12th Nov 2020. 9.01am

Regency View:

Update

Regency View:

Update

Click here for printer friendly version

AIM Investor Performance – please click to view

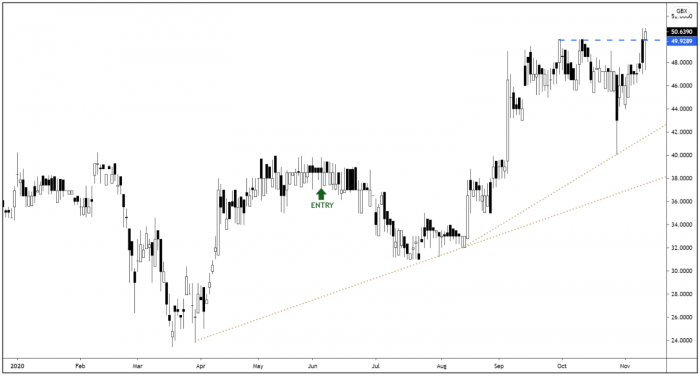

D4T4 announce four new contract wins

Big Data specialist D4T4 Solutions (D4T4) kicked off bonfire night with a bang by announcing four new contract wins on 5th Nov.

The four deals include:

A significant multi-year extension of a contract with a major US financial services organisation.

A new business win with a European BtoB e-commerce provider.

Two multi-year contract extensions in the financial services and automotive sectors.

The deals will add £5.5m to revenues for the current financial year and unsurprisingly, the market welcomed this news with the shares gapping higher.

BT picks Bango for BritBox launch

Mobile payments firm Bango (BGO) will be deploying its data-driven commerce platform to power bundled subscription services for BT Group.

The partnership will see Bango integrate a number of third party products for BT customers with BritBox being the first.

Commenting on the collaboration, Bango CEO Paul Larbey said:

“We welcome BT and BritBox to the Bango circle. BT will deliver a range of third-party products and services to its customers through the Bango Platform and will benefit from Bango data insights to optimize the targeting of product offers to boost consumer engagement. BritBox is an exciting initial launch, we look forward to powering many more leading third-party services for BT.”

The shares look to be coiling within a long-term wedge consolidation pattern (see chart below) and we would expect this to culminate in a breakout to new highs.

Oxford Metrics rally from key support following bullish trading statement

Oxford Metrics (OMG) look to have finally hammered in a bottom following a robust trading statement.

The motion capture software company said that it expects full-year revenues to hit £30.3m and adjusted pre-tax profits to come in at around about £25.3m.

Divisionally, Vicon delivered another profitable year and whilst the timing of orders was impacted by COVID-19, it achieved a slightly better performance in the second half than the first half.

Market activity for Yotta, OMG’s highways and infrastructure software arm, was muted for a time during the first lockdown but enjoyed a period of improved contract momentum in the final quarter due to COVID-19 accelerating the need for Local Authorities to manage their assets remotely.

The shares have once again rallied from 72p support, but this time prices have broken and closed above a short-term descending trendline.

We would expect this week’s burst of bullish momentum to trigger a more sustained move higher during the coming weeks.

Clinigen – Totect get FDA approval as breast cancer drug

It’s been a good week for Pharma platform Clinigen (CLIN) which has seen the drug, Totect receive dual approval from the US Food & Drug Administration (FDA).

The FDA has granted approval to broaden the indication for Totect to now include reducing the incidence and severity of cardiomyopathy associated with doxorubicin administration in women with metastatic breast cancer.

Clinigen CEO, Shaun Chilton commented:

“This exceptional accomplishment by our Global Regulatory and Medical Affairs teams makes Totect® the first and only FDA approved dexrazoxane product with a dual indication for the treatment of extravasation resulting from intravenous anthracycline chemotherapy as well as cardiomyopathy associated with doxorubicin in appropriately indicated women with metastatic breast cancer. As we continue to expand our global footprint, our commitment and primary focus remains on fulfilling our corporate mission to deliver the Right Medicine to the Right Patient at the Right Time.”

The shares have broken above their descending trendline this week – indicating that short-term momentum is now firmly bullish.

MTI contract wins keep coming

After announcing a Russian deal worth $1.5m towards the end of last month, MTI Wireless Edge (MWE) have kept the momentum going, announcing another series of contract wins this week.

MTI have secured an order from a new Northern European customer, worth up to $0.65m, for the development and manufacturing of military antennas.

The first stage of the agreement, which is already underway, is worth $0.3m, will provide the customer with prototype units expected to be completed within 12 months. The second stage is subject to the customer deciding to order the antennas to be manufactured and is expected to be worth up to $0.35m, depending on the size of the order.

This weeks news has driven the shares to new highs, breaking above 50p resistance – a very strong sign.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.