23rd Jul 2020. 8.58am

Regency View:

Update

Regency View:

Update

Earnings season is in full swing so we have plenty of trading statements to get through this week along with some interesting stock-specific newsflow…

Codemasters launch ‘all-time great racing game’ F1 2020

UK game developer Codemasters (CDM) have confirmed the release of F1® 2020 to great critical acclaim. The game is to be launched on the PlayStation®4 computer entertainment system, the Xbox One family of devices including the Xbox One X, Windows PC (DVD and via Steam), and, for the first time, Google Stadia.

F1® 2020 is one of the highest-scoring games of 2020 according to aggregator site Metacritic, averaging 91% on Xbox, 89% on PC and 86% on PlayStation 4 – it is being hailed as an “all-time great racing game” from Automobile magazine.

The shares surged to new highs on the release and Codemasters continue to be one of AIM’s star performers.

Ergomed surge higher on trading update

Pharma research provider Ergomed (ERGO) surged higher this week following an impressive set of full-year numbers.

The firm said it has made “exceptional progress” and told investors underlying earnings (EBITDA) for the full-year would be “materially ahead of market expectations”.

Like-for-like service fee revenue jumped 18% year-on-year in the first six months, while their order book expanded by 22% to £151.4m – providing “high visibility” for the remainder of the year “and beyond”.

The shares have broken above key resistance at 478p in recent sessions and this area should now provide support as Ergomed’s uptrend evolves.

Boohoo co-founder snaps up shares

During the last week, we’ve seen a raft of insider buying of Boohoo (BOO) shares.

Last Thursday, co-founder and executive chairman Mahmud Kamani purchased 5 million shares, group co-founder and executive director Carol Kane purchased 2 million shares, and non-executive director Iain McDonald bought 50,000 contracts for difference (CFDs).

This could be an expensive PR stunt, costing more than £20m collectively, but one can’t help but think this has more substance and is a credible display of insider confidence.

We’ve also seen news this week that Boohoo are planning to buy a 27,000 square feet plot of land in Leicester to build a ‘manufacturing village’.

The market’s reaction has been one of cautious optimism with prices forming a small double bottom just above the £2 marker. We continue to monitor the situation and will update you accordingly.

MTI expand into French wine market

Radio communications tech group MTI Wireless Edge (MWE) said its Mottech Water Solutions subsidiary, which specialises in wireless irrigation control solutlions, has entered the French wine market.

The new system was first installed in March and 200 French vineyards had already become customers, the company said.

Our position in MTI has failed to set the world alight, but it’s very early days and in such tough market conditions, MTI continue drip feed the market with positive newsflow, something that will likely be appreciated in the coming weeks.

Midwich bounce from lows on trading statement

Audio-visual distributor Midwich (MIDW) provided investors with some much needed confidence as it said it still expected to be profitable despite lower sales and margins.

Revenue for the six months through June was seeing falling 4% on-year, amid a 22% slump in underlying sales.

Margins were expected to be up to 2.5 percentage points lower, due to product mix.

Midwich said cost cutting meant it still expected to be profitable in the first half.

The shares finally look to have hammered out a bottom at 360p and this provides us with a clear line in the sand for measuring the firms perceived ability to recover moving forward.

Kape pleased with first half trading

Virtual Private Network (VPN) specialist, Kape Technologies (KAPE) delivered an upbeat first half trading statement on Tuesday as it continues to trade in-line with expectations.

First half revenue is expected to be around $59m (£46.5m), up 97% year-on-year, and 12% on a proforma basis.

Recurring revenue now represents about 90% of group revenue – something that provides investors with a high degree of earnings visibility.

The shares have performed well since we entered in April, carving out a series of higher swing lows and we expect this to continue.

Clinigen sees strong underlying growth despite COVID-19 headwinds

Pharma services platform, Clinigen (CLIN) said the 2020 financial year was one of “strong organic growth”, though the headwinds from the coronavirus lockdown were felt in the final quarter.

It said revenues are estimated to have grown by around 17% at constant currencies, or 13% on a gross reported basis for the year to June 30, 2020.

Clinigen CEO, Shaun Chilton commented:

“We have delivered a robust performance, showing strong organic growth despite the difficult trading conditions in the last few months of the financial year and in line with our previous guidance,”

The shares have undergone V-shaped recovery following their brutal February sell-off. Prices have recently drifted lower in a descending consolidation channel but we expect this to resolve itself in a break higher.

Upbeat SDI grows revenues and eyes fresh acquisitions

Cambridge tech innovator SDI Group (SDI) has seen revenues jump 41% in the year to April 30 – and is eyeing fresh acquisitions…

Full year revenues are up to £24.5m from £17.4m year-on-year; the growth is both organic (4%) and acquisitive (36%), reflecting full year contributions from Fistreem International, Thermal Exchange, Graticules Optics and MPB Industries.

Adjusted profit before tax increased 44% to £4.3m while cash generated from operations also rose 44% to £5.2m.

Chairman Ken Ford commented:

“We are pleased to report another year of growth in line with expectations, despite the impact of COVID-19…”

“SDI continues to seek acquisitions and looks forward to growing organically and through acquisition as conditions improve.”

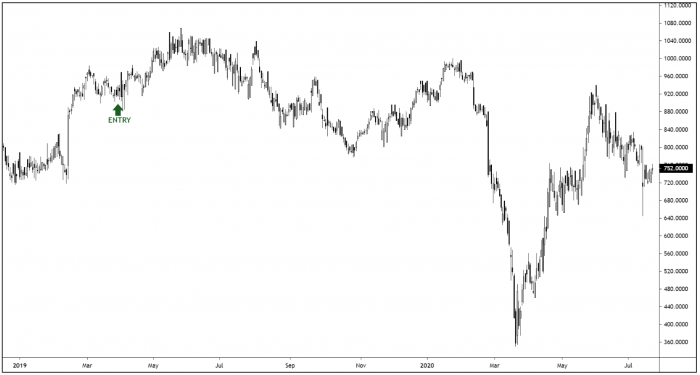

Bango forecasts record revenue growth for first half

Bango (BGO) is expecting “record revenue growth ahead of expectations” in the first half of its current year.

The mobile payment platform is set to report revenue growth of over 50% to £4.8m year-on-year as end user spending in the full year is expected to hit £2bn.

Adjusted earnings are predicted to exceed the £450,000 figure for the whole of 2019.

The shares have undergone a retracement lower since our entry last month, but with numbers like this we expect the shares to kick on higher in the coming weeks.