6th May 2021. 8.58am

Regency View:

Update

Regency View:

Update

Eckoh full year trading in-line with expectations

Eckoh (ECK) released a Full-Year trading update yesterday which indicated that trading for the year ended 31 March 2021 was ‘in line with market expectations’.

Highlights included strong revenue and order momentum in US Secure Payments and a resilient performance in the UK.

“Following record total order levels last year of £35.9m, we secured total orders in FY21 of £30.7m, with £16.7m in the second half. This is an excellent outcome given the continued disruption and uncertainty in market conditions, which were particularly acute in the first half of the financial year…” read the statement from the Board.

The strong performance in the US was driven by increasing demand from large businesses to secure customers’ payment data in their contact centre and IT operations – a technology solution for which Eckoh is the market leader.

Eckoh’s balance sheet remains solid with net cash of £11.7m (FY20: £11.6m), and total cash of £12.7m at the period end.

Much of yesterday’s update was previously stated in their end-March contract wins update, hence the lackluster market reaction.

Begbies Red Flag Alert Report records highest quarterly rise

Insolvency specialists Begbies Traynor (BEG) released their Q1 Red Flag Alert Report and it made for grim reading…

The report recorded its highest quarterly rise in businesses dropping into significant financial.

723,000 businesses now in ‘significant financial distress’, a 15% increase from Q4 2020 to Q1 2021 (almost 100,000 increase).

That’s a staggering 42% year-on-year increase in ‘significant financial distress’ since Q1 2020.

“Every one of the 22 sectors monitored by the Red Flag Alert research exhibited an increase in significant financial distress, with 19 sectors experiencing double-digit increases in the first quarter of 2021. This is a very concerning sign for the UK economy and highlights the deteriorating financial situation for many companies” read the report.

CEO Ric Traynor commented:

“Despite the unprecedented central government support offered to UK businesses it is now clear that many companies are struggling under the weight of increased debt combined with poor revenue streams.”

GB Group says FY total revenue up 9%

GB Group (GBG) posted a typically robust trading update at the end of April…

The identity data intelligence specialist said total revenue and organic constant currency revenue for the year grew by 9% to £217m, ‘ahead of updated market consensus’.

“Growth was strongest in Identity, helped by US stimulus and good growth in fintech. The Location business also grew well, supported by increased transactions in the online retail sector” read the update”…

“This growth has more than compensated for decline in those sectors affected by Covid and lower sales of Fraud products, which are traditionally deployed onsite where pandemic restrictions have impacted new sales and implementations.”

GBG expect to report adjusted operating profit of approximately £58m, a 21% jump on last year and also ahead of updated market consensus.

CEO Chris Clark, commented:

“I am very pleased with the performance of the business in FY21. We made significant financial and strategic progress in the most extraordinary circumstances and my thanks go to all GBG team members whose tireless work has enabled this.”

Boohoo FY earnings surge 37% as active customers top 18 million

Boohoo (BOO) released a bumper set of Full-Year earnings yesterdayas the pandemic supercharged shoppers transition from High Street to online…

The British online retailer, which has been busy snapping up distressed brands, has seen strong revenue growth across all geographies with UK up 39% and international up 44%.

Gross margin increased 20 basis points to 54.2%, and adjusted earnings jumped 37% to £173.6m.

Boohoo’s formidable acquisition war chest increased in size with net cash of £276m (2020: £240.6m).

CEO, John Lyttle commented:

“Our established businesses have continued to grow across all territories as we gain market share with our compelling consumer proposition. We completed over £250 million of acquisitions in the period, which included Oasis, Warehouse, Debenhams, Dorothy Perkins, Burton and Wallis, as well as the purchase of the remaining minority interest in PrettyLittleThing in a transaction that to date has resulted in substantial earnings enhancement for the group’s shareholders”.

Commenting on the controversial problems Boohoo have had with their supply chain, he added:

“We have also invested in improving the oversight and transparency of our supply chain and we are committed to embedding positive change through our ambitious UP.FRONT sustainability strategy.”

Inspecs cautious as global Covid cases remain high

Eyewear retailer Inspecs (SPEC) has urged caution as its key markets continue to battle the pandemic.

In a trading update, released at the end of April, Inspecs said “the Board remains cautious on 2021 as COVID-19 remains prevalent across the world”.

This caution comes on the back of a strong set of numbers which saw the group deliver Q1 revenues of $67m – ahead of expectations.

“This performance was achieved despite nationwide lockdowns in the UK, Germany and France and a variety of state lockdowns in the USA” read the update.

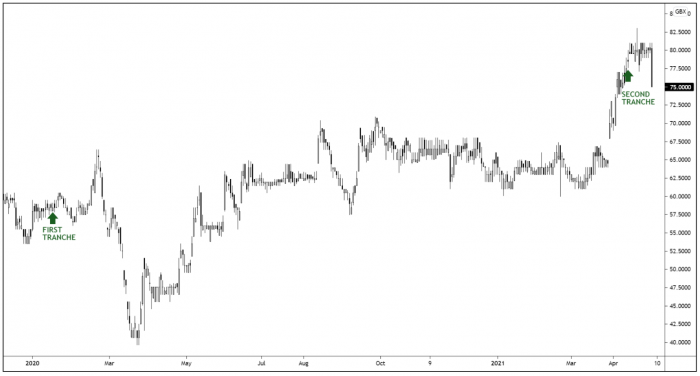

The market certainly hasn’t been phased by Inspecs caution and the share continue to push higher within a powerful uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.