14th Jan 2021. 8.59am

Regency View:

Update

Regency View:

Update

AIM Investor Performance – please click to view

Bango bounce on trading update

Bango (BGO) have reported record revenues and a big uptick in profits as lockdowns boost online commerce.

The mobile payments firm saw revenues surge 70% to £12.2m over the twelve months to end Dec 2020. Underlying profits jumped to more than £4m and platform spend rose to £1.9b from £1.1b.

CEO Paul Larbey commented:

“This trading update clearly demonstrates strong growth for Bango and for our customers during a tumultuous year. Global lockdowns have driven more users online and accelerated the adoption of digital payments by merchants and consumers, which will continue to drive-up end-user spend.”

“During 2020 Bango successfully grew the existing business and won new deals, which puts Bango in a stronger position than ever at the start of 2021.”

The shares have bounced higher on today’s news and prices are now trading below resistance 185p. Given the fundamental momentum that is building behind Bango, we don’t think it will be too long before the price chart follows suit.

MTI Wireless announce further contract wins

MTI Wireless Edge (MWE) have kicked off the New Year the way they ended the last one, by winning new contracts…

MTI Summit, the Group’s Distribution & Professional Consulting Services Division, has secured several “significant orders” from an existing customer totaling US$1.7 million, the majority of which will be delivered in Q1 2021.

CEO, Moni Borovitz commented:

“We are very pleased to have received these increased levels of orders at the beginning of the year for immediate supply, especially from a strategic customer, indicating that the relationship is strengthening which bodes well for the future. Trust is a particularly important factor in the defence sector and once earned can lead to the establishment of important long-term business relationships.”

MTI’s uptrend is gathering pace, and while short-term pullbacks are inevitable, the long-term trend shows no sign of slowing.

Ideagen completes acquisition

Compliance software specialist Ideagen (IDEA) announced that its acquisition of Huddle is now complete.

Huddle is a leading supplier of Software as a Service (SaaS) based collaboration and workflow solutions primarily in the UK and US.

Huddle represents Ideagen’s largest ever acquisition and brings with it an expected Annual Recurring Revenue of £10.5m.

Ideagen CEO, Ben Dorks, commented:

“Bringing together Huddle and PleaseReview will result in a hugely compelling offering of secure document collaboration and compliance software that will meet the needs of the toughest regulatory environment. This means we will be extremely well placed to take advantage of the growth in regulatory requirements and the increased need for people to be able to work remotely, while maintaining the ability to collaborate on projects.”

Ideagen’s uptrend is progressing nicely on the price chart through a series of steepening trendlines. Prices are currently going through a small pullback and we would expect the broken resistance at 240p to provide support moving forward.

Gamma sees full-year earnings ahead of forecast

Gamma Communications (GAMA) released a typically solid trading update on Monday.

The VOIP telecom group said that it expects Full-Year adjusted earnings be ahead of market expectations with performance “significantly ahead of last year”.

CEO Andrew Taylor, commented:

“We are pleased that Gamma has continued to grow strongly whilst also geographically expanding into Spain and Germany. The execution of our UCaaS product strategy is progressing very well and our product set has continued to perform well and has enabled our end users to work flexibly during the difficult conditions prevalent in 2020. I would like to thank our staff and partners for all of their hard work throughout the year.”

The shares have moved into a choppy sideways consolidation phase in recent months. Given that this consolidation is taking place within a long-term uptrend, we expect this to resolve in higher prices.

Restore snaps up Computer Disposals Ltd

Restore (RST) announced the acquisition of Computer Disposals Ltd on Tuesday – making Restore Technology the UK’s biggest IT recycling business.

Computer Disposals Ltd is a profitable and cash generative business which is expected to bring revenues of approximately £8m and earnings of more than £2m per annum in the medium term.

Charles Bligh, CEO, commented on the acquisition:

“CDL is one of the most respected operators in the market and after several years of discussions we are delighted that they have decided to become part of our fast-growing company. Restore Technology is now comfortably the UK market leader in the recycling of IT assets and with the addition of a major new site in the North West, we have increased our scale and created greater opportunity to grow, both organically and with additional acquisitions in the future.”

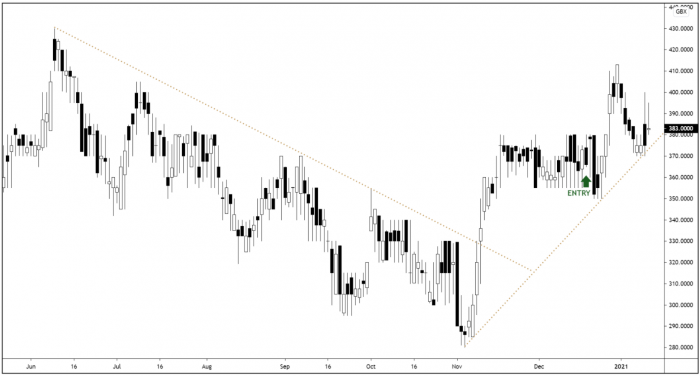

The shares have continued to carve out a bullish series of higher lows on the price chart.

It’s early days for our position, and whilst the COVID variant news in late December has pushed back hopes of a bounce back, we’re happy to hold Retore in our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.