Regency View:

Update

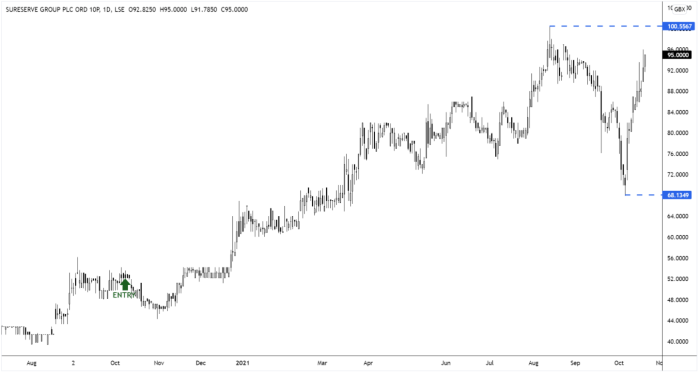

Sureserve’s order book grows more than 30%

Sureserve (SUR) released a strong trading update earlier this month in which it said its order book had grown more than 30% on the previous year’s £356m (FY 2020).

The compliance and energy support services group has seen strong growth in revenue, earnings, and cash flow – in-line with management’s Full-Year expectations.

Net cash as at end September was £16m, up four-fold on the previous year, and Sureserve will publish its Full Year results on Tuesday 25 January 2022.

Chairman Nick Winks commented:

“I am pleased to report that the financial year to 30 September 2021 saw the gradual return to the pre- Covid levels of full trading across the Group. Consequently, we expect results for the full year to be in line with our expectations.”

The market enjoyed Sureserve’s update and the shares have rallied strongly since it’s publication, we’re anticipating a retest of the August highs.

Anglo Asian Mining maintains production guidance

Anglo Asian Mining (AAZ) updated the market last week with a Q3 and 9-month 2021 Production and Operations Review.

The Azerbaijan gold miner said Q3 2021 production was 16,316 gold equivalent ounces (GEOs) (Q3 2020: 18,190 GEOs). With 9-month 2021 total production of 48,487 GEOs (9M 2020: 50,702 GEOs).

Full Year production guidance was maintained at 64,000 to 72,000 GEOs.

Anglo Asian CEO Reza Vaziri commented:

“I am pleased to report a steady rate of production year-to-date as we continue to mine our existing sites, and we reiterate production guidance for the full year 2021.”

“We made considerable progress in increasing our resources during the period and are now presented with several compelling growth opportunities. The high-quality Zafar deposit, and three exciting new contract areas, significantly strengthen our copper inventories. These will underpin our future long-term production and transition to a mid-tier producer.”

Anglo Asian announced an interim dividend of $0.045 per share to be paid gross to shareholders on 4th November 2021 for the year ending 31 December 2021.

Ramsdens expects FX volumes to rise as travel restrictions ease

Ramsdens (RFX) released a resilient trading update earlier this month in which it expects Full-Year profit before tax to be at least £0.5m.

The foreign exchange and pawn broking business said its diversified model had helped to maintain profitability in difficult market conditions.

Demand for pawnbroking lending has increased in recent months with new lending in September 2021 almost back to the pre-covid levels of September 2019.

Gold buying remains at approximately two thirds of pre-covid levels, but is expected to recover as demand for its foreign currency service returns.

Ramsdens said foreign currency exchanged has slowly increased throughout the summer, with September 2021 volumes being approximately 30% of September 2019 volumes – this is expected to recover further with the eased travel restrictions.

Peter Kenyon, CEO of Ramsdens commented:

“We are encouraged as we enter a new financial year that the latest easing of international travel restrictions will result in more people travelling over the coming months, and hopeful that we will see a return to normal foreign exchange trading volumes next summer”

Oxford Metrics woe investors at capital markets day

Oxford Metrics (OMG) share price burst higher yesterday as the motion capture company outlined an ambitious five-year growth strategy at its capital markets day.

OMG also released a trading update in which it said it was expecting revenues of £35.7m and adjusted profit before tax of £4.6m for the financial year ended 30 September.

The group finished the year with a robust cash position of £23m and no debt.

Its motion capture business, Vicon experienced growing demand during the second half and is expected to report a ‘very profitable year’ together with a solid order-book for next financial year.

While OMG’s infrastructure software business Yotta achieved its annual recurring revenue (ARR) year-end goal and is also expected to deliver a full year of profitability.

“It is the Group’s view that the strength of its current platform, combined with the strong financial footing it has achieved over the past five years of organic and inorganic revenue growth, provide it with routes to capitalise on latent opportunities for growth” read OMG’s trading update.

The shares are now within touching distance of their pre-pandemic highs – a key technical level for the stock.

Spectra ups full-year guidance following large Central Bank order

Banknote authentication company, Spectra Systems (SPSY) announced that one of its long-time central bank customers for banknote security materials has placed a new yearly order as part of another five-year renewal agreement.

Spectra said, “this year’s order is 50% higher than the typical orders with the exception of the large 2020 order during the peak of the pandemic”…

“Based on the value of this year’s order, we are confident that we will exceed market expectations for PBTA in 2021.”

Dr. Nabil Lawandy, Chief Executive Officer commented:

“I am very pleased that we have executed a five year renewal with this long standing central bank customer. The size of the order, as well as the agreement, further bolster our confidence in the role of, and demand for, reserve currencies going forward.”

The shares remain unmoved despite the bullish newsflow and prices continue to bounce along key support at 150p.

Spearad acquisition strengthens Tremor’s end-to-end CTV & video tech stack

This week, Tremor International (TRMR) announced the acquisition of Spearad, a TV media management platform and ad server.

The $14.7m deal will be financed through $11m cash reserves, with the remaining $3.7m being satisfied by the issue of 370,000 ordinary shares.

Spearad’s ad server technology will be integrated into Tremor’s Unruly platform, enabling connected TV (CTV) header bidding, channel inventory and ad pod management – complementing Tremor’s existing technology stack.

Ofer Druker, Chief Executive Officer of Tremor, commented:

“The Acquisition further strengthens our leadership position as a video-first end-to-end platform, which provides real efficiencies for global advertisers, media companies and broadcasters in an ecosystem increasingly centred on Connected TV.”

Tremor’s share price continues to consolidate sideways, and given the strength of its long-term uptrend, we expect this consolidation phase to resolve itself in higher prices.

Ixico upgrades full-year guidance

Ixico (IXI) delivered a bullish trading update on Monday in which it raised full-year guidance.

The neuroscience data analytics company said it expects full-year revenue of £9.2m – ahead of market expectations.

Ixico also said its year-end order book stood at £18.8m (2020: £21.7 million), despite £7.1m adverse impact from the descoping of the above Huntington Disease trials in March.

Year-end cash came in at £6.7 million, (2020: £7.9 million) reflecting more than £2m technology investment to support long term and the balance sheet remains debt-free.

The recovery of Ixico’s order book is continuing to gather pace and the trading updated sited an improving business outlook resulting from the initiation of new neuroimaging clinical trials during the 2022 financial year.

Ixico CEO, Giulio Cerroni commented:

“Despite a challenging business environment, we announced contracts with several new clients, initiating early-stage clinical trials contracts across a widened range of neurological therapeutic indications”…

We go into 2022 with an established track record of delivery, substantiated by a 25% 5-year revenue CAGR, a further year of growing profitability and a strengthened balance sheet”.

FURTHER UPDATE // Yesterday evening, news broke that one of Ixico’s clients has had to indefinitely halt one of its clinical trials following the receipt of ‘unexpected preclinical data’.

Contracted revenues for this trial represented £3.3m of the Company’s order book as at 30 September 2021, of which the Company had expected to deliver £0.8m revenues in the financial year to 30 September 2022.

Failure of clinical trials is part and parcel of the business, and whilst the shares have fallen this morning in response to the news, it does not alter our long-term view on the stock.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.