26th Nov 2020. 9.02am

Regency View:

Update

Regency View:

Update

Click here for printer friendly version

AIM Investor Performance – please click to view

Craneware release upbeat AGM statement

It’s been a cracking couple of weeks for Craneware (CRW)…

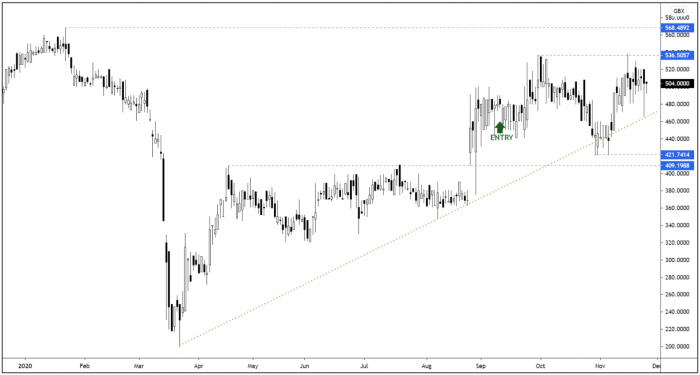

The US-focused healthcare financial software developer was given a boost by the Joe Biden US election win at the start of the month. They’ve followed that up by releasing a very upbeat AGM statement.

The statement said the firm has seen “strong sales growth, considerably ahead of the equivalent period of the prior year”.

“We expect revenues and adjusted EBITDA for the Interim period to 31 December 2020 to be ahead of the equivalent period in the prior year, building the foundation for a return to double-digit growth in the future. We look forward to providing further details within our Trading Update for the 6 months ended 31 December 2020” the statement continued.

The shares have surged some 70% from their October lows and this momentum is very encouraging.

Next Fifteen ahead of forecasts as activity recovers

Next Fifteen Communications (NFC) updated the market with a Q3 trading statement last week and it made for pleasant reading…

The digital marketing firm said: “revenues are expected to be up by approximately 7% compared with the same period last year and the operating profit margin has also shown strong growth compared with last year”.

Their strong performance has been driven by their business-to-business (B2B) technology-focused agencies such as Activate, Twogether and Agent3.

CEO Tim Dyson said the group remain “cautiously optimistic about trading as we enter the final quarter of our financial year and will continue to manage our cost base with care in what is still a highly uncertain general economic environment”.

Ideagen trading ‘comfortably’ in line with forecasts

Compliance software company, Ideagen (IDEA) released a solid trading update earlier in this month – indicating that they were “comfortably” on track to meet full-year forecasts.

Annual recurring revenue recognised during the first half was expected to be £24.4m, rising from £20.3m year-on-year, and representing 83% of total revenues, rising from 74% in the comparative prior period.

Ideagen said it expected to report total revenue up 7% at about £29.2m, and for adjusted earnings to have increased by 25% to approximately £10m.

We selected Ideagen for it’s quality and the ability for its SaaS business model to generate consistent revenue streams, it is not disappointing.

Eckoh fails to live up to the market’s lofty expectations

There is a risk with buying higher quality stocks on high multiples, the market can become very hard to please…

Secure payments provider Eckoh (ECK) delivered a solid set of first half numbers this week, but it received an underwhelming reaction from the market.

The US Secure Payments arm of the business saw its revenue surge 80% to US$6.5m from US$3.6m the year before, which offset the planned decline (by 61%) of revenue from its Support activities and an 85% decrease in revenue from the Coral contact.

UK revenue was down 11% year-on-year, with the pandemic having some impact on transactional revenues.

CEO Nik Philpot said: “In this challenging trading period Eckoh delivered a robust performance, in line with our expectations, generating comparable levels of profit to last year, which reflects the resilience of our business”.

After consolidating near their highs for several weeks, Eckoh’s share price has unfortunately broken lower following the trading update – we will be looking for the September swing lows at 57p to provide support.

MTI Wireless Edge 9-Month Operating Profit Up 20%

MTI Wireless Edge (MWE) has kept it’s flurry of good news flowing, releasing a strong set of results for the nine months to 30 September.

Despite the disruption caused by the pandemic, the wireless antenna specialists recorded 2% revenue growth to $29.6m during the period.

Operating profits jumped 20% “reflecting the benefits of increasing scale and reduced expenditure” and earnings per share increased 12% to 2.65 US cents.

Net cash increased 33% to $8.2m and CEO Moni Borovitz said “MTI has demonstrated its ability to trade through the current global pandemic”.

The shares have had a very strong month – surging through resistance at 50p and putting our position nicely into profit.

Begbies Traynor sees first half profits soar

Begbies Traynor (BEG) adjusted pre-tax profits jumped 25% despite the “subdued insolvency market” resulting from the government’s Covid-19 financial support measures.

Group revenue grew 10% and the board expects results for the full year to be “at least in line with current market consensus”.

Executive chairman Ric Traynor said:

“I am pleased to report a continuing strong financial performance in the first six months of the financial year, which is testament to how our teams continue to deliver excellent client service in a challenging environment.

“We anticipate continuing our recent financial track record of growth for the year as a whole, ensuring we are well placed to invest in our successful organic and acquisitive growth strategy.

“Overall, our medium-term outlook remains positive especially once the economy exits this current period of uncertainty.”

The market has responded well to Begbies numbers and the shares are now trading just below a key resistance level at 94p. Should the bulls manage to break this level, we would expect to see a re-test of the May highs.

Anglo Asian still on track for US$100mln in sales

In a production update this week, Anglo Asian Mining (AAZ) said it is set to produce between 68,000 and 72,000 ounces of gold equivalent in the year to December 2020.

The number is lower than initial expectations, as a number of engineering staff were conscripted to participate in the recent conflict with Armenia.

Underground development was consequently slower and less tunnelling progress was also made, due to underground rock faulting.

However, Anglo Asian noted that it is still on track to achieve sales of over US$100mln.

Staff members who were conscripted due to the territorial dispute with Armenia are expected to return to work early next year after the military starts to demobilise.

Demand for craft kits give IG Design sales a boost

It’s been a challenging year for IG Design (IGR), but sales are starting to gather momentum again…

IG released their interim results this week, and sales in the six months to September 30 rose to $434.6 million from $309.2 million with full-year sales expected to come in ahead of expectations.

CEO Paul Fineman said: “As a result of people spending more time at home we’ve seen our crafting business flourish with families embracing at-home activities to keep entertained through the periods of lockdown.”

As we move into the festive period, IG expect demand for cards and gift wrap to be strong as Fineman added: “we believe that Christmas is even more anticipated this year, with people embracing the Christmas spirit much earlier than in previous years, as our customers are reporting strong and earlier than usual sales of decorations, gift packaging and crackers.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.