer…

“Core to this performance is the strength of Tremor’s end-to-end technology and business platform, highlighted by a focus on CTV, which covers the three pillars of our business: DSP, DMP and SSP. Our end-to-end technology platform provides simplicity for our customers, better data empowerment for advertisers and media partners, and is accelerating the industry’s move towards supply path optimization”…

“Our core growth driver for the quarter was in CTV services, and our revenues grew 55% organically year-over year compared to Q3 2020.”

The shares have whipsawed within a consolidation pattern in recent months, but given the strength of Tremor’s long-term uptrend, we expect this consolidation phase to resolve in higher prices.

Renold HY operating profit rose 41%

Industrial chain maker, Renold (RNO) released a strong set of Interim Results last week…

Half-Year revenue increased 17% to £95.3m and adjusted operating profit surged 41% to £8.2m during the period.

Group order intake increased 49% year-on-year and Renold’s orderbook at end September hit a record high of £72.1m.

Renold CEO, Robert Purcell said:

“The strong trading momentum experienced in the fourth quarter of the last financial year has continued into the first half, resulting in growth of both revenues and profitability”…

“Despite the widely reported global supply chain and inflationary pressures that remain present, particularly with respect to materials, transport and energy costs, Renold continues to benefit from geographic, customer and market sector diversity…”

“With a record order book at the period end, coupled with the strategic initiatives previously implemented, we approach the second half with confidence, but cognisant of the very volatile and inflationary world we operate in.”

The shares have carved out a strong uptrend in recent weeks and prices are starting to build momentum. With this in mind, we are more than happy to continue to hold Renold in our portfolio.

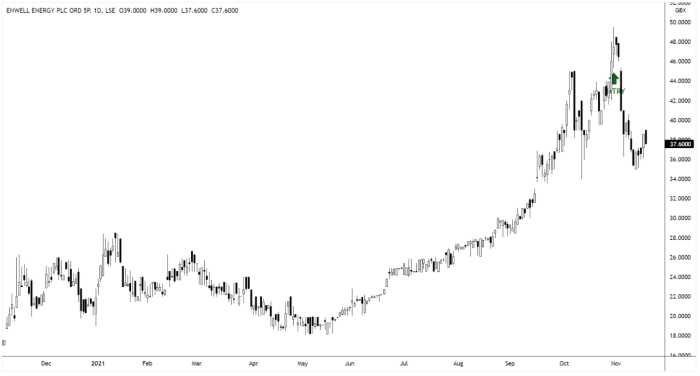

Enwell Q3 production volumes continued to be strong in Q3

Enwell Energy (ENW) released a production update on their Ukrainian operations last Friday…

Overall production volumes continued to be strong in Q3 2021, showing an increase of approximately 11% compared with Q3 2020, primarily as a result of new production volumes from the SV-25 well in the SV field, which commenced production in February 2021.

Enwell’s cash resources were approximately $62.7m, comprised of $25.7m equivalent in Ukrainian Hryvnia and the balance of $37m equivalent in a combination of US Dollars, Pounds Sterling and Euros.

Sergii Glazunov, Chief Executive Officer, said:

“We are pleased to report another very good operational quarter, with strong production volumes and significantly higher gas prices in Ukraine”…

“We are looking forward to the test results of the SV-29 well, to continued good progress with the drilling of the SC-4 and SV-31 wells, and to further progressing the Company’s overall development plans, enabled by the strong current gas revenues and cash resources resulting from the recent surge in gas prices.”