20th May 2021. 8.59am

Regency View:

Update

Regency View:

Update

Sureserve adjusted earnings jump 22%

Sureserve (SUR) posted an upbeat set of Interim Results this week with revenue up 4.6% to £114.6m for the six-month period ended 31 March 2021.

The compliance and energy services Group said adjusted earnings jumped 22.1% to £4.8m, up from £3.9m for the same period last year.

Interim Chairman, Robert Legget is cautiously optimistic:

“Sureserve has a substantial order book providing good levels of visibility of earnings, an established business model of recurrent revenues from our public sector client base and a strong balance sheet to support both organic and inorganic growth opportunities. We therefore are cautiously optimistic about the future.”

The shares have performed well since our October entry, and price have formed a strong uptrend with steepening trendlines.

Oxford Metrics announce Vicon contract win

Motion measurement and analysis Group, Oxford Metrics (OMG) announced akey contract win in the gaming industry…

OMG-owned Vicon, a world leader in motion measurement, won a contract with Sharkmob, a triple-A game developer, to deploy its flagship Vantage solution, flexible Vero system and Shōgun software.

Sharkmob will be launching a performance capture studio in the summer of 2021 in Malmö, Sweden.

Commenting on the deal, CEO Nick Bolton said:

“As the game industry continues to evolve rapidly, we have seen more and more games companies, both major developers and independents, choose Vicon to power their innovation. The creative team at Sharkmob are passionate about ensuring the quality and sophistication of their games, so we are proud that they chose a Vicon solution to launch their new studio, and we look forward to seeing continued innovation in their upcoming games”.

MTI Wireless Edge Q1 Pretax Profit Up 25%

5G antenna firm, MTI Wireless Edge (MWE) released their Q1 2021 results yesterday…

The numbers made for pleasant reading with revenue up 4% to $9.95m and pre-tax profit up 25% to $0.9m.

Cash generation remained strong with net cash up 10% to $9.5m, despite having paid a 2020 dividend of $2.2m in March 2021.

MTI said leading mobile phone companies are now incorporating 5G connectivity in mobile devices as standard. As a result, network operators are responding by rolling out higher bandwidth 5G services increasing demand for MTI’s backhaul antenna solutions.

CEO Moni Borovitz, commented:

“Of particular note, is the continued growth in revenue, combined with the sharper growth in profitability as we benefit from our economies of scale, which translated into a 25% improvement in profit before tax.”

Ideagen grow recurring revenues

The beauty of a software-as-a-service (SaaS) business model is the high margin recurring revenues it tends to generate, and Ideagen (IDEA) is a prime example…

Ideagen released a trading update last week which revealed that annual recurring revenue (ARR) is expected to be £54.2m (30 April 2020: £43.1m), representing 83% of total revenues, up from 76% in the comparative prior period.

The business-critical software stock said the ARR book of contracted revenue to be recognised over the coming 12 months increased by 50% during the financial year to approximately £69.3m (30 April 2020: £46.2m on a like for like basis), reflecting strong organic growth of approximately 13% in addition to acquisitions.

Commenting on the update, CEO Ben Dorks said:

Growth in organic and recurring revenue, in addition to excellent cash generation, reflects Ideagen’s resilience during the pandemic. As a SaaS business, we remain focussed on growing recurring revenues and expanding our customer base.

Midwich expects to pay interim and final dividend

In an AGM statement released earlier this month, Midwich (MIDW) declared a resumption of its dividend payout.

Starting with a special dividend of 3p per share, the audio-visual specialist said that it expects to pay both interim and final dividends for the current financial year, payable in October 2021 and June 2022.

Commenting on Midwich’s performance, Chairman Andrew Herbert said:

“The Group delivered a robust performance in 2020, achieving revenue growth and strong cash generation, developing our vendor portfolio and successfully completing two important strategic acquisitions which gave us a presence in the North American and Middle Eastern markets”…

“Trading in the first four months of the year has been ahead of the Board’s expectations, and significantly ahead of the comparative period last year. Although a number of the Group’s end user markets are expected to remain subdued for some time, good progress has been made in the rest of the business and all government employment support has now ceased. Should vaccine programmes continue to progress successfully in the Group’s key markets, the Board now expects that revenue and profit for the full year will be comfortably ahead of its original expectations.”

Renew’s order book hits £750m

Renew Holdings (RNWH) share price has surged higher in recent weeks and this week’s Half-Year numbers revealed why…

The critical infrastructure Group said it’s order book for the six months ended 31 March 2021 hit £750m, up from £690m (HY 2020).

Group revenue jumped 17% to £366.4m for the period and profit before tax increased 19% to 18.1 despite a small drop in operating margins to 6% from 6.4% (HY 2020).

Commenting on the upbeat numbers, CEO Paul Scott said:

“We are delighted to be reporting another set of record results for the Group and I would like to thank my colleagues across the entire business for their hard work and contributions despite the ongoing wider challenges presented by the pandemic”…

“After reporting strong organic growth in the first half, trading has started strongly into the second half of the year and we look to the future with confidence. We are well positioned to take advantage of the UK Government’s commitment to level up the economy by investing £640bn in an infrastructure-led recovery that will bring significant opportunities for Renew and our differentiated, diversified, low-risk business model.”

Somero sees strength in US market driving growth

In a trading update released earlier this month, Somero (SOM) said strength in US market driving healthy trading ahead of previous guidance.

The concrete levelling specialist said that as a result of stronger than anticipated trading momentum in the US in the first four months of the year alongside signs of improving activity levels in Europe and Australia, it now expects to “exceed previous guidance for FY 2021”…

“The Board now expects FY 2021 annual revenues will approximate US$ 100.0m, adjusted EBITDA will approximate US$ 31.0m, and a consequential improvement in the anticipated year end net cash position”.

Somero’s price chart reflects a picture-perfect uptrend, with prices currently consolidating in a small bull flag pattern.

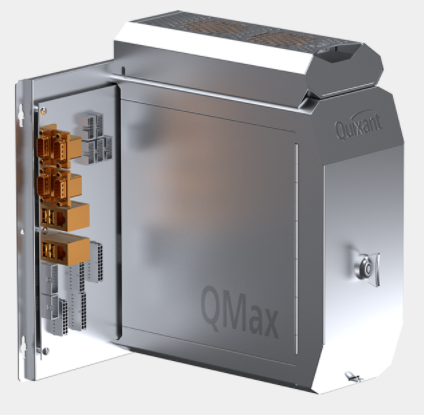

Quixant says order intake remains strong

Our casino recovery play, Quixant (QXT) continues to deliver positive newsflow…

In an AGM statement, released earlier this month, Quixant said that order intake remained strong, indicating that full-year expectations would be adjusted higher.

Quixant Chairman, Michael Peagram struck a cautious tone as the global shortage of semiconductors continued to impact business:

“We have continued to see healthy demand for our products across the business consistent with that communicated in the announcement of our financial results for FY2020 on 14 April 2021. Order intake remains strong, providing us with further improved order coverage for our internal full year budget. The global shortage of semiconductors is impacting many industries, including our own, and remains a risk we are continuing to manage.”

The shares have rallied strongly since our entry in February, and prices continue to build momentum.

Alumasc anticipates strong demand through remainder of year

Sustainable building products supplier Alumasc (ALU) released an upbeat trading statement last week in which it said momentum from a record First-Half had continued during the last quarter…

Conditions in the new build housing and maintenance sectors have continued to be strong into the second half year, and Alumasc said they anticipate “demand remaining strong through the remainder of the year to 30 June 2021”.

They did caution that increasing raw material and shipping cost inflation was starting to put pressure on margins, but that it expects performance for the year to come in ahead of expectations.

CEO, Paul Hooper commented:

“The great potential for the Group is starting to be realised with a strong continuation of the good performance seen in H1”…

“Together with the benefit of the structural efficiency improvements made by the Group in recent years and the continuing progress on the Levolux turnaround plan, the Group is well positioned to benefit from the significant opportunities within our markets, both short and longer term.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.