1st Oct 2020. 8.59am

Regency View:

Update

Regency View:

Update

Click here for printer friendly version

AIM Investor Performance – please click to view

Anglo Asian unaffected by troubles in Azerbaijan

Anglo Asian Mining (AAZ) hit the headlines last week as they released their interim results and a statement on the ongoing troubles in Azerbaijan.

The half year numbers were mixed with a rise in the average gold price offsetting a 19% fall in production – leading to an overall 6% increase in revenues to $46m.

However, management are confident about the second half and have announced a hike in their interim dividend by 29% to 4.5 US cents per share. A special dividend is also being considered due to the strength of the underlying gold price.

On the escalation of the on-going dispute between Azerbaijan and Armenia over the Nagorno-Karabakh region AAZ said there had been “no impact to its operations” and that the company’s office in Baku and operations at Gedabek continue to “function as normal“.

Boohoo’s bounce back continues following record profits

It’s been a much-needed good PR week for Boohoo (BOO) as they released a bumper set of first half numbers.

Pre-tax profits in the six months to 31 August surged £68.1m, up 50% from £45.2m a year earlier.

Management also raised full-year guidance stating, “group revenue growth for the year to 28 February 2021 is expected to be 28-32%, up from approximately 25% as previously guided”.

Active customer numbers in the last 12 months went up by 34% to 17.4 million, with an “exceptional increase” during lockdown.

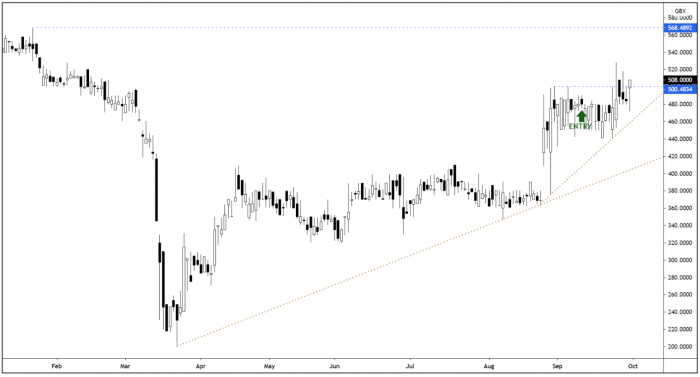

The market has responded accordingly and the shares have gapped through the resistance area that we’ve been monitoring closely at 329p.

Learning Tech receives muted reaction to “resilient” numbers

Digital learning services group Learning Technologies (LTG) delivered a “resilient performance” in the first half of 2020 despite the ongoing Covid-19 pandemic.

Revenues ticked over at £64m, 2% higher year-on-year but adjusted earnings dropped 5% to 18.4m as margins contracted to 28.7% from 31.1% – causing the shares to close lower on the day of the results.

However, on a more positive note, recurring revenues increased to 81% from 74% and this is a very positive sign. As a result of the “robust performance and cash generation”, the group said it intends to reinstate its 2019 final dividend of 0.50p – in addition to a proposed interim dividend of 0.25p.

Ergomed’s cash position strengthens after strong first half

Ergomed (ERGO) have continued to kick on higher following another bullish set of results.

The specialty pharmaceutical services company saw revenues to 30 June 2020 jump 14% to £40.4m.

Revenue growth was driven by strong organic growth in pharmacovigilance sales which grew 36% and in total were 62% higher year-on-year to £26.1m, boosted by the acquisition of PrimeVigilance USA, which more than doubled US revenues to £14.4m.

Margins also increased as a result of good cost control and operational leverage – boosting adjusted earnings by 40% to £9.1 million.

The cash has also been rolling in with operating cash flow more than doubling to £8.1m from £3.3m.

These are very strong numbers and the shares have an almost text-book uptrend to match, needless to say, we’re happy to hold them!

Craneware sees sales cycle ‘normalising’

Craneware (CRW) released their full year numbers last week which indicated that their key market, US healthcare is starting to gain traction.

Figures for the year to the end of June showing profit before tax increased 5% to $19.3m (FY19: $18.3m) on a standstill revenue of $71.5m (FY19: $71.4m).

CEO Keith Neilson said:

“Craneware made good progress in the year despite the difficulties imposed by the COVID-19 pandemic in the final quarter…

“We have experienced strong sales momentum in Q1 and continue to have sales discussions with hospitals across the US. We are cautiously optimistic we are seeing the first signs of sales cycles slowly normalising; however, we remain cognisant of the ongoing macro uncertainties…

“We continue to benefit from a strong balance sheet and high levels of recurring revenue, entering the new financial year with an annuity revenue base of over $65m, providing us with a strong foundation for future growth.”

Craneware are proposing a final dividend of 15p per share giving a total dividend for the year of 26.5p per share and a yield of 1.7%.

Ideagen delivers 11th consecutive year of growth

Strong track records in revenue and earnings growth are a real hallmark of quality and Ideagen (IDEA) is a prime example of this..

Last week they released their full year numbers – delivering their 11th consecutive year of revenue and earnings growth.

Revenues jumped 21% to £56.6m of which £43.1m were recurring in nature. Software as a Service (SaaS) revenues increased by 61% to £22.1m and now represent the largest sector of revenue.

Commenting on the impact of the pandemic, CEO Ben Dorks said:

“We reacted quickly to the threat posed by the coronavirus pandemic and acted to reduce our cost base and secure a strong base from which to move forward.”

This is a pleasing set of full-year numbers and the shares are currently going through a retracement phase following a strong move higher in August. With this in mind, we are more than happy to hold them in our AIM Investor portfolio.

Next Fifteen raises full-year expectations

Our recent addition of Next Fifteen Communications (NFC) has got off to a strong start…

The shares have broken to six-month highs this week following a robust set of half-year numbers which raised full-year guidance.

The six months to the end of July saw net revenue rise 6% to £126.2m. Adjusted profit before tax jumped 20% to £20.7m and net cash inflow from operating activities increased to £31.5mln (2019: £19.3m).

No interim dividend has been proposed but the board has signalled that it expects to resume dividend payments with a final dividend in respect of the current financial year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.