3rd Jun 2021. 8.58am

Regency View:

Update

Regency View:

Update

Tremor Q1 revenue surges 96%

Tremor International (TRMR) delivered a record performance in Q1 2021, which is historically a quieter period for the Company.

The digital video advertising platform said net revenue increased 96% to $63m (Q1 2020: $32.1 million). While total cash and cash equivalents came in at $130m with no debt, after conducting a buyback of $6.6m during Q1 2021.

“All acquisitions are now fully integrated with Tremor delivering record levels of organic revenue growth” read the update, released last week.

‘Programatic’ net revenue more than doubled to $55.7m (Q1 2020: $27.2 m) – underpinned by revenue growth in Connected TV (“CTV”), the self-serve platform and private marketplaces.

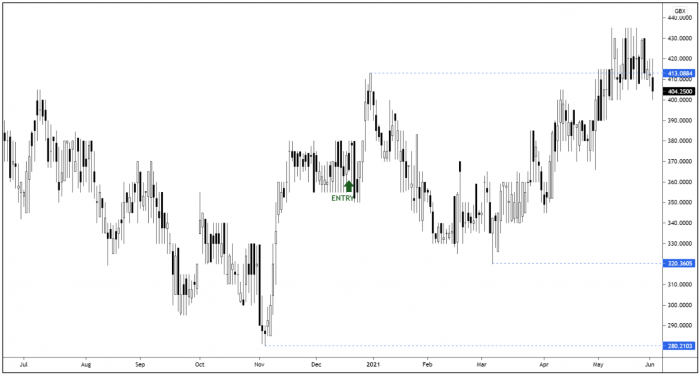

It’s early days for our Tremor position, but so far so good, with the shares breaking through resistance on the back of the trading update.

Bioventix hikes dividend despite tough year

Bioventix (BVXP) released a resilient set of Half-Year numbers last week in which revenue held steady at +1.3% to £5.2m (2019: £5.1m), while profits dropped 9% to £3.7m (2019: £4.1m).

The clinical diagnostic specialist said that the pandemic had “without doubt, affected the activity within diagnostic pathways in hospitals and clinics around the world”…

“Not only have medical care resources been diverted to cope with COVID-19 patients but, even where capacity remains, there is ongoing evidence that patients are choosing not to present to healthcare professionals or not to enter diagnostic pathways” read the Chairman and CEO’s statement.

However, Bioventix are “pleased with the continued success of our vitamin D antibody and core antibody business”…. And “remain optimistic about our troponin revenues and the success of these high sensitivity troponin products around the world”.

This optimistic outlook was backed up by a 20% hike in their dividend to 43p per share.

AAZ post record turnover

Anglo Asian Mining (AAZ) delivered record Full-Year turnover of $102.1 million and an increase in profit before tax to $35.7 million.

AAZ’s balance sheet remains strong with cash of $38.8 million and no bank debt at 31 December 2020. This was underlined by a final dividend of $0.035 per ordinary share giving a total dividend of $0.095 per ordinary share for 2020 (2019: $0.08 per share).

Full-Year gold production levels dropped but were in-line with expectations at 56,864 ounces (FY 2019: 70,098 ounces).

Silver production for the year was 122,962 ounces (FY 2019: 159,356 ounces) and copper production for FY 2020 increased by 17% year-on-year to 2,591 tonnes (FY 2019: 2,210 tonnes).

Gold production outlook was a further reduction on 2020 levels with a forecast of 54,000 ounces of gold and between 2,500 and 2,800 tonnes of copper. This reduction is due to the exhaustion of the Ugur open pit in 2020 and we will be looking for AAZ to deliver on its discovery programme, especially given the collapse of the Conroy gold joint venture.

Learning Tech says current year trading has started well

In an AGM statement, released last week, Learning Technology (LTG) said that current trading for the year has started well and was “in-line with management expectations”.

Commenting on the company’s aggressive growth via acquisition model, Chairman, Andrew Brode said:

“LTG broadened its offering and addressable market significantly through the acquisitions of Open LMS, eThink and eCreators which together give the Group global market leadership in the open-source Moodle™ market”…

“The acquisition of Patheer in 2020, and of Reflektive and Bridge in the first quarter of 2021, have further strengthened our expansion into the talent development mid-market.”

The shares have been in consolidation mode since the turn of the year, but given LTG’s upbeat statement, we expect prices to kick-on higher as the global recovery gathers pace.

Cohort’s order book balloons 31%

Defence tech firm Cohort (CHRT) released a trading update last week which indicated that Full-Year trading would be in-line with management expectations.

Their closing order book hit record levels at £240m (30 April 2020: £183.3m) – underpinning £100m (63%) of the market revenue expectations for the year ended 30 April 2022 (2020: £83m, 60%).

“The strong growth in the Group’s order book has given us enhanced visibility across our businesses. This is particularly so at Chess, ELAC, MASS and SEA; however, the Group has seen some potential orders delayed over the course of the year, notably at EID, in part arising from the impact of the COVID-19 pandemic. Some of these orders are now expected to be secured in 2022 and 2023” read the update.

CEO Andrew Thomis said:

“Our financial position ended the year stronger than expected with positive net funds. Together with our banking facilities, this provides us with the flexibility to continue to invest in the business and consider acquisitions.”

Restore announce strong trading update and new customer win

Data management group Restore (RST) released an upbeat trading update last week in which it said Q1 trading has been in-line with the boards expectations…

“Activity levels continue to show sustained improvement, with revenue for the Period being approximately 3% ahead of the comparative period for the previous year and approximately 95% of the same pre COVID-19 period during 2019” read the update.

The group also announced that the Department for Work & Pensions (‘DWP’) has awarded Restore a document services project of approximately £10m over 20 months from June 2021. As part of the service, 95 staff will transfer from the current provider to Restore.

CEO, Charles Bligh commented:

“Our core business is recovering well with increasing activity across all business units and we continue to win new customers and contracts, whilst now being able to offer an increasing suite of services to existing customers.”

Robinson Full-Year revenue rose 6% to £37.2m

Packaging group Robinson (RBN) posted a strong set of Full-Year results last week showing a 6% jump in revenue to £37.2m (2019: £35.1m).

Gross margins increased 23.0% from 21.4% in 2019, and operating profit before amortisation of intangible assets rose 8% to £2.7m (2019: £2.5m).

Alan Raleigh, Chairman, commented:

“I am pleased to report further progress in revenues and profits in 2020, despite the challenging conditions created by the Covid-19 pandemic” …

“We have recently expanded our footprint, capabilities and geographical reach with the acquisition of Schela Plast, which will better position us to serve customers in Northern Europe, as well as Central Europe and the UK in the coming year.”

The shares have been consolidating since the turn of the year. This isn’t too concerning given the strength of Robinson’s long-term but we are looking for prices to respect the key support level at 134p.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.