Regency View:

Update

Restore strategically snap up The Document Warehouse

Last week, Restore (RST) announced the ‘strategic acquisition’ of The Document Warehouse (TDW) in the UK for a cash sum of £6.5m.

TDW has a modern freehold warehouse and logistics centre that will provide a strategically well-located site with capacity to service the key London and the South of England markets for Restore’s growing box estate.

Charles Bligh, CEO, commented:

“I am delighted with the acquisition of TDW, which brings new customers and associated revenue to the Group, alongside a strategically valuable freehold site. The potential to create c. 680k of new box capacity near London will enable Restore to support both organic and inorganic growth in the region as well as generating further cost saving opportunities as part of our footprint optimisation strategy.

“We have made excellent progress on our strategic priority to grow with acquisitions, with close to £84m invested across six transactions so far this year and we have a number of well advanced opportunities across all business units to close in 2021 and 2022.”

Inspecs posts confident trading update

Inspecs (SPEC) delivered revenue of $185m for the nine months to September 30 with $125.7m of that achieved in the six months to June.

The Bath-based eyewear designer and distributor did note that it remains “cautious” about the trading performance in the fourth quarter, as Covid-19 continues to impact the global supply chain.

Nonetheless, Inspecs asserted confidence in its full-year outlook and stated that it expected trading for 2022 to be “in line with management’s expectation”.

The shares have performed well for us since our entry earlier in the year.

Prices have started to carve out a series of higher swing lows – ‘funnelling’ the shares towards the apex of a bullish ascending triangle pattern (see chart below).

With this in mind, and the robust quarterly numbers, we are more than happy to hold Inspecs in our AIM Investor portfolio.

IG Design suffer supply disruption

IG Design’s (IGR) share price was sold off sharply last week following a disappointing trading update.

The giftware company are facing a margin squeeze following unprecedented disruption within the Company’s global supply chain, partially related to the impact of Covid-19.

Sea freight costs are up significantly across all regions, alongside raw material and labour inflation.

Because of this, IG have said that full year earnings will be significantly below current market expectations.

Paul Fineman, Group CEO, commented:

“It is more than frustrating to have to report a decline in expected earnings at a time when demand from our customers remains so positive, driven by the continued execution of our strategy and our best ever portfolio of products, brands and service.”

“However, we are not immune to the unprecedented supply chain issues affecting just about every sector, including the significant increase in shipping costs, and despite our best and ongoing efforts to mitigate the impact, these factors have affected our margins. No one knows how long these supply issues will last and we are taking a cautious approach to the near-term outlook, especially in light of the recent increased Covid-19 concerns.”

We’re not going to be too reactive following the large sell-off. The festive period is typically IG Designs strongest quarter of the year, and we will asses our position in the New Year.

The company will announce its Interim Results on Tuesday 23rd November.

Serica post Columbus field update

North Sea oil & gas producer Serica Energy (SQZ) published an operational update on its Columbus field last week…

Serica said Columbus production will flow into the Arran subsea system before processing on the Shell operated Shearwater platform.

However, Shell have informed Serica that the Shearwater platform is “currently operating at restricted capacity” which will result in a delay to the start-up of Columbus production, although it is still “expected that first production will be achieved in Q4 this year”.

As a result of the delays, Serica’s full year net production is “expected to be slightly lower than the current guidance of 23,000 to 25,000 boe/d”.

Serica CEO, Mitch Flegg commented:

“There will be no significant long-term impact resulting from this short delay to the Columbus start-up and I am pleased that the well is ready to produce as soon as the export system allows”.

After such a strong run higher in recent weeks, it’s no real surprise to see Serica’s share price undergoe a retracement on the back of this news.

Eckoh on-track to meet full-year guidance

Eckoh (ECK) released a half-year trading update this week, in which it said full year performance was “expected to be in line with market expectations”.

The global secure payments firm has seen a recovery in the UK offering which has enhanced revenue visibility.

On an underlying basis revenue was “slightly higher” and recurring revenues increased by 7% (representing 73% of total revenues) and operating profit grew by 18%.

Eckoh said growth in its cloud-based offering was being driven the long-term structural factors including; tightening regulation, the need to mitigate the risk of data breaches (and fraud) within our clients’ IT and Contact Centre operations and the migration to a greater level of remote working.

Despite the solid trading update, the market remains unimpressed and this is a concern…

We took the decision to buy a second tranche of Eckoh on news that it’s US business was in rude health. Since then, the shares have been trending lower – creating a headache for us.

On the price chart we have a major level of support at March 2020 lows, and we would expect Eckoh’s downtrend to reverse prior to this structural level. For now, we will remain patient and continue to hold firm.

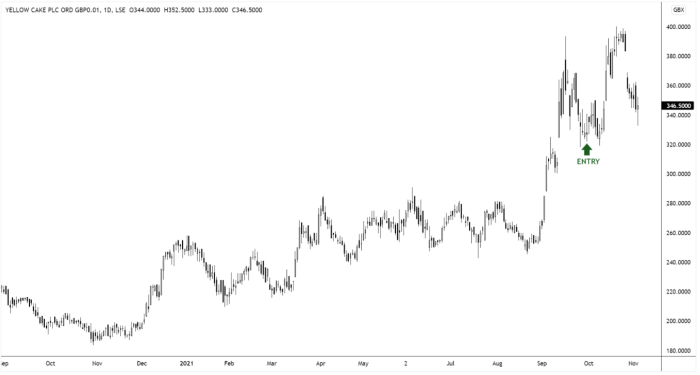

Yellow Cake announces placing to raise $150m for uranium purchase

Yellow Cake’s (YCA) share price dropped last week after the announcement of a $150m share placing.

The uranium holding company said it was going to use all the proceeds of the placement to purchase more uranium.

Yellow Cake said the placement comprises of 30 million new ordinary shares to raise about £109m ($149.9m).

Periodic placements of this nature are to be expected and our long-term outlook on uranium and Yellow Cake remains unchanged.

Gattaca drops on underwhelming prelims

We’ve seen Gattaca’s share price drop this morning following the release of their unaudited Preliminary Results for the year ended 31 July 2021…

The engineering and technology recruiter said it “continues to trade in line with market expectations”, but market conditions for its clients are challenging given the scarcity of talent.

Gattaca delivered net fee income of £42.1m (2020 restated: £52.8m), and reported continuing underlying profits before tax of £3.2m (2020 restated: £4.8m), which Gattaca said had exceeded their expectations at the beginning of the year.

Gattaca also confirmed that it will reinstate its dividend and that an initial payout of 1.5p per share is a “reasonable first step”.

Whilst the shares have dropped this morning, we’re not overly concerned given that there were no real surprises in the numbers.

Prices are trading back at a long-term level of support and we expect this level to hold firm.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.