20th Aug 2020. 9.03am

Regency View:

Update

Regency View:

Update

Summer earnings season has benefited our portfolio, which has a very healthy glow to it.

Our focus on stocks with strong balance sheets, diverse client bases and proven management track records has seen many of our stocks deliver summer trading updates that were positive, despite the immense headwind created by the pandemic.

Impressive recent performances by the likes of Oxford Metrics (OMG), Gamma Communications (GAMA), Sylvania Platinum (SLP) and Ergomed (ERGO) have helped to offset weakness from IG Design (IGR) and Midwich (MIDW).

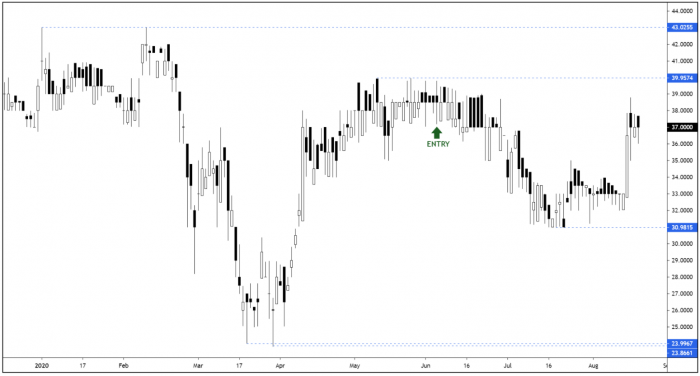

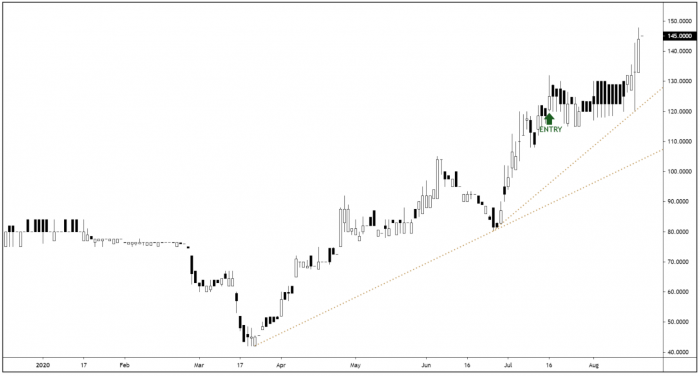

AIM Investor Performance – please click to view

Eckoh wins Transport for London contract extension

Eckoh (ECK) has secured a six-year contract extension worth £4 million to provide services for London’s congestion charge to Transport for London.

The secure payments firm will now deliver an expanded remit for the congestion charge service, providing customer contact solutions alongside the existing secure payments service.

CEO Nik Philpot said:

“We are delighted to have secured such a significant, valuable and long-term contract extension for TfL through Capita, who remain a key strategic partner and whose relationship continues to play a pivotal role in the growth of our business,”

The shares surged to new highs on the back of the news and Eckoh’s long-term uptrend is back in full swing.

GB Group release bullish pre-AGM statement

GB Group (GBG) is a favourite within our portfolio for many reasons, and last week’s pre-AGM statement only served to strengthen our conviction.

The data security company told shareholders that first-quarter trading had been better than expected with growth year-on-year.

And whilst the impact of the pandemic varies significantly by product and region, overall, the first-quarter figures were still at pre-COVID-19 levels, specifically customer churn, solvency and bad debt.

“We remain focused on effective cash management and maintaining operational capability. At the same time, our cash-generative model has allowed us to continue to invest in strategically important projects that will enable us to emerge from the pandemic in a stronger position” – the Group statement read.

GB Group continue to carve out higher swing lows on the price chart and we don’t expect it will be too long before the December highs at 805p are broken.

Midwich launches hardware as a service programme

Audio video specialist Midwich (MIDW) announced a new Hardware as a Service programme to be launched September 1.

The new service is designed specifically so that new and existing channel partners can offer the latest unified communications (UC) technology to their customers, without the requirement for substantial upfront outlay.

Midwich also announced a worldwide distribution partnership with Plantronics – who create headsets which enhance the quality of Zoom Video Communications meetings.

Jeff Smith, Head of Zoom Rooms, Zoom Video Communications, commented:

“Hardware as a Service is an important tool to help customers deploy video communications equipment more quickly in these challenging times. We’re pleased to work with Midwich Group to enable channel resellers to offer Zoom appliances as a service to our joint customers.”

This new deal is encouraging and indicates that Midwich are doing all they can to adapt their product offering.

MTI’s ‘balanced diversification’ delivers solid trading update

5G antenna firm MTI Wireless Edge (MWE) delivered a strong half-year update on Monday with operating profit up 28% to $1.9m.

While the pandemic did slow activity, all three of the company’s divisions still recorded growth on a year on year basis.

CEO Moni Borovitz said:

“The Covid-19 pandemic did reduce revenue in certain areas and added to supply chain costs, in particular freight costs, however, this was offset by cost savings across the business and with its balanced diversification across three divisions and multiple countries.”

MTI remain on track to meet market expectations for the financial year with Borovitz stating:

“Overall, we are cautiously optimistic for MTI’s prospects in 2020. Looking further ahead, we confidently believe the company’s clear focus on providing radio frequency solutions coupled to being diversified across several markets and geographies positions us well to continue to grow and expand through a mix of acquisition led and organic growth.”

The market has responded well to the update and MTI’s share price now has some bullish short-term momentum behind it.

Robinson break to new highs on the back of strong numbers

Our consumer defensive play Robinson (RBN) broke to new highs this week following an impressive set of first half numbers.

The packaging company posted a rise in first-half profit and declared a second interim dividend amid increased demand from the cleaning sector.

Pre-tax profit for the six months through June amounted to £1.1m, up from £0.3m the year previous, as revenue climbed 5% to £17.9m.

The anticipated steady reinstatement of Robinson’s dividend was a key driver behind our original recommendation, and this is coming to fruition.

Robinson declared a second interim dividend of 2p per share and said, subject to trading performance, that it planned to pay a full-year dividend of 8.5p, up from 2.5p on-year.

CEO Alan Raleigh said:

“We are committed to investing in new production equipment and additional capabilities to grow the business in the second half of 2020, including developing our go-to-market approach and reinforcing our sustainability proposition…

“As a result, operating costs will be significantly higher than the same period in 2019.”

“Notwithstanding this increase and subject to any disruption to trading that may arise from the ongoing pandemic, we expect full year earnings to be slightly higher than last year and remain committed to ongoing delivery of our target of 6-8% return on sales.”

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.